Use of Unmanned Aerial Vehicles (UAVs) and Remote-Control Drones

The use of unmanned aerial vehicles (UAVs) and remote-control drones is increasing in the mapping and surveying professions. These technologies have many potential applications within several sectors related to land surveys, agriculture, and environmental monitoring. With the help of drones and UAVs, surveyors can get their data precisely and quickly. UAVs and drones are safer as it eliminates the requirement of manpower to enter dangerous environments for measurements. With the help of these technologies, surveyors can access areas that are inaccessible to humans. UAVs combines photogrammetry, 3D mapping, land surveys, topographic surveying, etc. However, legal permission must be taken from the respective authority before using UAVs and drones by the surveyors. There are a few challenges associated with using drones and UAVs for a survey, such as pilot training for the operator and its assessment, keeping up with regulations for the operation, and providing professional output to the customer. If surveyors overcome these challenges, the use of UAVs and drones is expected to become a trend in the land survey equipment market across the region.Market Overview

- Based on country, the Middle East & Africa land survey equipment market is segmented into Saudi Arabia, the UAE, Egypt, and the Rest of the Middle East & Africa. The region has a large mining industry, wherein Saudi Arabia has the largest landmass for mining. According to the Yahia AlShangiti, CEO of AMAK, the mining sector of Saudi Arabia could add US$ 64 billion (SR240 billion) to its GDP by 2030. In addition, under the Saudi Vision 2030 development plan, the mining industry is positioned as the third pillar of its economic development, after energy and petrochemicals. Thus, the growth in the mining industry is projected to boost the growth of the land survey equipment market in the region over the forecast period. Middle East's oil and gas sector contributes largely to its economy. The UAE is one of the world's top 10 largest oil producers. About 96% of the country's oil reserves are in Abu Dhabi, thus, ranking the city at number 6 worldwide. The country produces around 3.2 million barrels of petroleum and liquids per day. The oil and gas industry contributes around 30% of the UAE's GDP and 13% of its exports. According to the International Trade Administration, the US Department of Commerce, Abu Dhabi National Oil Company (ADNOC), a global leader in the oil and gas industry, is expected to reach 5 million barrels of maximum sustainable production capacity by 2030. These factors are likely to fuel the growth of the land survey equipment market in the Middle East during the projection period. The Africa land survey equipment market is segmented into South Mauritius, Seychelles, and the Rest of Africa. The regional market's growth is attributed to the expanding agriculture sector in Africa. Around 60% of the sub-Saharan African population works in the agriculture sector, contributing to 23% of the region's GDP. Also, the governments of African countries are working on various plans to develop the agriculture sector. Under the Comprehensive African Agricultural Development Programme (CAADP), the governments are expected to increase their agricultural investment over the forecast period. They are expecting to allocate 10% of national budgets to agriculture and rural development in coming years. Thus, this investment is expected to achieve at least 6% agricultural growth per annum. Thus, the rising investment for development in the agriculture sector will boost the land survey equipment market in Africa during the projection period. In addition, the region has a large oil and gas industry which is growing continuously. The African continent is fifth among the top thirty oil-producing nations in the world. African countries, such as Nigeria, Angola, Algeria, Libya, and others, accounted for approximately 8 million barrels per day, around 10% of global output. In addition, the region produces around 7% of the world's gas and consists of around 2400 hydrocarbon deposits. Thus, the growing agriculture and oil and gas industry will propel the region's land survey equipment market in the years to come.

MEA Land Survey Equipment Market Segmentation

TheMEA land survey equipment market is segmented based on solution, industry, application, hardware, and country.- Based on solution, the MEA land survey equipment market is segmented into hardware, software, and services. The hardware segment held the largest market share in 2022.

- Based on industry, the MEA land survey equipment market is segmented into mining, construction, agriculture, oil & gas, and others. The construction segment held the largest market share in 2022.

- Based on application, the MEA land survey equipment market is segmented into volumetric calculations, inspection, layout points, monitoring, and others. The inspection segment held the largest market share in 2022.

- Based on hardware, the MEA land survey equipment market is segmented into GNSS systems, levels, 3D laser scanners, total stations, theodolites, unmanned aerial vehicles, machine control systems, machine guidance systems, and others. The GNSS systems segment held the largest market share in 2022.

- Based on country, the MEA land survey equipment market has been categorized into Saudi Arabia, the UAE, Egypt, Mauritius, Seychelles, and the Rest of MEA. Our regional analysis states that the Rest of MEA dominated the market share in 2022.

Table of Contents

1. Introduction1.1 Study Scope

1.2 Research Report Guidance

1.3 Market Segmentation

2. Key Takeaways

3. Research Methodology

3.1 Coverage

3.2 Secondary Research

3.3 Primary Research

4. MEA Land Survey Equipment Market Landscape

4.1 Market Overview

4.2 MEA PEST Analysis

4.3 Ecosystem Analysis

4.4 Expert Opinion

5. MEA Land Survey Equipment Market - Key Market Dynamics

5.1 Key Market Drivers

5.1.1 Rising Development in Real Estate

5.1.2 Increasing Growth of Industrial & Agriculture Sectors

5.2 Key Market Restraints

5.2.1 Lack of Skilled Manpower

5.3 Key Market Opportunities

5.3.1 Development of Terrestrial Laser Scanners

5.4 Future Trends

5.4.1 Use of Unmanned Aerial Vehicles (UAVs) and Remote-Control Drones

5.5 Impact Analysis of Drivers and Restraints

6. Land Survey Equipment Market - MEA Analysis

6.1 MEA Land Survey Equipment Market Overview

6.2 MEA Land Survey Equipment Market - Revenue and Forecast to 2028 (US$ Million)

7. MEA Land survey equipment Market Analysis - By Solution

7.1 Overview

7.2 MEA Land Survey Equipment Market, By Solution (2021 And 2028)

7.3 Hardware

7.3.1 Overview

7.3.2 Hardware: Land survey equipment Market Revenue and Forecast To 2028 (US$ Million)

7.4 Software

7.4.1 Overview

7.4.2 Software: Land survey equipment Market Revenue and Forecast To 2028 (US$ Million)

7.5 Services

7.5.1 Overview

7.5.2 Services: Land survey equipment Market Revenue and Forecast To 2028 (US$ Million)

8. MEA Land Survey Equipment Market Analysis - By Industry

8.1 Overview

8.2 MEA Land Survey Equipment Market, By Industry (2021 and 2028)

8.3 Mining

8.3.1 Overview

8.3.2 Mining: Land Survey Equipment Market - Revenue, and Forecast to 2028 (US$ Million)

8.4 Construction

8.4.1 Overview

8.4.2 Construction: Land Survey Equipment Market - Revenue, and Forecast to 2028 (US$ Million)

8.5 Agriculture

8.5.1 Overview

8.5.2 Agriculture: Land Survey Equipment Market - Revenue, and Forecast to 2028 (US$ Million)

8.6 Oil and Gas

8.6.1 Overview

8.6.2 Oil and Gas: Land Survey Equipment Market - Revenue, and Forecast to 2028 (US$ Million)

8.7 Others

8.7.1 Overview

8.7.2 Others: Land Survey Equipment Market - Revenue, and Forecast to 2028 (US$ Million)

9. MEA Land Survey Equipment Market Analysis - By Application

9.1 Overview

9.2 MEA Land Survey Equipment Market, By Application (2021 and 2028)

9.4 Volumetric Calculations

9.4.1 Overview

9.4.2 Volumetric Calculations: Land Survey Equipment Market - Revenue and Forecast to 2028 (US$ Million)

9.5 Inspection

9.5.1 Overview

9.5.2 Inspection: Land Survey Equipment Market - Revenue and Forecast to 2028 (US$ Million)

9.6 Layout Points

9.6.1 Overview

9.6.2 Layout Points: Land Survey Equipment Market - Revenue and Forecast to 2028 (US$ Million)

9.7 Monitoring

9.7.1 Overview

9.7.2 Monitoring: Land Survey Equipment Market - Revenue and Forecast to 2028 (US$ Million)

9.8 Others

9.8.1 Overview

9.8.2 Others: Land Survey Equipment Market - Revenue, and Forecast to 2028 (US$ Million)

10. MEA Land Survey Equipment Market Analysis - By Hardware

10.1 Overview

10.2 MEA Land Survey Equipment Market Breakdown, by Hardware, (2021 & 2028)

10.3 GNSS Systems

10.3.1 Overview

10.3.2 GNSS Systems: Land Survey Equipment Market Revenue and Forecast to 2028 (US$ Million)

10.4 Levels

10.4.1 Overview

10.4.2 Levels: Land Survey Equipment Market Revenue and Forecast to 2028 (US$ Million)

10.5 3D Laser Scanners

10.5.1 Overview

10.5.2 3D Laser Scanners: Land Survey Equipment Market Revenue and Forecast to 2028 (US$ Million)

10.6 Total Stations

10.6.1 Overview

10.6.2 Total Stations: Land Survey Equipment Market Revenue and Forecast to 2028 (US$ Million)

10.7 Theodolites

10.7.1 Overview

10.7.2 Theodolites: Land Survey Equipment Market Revenue and Forecast to 2028 (US$ Million)

10.8 Unmanned Aerial Vehicle

10.8.1 Overview

10.8.2 Unmanned Aerial Vehicle: Land Survey Equipment Market Revenue and Forecast to 2028 (US$ Million)

10.9 Machine Control Systems

10.9.1 Overview

10.9.2 Machine Control Systems: Land Survey Equipment Market Revenue and Forecast to 2028 (US$ Million)

10.10 Machine Guidance Systems

10.10.1 Overview

10.10.2 Machine Guidance Systems: Land Survey Equipment Market Revenue and Forecast to 2028 (US$ Million)

10.11 Others

10.11.1 Overview

10.11.2 Others: Land Survey Equipment Market Revenue and Forecast to 2028 (US$ Million)

11. MEA Land Survey Equipment Market - Country Analysis

11.1 Overview

11.1.1 MEA: Land Survey Equipment Market, By Country

11.1.1.1 Saudi Arabia: Land Survey Equipment Market - Revenue and Forecast to 2028 (US$ Million)

11.1.1.1.1 Saudi Arabia: Land Survey Equipment Market, by Solution

11.1.1.1.2 Saudi Arabia: Land Survey Equipment Market, by Industry

11.1.1.1.3 Saudi Arabia: Land Survey Equipment Market, by Application

11.1.1.1.4 Saudi Arabia: Land Survey Equipment Market, by Hardware

11.1.1.2 UAE: Land Survey Equipment Market - Revenue and Forecast to 2028 (US$ Million)

11.1.1.2.1 UAE: Land Survey Equipment Market, by Solution

11.1.1.2.2 UAE: Land Survey Equipment Market, by Industry

11.1.1.2.3 UAE: Land Survey Equipment Market, by Application

11.1.1.2.4 UAE: Land Survey Equipment Market, by Hardware

11.1.1.3 Egypt: Land Survey Equipment Market - Revenue and Forecast to 2028 (US$ Million)

11.1.1.3.1 Egypt: Land Survey Equipment Market, by Solution

11.1.1.3.2 Egypt: Land Survey Equipment Market, by Industry

11.1.1.3.3 Egypt: Land Survey Equipment Market, by Application

11.1.1.3.4 Egypt: Land Survey Equipment Market, by Hardware

11.1.1.4 Mauritius: Land Survey Equipment Market - Revenue and Forecast to 2028 (US$ Million)

11.1.1.4.1 Mauritius: Land Survey Equipment Market, by Solution

11.1.1.4.2 Mauritius: Land Survey Equipment Market, by Industry

11.1.1.4.3 Mauritius: Land Survey Equipment Market, by Application

11.1.1.4.4 Mauritius: Land Survey Equipment Market, by Hardware

11.1.1.5 Seychelles: Land Survey Equipment Market - Revenue and Forecast to 2028 (US$ Million)

11.1.1.5.1 Seychelles: Land Survey Equipment Market, by Solution

11.1.1.5.2 Seychelles: Land Survey Equipment Market, by Industry

11.1.1.5.3 Seychelles: Land Survey Equipment Market, by Application

11.1.1.5.4 Seychelles: Land Survey Equipment Market, by Hardware

11.1.1.6 Rest of MEA: Land Survey Equipment Market - Revenue and Forecast to 2028 (US$ Million)

11.1.1.6.1 Rest of MEA: Land Survey Equipment Market, by Solution

11.1.1.6.2 Rest of MEA: Land Survey Equipment Market, by Industry

11.1.1.6.3 Rest of MEA: Land Survey Equipment Market, by Application

11.1.1.6.4 Rest of Middle East: Land Survey Equipment Market, by Hardware

12. Industry Landscape

12.1 Overview

12.2 Market Initiative

12.3 Merger and Acquisition

12.4 New Product Launch

13. Company Profile

13.1 Hexagon AB

13.1.1 Key Facts

13.1.2 Business Description

13.1.3 Products and Services

13.1.4 Financial Overview

13.1.5 SWOT Analysis

13.1.6 Key Developments

13.2 GUANGDONG KOLIDA INSTRUMENT CO., LTD.

13.2.1 Key Facts

13.2.2 Business Description

13.2.3 Products and Services

13.2.4 Financial Overview

13.2.5 SWOT Analysis

13.2.6 Key Developments

13.3 Shanghai Huace Navigation Technology Ltd.

13.3.1 Key Facts

13.3.2 Business Description

13.3.3 Products and Services

13.3.4 Financial Overview

13.3.5 SWOT Analysis

13.3.6 Key Developments

13.4 South Surveying & Mapping Technology CO., LTD.

13.4.1 Key Facts

13.4.2 Business Description

13.4.3 Products and Services

13.4.4 Financial Overview

13.4.5 SWOT Analysis

13.4.6 Key Developments

13.5 Topcon Corporation

13.5.1 Key Facts

13.5.2 Business Description

13.5.3 Products and Services

13.5.4 Financial Overview

13.5.5 SWOT Analysis

13.5.6 Key Developments

13.6 Trimble Inc.

13.6.1 Key Facts

13.6.2 Business Description

13.6.3 Products and Services

13.6.4 Financial Overview

13.6.5 SWOT Analysis

13.6.6 Key Developments

13.7 Hi-Target

13.7.1 Key Facts

13.7.2 Business Description

13.7.3 Products and Services

13.7.4 Financial Overview

13.7.5 SWOT Analysis

13.7.6 Key Developments

13.8 PENTAX Surveying

13.8.1 Key Facts

13.8.2 Business Description

13.8.3 Products and Services

13.8.4 Financial Overview

13.8.5 SWOT Analysis

13.8.6 Key Developments

13.9 Suzhou FOIF Co., Ltd.

13.9.1 Key Facts

13.9.2 Business Description

13.9.3 Products and Services

13.9.4 Financial Overview

13.9.5 SWOT Analysis

13.9.6 Key Developments

13.10 Robert Bosch Tool Corporation

13.10.1 Key Facts

13.10.2 Business Description

13.10.3 Products and Services

13.10.4 Financial Overview

13.10.5 SWOT Analysis

13.10.6 Key Developments

14. Appendix

14.1 About the Insight Partners

14.2 Word Index

List of Tables

Table 1. MEA Land Survey Equipment Market - Revenue and Forecast to 2028 (US$ Million)

Table 2. Saudi Arabia: Land Survey Equipment Market, By Solution - Revenue and Forecast to 2028 (US$ Million)

Table 3. Saudi Arabia: Land Survey Equipment Market, By Industry - Revenue and Forecast to 2028 (US$ Million)

Table 4. Saudi Arabia: Land Survey Equipment Market, By Application - Revenue and Forecast to 2028 (US$ Million)

Table 5. Saudi Arabia: Land Survey Equipment Market, By Hardware - Revenue and Forecast to 2028 (US$ Million)

Table 6. UAE: Land Survey Equipment Market, By Solution - Revenue and Forecast to 2028 (US$ Million)

Table 7. UAE: Land Survey Equipment Market, By Industry - Revenue and Forecast to 2028 (US$ Million)

Table 8. UAE: Land Survey Equipment Market, By Application - Revenue and Forecast to 2028 (US$ Million)

Table 9. UAE: Land Survey Equipment Market, By Hardware - Revenue and Forecast to 2028 (US$ Million)

Table 10. Egypt: Land Survey Equipment Market, By Solution - Revenue and Forecast to 2028 (US$ Million)

Table 11. Egypt: Land Survey Equipment Market, By Industry - Revenue and Forecast to 2028 (US$ Million)

Table 12. Egypt: Land Survey Equipment Market, By Application - Revenue and Forecast to 2028 (US$ Million)

Table 13. Egypt: Land Survey Equipment Market, By Hardware - Revenue and Forecast to 2028 (US$ Million)

Table 14. Mauritius: Land Survey Equipment Market, By Solution - Revenue and Forecast to 2028 (US$ Million)

Table 15. Mauritius: Land Survey Equipment Market, By Industry - Revenue and Forecast to 2028 (US$ Million)

Table 16. Mauritius: Land Survey Equipment Market, By Application - Revenue and Forecast to 2028 (US$ Million)

Table 17. Mauritius: Land Survey Equipment Market, By Hardware - Revenue and Forecast to 2028 (US$ Million)

Table 18. Seychelles: Land Survey Equipment Market, By Solution - Revenue and Forecast to 2028 (US$ Million)

Table 19. Seychelles: Land Survey Equipment Market, By Industry - Revenue and Forecast to 2028 (US$ Million)

Table 20. Seychelles: Land Survey Equipment Market, By Application - Revenue and Forecast to 2028 (US$ Million)

Table 21. Seychelles: Land Survey Equipment Market, By Hardware - Revenue and Forecast to 2028 (US$ Million)

Table 22. Rest of MEA: Land Survey Equipment Market, By Solution - Revenue and Forecast to 2028 (US$ Million)

Table 23. Rest of MEA: Land Survey Equipment Market, By Industry - Revenue and Forecast to 2028 (US$ Million)

Table 24. Rest of MEA: Land Survey Equipment Market, By Application - Revenue and Forecast to 2028 (US$ Million)

Table 25. Rest of Middle East: Land Survey Equipment Market, By Hardware - Revenue and Forecast to 2028 (US$ Million)

Table 26. List of Abbreviation

List of Figures

Figure 1. MEA Land Survey Equipment Market Segmentation

Figure 2. MEA Land Survey Equipment Market Segmentation - By Country

Figure 3. MEA Land Survey Equipment Market Overview

Figure 4. MEA Land Survey Equipment Market, By Solution

Figure 5. MEA Land Survey Equipment Market, By Country

Figure 6. Middle East: PEST Analysis

Figure 7. Africa: PEST Analysis

Figure 8. Expert Opinion

Figure 9. MEA Land Survey Equipment Market Impact Analysis of Drivers and Restraints

Figure 10. MEA Land Survey Equipment Market - Revenue and Forecast to 2028 (US$ Million)

Figure 11. MEA Land Survey Equipment Market, By Solution (2021 and 2028)

Figure 12. MEA Hardware: Land survey equipment Market Revenue and Forecast to 2028 (US$ Million)

Figure 13. MEA Software: Land survey equipment Market Revenue and Forecast to 2028 (US$ Million)

Figure 14. MEA Services: Land survey equipment Market Revenue and Forecast to 2028 (US$ Million)

Figure 15. MEA Land Survey Equipment Market Revenue Share, by Industry (2021 and 2028)

Figure 16. MEA Mining: Land Survey Equipment Market - Revenue, and Forecast to 2028 (US$ Million)

Figure 17. MEA Construction: Land Survey Equipment Market - Revenue, and Forecast to 2028 (US$ Million)

Figure 18. MEA Agriculture: Land Survey Equipment Market - Revenue, and Forecast to 2028 (US$ Million)

Figure 19. MEA Oil and Gas: Land Survey Equipment Market - Revenue, and Forecast to 2028 (US$ Million)

Figure 20. MEA Others: Land Survey Equipment Market - Revenue, and Forecast to 2028 (US$ Million)

Figure 21. MEA Land Survey Equipment Market Revenue Share, by Application (2021 and 2028)

Figure 22. MEA Volumetric Calculations: Land Survey Equipment Market - Revenue and Forecast to 2028 (US$ Million)

Figure 23. MEA Inspection: Land Survey Equipment Market - Revenue and Forecast to 2028 (US$ Million)

Figure 24. MEA Layout Points: Land Survey Equipment Market - Revenue and Forecast to 2028 (US$ Million)

Figure 25. MEA Monitoring: Land Survey Equipment Market - Revenue and Forecast to 2028 (US$ Million)

Figure 26. MEA Others: Land Survey Equipment Market - Revenue, and Forecast to 2028 (US$ Million)

Figure 27. MEA Land Survey Equipment Market Breakdown, by Hardware (2021 and 2028)

Figure 28. MEA GNSS Systems: Land Survey Equipment Market Revenue and Forecast to 2028(US$ Million)

Figure 29. MEA Levels: Land Survey Equipment Market Revenue and Forecast to 2028(US$ Million)

Figure 30. MEA 3D Laser Scanners: Land Survey Equipment Market Revenue and Forecast to 2028(US$ Million)

Figure 31. MEA Total Stations: Land Survey Equipment Market Revenue and Forecast to 2028(US$ Million)

Figure 32. MEA Theodolites: Land Survey Equipment Market Revenue and Forecast to 2028(US$ Million)

Figure 33. MEA Unmanned Aerial Vehicle: Land Survey Equipment Market Revenue and Forecast to 2028(US$ Million)

Figure 34. MEA Machine Control Systems: Land Survey Equipment Market Revenue and Forecast to 2028(US$ Million)

Figure 35. MEA Machine Guidance Systems: Land Survey Equipment Market Revenue and Forecast to 2028(US$ Million)

Figure 36. MEA Others: Land Survey Equipment Market Revenue and Forecast to 2028(US$ Million)

Figure 37. MEA: Land Survey Equipment Market, by Key Country - Revenue (2021) (US$ ‘Million)

Figure 38. MEA: Land Survey Equipment Market Revenue Share, By Country (2021 and 2028)

Figure 39. Saudi Arabia: Land Survey Equipment Market - Revenue and Forecast to 2028 (US$ Million)

Figure 40. UAE: Land Survey Equipment Market - Revenue and Forecast to 2028 (US$ Million)

Figure 41. Egypt: Land Survey Equipment Market - Revenue and Forecast to 2028 (US$ Million)

Figure 42. Mauritius: Land Survey Equipment Market - Revenue and Forecast to 2028 (US$ Million)

Figure 43. Seychelles: Land Survey Equipment Market - Revenue and Forecast to 2028 (US$ Million)

Figure 44. Rest of MEA: Land Survey Equipment Market - Revenue and Forecast to 2028 (US$ Million)

Companies Mentioned

- GUANGDONG KOLIDA INSTRUMENT CO., LTD.

- Hexagon AB

- Hi-Target

- PENTAX Surveying

- Robert Bosch Tool Corporation

- Shanghai Huace Navigation Technology Ltd.

- South Surveying & Mapping Technology CO., LTD.

- Suzhou FOIF Co., Ltd.

- Topcon Corporation

- Trimble Inc.

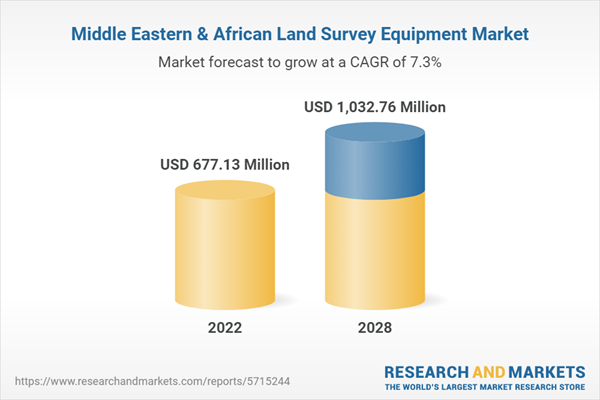

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 167 |

| Published | December 2022 |

| Forecast Period | 2022 - 2028 |

| Estimated Market Value ( USD | $ 677.13 Million |

| Forecasted Market Value ( USD | $ 1032.76 Million |

| Compound Annual Growth Rate | 7.3% |

| Regions Covered | Africa, Middle East |

| No. of Companies Mentioned | 10 |