Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Positioned as a critical enabler of the global energy transition, green methanol offers a practical decarbonization solution for sectors where electrification is either limited or unfeasible. With increasing regulatory support, advancing technological efficiency, and rising demand across fuel, chemical, and transport applications, the market is evolving from pilot-scale projects to full-scale commercial deployment.

The green methanol market represents a high-growth, innovation-led opportunity with strong potential for long-term value creation. It presents a compelling proposition not only in clean fuel alternatives but also in sustainable chemical production, low-carbon logistics, and circular economy models making it a promising area for strategic investment, industrial transformation, and environmental leadership.

Key Market Drivers

Rising Demand for Clean Marine and Aviation Fuels

The aviation industry contributes 2-3% of global CO₂ emissions and is under rising scrutiny from regulators and climate-conscious consumers. With electrification and hydrogen-powered flight still decades away from commercialization at scale, sustainable aviation fuels (SAFs) are viewed as the most immediate path to emissions reduction. Green methanol is increasingly being recognized as a precursor for synthetic jet fuels.When processed through technologies like methanol-to-jet (MTJ), green methanol can be converted into drop-in SAFs that meet existing aviation fuel standards. Government mandates and incentives such as the ReFuelEU Aviation initiative and SAF blending quotas in the U.S. and Europe are expected to create sustained demand for methanol-derived e-fuels over the next two decades. Major carriers are exploring partnerships with green methanol producers to secure SAF feedstocks. Airlines are increasingly including methanol-based e-fuels in their carbon reduction strategies, particularly for long-haul flights where electrification is not feasible.

The simultaneous uptake of green methanol in both marine and aviation sectors is creating a dual-market pull, leading to greater economies of scale for producers. This rising demand is justifying investments in large-scale production facilities across Europe, North America, and the Middle East, further accelerating market growth. The rising demand for clean fuels in marine and aviation sectors is not merely a supportive trend it is a structural shift that is fundamentally transforming the fuel value chain. Green methanol stands at the intersection of regulatory compliance, commercial readiness, and environmental performance, making it a highly attractive solution for both industries. As shipping and aviation continue their transition to sustainable operations, green methanol will play a central role, thereby serving as a key growth engine for the global market.

Key Market Challenges

Underdeveloped Infrastructure and Supply Chain Limitations

The green methanol market currently lacks a mature and standardized infrastructure to support widespread production, distribution, and consumption. This includes everything from electrolyzer installations and CO₂ capture systems to storage, transport, and refueling facilities.Limited bunkering and fueling stations for methanol, especially in emerging maritime hubs. Insufficient pipeline and storage infrastructure for CO₂ and hydrogen feedstocks, which affects supply chain efficiency. Transport and logistics constraints due to the chemical's flammability and toxicity, which require specialized handling and safety compliance. Lack of harmonized technical standards and fuel certification protocols, which creates fragmentation and limits interoperability across regions.

These gaps create logistical bottlenecks and scaling difficulties. Even if production capacity increases, the lack of downstream infrastructure may hinder green methanol’s ability to reach key demand centers, such as ports, industrial clusters, or aviation hubs.

Key Market Trends

Strategic Integration of Green Methanol into Industrial Decarbonization Roadmaps

Green methanol is increasingly being positioned not just as a fuel, but as a core building block in broader industrial decarbonization strategies. Companies across sectors including chemicals, steel, cement, and heavy manufacturing are exploring green methanol as a sustainable carbon source to replace fossil-derived feedstocks, thereby lowering the embedded carbon footprint of their products.Leading chemical manufacturers are reconfiguring existing methanol-to-olefins (MTO) and methanol-to-propylene (MTP) units to accommodate low-carbon methanol, offering "green" alternatives for plastics, adhesives, and solvents. Integrated industrial parks are being planned with on-site CO₂ capture and green methanol production, creating closed-loop ecosystems. Industries are including green methanol in their Scope 3 emissions strategies, enabling downstream customers to decarbonize.

As green methanol moves from an energy transition solution to a core enabler of sustainable industrial processes, its demand will no longer be confined to fuels alone but will expand across the materials and manufacturing value chain.

Key Market Players

- OCI N.V.

- Methanex Corporation

- Enerkem Inc.

- Carbon Recycling International

- Södra Skogsägarna

- BASF SE

- Topsoe A/S

- Liquid Wind AB

- Eni S.p.A.

- ABEL Energy Pty Ltd

Report Scope:

In this report, the Global Green Methanol Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Green Methanol Market, By Feedstock:

- CO2 Emissions

- Municipal Solid Waste

- Agricultural Waste

- Forestry Residues

- Others

Green Methanol Market, By Type:

- E-Methanol

- Bio Methanol

Green Methanol Market, By Application:

- Fuel Grade

- Chemical Feedstock

- Others

Green Methanol Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe

- France

- United Kingdom

- Italy

- Germany

- Spain

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Green Methanol Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

Table of Contents

Companies Mentioned

- OCI N.V.

- Methanex Corporation

- Enerkem Inc.

- Carbon Recycling International

- Södra Skogsägarna

- BASF SE

- Topsoe A/S

- Liquid Wind AB

- Eni S.p.A.

- ABEL Energy Pty Ltd

Table Information

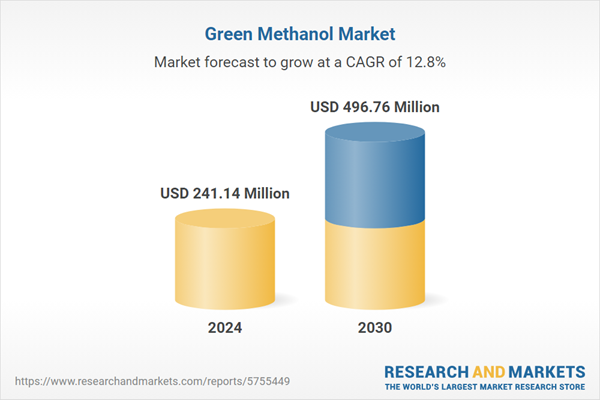

| Report Attribute | Details |

|---|---|

| No. of Pages | 188 |

| Published | August 2025 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 241.14 Million |

| Forecasted Market Value ( USD | $ 496.76 Million |

| Compound Annual Growth Rate | 12.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |