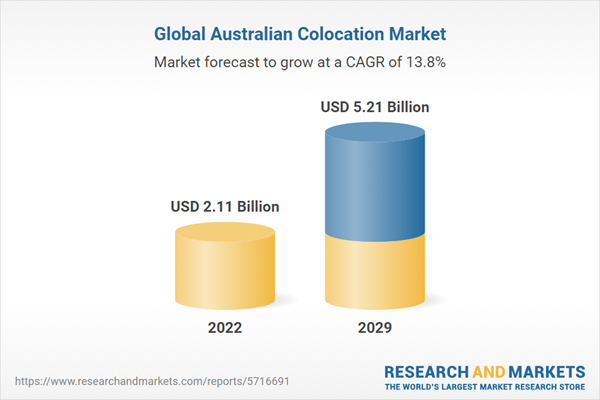

The australia colocation market is evaluated at US$2.105 billion for the year 2022 growing at a CAGR of 13.82% reaching the market size of US$5.209 billion by the year 2029.

Colocation market in Australia is anticipated to show steady growth which is attributed to the increasing number of data centers, favorable regulation coupled with good infrastructural facilities, and the high internet penetration rate in the country. The market is being exacerbated by the expanding effects of big data, the Internet of Things (IoT), and the increasing adoption of online modes of shopping, virtual entertainment, learning, and others, especially during the COVID-19 pandemic.Market Drivers

Rapid urbanization and digital innovation has propel the market growth.

High urbanization in the country is a prime factor contributing to the increasing use of data centers. According to the World Bank, in 2021, 86% of the population lives in urban development, which is about 22.23 million individuals. Data centers are a growingly desirable asset class with promising signs of future expansion in Australia. Moreover, the increasing penetration of 5G internet networks coupled with the rising adoption of industry 4.0 is expected to rise in the coming years.Growing internet penetration

Australia, being a developed nation, has a significantly high internet penetration rate which has increased the rate of online transactions, be it for online shopping, e-learning, or any other day-to-day activity. Government initiatives in IT sectors coupled with the development and emergence of 5G is further expected to drive the colocation services throughout the forecast period.Moreover, the significant share of this segment can be attributed to the increased number of mobile phone and internet users and the continuous development of high-tech applications and software in the industry. This is expected to lead to the rise of unstructured data and consequently result in the growth of data center colocation in the country which is projected to propel growth for the market. The Capex (capital expenditure) investments in the country are also expected to boost the telecommunications industry which has been projected to propel growth for the colocation market.

Key Developments

- In April 2023: Engineering firm HDR Inc. developed two new data centers namely “M3 Melbourne” and “M2 Melbourne” which will collectively provide 210 megawatts of power to critical IT infrastructure, government, and enterprises in Melbourne.

Segmentation:

By Colocation Model

- Retail Colocation

- Wholesale Colocation

By End-User Industry

- Banking and Financial Services

- Manufacturing

- Communication Technology

- Healthcare

- Energy

- Education

- Government

- Media and Entertainment

- Others

Table of Contents

Companies Mentioned

- Telstra Corporation Limited

- Nextdc Ltd.

- Fluccs - The Australian Cloud Pty Ltd

- Equinix Australia Pty Ltd.

- Over The Wire Pty. Ltd.

- Exetel Pty Ltd

- Interactive Pty Ltd

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 76 |

| Published | February 2024 |

| Forecast Period | 2022 - 2029 |

| Estimated Market Value ( USD | $ 2.11 Billion |

| Forecasted Market Value ( USD | $ 5.21 Billion |

| Compound Annual Growth Rate | 13.8% |

| Regions Covered | Australia |

| No. of Companies Mentioned | 7 |