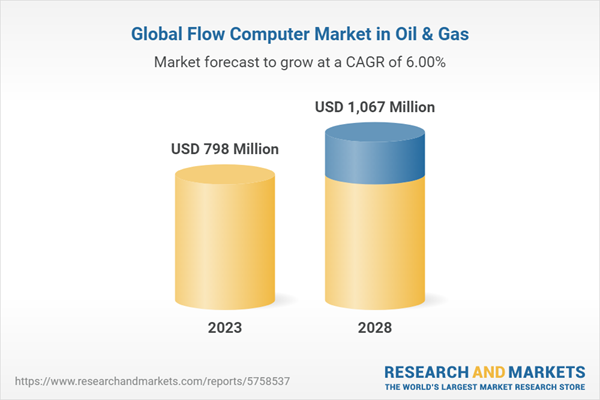

The flow computer market in oil & gas is projected to grow from USD 798 million in 2023 to USD 1,067 million in 2028; it is expected to grow at a CAGR of 6.0% during the forecasted period. The technological advancements in oil & gas industry and suitability in many functions of the oil & gas industry and increasing adoption of process automation providing opportunities for flow computer market in oil & gas.

Hardware component is expected to register larger market share during the forecast period

In the flow computer hardware market, the market size of the actual flow computer device is considered. The flow computer is a flow measurement device that calculates the correct flow of liquid and gas based on the signals from the flow meter, pressure transmitter, and temperature transmitters. These flow computers are of different types and are manufactured considering their functions in different applications, accuracy needs, and I/O connection needs. They are used in liquid & gas measurement, wellhead measurement and optimization, custody transfer and control, fuel monitoring, fiscal flow metering, flow meter proving, pipeline transmission and distribution, ship/rail/road loading, and many others

Midstream & Downstream is expected to register larger market share during the forecast period

Flow computers are used in many midstream and downstream functions such as metering, meter proving, ticketing, valve control, batching, product interfacing, and custody transfer. These flow computers are installed in midstream pipelines, distribution points, refineries, and billing points. As a result, the market size of flow computers in midstream and downstream operations is large compared to upstream operations.. Midstream enables processing, storing, and transportation of oil & gas. It is a process that falls between upstream and downstream operation whereas downstream is a process in which oil & gas is converted into finished products.

Market in North America is expected to register larger market share during the forecast period

In 2022, North America accounted highest market share of the flow computer market in oil & gas. The regional market here has been segmented into US, Canada and Mexico. US was the largest oil & gas-producing country in the world. Consequently, the installation of flow computers at production sites or wellheads is large in US. The midstream oil & gas pipeline length and installed oil and gas refining capacity are also large in US. Similarly, Canada has the third-largest oil reserve in the world, with a major petroleum production industry. It is the fifth-largest producer of natural gas and the sixth-largest producer of crude oil worldwide. Its expanding production enables the adoption of flow computers in oil and natural gas plants. Hence, Flow computers are installed in large quantities in the upstream, midstream, and downstream operations.

Breakdown of the profiles of primary participants:

- By Company Type: Tier 1 - 45%, Tier 2 - 35%, and Tier 3 - 20%

- By Designation: C-level Executives - 35%, Directors - 43%, and others - 22%

- By Region: North America - 31%, Europe - 19%, Asia Pacific - 27%, and RoW - 15%

Major players profiled in this report are as follows: Emerson Electric Co. (US), Honeywell International, Inc. (US), ABB (Switzerland), Thermo Fisher Scientific Inc. (US), Schneider Electric (France), Krohne Messtechnik GmbH (Germany), Yokogawa Electric Corporation (Japan), TechnipFMC plc (US), OMNI Flow Computers, Inc. (US), Dynamic Flow Computers, Inc. (US), Contrec Limited (UK), Kessler-Ellis Products (KEP) Co, Inc. (US), Sensia (US). Prosoft Technology, Inc.(US), Flowmetric, Inc.(US), Spirax Sarco Limited (UK), SICK AG (Germany), Badger Meter, Inc.(US), Quorum Business Solution, Inc.(US), Endress+Hauser AG (Switzerland), PLUM Sp. Zo. O (Poland), Fluidwell BV (Netherlands), Oval Corporation (Japan), Seneca srl (Italy), and Hoffer Flow Controls, Inc. (US).

Research Coverage

This research report categorizes the flow computer market in oil & gas on the basis of components, operation, and region. The report describes the major drivers, restraints, challenges, and opportunities pertaining to the flow computer market in oil & gas and forecasts the same till 2028. Apart from these, the report also consists of leadership mapping and analysis of all the companies included in the flow computer ecosystem.

Key Benefits of Buying the Report:

The report will help market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall flow computer market in oil & gas and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to better position their businesses and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

Table of Contents

1 Introduction

1.1 Study Objectives

1.2 Market Definition

1.2.1 Inclusions and Exclusions

1.3 Study Scope

1.3.1 Markets Covered

Figure 1 Segmentation of Flow Computer Market in Oil & Gas

1.3.2 Regional Scope

1.3.3 Years Considered

1.4 Currency Considered

1.5 Limitations

1.6 Stakeholders

1.7 Summary of Changes

2 Research Methodology

2.1 Research Data

Figure 2 Flow Computer Market in Oil & Gas: Research Design

2.1.1 Secondary and Primary Research

2.1.1.1 Key Industry Insights

2.1.2 Secondary Data

2.1.2.1 List of Major Secondary Sources

2.1.2.2 Secondary Sources

2.1.3 Primary Data

2.1.3.1 Primary Interviews with Experts

2.1.3.2 Breakdown of Primaries

2.1.3.3 Key Data from Primary Sources

2.2 Market Size Estimation

Figure 3 Market Size Estimation Methodology: Supply-Side Approach

2.2.1 Bottom-Up Approach

2.2.1.1 Approach to Estimate Market Size Using Bottom-Up Analysis (Demand Side)

Figure 4 Market Size Estimation Methodology: Bottom-Up Approach

2.2.2 Top-Down Approach

2.2.2.1 Approach to Estimate Market Size Using Top-Down Analysis (Supply Side)

Figure 5 Market Size Estimation Methodology: Top-Down Approach

2.3 Market Breakdown and Data Triangulation

Figure 6 Data Triangulation

2.4 Research Assumptions

Figure 7 Research Study Assumptions

2.5 Parameters Considered to Analyze Impact of Recession on Flow Computer Market in Oil & Gas

3 Executive Summary

Figure 8 Hardware Segment to Account for Largest Share of Flow Computer Market in Oil & Gas in 2028

Figure 9 Upstream Operations to Create High-Growth Opportunities for Flow Computer Market During Forecast Period

Figure 10 North America Accounted for Largest Market Share in 2022

3.1 Analysis of Recession Impact on Flow Computer Market in Oil & Gas

Figure 11 GDP Growth Projection Till 2023 for Major Economies (Percentage Change)

4 Premium Insights

4.1 Attractive Opportunities for Players in Flow Computer Market in Oil & Gas

Figure 12 Adoption of Process Automation in Oil & Gas Industry to Provide Opportunities for Market Players

4.2 Flow Computer Market in Oil & Gas, by Offering

Figure 13 Software Segment to Register Highest CAGR in Flow Computer Market in Oil & Gas Between 2023 and 2028

4.3 Flow Computer Market in Oil & Gas in North America, by Country and Operation

Figure 14 US and Midstream and Downstream to Account for Largest Share of Flow Computer Market in Oil & Gas in North America in 2028

4.4 Region-Wise Growth Rate of Flow Computer Market in Oil & Gas

Figure 15 North America to Record Highest CAGR During Forecast Period

5 Market Overview

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Technological Advancements in Oil & Gas Industry

5.2.1.2 Need to Maximize Production Potential from Mature Wells

5.2.1.3 Suitability in Oil & Gas Industry

Figure 16 Flow Computer Market in Oil & Gas: Impact Analysis of Drivers

5.2.2 Restraints

5.2.2.1 Cybersecurity Threats

5.2.2.2 High Cost of Flow Computer and Regular Maintenance

Figure 17 Flow Computer Market in Oil & Gas: Impact Analysis of Restraints

5.2.3 Opportunities

5.2.3.1 Growing Demand for Offshore/Ultra-Deep Discoveries

5.2.3.2 Increasing Adoption of Process Automation

Figure 18 Flow Computer Market in Oil & Gas: Impact Analysis of Opportunities

5.2.4 Challenges

5.2.4.1 Interoperability of Multiple Components from Different Solution Providers

Figure 19 Flow Computer Market in Oil & Gas: Impact Analysis of Challenges

5.3 Value Chain Analysis

Figure 20 Value Chain Analysis: Major Value Addition During Manufacturing and System Integration Phase

5.4 Ecosystem Analysis

Figure 21 Flow Computer Market in Oil & Gas: Ecosystem Analysis

Table 1 Flow Computer Market in Oil & Gas: Ecosystem

5.5 Pricing Analysis

Figure 22 Average Selling Price Trend of Flow Computer

Table 2 Indicative Prices of Flow Computer

5.5.1 Average Selling Price of Flow Computers Offered by Key Players

Figure 23 Average Selling Prices of Flow Computers Offered by Key Players

Table 3 Average Selling Prices of Flow Computers Offered by Key Players (USD)

Table 4 Average Selling Prices of Flow Computer by Region (USD)

5.6 Trends/Disruptions Impacting Customers’ Businesses

Figure 24 Revenue Shift and New Revenue Pockets for Players in Flow Computer Market in Oil & Gas

5.7 Technology Analysis

5.7.1 Impact of IIoT on Flow Computer Market in Oil & Gas

5.7.2 Integration of Artificial Intelligence into Flow Computers

5.8 Porter's Five Forces Analysis

Figure 25 Flow Computer Market in Oil & Gas: Porter's Five Forces Analysis

5.9 Key Stakeholders and Buying Criteria

5.9.1 Key Stakeholders in Buying Process

Figure 26 Influence of Stakeholders on Buying Process for Top 3 Components

Table 5 Influence of Stakeholders on Buying Process for Top 3 Components (%)

5.9.2 Buying Criteria

Figure 27 Key Buying Criteria for Top 3 Components

Table 6 Key Buying Criteria for Top 3 Components

5.10 Case Studies

Table 7 Turkstream Gas Pipeline Used Contrec's 515 Gas Flow Computers for Flow Measurement Solution

Table 8 Installation of E-Chart Flow Computers for Accurate Monitor Measurements for Gas Lift Operation

Table 9 Husky Energy Upgraded Its Lima Refinery with Micro Mvl Flow Computer for Reliable Measurement

Table 10 Installation of Emerson's Fb1200 Flow Computer by Waterbridge to Achieve Accurate and Low Maintenance Meter Performance

5.11 Trade Analysis

Figure 28 Import Data, by Country, 2017-2021 (USD Million)

Figure 29 Export Data, by Country, 2017-2021 (USD Million)

5.12 Patent Analysis

Figure 30 Top 10 Companies with Highest Number of Patent Applications in Last 10 Years

Table 11 Top 20 Patent Owners in US in Last 10 Years

Figure 31 Number of Patents Granted from 2013 to 2022

Table 12 List of Few Patents in Flow Computer Market in Oil & Gas, 2020-2023

5.13 Key Conferences and Events, 2023-2024

Table 13 Flow Computer Market in Oil & Gas: Detailed List of Conferences and Events

5.14 Regulatory Bodies, Government Agencies, and Other Organizations

Table 14 North America: List of Regulatory Bodies, Government Agencies, and Other Organizations

Table 15 Europe: List of Regulatory Bodies, Government Agencies, and Other Organizations

Table 16 Asia-Pacific: List of Regulatory Bodies, Government Agencies, and Other Organizations

Table 17 Rest of the World: List of Regulatory Bodies, Government Agencies, and Other Organizations

5.14.1 Standards

Table 18 Standards for Flow Computer Market in Oil & Gas

6 Applications of Flow Computers in Oil & Gas Industry

6.1 Introduction

6.2 Custody Transfer

6.3 Pipeline Flow Monitoring

6.4 Wellhead Monitoring

7 Flow Computer Market in Oil & Gas, by Offering

7.1 Introduction

Figure 32 Hardware Segment to Lead Market During Forecast Period

Table 19 Flow Computer Market in Oil & Gas, by Offering, 2019-2022 (USD Million)

Table 20 Flow Computer Market in Oil & Gas, by Offering, 2023-2028 (USD Million)

7.2 Hardware

7.2.1 Used in Wellhead Measurement, Custody Transfer, and Fuel Monitoring

7.2.2 Processor

7.2.3 Memory

7.2.4 Input/Output (I/O) Module

7.2.5 Power Supply

7.2.6 Communication Interface

7.2.7 Enclosure

7.2.8 Display

7.3 Software

7.3.1 Enables Accurate Measurement, Monitoring, and Flow of Medium

7.4 Support Services

7.4.1 Minimizes Economic Losses and Technical Issues Post Installation

7.4.2 System Integration

7.4.3 Customization

7.4.4 Field Services

7.4.5 Consulting Services

8 Flow Computer Market in Oil & Gas, by Operation

8.1 Introduction

Figure 33 Midstream and Upstream Operation to Account for Largest Market Share During Forecast Period

Table 21 Flow Computer Market in Oil & Gas, by Operation, 2019-2022 (USD Million)

Table 22 Flow Computer Market in Oil & Gas, by Operation, 2023-2028 (USD Million)

8.2 Upstream

8.2.1 Engages in Exploration, Drilling, and Production

Table 23 Upstream Flow Computer Market, by Region, 2019-2022 (USD Million)

Table 24 Upstream Flow Computer Market, by Region, 2023-2028 (USD Million)

Table 25 North America: Upstream Flow Computer Market, by Country, 2019-2022 (USD Million)

Table 26 North America: Upstream Flow Computer Market, by Country, 2023-2028 (USD Million)

Table 27 Europe: Upstream Flow Computer Market, by Country, 2019-2022 (USD Million)

Table 28 Europe: Upstream Flow Computer Market, by Country, 2023-2028 (USD Million)

Table 29 Middle East: Upstream Flow Computer Market, by Country, 2019-2022 (USD Million)

Table 30 Middle East: Upstream Flow Computer Market, by Country, 2023-2028 (USD Million)

Table 31 Asia-Pacific: Upstream Flow Computer Market, by Country, 2019-2022 (USD Million)

Table 32 Asia-Pacific: Upstream Flow Computer Market, by Country, 2023-2028 (USD Million)

Table 33 Rest of the World: Upstream Flow Computer Market, by Country, 2019-2022 (USD Million)

Table 34 Rest of the World: Upstream Flow Computer Market, by Country, 2023-2028 (USD Million)

8.3 Midstream and Downstream

8.3.1 Applications in Custody Transfer, Pipeline Flow Monitoring, Allocation, Blending, and Batching

Table 35 Midstream and Downstream Flow Computer Market, by Region, 2019-2022 (USD Million)

Table 36 Midstream and Downstream Flow Computer Market, by Region , by Region, 2023-2028 (USD Million)

Table 37 North America: Midstream and Upstream Flow Computer Market, by Country, 2019-2022 (USD Million)

Table 38 North America: Midstream and Upstream Flow Computer Market, by Country, 2023-2028 (USD Million)

Table 39 Europe: Midstream and Upstream Flow Computer Market, by Country, 2019-2022 (USD Million)

Table 40 Europe: Midstream and Upstream Flow Computer Market, by Country, 2023-2028 (USD Million)

Table 41 Middle East: Midstream and Upstream Flow Computer Market, by Country, 2019-2022 (USD Million)

Table 42 Middle East: Midstream and Upstream Flow Computer Market, by Country, 2023-2028 (USD Million)

Table 43 Asia-Pacific: Midstream and Upstream Flow Computer Market, by Country, 2019-2022 (USD Million)

Table 44 Asia-Pacific: Midstream and Upstream Flow Computer Market, by Country, 2023-2028 (USD Million)

Table 45 Rest of the World: Midstream and Upstream Flow Computer Market, by Country, 2019-2022 (USD Million)

Table 46 Rest of the World: Midstream and Upstream Flow Computer Market, by Country, 2023-2028 (USD Million)

9 Flow Computer Market in Oil & Gas, by Region

9.1 Introduction

Figure 34 US to Exhibit Highest CAGR in Flow Computer Market in Oil & Gas During Forecast Period

Table 47 Flow Computer Market in Oil & Gas, by Region, 2019-2022 (USD Million)

Table 48 Flow Computer Market in Oil & Gas, by Region, 2023-2028 (USD Million)

9.2 North America

Figure 35 North America: Snapshot of Flow Computer Market in Oil & Gas

Table 49 North America: Flow Computer Market in Oil & Gas, by Country, 2019-2022(USD Million)

Table 50 North America: Flow Computer Market in Oil & Gas, by Country, 2023-2028 (USD Million)

Table 51 North America: Flow Computer Market in Oil & Gas, by Operation, 2019-2022 (USD Million)

Table 52 North America: Flow Computer Market in Oil & Gas, by Operation, 2023-2028 (USD Million)

9.2.1 US

9.2.1.1 Contributes Highest Market Share in Region

Table 53 Us: Flow Computer Market in Oil & Gas, by Operation, 2019-2022 (USD Million)

Table 54 Us: Flow Computer Market in Oil & Gas, by Operation, 2023-2028 (USD Million)

9.2.2 Canada

9.2.2.1 Significant Oil Reserves and Expanding Production

Table 55 Canada: Flow Computer Market in Oil & Gas, by Operation, 2019-2022 (USD Million)

Table 56 Canada: Flow Computer Market in Oil & Gas, by Operation, 2023-2028 (USD Million)

9.2.3 Mexico

9.2.3.1 Moderate Market Growth

Table 57 Mexico: Flow Computer Market in Oil & Gas, by Operation, 2019-2022 (USD Million)

Table 58 Mexico: Flow Computer Market in Oil & Gas, by Operation, 2023-2028 (USD Million)

9.3 Europe

Figure 36 Europe: Snapshot of Flow Computer Market in Oil & Gas

Table 59 Europe: Flow Computer Market in Oil & Gas, by Country, 2019-2022(USD Million)

Table 60 Europe: Flow Computer Market in Oil & Gas, by Country, 2023-2028 (USD Million)

Table 61 Europe: Flow Computer Market in Oil & Gas, by Operation, 2019-2022 (USD Million)

Table 62 Europe: Flow Computer Market in Oil & Gas, by Operation, 2023-2028 (USD Million)

9.3.1 Norway

9.3.1.1 Growing Investments in Oil & Gas Projects

Table 63 Norway: Flow Computer Market in Oil & Gas, by Operation, 2019-2022 (USD Million)

Table 64 Norway: Flow Computer Market in Oil & Gas, by Operation, 2023-2028 (USD Million)

9.3.2 Kazakhstan

9.3.2.1 Exports 80% of Oil Produced

Table 65 Kazakhstan: Flow Computer Market in Oil & Gas, by Operation, 2019-2022 (USD Million)

Table 66 Kazakhstan: Flow Computer Market in Oil & Gas, by Operation, 2023-2028 (USD Million)

9.3.3 UK

9.3.3.1 Presence of Several Technology Providers

Table 67 Uk: Flow Computer Market in Oil & Gas, by Operation, 2019-2022 (USD Million)

Table 68 Uk: Flow Computer Market in Oil & Gas, by Operation, 2023-2028 (USD Million)

9.3.4 Rest of Europe

Table 69 Rest of Europe: Flow Computer Market in Oil & Gas, by Operation, 2019-2022 (USD Million)

Table 70 Rest of Europe: Flow Computer Market in Oil & Gas, by Operation, 2023-2028 (USD Million)

9.4 Middle East

Table 71 Middle East: Flow Computer Market in Oil & Gas, by Country, 2019-2022(USD Million)

Table 72 Middle East: Flow Computer Market in Oil & Gas, by Country, 2023-2028 (USD Million)

Table 73 Middle East: Flow Computer Market in Oil & Gas, by Operation, 2019-2022 (USD Million)

Table 74 Middle East: Flow Computer Market in Oil & Gas, by Operation, 2023-2028 (USD Million)

9.4.1 Saudi Arabia

9.4.1.1 Continuous Oil Exploration and Development by Saudi Aramco

Table 75 Saudi Arabia: Flow Computer Market in Oil & Gas, by Operation, 2019-2022 (USD Million)

Table 76 Saudi Arabia: Flow Computer Market in Oil & Gas, by Operation, 2023-2028 (USD Million)

9.4.2 Iran

9.4.2.1 Increased Production Activities

Table 77 Iran: Flow Computer Market in Oil & Gas, by Operation, 2019-2022 (USD Million)

Table 78 Iran: Flow Computer Market in Oil & Gas, by Operation, 2023-2028 (USD Million)

9.4.3 Qatar

9.4.3.1 Depleting Oil Production

Table 79 Qatar: Flow Computer Market in Oil & Gas, by Operation, 2019-2022 (USD Million)

Table 80 Qatar: Flow Computer Market in Oil & Gas, by Operation, 2023-2028 (USD Million)

9.4.4 Rest of Middle East

Table 81 Rest of Middle East: Flow Computer Market in Oil & Gas, by Operation, 2019-2022 (USD Million)

Table 82 Rest of Middle East: Flow Computer Market in Oil & Gas, by Operation, 2023-2028 (USD Million)

9.5 Asia-Pacific

Figure 37 Asia-Pacific: Snapshot of Flow Computer Market in Oil & Gas

Table 83 Asia-Pacific: Flow Computer Market in Oil & Gas, by Country, 2019-2022(USD Million)

Table 84 Asia-Pacific: Flow Computer Market in Oil & Gas, by Country, 2023-2028 (USD Million)

Table 85 Asia-Pacific: Flow Computer Market in Oil & Gas, by Operation, 2019-2022 (USD Million)

Table 86 Asia-Pacific: Flow Computer Market in Oil & Gas, by Operation, 2023-2028 (USD Million)

9.5.1 China

9.5.1.1 Expected to Dominate Market in Asia-Pacific

Table 87 China: Flow Computer Market in Oil & Gas, by Operation, 2019-2022 (USD Million)

Table 88 China: Flow Computer Market in Oil & Gas, by Operation, 2023-2028 (USD Million)

9.5.2 India

9.5.2.1 Redevelopment of Legacy Oilfields and Government Initiatives

Table 89 India: Flow Computer Market in Oil & Gas, by Operation, 2019-2022 (USD Million)

Table 90 India: Flow Computer Market in Oil & Gas, by Operation, 2023-2028 (USD Million)

9.5.3 Indonesia

9.5.3.1 Government Plans to Boost Oil & Gas Production

Table 91 Indonesia: Flow Computer Market in Oil & Gas, by Operation, 2019-2022 (USD Million)

Table 92 Indonesia: Flow Computer Market in Oil & Gas, by Operation, 2023-2028 (USD Million)

9.5.4 Rest of Asia-Pacific

Table 93 Rest of Asia-Pacific: Flow Computer Market in Oil & Gas, by Operation, 2019-2022 (USD Million)

Table 94 Rest of Asia-Pacific: Flow Computer Market in Oil & Gas, by Operation, 2023-2028 (USD Million)

9.6 Rest of the World

Table 95 Rest of the World: Flow Computer Market in Oil & Gas, by Region, 2019-2022(USD Million)

Table 96 Rest of the World: Flow Computer Market in Oil & Gas, by Region, 2023-2028 (USD Million)

Table 97 Rest of the World: Flow Computer Market in Oil & Gas, by Operation, 2019-2022 (USD Million)

Table 98 Rest of the World: Flow Computer Market in Oil & Gas, by Operation, 2023-2028 (USD Million)

9.6.1 South America

9.6.1.1 Digitalization in Oilfields

Table 99 South America: Flow Computer Market in Oil & Gas, by Operation, 2019-2022 (USD Million)

Table 100 South America: Flow Computer Market in Oil & Gas, by Operation, 2023-2028 (USD Million)

9.6.2 Africa

9.6.2.1 Governments Plans to Expand Energy Segment

Table 101 Africa: Flow Computer Market in Oil & Gas, by Operation, 2019-2022 (USD Million)

Table 102 Africa: Flow Computer Market in Oil & Gas, by Operation, 2023-2028 (USD Million)

10 Competitive Landscape

10.1 Introduction

10.2 Top 5 Company Revenue Analysis

Figure 38 Flow Computer Market in Oil & Gas: Revenue Analysis of Five Key Players, 2018-2022

10.3 Market Share Analysis of Top Five Players, 2022

Figure 39 Share of Major Players in Flow Computer Market in Oil & Gas, 2022

Table 103 Market Share of Top Five Players in Flow Computer Market in Oil & Gas, 2022

10.4 Company Evaluation Quadrant, 2022

10.4.1 Stars

10.4.2 Emerging Leaders

10.4.3 Pervasive Players

10.4.4 Participants

Figure 40 Flow Computer Market in Oil & Gas: Company Evaluation Quadrant, 2022

10.5 Flow Computer Market in Oil & Gas: Product Footprint

Table 104 Company Footprint

Table 105 Product Type Footprint of Companies

Table 106 Operation Footprint of Companies

Table 107 Regional Footprint of Companies

10.6 Small and Medium-Sized Enterprises (Sme) Evaluation Matrix, 2022

10.6.1 Progressive Companies

10.6.2 Responsive Companies

10.6.3 Dynamic Companies

10.6.4 Starting Blocks

Figure 41 Flow Computer Market in Oil & Gas, Sme Evaluation Quadrant, 2022

10.6.5 Startups/Smes Evaluation Matrix

Table 108 Flow Computer Market in Oil & Gas: Detailed List of Key Startups/Smes

Table 109 Flow Computer Market in Oil & Gas: Competitive Benchmarking of Key Startups/Smes

10.7 Competitive Situations and Trends

10.7.1 Flow Computer Market in Oil & Gas: Product Launches, September 2021-January 2023

Table 110 Flow Computer Market in Oil & Gas: Product Launches, September 2021-January 2023

10.7.2 Flow Computer Market in Oil & Gas: Deals, June 2022

Table 111 Flow Computer Market in Oil & Gas: Deals, June 2022

10.7.3 Flow Computer Market in Oil & Gas: Others, February 2021

Table 112 Flow Computer Market in Oil & Gas: Others, February 2021

11 Company Profiles

11.1 Key Players

(Business Overview, Products Offered, Recent Developments, and Analyst's View (Key Strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))*

11.1.1 Emerson Electric Co.

Table 113 Emerson Electric Co.: Company Overview

Figure 42 Emerson Electric Co.: Company Snapshot

Table 114 Emerson Electric Co.: Products Offered

Table 115 Emerson Electric Co.: Product Launches

11.1.2 Honeywell International, Inc.

Table 116 Honeywell International, Inc.: Company Overview

Figure 43 Honeywell International, Inc.: Company Snapshot

Table 117 Honeywell International, Inc.: Products Offered

11.1.3 Abb

Table 118 Abb: Company Overview

Figure 44 Abb: Company Snapshot

Table 119 Abb: Products Offered

Table 120 Abb: Deals

Table 121 Abb: Others

11.1.4 Thermo Fisher Scientific Inc.

Table 122 Thermo Fisher Scientific Inc.: Company Overview

Figure 45 Thermo Fisher Scientific Inc.: Company Snapshot

Table 123 Thermo Fisher Scientific Inc.: Products Offered

Table 124 Thermo Fisher Scientific Inc.: Product Launches

11.1.5 Schneider Electric

Table 125 Schneider Electric: Company Overview

Figure 46 Schneider Electric: Company Snapshot

Table 126 Schneider Electric: Products Offered

11.1.6 Krohne Messtechnik Gmbh

Table 127 Krohne Messtechnik Gmbh: Company Overview

Table 128 Krohne Messtechnik Gmbh: Products Offered

Table 129 Yokogawa Electric Corporation: Company Overview

Figure 47 Yokogawa Electric Corporation: Company Snapshot

Table 130 Yokogawa Electric Corporation: Products Offered

11.1.8 Technipfmc plc

Table 131 Technipfmc plc: Company Overview

Figure 48 Technipfmc plc: Company Snapshot

Table 132 Technipfmc plc: Products Offered

11.1.9 Omni Flow Computers, Inc.

Table 133 Omni Flow Computers, Inc.: Company Overview

Table 134 Omni Flow Computers, Inc.: Products Offered

11.1.10 Dynamic Flow Computers, Inc.

Table 135 Dynamic Flow Computers, Inc.: Company Overview

Table 136 Dynamic Flow Computers, Inc.: Products Offered

11.1.11 Contrec Limited

Table 137 Contrec Limited: Company Overview

Table 138 Contrec Limited: Products Offered

11.1.12 Kessler-Ellis Products (Kep) Co, Inc.

Table 139 Kessler-Ellis Products Co, Inc.: Company Overview

Table 140 Kessler-Ellis Products Co, Inc.: Products Offered

11.1.13 Sensia

Table 141 Sensia: Company Overview

Table 142 Sensia: Products Offered

11.2 Other Key Players

11.2.1 Prosoft Technology, Inc.

11.2.2 Flowmetrics, Inc.

11.2.3 Spirax Sarco Limited

11.2.4 Sick Ag

11.2.5 Badger Meter, Inc.

11.2.6 Quorum Business Solutions, Inc.

11.2.7 Endress+Hauser Ag

11.2.8 Plum Sp. Z O.O

11.2.9 Fluidwell Bv

11.2.10 Oval Corporation

11.2.11 Seneca Srl

11.2.12 Hoffer Flow Controls, Inc.

*Details on Business Overview, Products Offered, Recent Developments, and Analyst's View (Key Strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) Might Not be Captured in Case of Unlisted Companies.

12 Adjacent and Related Markets

12.1 Introduction

12.2 Study Limitations

12.3 Process Automation and Instrumentation Market, by Instrument

Table 143 Process Automation and Instrumentation Market, by Type, 2018-2021 (USD Million)

Table 144 Process Automation and Instrumentation Market, by Type, 2022-2027 (USD Million)

Table 145 Process Automation and Instrumentation Market, by Instrument, 2018-2021 (USD Million)

Table 146 Process Automation and Instrumentation Market, by Instrument, 2022-2027 (USD Million)

12.3.1 Field Instruments

12.3.1.1 Level Transmitters

12.3.1.1.1 Accurate Measurements in Water & Wastewater Treatment Industry

12.3.1.2 Pressure Transmitters

12.3.1.2.1 Widespread Use in Oil & Gas Industry

12.3.1.3 Temperature Transmitters

12.3.1.3.1 Simplify Operations

12.3.1.4 Others

12.3.1.4.1 Humidity Transmitters

12.3.1.5 Vibration Level Switches

12.3.2 Process Analyzers

12.3.2.1 High Demand from Pharmaceutical Industry

13 Appendix

13.1 Discussion Guide

13.2 Knowledgestore: The Subscription Portal

13.3 Customization Options

13.4 Related Reports

13.5 Author Details

Companies Mentioned

- ABB

- Badger Meter, Inc.

- Contrec Limited

- Dynamic Flow Computers, Inc.

- Emerson Electric Co.

- Endress+Hauser Ag

- Flowmetrics, Inc.

- Fluidwell Bv

- Hoffer Flow Controls, Inc.

- Honeywell International, Inc.

- Kessler-Ellis Products (Kep) Co, Inc.

- Krohne Messtechnik Gmbh

- Omni Flow Computers, Inc.

- Oval Corporation

- Plum Sp. Z O.O

- Prosoft Technology, Inc.

- Quorum Business Solutions, Inc.

- Schneider Electric

- Seneca Srl

- Sensia

- Sick Ag

- Spirax Sarco Limited

- Technipfmc plc

- Thermo Fisher Scientific Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 177 |

| Published | March 2023 |

| Forecast Period | 2023 - 2028 |

| Estimated Market Value ( USD | $ 798 Million |

| Forecasted Market Value ( USD | $ 1067 Million |

| Compound Annual Growth Rate | 6.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 24 |