Speak directly to the analyst to clarify any post sales queries you may have.

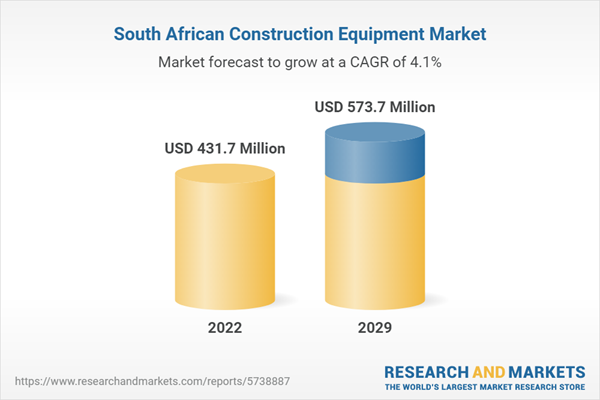

The South Africa construction equipment market is expected to grow at a CAGR of approximately 4.15% from 2022 to 2029. In the South Africa construction equipment market, the earthmoving construction equipment segment accounted for the largest industry share in 2022. In the earthmoving segment, excavators accounted for the largest share in 2022.

South African government's increased investments in residential buildings, roads, and railways are expected to drive the demand for excavators during the forecast period. A few upcoming road construction projects in 2022, like the upgradation of the N2 and N3 Highway by the South African National Roads Agency Limited (SANRAL), are expected to boost the demand for road construction machinery in the South Africa construction equipment market. The project is estimated to be completed in 2023, and SANRAL stated an investment of USD 1.63 billion. Other construction projects, for instance, the R573 Moloto Rehabilitation Project, involve upgrading the route that connects Pretoria with Marble Hall via KwaMhlanga and Siyabuswa. The project is expected to complete in 2025.

Eskom is constructing Kusile Coal Power Plant. It constitutes six 900 MW units and is one of the largest coal-fired power plants. It is expected to be operational by 2024 with an estimated cost of USD 8.2 billion.

Hive Hydrogen and African Oxygen (Afrox) had announced to invest in developing a new green ammonia plant in Nelson Mandela Bay by 2025. The construction is expected to commence in 2024. Another project, ‘The Salvokop Mixed-Use Precinct’ in Tshwane, would include the construction of five government client departments, schools, houses, and healthcare infrastructure. The project is valued at approximately USD 1.04 billion and is expected to be completed in December 2025.

The University of Johannesburg and the Department of Electronic Administrations have signed to develop an e-waste management project to improve electronic waste recycling and disposal. The project is in Gauteng and was launched on 1st March 2022. Additionally, Averda (a waste management company) has planned to build a plastic recycling plant in Gauteng. The plant is expected to process up to 12,000 t/y of high-density polyethylene into reusable plastic pellets.

Additionally, the construction of a few other ongoing projects, for instance, the three Harbor Arch towers in Cape Town, is expected to boost the sales of aerial platforms in the country. The towers are designed to be 23-storeyed, encompassing 560 residential apartments, retail spaces, and restaurants. The construction commenced in 2020 and is expected to be completed by 2030.

A few active investor countries in South Africa are the UK, Belgium, Germany, Netherlands, the US, China, Japan, and Australia. These countries majorly invest in the country’s mining, manufacturing, and financial sector.

MARKET TRENDS & DRIVERS

Investments Under National Infrastructure Plan 2050 is expected to Boost Construction Machinery Demand

In 2021, the South African government liquidated USD 20.08 billion and announced the development of 62 Integrated Projects to aid the country’s aim to reach the pre-pandemic levels. Additionally, the government later the same year granted USD 35.14 billion for 55 new catalytic infrastructure projects. The Commission had planned to invest approximately USD 385 billion under its National Development Plan 2030 between 2016-2040. Further, the ‘National Infrastructure Plan 2050’ (NIP), launched by the South African government, focuses on boosting private investment in public infrastructure.

The government has announced an investment of approximately USD 6 billion in the Infrastructure Fund, which focuses on constructing public infrastructure projects. The Infrastructure Fund has additionally funded USD 0.21 billion in the construction of student housing infrastructure. These growing investments are projected to support the South Africa Aconstruction equipment market growth.

Investments in the Mining Sector are Expected to Encourage the Sales of Earthmoving Construction Equipment

South African government recently, in 2022, declared that the mining industry saw a growth of 11.8% in 2021, which was the highest among all the industries in the country. In 2021, the sector generated revenues of roughly USD 1 trillion. The alliance between the Department of Mineral Resources and the Energy & Minerals Council SA has further boosted the growth of the mining industry.

The government is investing to make the mining industry greener, with the ESG policy gaining traction, and the Standard Bank has planned to integrate renewable energy projects in the sector with a capacity of 2,500 MW. Few mining companies have started using green energy sources, for instance, solar and green hydrogen, in the extraction process. Additionally, the rise in the demand for electric vehicles by the citizens in the country is increasing the demand for minerals, such as copper, nickel, cobalt, lithium, and manganese, used in batteries of e-motors.

Upcoming Renewable Energy Projects in the Country are Expected to Propel the Sales of Material Handling Equipment

The constant power outrage issue has stimulated the renewable energy industry in South Africa. In its Risk Mitigation Independent Power Producer Procurement Programme (RMIPPPP), the government has targeted bringing the solar capacity to 540 MW. In July 2022, the country's president liquidated USD 8.5 billion worth of investment in green energy.

The African Cities Water Adaptation Fund (ACWA) invested USD 0.68 billion to develop the Redstone solar power plant in the Northern Cape. The plant’s operation is expected to commence in Q4 2023. Scatec (a Norwegian company) has announced building three renewable projects in Northern Cape, valued at USD 1 billion. The project is expected to be one of the world's largest solar and battery facilities.

INDUSTRY RESTRAINTS

Skill Labor Shortage in the Country is Expected to Hamper the Development of Construction Projects

The 2019 survey report by the government published that the global skill labor shortage amounted to 54%, whereas it was 34% in South Africa. The onset of Covid-19 in 2020 added further pressure to the existing labor issues in the country, for instance, a high number of old employees retiring. The report ‘Skill Supply and Demand in South Africa’ 2022, published by the government, mentioned a significant imbalance between labor demand and supply in the country because most laborers are either medium or low-skilled. Therefore, South African youth (15-24) represents the highest unemployment rate. The employed people amounted to 14.9 million, and the number of unemployed rose to 11.1 million during 2018-2021. The falling number of skilled laborers will further slow the construction project, hampering the South African construction equipment market.

Energy Crises in the Country are Hindering the Timeline of the Projects

The year 2019 in South Africa was the worst year for the citizens and the industries as they witnessed blackouts for a total of 530 hours due to frequent load shedding implemented by Eskom (the prime electricity supplier in the country). The investments in the construction industry were negatively affected. Major industry players (suppliers, manufacturers, & contractors) were negatively impacted. Further, the constant power outrage delays construction project completion, impacting the South Africa construction equipment market. Recently, in 2022, the National Energy Regulator of SA (Nersa), on the request by Eskom, increased the energy prices by 9.6%, impacting the timeline of the new residential projects because of delayed permits. Moreover, roughly 18,000 building permits posed a risk.

Increasing Inflation & Poor Performance of Rand to Increase Construction Costs

The continuous weakening of the South African currency-Rand (ZAR), against the US $ has significantly impacted South Africa’s economic growth. The deportation of the currency has caused the profits to decline quarterly of the construction industry to, consequently impacting the demand for construction projects in the country. In October 2022, the country’s currency reached its lowest level since 2020, losing 1.5% against the dollar. A few factors attributed to Rand's poor performance are the geopolitical crises (Russia-Ukraine war). Further, the spike in the US dollar interest rates are backing up the dollar value and the national challenges such as flooding and load-shedding in KwaZulu-Natal.

VENDOR LANDSCAPE

- Prominent vendors in the South Africa construction equipment market are Caterpillar, Volvo Construction Equipment, Liebherr, Hitachi Construction Machinery & Komatsu.

- Other prominent vendors are John Deere, Hyundai Construction Equipment, CNH Industrial, & Liugong.

- Caterpillar has the strongest South Africa construction equipment market share. Caterpillar, Volvo CE, Komatsu, & Hitachi Construction Machinery are the industry leaders in South Africa’s market and has a strong distribution network & have a diversified product portfolio.

- SANY, JCB, Liugong & XCMG are emerging strong in the South Africa construction equipment market. These companies are introducing innovative products to capture construction equipment market share.

- In 2022, CNH Industrial launched its new V-Series Backhoe Loader in South Africa. CNH and Manitou Group are the South African construction equipment market niches.

Key Vendors

- Komatsu

- Hitachi Construction Machinery

- Liebherr

- Caterpillar

- SANY

- Volvo Construction Equipment

- Xuzhou Construction Machinery Group Co. Ltd. (XCMG)

- Manitou

- JCB

Other Prominent Vendors

- Hyundai Construction Equipment

- John Deere

- Liu Gong

- CNH Industrial

Distributors Profiles

- Barloworld Equipment

- BIA Cameroun S.A.

- Babcock Equipment

- BELL Sales Equipment

- ELB Equipment

- HPE Africa

Segmentation by Type

- Earthmoving Equipment

- Excavator

- Backhoe Loaders

- Wheeled Loaders

- Other Earthmoving Equipment (Other loaders, Bulldozers, Trenchers)

- Material Handling Equipment

- Crane

- Forklift & Telescopic Handlers

- Aerial Platforms (Articulated Boom Lifts, Telescopic Boom lifts, Scissor lifts)

- Road Construction Equipment

- Road Rollers

- Asphalt Pavers

- End Users

- Construction

- Manufacturing

- Mining

- Others

Table of Contents

1. Introduction1.1. Market Snapshot

1.2. Executive Summary

2. The Market Overview

2.1. Economic Scenario, Foreign Direct Investment, Major Infrastructure Projects

3. Market Landscape

3.1. South Africa Construction Equipment Market by Type (Volume & Value)

3.1.1. Earthmoving Equipment

3.1.1.1. Excavator

3.1.1.2. Backhoe Loader

3.1.1.3. Wheeled Loader

3.1.1.4. Other Earth Moving Equipment (Other Loaders, Bulldozer, Trencher, Etc.)

3.1.2. Material Handling Equipment

3.1.2.1. Crane

3.1.2.2. Forklift and Telescopic Handler

3.1.2.3. Aerial Platform (Articulated Boom Lifts, Telescopic Boom Lifts, Scissor Lifts, Etc)

3.1.3. Road Construction Equipment

3.1.3.1. Road Roller

3.1.3.2. Asphalt Paver

3.2 South Africa Construction Equipment Market by End-User (Volume & Value)

3.2.1 Construction

3.2.2 Mining

3.2.3 Manufacturing

3.2.4 Others (Power Generation, Utilities Municipal Corporations, Oil & Gas, Cargo Handling, Power Generation Plants, Waste Management, Etc)

4 Market Dynamics

4.2 Market Drivers, Restraints, Trends, Advantages South Africa, Key Economic Regions, Import/Export Trends, Supply Chain Analysis, Covid-19 Impact

5 Technology Development

5.2 Advent of New Technology

6 Competitive Landscape

6.2 Competitive Landscape Overview

6.3 Major Vendors (Caterpillar | Volvo Construction Equipment | Liebherr | Komatsu | Hitachi Construction Machinery | Sany | Cnh Industrial | Jcb | Hyundai Construction Equipment | Xcmg | Manitou Group | John Deere | Liugong)

6.4 Other Prominent Vendors

6.5 Distributors Profile

7 Quantitative Summary

8 Report Summary

8.2 Key Insights

8.3 Abbreviations

8.4 List of Graphs

8.5 List of Tables

9 Report Scope & Definition

9.2 Research Methodology

9.3 Research Objective

9.4 Market Definition, Inclusion & Exclusion

Companies Mentioned

- Komatsu

- Hitachi Construction Machinery

- Liebherr

- Caterpillar

- SANY

- Volvo Construction Equipment

- Xuzhou Construction Machinery Group Co. Ltd. (XCMG)

- Manitou

- JCB

- Hyundai Construction Equipment

- John Deere

- Liu Gong

- CNH Industrial

- Barloworld Equipment

- BIA Cameroun S.A.

- Babcock Equipment

- BELL Sales Equipment

- ELB Equipment

- HPE Africa

Methodology

Our research comprises a mix of primary and secondary research. The secondary research sources that are typically referred to include, but are not limited to, company websites, annual reports, financial reports, company pipeline charts, broker reports, investor presentations and SEC filings, journals and conferences, internal proprietary databases, news articles, press releases, and webcasts specific to the companies operating in any given market.

Primary research involves email interactions with the industry participants across major geographies. The participants who typically take part in such a process include, but are not limited to, CEOs, VPs, business development managers, market intelligence managers, and national sales managers. We primarily rely on internal research work and internal databases that we have populated over the years. We cross-verify our secondary research findings with the primary respondents participating in the study.

LOADING...

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 109 |

| Published | February 2023 |

| Forecast Period | 2022 - 2029 |

| Estimated Market Value ( USD | $ 431.7 Million |

| Forecasted Market Value ( USD | $ 573.7 Million |

| Compound Annual Growth Rate | 4.1% |

| Regions Covered | South Africa |

| No. of Companies Mentioned | 19 |