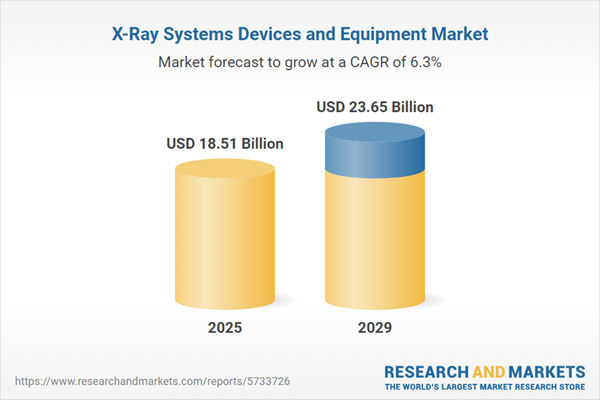

The X-ray systems devices and equipment market size has grown strongly in recent years. It will grow from $17.32 billion in 2024 to $18.51 billion in 2025 at a compound annual growth rate (CAGR) of 6.8%. The growth in the historic period can be attributed to medical diagnostics, population growth, aging population, preventive and routine healthcare.

The X-ray systems devices and equipment market size is expected to see strong growth in the next few years. It will grow to $23.65 billion in 2029 at a compound annual growth rate (CAGR) of 6.3%. The growth in the forecast period can be attributed to digital transformation, specialized applications, population health management, advancements in radiation safety. Major trends in the forecast period include 3d and cone-beam ct imaging, point-of-care x-ray, ai-enhanced imaging, remote and mobile imaging.

The growing incidence of injuries worldwide is serving as a driving force for the medical diagnostic X-ray systems, devices, and equipment market. The increasing frequency of accidents, sports-related injuries, severe muscle and bone damage, and other forms of trauma is fueling the demand for diagnostic equipment, particularly X-ray systems and related devices. For instance, in November 2023, the United States Department of Labor, a U.S.-based government department, reported that in 2022, private industry employers documented 2.8 million nonfatal workplace injuries and illnesses, representing a 7.5% increase from 2021. This rising incidence of injuries globally is driving the growth of the medical diagnostic X-ray systems, devices, and equipment market.

The growing demand for diagnostic imaging procedures is expected to drive the expansion of the X-ray systems, devices, and equipment market. Diagnostic imaging procedures involve medical tests that use various technologies to create images of the body’s interior, aiding in the diagnosis of diseases, assessment of injuries, monitoring of treatment effectiveness, and planning of surgical procedures. X-ray systems play a crucial role in these diagnostic imaging procedures, helping detect abnormalities and allowing healthcare professionals to accurately diagnose conditions or injuries. For example, in December 2022, the National Health Service (NHS) in the UK reported that, in the year ending March 2022, England conducted 44 million imaging tests, marking a 26% increase from 34.9 million the previous year. X-rays led the category with 21.8 million tests (a 30% increase), followed by ultrasound at 10.1 million (up 23%), CT scans at 6.7 million (up 21%), and MRI scans at 3.8 million (up 28%). Other imaging modalities also saw growth, including fluoroscopy (up 23%), nuclear medicine (up 22%), SPECT (up 39%), PET-CT scans (up 20%), and medical photography (up 11%). This surge in diagnostic imaging procedures highlights the increasing need for such technologies, contributing to the growth of the X-ray systems, devices, and equipment market.

The X-ray systems, devices, and equipment market is currently witnessing a surge in mergers and acquisitions (M&A) activity. These M&A deals are primarily driven by companies looking to diversify their business interests into the field of medical diagnostic imaging and radiology. For example, in April 2024, Shimadzu Corporation, a Japan-based manufacturer of precision instruments, measuring instruments, and medical equipment, acquired X-ray Imaging Services, Inc. for an undisclosed amount. This acquisition of X-ray Imaging Services, Inc. (CIS), based in California, by Shimadzu Medical Systems USA aims to expand its direct sales and service operations in the U.S., particularly on the West Coast. X-ray Imaging Services, Inc. is a leading supplier of X-ray imaging and security equipment to government and business entities in California.

Major companies in the X-Ray Systems, Devices, and Equipment market are focusing on developing innovative solutions, such as mobile X-ray systems, to enhance accessibility and improve diagnostic capabilities across various healthcare settings. Mobile X-ray systems are portable imaging machines designed for easy transportation and use in a range of healthcare environments, enabling quick and convenient diagnostic imaging without requiring patients to be moved to a fixed facility. For example, in July 2022, Siemens Healthcare, a Germany-based healthcare company, launched the Mobilett Impact, a state-of-the-art mobile X-ray system designed for bedside imaging, particularly for patients in intensive care units (ICUs). This system integrates seamlessly with hospital workflows, enabling wireless transmission of imaging data. Its user-friendly interface minimizes training time for technicians while delivering high-quality images with optimized radiation doses. The Mobilett Impact can capture images in approximately 6.5 seconds, facilitating timely diagnostics and enhancing patient care.

In March 2022, Canon Medical Systems, a Japanese medical equipment manufacturer, acquired Nordisk Røntgen Teknik (NRT) for an undisclosed amount. This acquisition has provided Canon with access to European technology and advanced radiographic solutions. NRT, a Danish medical equipment manufacturer, specializes in diagnostic X-ray systems and technologies.

X-ray devices and equipment are essential tools for medical imaging and diagnosis. They use radiography or X-ray technology to create images of internal bodily structures using small amounts of electromagnetic energy. These images are crucial for diagnosing and monitoring various medical conditions.

The main types of X-ray devices and equipment include portable and stationary systems. Portable X-ray devices are smaller and easily movable, allowing dental professionals to capture X-ray images with convenience. X-ray images can be in 2D, 3D, or 4D formats, and various product types include computed tomography, mobile X-ray devices, C-arm devices, dental X-ray, mammography, and more. X-ray technologies can be either analog or digital, and they find applications in cardiovascular, respiratory, mammography, dental, orthopedics, and other medical specialties. These devices are crucial for healthcare professionals to visualize and diagnose medical conditions accurately.

The X-ray devices and equipment market research report is one of a series of new reports that provides X-ray devices and equipment market statistics, including X-ray devices and equipment industry global market size, regional shares, competitors with a X-ray devices and equipment market share, detailed X-ray devices and equipment market segments, market trends and opportunities, and any further data you may need to thrive in the X-ray devices and equipment industry. This X-ray devices and equipment market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

Major companies operating in the x-ray systems devices and equipment market include Siemens Healthcare, Carestream Health, Philips Healthcare, Hitachi Medical, GE Healthcare, Shimadzu Corporation, Fujifilm Holdings, Toshiba Medical Systems Corporation, Canon Inc., Agfa HealthCare N.V., Hologic Inc., Konica Minolta, Samsung, Analogic Corporation, Summit Industries, Rapiscan Systems, Swissray International Inc., Ziehm Imaging GmbH, RMS India, KUB Technologies Inc., Source Ray Inc., Allengers Medical Systems, Dentsply Sirona, Bennett, MinXray Inc., Varian Medical Systems, Angell Technology, Control-X Medical, DMS Imaging, Esaote, IAE SPA, Infimed Sp. z o.o., Medonica Healthcare Private Limited, PerkinElmer Inc., Planmed Oy.

Western Europe was the largest region in the global X-ray devices and equipment market in 2024. North America was the second-largest region in global X-ray devices and equipment market share. The regions covered in the x-ray systems devices and equipment market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, and Africa. The countries covered in the x-ray systems devices and equipment market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Italy, Spain, Canada.

The X-ray devices and equipment market consists of sales dental x-ray machine, mobile x-ray machine, veterinary x-ray machine, analog machine, digital machine, and fully digital machine. Values in this market are factory gate values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors, and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Executive Summary

X-Ray Systems Devices and Equipment Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on x-ray systems devices and equipment market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 50 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for x-ray systems devices and equipment ? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The x-ray systems devices and equipment market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include: the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Type: Portable Type; Stationary Type2) By Product Type: Computed Tomography; Mobile X-Ray Devices; C-Arm Devices; Dental X-Ray; Mammography; Other Product Types

3) By image type: 2D images; 3D images; 4D images 4) By Technology: Analog X-Ray Machine ; Digital X-Ray Machine

4) By Technology: Analog X-Ray Machine, Digital X-Ray Machine

5) By Application: Cardiovascular; Respiratory; Mammography; Dental; Orthopedics; Other Applications

Subsegments:

1) By Portable Type: Mobile X-Ray Systems; Handheld X-Ray Devices; Veterinary X-Ray Systems2) By Stationary Type: Conventional X-Ray Systems; Computed Radiography (CR) Systems; Digital Radiography (DR) Systems; Fluoroscopy X-Ray Systems

Key Companies Mentioned: Siemens Healthcare; Carestream Health; Philips Healthcare; Hitachi Medical; GE Healthcare

Countries: Australia; China; India; Indonesia; Japan; South Korea; Bangladesh; Thailand; Vietnam; Malaysia; Singapore; Philippines; Hong Kong; New Zealand; USA; Canada; Mexico; Brazil; Chile; Argentina; Colombia; Peru; France; Germany; UK; Austria; Belgium; Denmark; Finland; Ireland; Italy; Netherlands; Norway; Portugal; Spain; Sweden; Switzerland; Russia; Czech Republic; Poland; Romania; Ukraine; Saudi Arabia; Israel; Iran; Turkey; UAE; Egypt; Nigeria; South Africa

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

The major companies featured in this X-Ray Systems Devices and Equipment market report include:- Siemens Healthcare

- Carestream Health

- Philips Healthcare

- Hitachi Medical

- GE Healthcare

- Shimadzu Corporation

- Fujifilm Holdings

- Toshiba Medical Systems Corporation

- Canon Inc.

- Agfa HealthCare N.V.

- Hologic Inc.

- Konica Minolta

- Samsung

- Analogic Corporation

- Summit Industries

- Rapiscan Systems

- Swissray International Inc.

- Ziehm Imaging GmbH

- RMS India

- KUB Technologies Inc.

- Source Ray Inc.

- Allengers Medical Systems

- Dentsply Sirona

- Bennett

- MinXray Inc.

- Varian Medical Systems

- Angell Technology

- Control-X Medical

- DMS Imaging

- Esaote

- IAE SPA

- Infimed Sp. z o.o.

- Medonica Healthcare Private Limited

- PerkinElmer Inc.

- Planmed Oy

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 250 |

| Published | April 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 18.51 Billion |

| Forecasted Market Value ( USD | $ 23.65 Billion |

| Compound Annual Growth Rate | 6.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 36 |