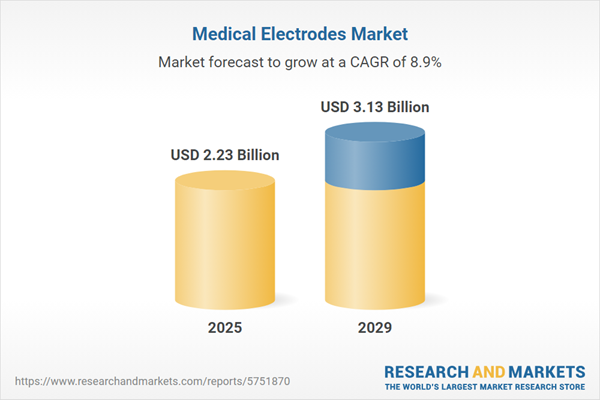

The medical electrodes market size has grown strongly in recent years. It will grow from $2.08 billion in 2024 to $2.23 billion in 2025 at a compound annual growth rate (CAGR) of 7.1%. The growth in the historic period can be attributed to cardiovascular diseases, neurological disorders, aging population, electrotherapy and pain management, regulatory compliance.

The medical electrodes market size is expected to see strong growth in the next few years. It will grow to $3.13 billion in 2029 at a compound annual growth rate (CAGR) of 8.9%. The growth in the forecast period can be attributed to personalized medicine, patient-centric design, telemedicine expansion, medical tourism, sustainability and eco-friendly materials. Major trends in the forecast period include miniaturization and wearable electrodes, advanced electrode materials, smart electrodes, artificial intelligence (ai) and data analytics, sensor integration.

The anticipated increase in chronic diseases' prevalence is expected to drive the growth of the medical electrodes market. Chronic diseases, characterized by prolonged sickness often incurable but sometimes controllable, are on the rise due to factors such as increased tobacco product use, poor nutrition, physical inactivity, and excessive alcohol consumption. Medical electrodes play a crucial role in treating chronic diseases by measuring, monitoring, and recording vital body functions like heartbeat and brain waves during medical interventions. For instance, projections from the National Center for Biotechnology Information (NCBI) indicate a global increase in chronic diseases, reaching 142.66 million people by 2050, up from 71.522 million in 2020. Consequently, the surge in chronic diseases drives the growth of the medical electrodes market.

The expansion of telehealth and telemedicine is poised to fuel the growth of the medical electrodes market. Telehealth involves utilizing telecommunications technology to provide a range of healthcare services remotely, while telemedicine specifically encompasses remote clinical consultations and healthcare delivery. The growing adoption of telehealth and telemedicine increases the demand for precise diagnostic data collection during remote patient monitoring, driving the use of wearable health devices equipped with electrodes. For example, a report from the Centers for Disease Control and Prevention (CDC) in October 2022 indicated that in 2021, 37% of adults utilized telemedicine within the preceding 12 months. Consequently, the expansion of telehealth and telemedicine is a key driver for the growth of the medical electrodes market.

Technological advancement is a significant trend gaining traction in the medical electrodes market. The development of medical device electrodes primarily focuses on enhancing patient comfort and improving the electrode-tissue interface for better recording and stimulation. There is increasing demand for key electrodes, including electrocardiography electrodes, electroencephalography electrodes, and others. Leading companies in the medical electrodes market are innovating new technologies and advanced medical electrode products to enhance their market presence. For example, in May 2024, Soterix Medical, a US-based medical device company, introduced the MxN-GO EEG device, which integrates EEG capabilities with high-definition transcranial electrical stimulation (HD-tES). This system is intended for research applications that require both electrical brain stimulation and activity recording in natural, mobile settings. Soterix Medical’s HD-tES employs advanced electrode designs, ensuring the safe and comfortable delivery of electrical currents through high-definition electrodes. Additionally, the technology features personalized brain current-flow modeling and proprietary targeting algorithms, which assist in the precise placement and activation of HD electrodes on the head.

Major companies in the medical electrodes market are introducing new products to gain a competitive edge. For instance, in May 2023, NeuroOne Medical Technologies Corp., a US-based medical technology company, launched the Evo sEEG electrode product line. The Evo sEEG electrode offers extended recording, monitoring, and stimulation of electrical signals in the subsurface levels of the brain for up to 30 days, eliminating the need for invasive procedures like skull removal. Featuring high-definition, thin-film technology, these electrodes enhance signal clarity and reduce noise.

In August 2023, Resonac Corporation, a Japan-based chemical manufacturing company, acquired AMI Automation for an undisclosed amount. This strategic acquisition enables Resonac to provide integrated innovative solutions for enhanced steel-making performance, improved operational efficiency, safety promotion, energy conservation, and reduced greenhouse gas emissions, delivering greater value. AMI Automation, a Mexico-based automation and control solutions company, specializes in providing automation solutions, advanced power control systems, and software optimization for electric arc furnaces, offering customized solutions across various industries.

Major companies operating in the medical electrodes market include 3M Company, ConMed Corporation, Koninklijke Philips N.V., Medtronic plc, Ambu A/S, General Electric Company, Nihon Kohden Corporation, Cardinal Health Inc., Dymedix Diagnostics Inc., Natus Medical Incorporated, CooperSurgical Inc., B. Braun Melsungen AG, ZOLL Medical Corporation, Rhythmlink International LLC, Cognionics Inc., Compumedics Limited, Nissha Medical Technologies Group, C.R. Bard Inc., Curbell Medical Products Inc., Leonhard Lang GmbH, Graphic Controls Ltd., Bio Protech Inc., Medico Electrodes International Ltd., Ad-Tech Medical Instrument Corporation, Tenko Medical Systems Crop., Ambulatory Monitoring Inc., R&D Medical Electrodes, NeuroWave Systems Inc., NCC Medical Co. Ltd., Nihon Kohden America Inc., Zynex Medical Inc.

North America was the largest region in the medical electrodes market in 2024. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the medical electrodes market share report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East and Africa. The countries covered in the medical electrodes market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK and USA.

Medical electrodes play a crucial role in transmitting electricity from an instrument to a patient for treatment or surgery. They are instrumental in measuring internal ionic currents, aiding in the diagnosis of ocular, nervous, cardiac, and muscular disorders. The key function of medical electrodes is to establish the appropriate electrical contact between the recording device and the patient. Typically constructed of materials such as metal, lead, and a conductive gel or paste, these electrodes come in two main types: disposable and reusable.

Disposable medical electrodes consist of a disc made of semi-rigid plastic with a centrally positioned recessed embossment. The disc features a metallic electrical contact with sections on both sides, often used with snap-connect lead wires. Various technologies, including wet, dry, and needle electrodes, are employed in disposable medical electrodes. These electrodes find applications in procedures such as electrocardiography, electroencephalography, and electromyography, and are utilized in fields like cardiology, neurophysiology, sleep disorders, and intraoperative monitoring.

The medical electrodes market research report is one of a series of new reports that provides medical electrodes market statistics, including medical electrodes industry global market size, regional shares, competitors with a medical electrodes market share, detailed medical electrodes market segments, market trends and opportunities, and any further data you may need to thrive in the medical electrodes industry. This medical electrodes market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenarios of the industry.

The medical electrodes market consists of sales of electrocardiography (ECG) electrodes, fetal scalp electrodes, electroencephalography electrodes, transcutaneous electrical nerve stimulation TENS electrodes, and pacemaker electrodes. Values in this market are ‘factory gate’ values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Medical Electrodes Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on medical electrodes market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for medical electrodes? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The medical electrodes market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) Covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Usability: Disposable Medical Electrodes; Reusable Medical Electrodes2) By Technology: Wet Electrodes; Dry Electrodes; Needle Electrodes

3) By Procedure: Electrocardiography; Electroencephalography; Electromyography; Other Procedures

4) By Application: Cardiology; Neurophysiology; Sleep Disorders; Intraoperative Monitoring; Other Applications

Subsegments:

1) By Disposable Medical Electrodes: ECG Electrodes; EEG Electrodes; EMG Electrodes2) By Reusable Medical Electrodes: Reusable ECG Electrodes; Reusable EEG Electrodes; Reusable EMG Electrodes

Key Companies Mentioned: 3M Company; ConMed Corporation; Koninklijke Philips N.V.; Medtronic plc; Ambu a/S

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

Some of the major companies featured in this Medical Electrodes market report include:- 3M Company

- ConMed Corporation

- Koninklijke Philips N.V.

- Medtronic plc

- Ambu A/S

- General Electric Company

- Nihon Kohden Corporation

- Cardinal Health Inc.

- Dymedix Diagnostics Inc.

- Natus Medical Incorporated

- CooperSurgical Inc.

- B. Braun Melsungen AG

- ZOLL Medical Corporation

- Rhythmlink International LLC

- Cognionics Inc.

- Compumedics Limited

- Nissha Medical Technologies Group

- C.R. Bard Inc.

- Curbell Medical Products Inc.

- Leonhard Lang GmbH

- Graphic Controls Ltd.

- Bio Protech Inc.

- Medico Electrodes International Ltd.

- Ad-Tech Medical Instrument Corporation

- Tenko Medical Systems Crop.

- Ambulatory Monitoring Inc.

- R&D Medical Electrodes

- NeuroWave Systems Inc.

- NCC Medical Co. Ltd.

- Nihon Kohden America Inc.

- Zynex Medical Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | February 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 2.23 Billion |

| Forecasted Market Value ( USD | $ 3.13 Billion |

| Compound Annual Growth Rate | 8.9% |

| Regions Covered | Global |

| No. of Companies Mentioned | 32 |