Speak directly to the analyst to clarify any post sales queries you may have.

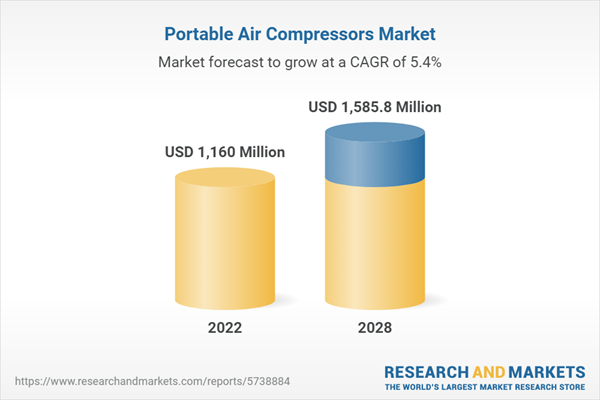

The global portable air compressor market by revenue is expected to grow at a CAGR of 5.35% from 2022 to 2028. A portable air compressor provides compressed air to several industries, such as construction, automotive, and oil & gas. They are also utilized as backup compressors in several industries when the stationary compressors break down or require maintenance. The increasing adoption of variable-speed systems, low maintenance cost, effective operation, and retrofitting for existing methods are some factors propelling the global portable air compressor market among the end-use industries. Moreover, energy-efficient portable air compressors are witnessing a surge in demand owing to their cost-effective operations. Hence, air monitoring systems are widely installed for measuring air compressors' impact. Additionally, the subsequent introduction of oil-free-based projects and continuous industry investments are driving the demand for oil-free portable air compressors.

Prominent manufacturers in the global portable air compressor market are developing eco-friendly and low-maintenance systems in their products to encourage users to opt for next-generation compressors. Further, companies such as Sullair, Ingersoll Rand Plc, and Atlas Copco Inc. have developed their products with next-generation systems and high-performance capabilities to differentiate them from other vendors in this highly competitive market. For instance, in 2020, Sullair introduced its redesigned, next-generation 1600H Tier 4 Final portable diesel air compressor, an enhanced model based on the direct voice of customer feedback. A few of the key features offered by these portable air compressors include increased efficiency and reduced noise levels. Moreover, technology integration is the key approach companies select to refine the technologies utilized in their new products and services. An effective technology-integration process starts in the earliest phases of an R&D project and provides a road map for all design, engineering, and manufacturing activities.

Various manufacturers provided IoT-connected air compressors, including Kaeser, Atlas Copco, Elgi, and Hitachi Sullair. For instance, in 2020, Atlas Copco had approximately 100,000 IoT-connected compressors at approximately 35,000 production sites globally. Hence, these compressors deliver more than 150 data measurements per second, including sharing the real-time status of internal parts, such as the motor, belt, etc. Therefore, the advancement and development of new technologies have revolutionized the global portable air compressor market. Moreover, the constant efforts to develop new features and technology for compressors are expected to create new opportunities to expand the portable compressor market during the forecast period.

FUTURE GROWTH OPPORTUNITIES

The manufacturers are emphasizing manufacturing energy-efficient compressors by adopting VFD and VSD technologies, which enables them to save huge amounts of energy on their products in the portable air compressor market. For instance, Atlas Copco’s GA 7-110 VSD+ is an innovative oil-injected compressor that took energy efficiency to a new level with an approximately 50% reduction in energy consumption. Hence, such adoption of energy-efficient technologies is providing an opportunity to the manufacturers during the forecast period.

Further, according to the report by the Department of Business, Energy, and Industrial Strategies state that compressed air systems are one of the large consumers of energy, consuming around 10% of all industrial electrical consumption or 8.8 TWh each year, which results in CO2 emissions of 3,100 kt/year. Hence, such factors are expected to encourage the adoption of energy-efficient electric portable air compressors during the forecast period.

SEGMENTATION INSIGHTS

- The reciprocating portable air compressors segment accounted for a revenue share of USD 623.18 million in the global portable air compressor market, owing to the high adoption of these compressors in manufacturing. Further, these compressors are widely used in the oil and gas sector for operating pneumatic equipment for pipelines, oil extraction & refining, and other processes.

- In the end-user global portable air compressor market, the construction segment is growing at a high CAGR due to the increasing adoption of compressors to provide a power source to pneumatic tools such as sanders, grinders, and wrenchers, among others, and is expected to cross USD 360.34 million by 2028.

- The consumption of portable compressors in the automotive sector is also gaining momentum across several regions. The gaining momentum is contributed by the compressed air used as an energy carrier in the automotive industry to move robotic lines, cutting & welding operations, paint pump operations, and many other applications.

- The adoption of oil-free portable compressors is high in the APAC region owing to the growing manufacturing and automotive industries. In 2022, it accounted for a revenue share of 37.85% in the global portable air compressor market.

- The oil-free segment in the lubrication portable air compressor market is expected to grow at a higher growth rate of 5.56% during the forecast period. The growth is propelled due to the growing implementation of regulations to curb emissions and governments' rising focus on environmental safety.

Segmentation by Product Type

- Reciprocating

- Rotary Screw

- Centrifugal

- Axial

Segmentation by Lubrication Type

- Oil-Injected

- Oil-Free

Segmentation by Airflow Type

- Below 400 CFM

- 400-800 CFM

- Above 800 CFM

Segmentation by Fuel Type

- Conventional

- Electric

Segmentation by End-user Type

- Manufacturing

- Construction

- Pharmaceutical/Healthcare

- Automotive

- Power Generation

- Oil & Gas

- Agriculture

- Others

GEOGRAPHICAL INSIGHTS

APAC accounted for a revenue share of 47.08% in the global portable air compressor market in 2022, owing to continuous government investments in infrastructure development and rapid industrialization. The demand for portable air compressors from various applications, such as manufacturing, home applications, and automotive industries, drives the market growth. Moreover, several manufacturers of compressors in China and India are expected to drive industry growth in the region.

Europe and North America are expected to grow steadily in the portable air compressor market during the forecast period. However, rising investments for infrastructural development in both regions are expected to augment the growth opportunities for industrial air compressors. Further, the increasing focus of consumers on easy-to-use and energy-efficient products is projected to propel the industry growth.

Segmentation by Geography

- North America

- US

- Canada

- Europe

- Germany

- UK

- Italy

- France

- Spain

- APAC

- China

- Japan

- South Korea

- India

- Australia

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East & Africa

- South Africa

- UAE

- Saudi Arabia

VENDOR LANDSCAPE

The portable air compressor market can be defined as a competitive market characterized by several prominent industry players, such as Atlas Copco; Bauer Ingersoll Rand Plc; Kaeser Compressors; and Sullair LLC, among others. These companies are expanding their product portfolio to gain a larger industry share. These players are using several organic and inorganic growth strategies, such as M&A and collaborations, to bolster their position in the global market.

Key Vendors

- Atlas Copco

- Gardner Denver

- Kaeser Kompressoren

- Ingersoll-Rand

Other Prominent Vendors

- Sullair, LLC

- Deere & Company

- Rolair Systems

- Doosan Portable Power

- Sullivan-Palatek Inc.

- Hubei Teweite Power Technology Co., Ltd.

- Elgi Compressors USA, Inc.

- CIASONS

- MAT Holding, Inc.

- Quincy Compressor

- Vanair Manufacturing

- BAC Compressor

- SeaComAir

- JSC Remeza

KEY QUESTIONS ANSWERED

- How big is the portable air compressor market?

- What is the growth rate of the portable air compressor market?

- Who are the key players in the global portable air compressor market?

- What are the key driving factors in the portable air compressor market?

- Which region dominates the portable air compressor market?

Table of Contents

1 Research Methodology

2 Research Objectives

3 Research Process

4 Scope & Coverage

4.1 Market Definition

4.1.1 Inclusions

4.1.2 Exclusions

4.1.3 Market Estimation Caveats

4.2 Base Year

4.3 Scope of the Study

4.1 Market Segmentation

4.1.1 Market Segmentation by Product Type

4.1.2 Market Segmentation by Lubrication Type

4.1.3 Market Segmentation by Airflow Type

4.1.4 Market Segmentation by Fuel Type

4.1.5 Market Segmentation by End-User Type

4.1.6 Market Segmentation by Geography

5 Report Assumptions & Caveats

5.1 Key Caveats

5.2 Currency Conversion

5.3 Market Derivation

6 Market at a Glance

7 Premium Insights

7.1 Market Overview

7.2 Future Growth Opportunities

7.3 Segmentation Insights

7.4 Geographical Insights

7.5 Vendor Landscape

8 Introduction

8.1 Overview

8.2 Benefits of Portable Air Compressors

8.2.1 Less Noise

8.2.2 Versatile

8.2.3 Power Source

8.2.4 Compact

8.3 Code of Federal Regulations

8.3.1 Applicability

8.3.2 Noise Emissions Standards

8.3.3 Test Procedures

8.4 Initiatives to Curb Industrial Greenhouse Effect

8.5 Economy Scenario

8.6 Value Chain

8.6.1 Raw Materials

8.6.2 Manufacturers/Vendors

8.6.3 Dealers/Distributors

8.6.4 Retailers

8.6.5 End-Users

9 Import & Export Statistics

10 Market Opportunities & Trends

10.1 Growing Demand for Energy-Efficient Compressors

10.2 Advances in Battery Technology

10.3 Growing Inclination Toward Sustainability

11 Market Growth Enablers

11.1 Integration of Technology in Compressors

11.2 Increase in Use of Compressors in Construction Activities

11.3 Increase in Use of Compressors in Households

12 Market Restraints

12.1 Effects of Diesel Consumption

12.2 Volatility in Raw Material Prices

13 Market Landscape

13.1 Market Overview

13.2 Five Forces Analysis

13.2.1 Threat of New Entrants

13.2.2 Bargaining Power of Suppliers

13.2.3 Bargaining Power of Buyers

13.2.4 Threat of Substitutes

13.2.5 Competitive Rivalry

14 Product Type

14.1 Market Snapshot & Growth Engine (Value)

14.2 Market Snapshot & Growth Engine (Volume)

14.3 Market Overview

14.4 Market Size & Forecast

14.5 Reciprocating

14.5.1 Market Overview

14.5.2 Market Size & Forecast

14.5.3 Market by Geography

14.6 Rotary Screw

14.6.1 Market Overview

14.6.2 Market Size & Forecast

14.6.3 Market by Geography

14.7 Centrifugal

14.7.1 Market Overview

14.7.2 Market Size & Forecast

14.7.3 Market by Geography

14.8 Axial

14.8.1 Market Overview

14.8.2 Market Size & Forecast

14.8.3 Market by Geography

15 Lubrication Type

15.1 Market Snapshot & Growth Engine (Value)

15.2 Market Snapshot & Growth Rate (Volume)

15.3 Market Overview

15.4 Market Size & Forecast

15.5 Oil-Injected

15.5.1 Market Overview

15.5.2 Market Size & Forecast

15.5.3 Market by Geography

15.6 Oil-Free

15.6.1 Market Overview

15.6.2 Market Size & Forecast

15.6.3 Market by Geography

16 Airflow Type

16.1 Market Snapshot & Growth Engine (Value)

16.2 Market Snapshot & Growth Rate (Volume)

16.3 Market Overview

16.4 Market Size & Forecast

16.5 Below 400 Cfm

16.5.1 Market Overview

16.5.2 Market Size & Forecast

16.5.3 Market by Geography

16.6 400-800 Cfm

16.6.1 Market Overview

16.6.2 Market Size & Forecast

16.6.3 Market by Geography

16.7 Above 800 Cfm

16.7.1 Market Overview

16.7.2 Market Size & Forecast

16.7.3 Market by Geography

17 Fuel Type

17.1 Market Snapshot & Growth Engine (Value)

17.2 Market Snapshot & Growth Rate (Volume)

17.3 Market Overview

17.4 Market Size & Forecast

17.5 Conventional

17.5.1 Market Overview

17.5.2 Market Size & Forecast

17.5.3 Market by Geography

17.6 Electric

17.6.1 Market Overview

17.6.2 Market Size & Forecast

17.6.3 Market by Geography

18 End-User Type

18.1 Market Snapshot & Growth Engine (Value)

18.2 Market Snapshot & Growth Rate (Volume)

18.3 Market Overview

18.4 Market Size & Forecast

18.5 Manufacturing

18.5.1 Market Overview

18.5.2 Market Size & Forecast

18.5.3 Market by Geography

18.6 Construction

18.6.1 Market Overview

18.6.2 Market Size & Forecast

18.6.3 Market by Geography

18.7 Pharmaceutical & Healthcare

18.7.1 Market Overview

18.7.2 Market Size & Forecast

18.7.3 Market by Geography

18.8 Automotive

18.8.1 Market Overview

18.8.2 Market Size & Forecast

18.8.3 Market by Geography

18.9 Power Generation

18.9.1 Market Overview

18.9.2 Market Size & Forecast

18.9.3 Market by Geography

18.10 Oil & Gas

18.10.1 Market Overview

18.10.2 Market Size & Forecast

18.10.3 Market by Geography

18.11 Agriculture

18.11.1 Market Overview

18.11.2 Market Size & Forecast

18.11.3 Market by Geography

18.12 Others

18.12.1 Market Overview

18.12.2 Market Size & Forecast

18.12.3 Market by Geography

19 Geography

19.1 Market Snapshot & Growth Engine (Value)

19.2 Market Snapshot & Growth Rate (Volume)

19.3 Geographic Overview

20 APAC

20.1 Market Overview

20.2 Market Size & Forecast

20.2.1 Product Type

20.2.2 Lubricant Type

20.2.3 Airflow Type

20.2.4 Fuel Type

20.2.5 End-User Type

20.3 Key Countries

20.3.1 Market Snapshot & Growth Rate (Value)

20.3.2 Market Snapshot & Growth Rate (Volume)

20.3.3 China: Market Size & Forecast

20.3.4 Japan: Market Size & Forecast

20.3.5 India: Market Size & Forecast

20.3.6 South Korea: Market Size & Forecast

20.3.7 Australia: Market Size & Forecast

21 Europe

21.1 Market Overview

21.2 Market Size & Forecast

21.2.1 Product Type

21.2.2 Lubricant Type

21.2.3 Airflow Type

21.2.4 Fuel Type

21.2.5 End-User Type

21.3 Key Countries

21.3.1 Market Snapshot & Growth Rate (Value)

21.3.2 Market Snapshot & Growth Rate (Volume)

21.3.3 Germany: Market Size & Forecast

21.3.4 Uk: Market Size & Forecast

21.3.5 France: Market Size & Forecast

21.3.6 Italy: Market Size & Forecast

21.3.7 Spain: Market Size & Forecast

22 North America

22.1 Market Overview

22.2 Market Size & Forecast

22.2.1 Product Type

22.2.2 Lubricant Type

22.2.3 Airflow Type

22.2.4 Fuel Type

22.2.5 End-User Type

22.3 Key Countries

22.3.1 Market Snapshot & Growth Rate (Value)

22.4.1 Market Snapshot & Growth Rate (Volume)

22.4.2 Us: Market Size & Forecast

22.4.3 Canada: Market Size & Forecast

23 Latin America

23.1 Market Overview

23.2 Market Size & Forecast

23.2.1 Product Type

23.2.2 Lubricant Type

23.2.3 Airflow Type

23.2.4 Fuel Type

23.2.5 End-User Type

23.3 Key Countries

23.3.1 Market Snapshot & Growth Rate (Value)

23.3.2 Market Snapshot & Growth Rate (Volume)

23.3.3 Brazil: Market Size & Forecast

23.3.4 Mexico: Market Size & Forecast

23.3.5 Argentina: Market Size & Forecast

24 Middle East & Africa

24.1 Market Overview

24.2 Market Size & Forecast

24.2.1 Product Type

24.2.2 Lubricant Type

24.2.3 Airflow Type

24.2.4 Fuel Type

24.2.5 End-User Type

24.3 Key Countries

24.3.1 Market Snapshot & Growth Rate (Value)

24.3.2 Market Snapshot & Growth Rate (Volume)

24.3.3 Saudi Arabia: Market Size & Forecast

24.3.4 Uae: Market Size & Forecast

24.3.5 South Africa: Market Size & Forecast

25 Competitive Landscape

25.1 Competition Overview

26 Key Company Profiles

26.1 Atlas Copco

26.1.1 Business Overview

26.1.2 Key Strategies

26.1.3 Product Offerings

26.1.4 Key Strengths

26.1.5 Key Opportunities

26.2 Gardner Denver

26.2.1 Business Overview

26.2.2 Product Offerings

26.2.3 Key Strategies

26.2.4 Key Strengths

26.2.5 Key Opportunities

26.3 Kaeser Kompressoren

26.3.1 Business Overview

26.3.2 Product Offerings

26.3.3 Key Strategies

26.3.4 Key Strengths

26.3.5 Key Opportunities

26.4 Ingersoll-Rand

26.4.1 Business Overview

26.4.2 Product Offerings

26.4.3 Key Strategies

26.4.4 Key Strengths

26.4.5 Key Opportunities

27 Other Prominent Vendors

27.1 Sullair, LLC

27.1.1 Business Overview

27.1.2 Product Offerings

27.2 Deere & Company

27.2.1 Business Overview

27.2.2 Product Offerings

27.3 Rolair Systems

27.3.1 Business Overview

27.3.2 Product Offerings

27.4 Doosan Portable Power

27.4.1 Business Overview

27.4.2 Product Offerings

27.5 Sullivan-Palatek, Inc.

27.5.1 Business Overview

27.5.2 Product Offerings

27.6 Hubei Teweite Power Technology Co. Ltd.

27.6.1 Business Overview

27.6.2 Product Offerings

27.7 Elgi Compressors Usa, Inc.

27.7.1 Business Overview

27.7.2 Product Offerings

27.8 Ciasons

27.8.1 Business Overview

27.8.2 Product Offerings

27.9 Mat Holding, Inc.

27.9.1 Business Overview

27.9.2 Product Offerings

27.10 Quincy Compressor

27.10.1 Business Overview

27.10.2 Product Offerings

27.11 Vanair Manufacturing

27.11.1 Business Overview

27.11.2 Product Offerings

27.12 Bca Compressors

27.12.1 Business Overview

27.12.2 Product Offerings

27.13 Seacomair

27.13.1 Business Overview

27.13.2 Product Offerings

27.14 Remeza Jsc

27.14.1 Business Overview

27.14.2 Product Offerings

28 Report Summary

28.1 Key Takeaways

28.2 Strategic Recommendations

29 Quantitative Summary

29.1 Market by Geography

29.2 Market by Product Type

29.3 Market by Lubricant Type

29.4 Market by Airflow Type

29.5 Market by Fuel Type

29.6 Market by End-User Type

30 Appendix

30.1 Abbreviations

Companies Mentioned

- Atlas Copco

- Gardner Denver

- Kaeser Kompressoren

- Ingersoll-Rand

- Sullair, LLC

- Deere & Company

- Rolair Systems

- Doosan Portable Power

- Sullivan-Palatek Inc.

- Hubei Teweite Power Technology Co., Ltd.

- Elgi Compressors USA, Inc.

- CIASONS

- MAT Holding, Inc.

- Quincy Compressor

- Vanair Manufacturing

- BAC Compressor

- SeaComAir

- JSC Remeza

Methodology

Our research comprises a mix of primary and secondary research. The secondary research sources that are typically referred to include, but are not limited to, company websites, annual reports, financial reports, company pipeline charts, broker reports, investor presentations and SEC filings, journals and conferences, internal proprietary databases, news articles, press releases, and webcasts specific to the companies operating in any given market.

Primary research involves email interactions with the industry participants across major geographies. The participants who typically take part in such a process include, but are not limited to, CEOs, VPs, business development managers, market intelligence managers, and national sales managers. We primarily rely on internal research work and internal databases that we have populated over the years. We cross-verify our secondary research findings with the primary respondents participating in the study.

LOADING...

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 317 |

| Published | February 2023 |

| Forecast Period | 2022 - 2028 |

| Estimated Market Value ( USD | $ 1160 Million |

| Forecasted Market Value ( USD | $ 1585.8 Million |

| Compound Annual Growth Rate | 5.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 18 |