Rise in Diagnosis of Deep Venous Diseases in Hospitals Leading to Increased Use of Treatment Devices

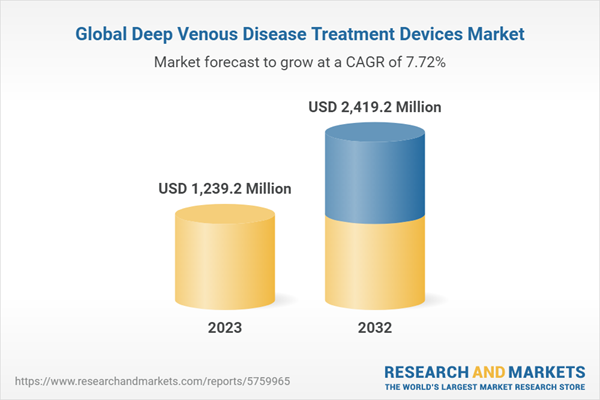

The global deep venous disease treatment devices market was valued at $1,119.3 million in 2022 and is anticipated to reach $2,419.2 million by 2032, witnessing a CAGR of 7.72% during the forecast period 2023-2032. The market is driven by factors such as the upsurge in the incidence of deep vein diseases leading to increased demand for treatment devices, increasing awareness of preventative devices leading to the growth of deep venous disease devices in the market, and a rise in diagnosis of deep venous diseases in hospitals leading to increased use of treatment devices.

Market Lifecycle Stage

The global deep venous disease treatment devices market is in the developed phase. The technological advancements in vascular stents and the development of advanced intermittent pneumatic compression (IPC) devices for prophylaxis of diseases are some of the major opportunities in the global deep venous disease treatment devices market.

Impact of COVID-19

The COVID-19 pandemic has impacted the global healthcare ecosystem in different manners. Among the sectors of the healthcare ecosystem that got less impacted by the pandemic are the deep venous disease treatment devices. Since the number of patients hospitalized during the pandemic was at its peak, the risk of patients developing different deep venous diseases got highly increased and resulted in more cases of diseases such as deep vein thrombosis. Hence, the COVID-19 pandemic has resulted in an increase in treatment and prevention devices for deep venous diseases.

Market Segmentation

Segmentation 1: by Product Type

- Thrombectomy and Thrombolysis Device

- Inferior Vena Cava (IVC) Filter

- Peripheral Vascular Stent

- PTA Balloon Catheter

- Accessory Device

- Compression Device/Stockings

The accessory device is the largest segment among the products, followed by the thrombectomy and thrombolysis device segment.

Segmentation 2: by End User

- Hospitals and Clinics

- Ambulatory Surgical Centres

- Home-Care

The global deep venous disease treatment devices market (by end user) is expected to be dominated by the hospitals and clinics segment.

Segmentation 3: by Region

- North America - U.S., Canada

- Europe - Germany, U.K., France, Italy, Spain, and Rest-of-Europe

- Asia-Pacific - China, Japan, India, Australia, South Korea, and Rest-of-Asia-Pacific

- Rest-of-the-World - Brazil, South Africa, and Rest-of-Rest-of-the-World

The global deep venous disease treatment devices market (by region) is dominated by the North America segment.

Recent Developments in the Global Deep Venous Disease Treatment Devices Market

- In January 2023, Innova Vascular, Inc. submitted the 510(k) Premarket Notification for its thrombectomy devices for the treatment of peripheral vascular disease to the U.S. Food and Drug Administration (FDA).

- In January 2023, Penumbra, Inc. launched its “Lightning Flash,” a mechanical thrombectomy system with U.S. FDA clearance.

- In December 2022, Zylox-Tonbridge Medical Technology received approval from China’s National Medical Products Administration (NMPA) for the commercialization of its Zylox Octoplus retrievable inferior vena cava (IVC) filter. The company’s product provides a reliable treatment solution for patients with high-risk deep vein thrombosis (DVT).

- In September 2022, Penumbra, Inc. collaborated with Asahi Intecc Co., Ltd. Through this collaboration, the companies aimed to introduce Penumbra, Inc.’s “Indigo Aspiration System” commercially in the Japan market.

- In February 2022, Innova Vascular, Inc. partnered with Cardiovascular Systems, Inc. with the aim of developing a complete line of thrombectomy devices.

- In September 2022, Merit Medical Systems, Inc. commercially launched its “Prelude Roadster Guide Sheath” in the U.S.

- In February 2022, Boston Scientific Corporation announced the acquisition of Baylis Medical Company Inc. Through this acquisition, the company enhanced its product portfolio by adding several products made by Baylis Medical Company Inc., such as transseptal access solutions, guidewires, sheaths, and dilators.

- In January 2022, Akura Medical, Inc., a subsidiary of Shifamed LLC, raised a funding of $25 million in its Series A1 financing round. Through this funding, the company aims to support the development of its next-generation thrombectomy device.

- In July 2021, Surmodics, Inc. announced the acquisition of Vetex Medical Ltd. Through this acquisition, the company aimed to boost its thrombectomy product portfolio.

Demand - Drivers and Limitations

The following are the drivers for the global deep venous disease treatment devices market:

- Upsurge in Incidence of Deep Vein Diseases Leading to Increased Demand for Treatment Devices

- Increasing Awareness of Preventative Devices Leading to the Growth of Deep Venous Disease Devices in the Market

- Rise in Diagnosis of Deep Venous Diseases in Hospitals Leading to Increased Use of Treatment Devices

The market is expected to face some limitations as well due to the following challenges:

- Rise in Drug-Based Treatment for Deep Venous Diseases Hindering the Adoption of Surgical Devices

- Lack of Skilled Professionals Performing Vascular Surgery Expected to Hinder the Market of Surgical Treatment Devices

How can this report add value to an organization?

Offerings: The offerings segment helps the reader understand the different types of deep venous disease treatment devices available in the market. Moreover, the study provides the reader with a detailed understanding of products that fall under the six main segments, i.e., thrombectomy and thrombolysis device, inferior vena cava filter, peripheral vascular stent, PTA balloon catheter, accessory device, and compression device/stockings.

Growth/Marketing Strategy: The global deep venous disease treatment devices market has witnessed major developments by key players operating in the market, such as product launches, business expansions, partnerships, collaborations, mergers and acquisitions, funding activities, and regulatory and legal approvals. The favored strategy for the companies has been regulatory and legal activities to strengthen their position in the market. For instance, in January 2023, Innova Vascular, Inc. submitted the 510(k) Premarket Notification for its thrombectomy devices for the treatment of peripheral vascular disease to the U.S. Food and Drug Administration (FDA).

Competitive Strategy: The key players in the global deep venous disease treatment devices market analyzed and profiled in the study involve established and emerging players that offer different products for deep venous diseases. Moreover, a detailed competitive benchmarking of the players operating in the global deep venous disease treatment devices market has been done to help the reader understand the ways in which players stack against each other, presenting a clear market landscape. Moreover, comprehensive competitive strategies such as partnerships, agreements, collaborations, and mergers and acquisitions will help the reader understand the untapped revenue pockets in the market.

Key Market Players and Competition Synopsis

The companies that are profiled have been selected based on inputs gathered from primary experts and analyzing company coverage, product portfolio, and market penetration.

Key Companies Profiled

- Abbott Laboratories

- AndraTec GmbH

- AngioDynamics, Inc.

- Boston Scientific Corporation

- Cardinal Health

- Cook Group

- Innova Vascular, Inc.

- Koninklijke Philips N.V.

- Medtronic plc

- Nipro Corporation

- Penumbra, Inc.

- Stryker Corporation

- Surmodics, Inc. (Vetex Medical Ltd.)

- Teleflex Incorporated

- Terumo Corporation

Table of Contents

1 Markets

1.1 Global Market Outlook

1.1.1 Product Definition

1.1.2 Inclusion and Exclusion Criteria

1.1.3 Key Findings

1.1.4 Global Market Scenario

1.1.4.1 Realistic Growth Scenario

1.1.4.2 Optimistic Scenario

1.1.4.3 Pessimistic Scenario

1.2 Industry Outlook

1.2.1 Key Trends

1.2.1.1 Rise in the Number of Regulatory Approvals and Legal Activities of Products and Devices for Deep Venous Disease Treatment

1.2.1.2 Upsurge in the Use of Non-Invasive and Minimally Invasive Techniques to Treat and Prevent Deep Venous Diseases

1.2.2 Patent Analysis

1.2.2.1 Awaited Technological Developments

1.2.2.2 Patent Filing Trend (by Year)

1.2.2.3 Patent Filing Trend (by Region)

1.2.3 Product Benchmarking

1.2.4 Ongoing Clinical Trial Analysis

1.2.5 Product Pipeline

1.2.6 Regulatory Scenario

1.2.6.1 U.S. Food and Drugs Administration (U.S. FDA)

1.2.6.2 European Medicines Agency (EMA)

1.2.6.3 National Medical Products Administration (NMPA)

1.2.6.4 Pharmaceuticals and Medical Devices Agency (PMDA)

1.3 Impact of COVID-19 on Deep Venous Disease Treatment Devices Market

1.3.1 Impact on Deep Venous Disease Treatment Devices

1.3.2 Impact on New Product Launches by Market Players

1.3.3 Impact on Market Size

1.3.3.1 Pre-COVID-19 Phase

1.3.3.2 During COVID-19 Phase

1.3.3.3 Post-COVID-19 Phase

1.4 Business Dynamics

1.4.1 Impact Analysis

1.4.2 Business Drivers

1.4.2.1 Upsurge in Incidence of Deep Vein Diseases Leading to Increased Demand for Treatment Devices

1.4.2.2 Increasing Awareness of Preventative Devices Leading to the Growth of Deep Venous Disease Devices in the Market

1.4.2.3 Rise in Diagnosis of Deep Venous Diseases in Hospitals Leading to Increased Use of Treatment Devices

1.4.3 Business Restraints

1.4.3.1 Rise in Drug-Based Treatment for Deep Venous Diseases Hindering the Adoption of Surgical Devices

1.4.3.2 Lack of Skilled Professionals Performing Vascular Surgery Expected to Hinder the Market of Surgical Treatment Devices

1.4.4 Business Opportunities

1.4.4.1 Development of Patient Specific Vascular Stents

1.4.4.2 Development of Advanced Intermittent Pneumatic Compression (IPC) Device for Prophylaxis of Diseases.

2 Global Deep Venous Disease Treatment Devices Market (by Product)

2.1 Opportunity Assessment

2.2 Growth-Share Matrix

2.3 Thrombectomy and Thrombolysis Device

2.3.1 Market Dynamics

2.3.2 Competitive Analysis

2.3.3 Market Size and Forecast

2.3.3.1 Thrombectomy and Thrombolysis Device (by Device)

2.4 Inferior Vena Cava (IVC) Filter

2.4.1 Market Dynamics

2.4.2 Competitive Analysis

2.4.3 Market Size and Forecast

2.4.3.1 Inferior Vena Cava Filter (by Device)

2.5 Peripheral Vascular Stent

2.5.1 Market Dynamics

2.5.2 Competitive Analysis

2.5.3 Market Size and Forecast

2.5.3.1 Peripheral Vascular Stent (by Type)

2.6 PTA Balloon Catheter

2.6.1 Market Dynamics

2.6.2 Competitive Analysis

2.6.3 Market Size and Forecast

2.6.3.1 PTA Balloon Catheter (by Material)

2.7 Accessory Device

2.7.1 Competitive Analysis

2.7.2 Market Size and Forecast

2.7.2.1 Accessory Device (by Type)

2.8 Compression Device/Stockings

2.8.1 Market Dynamics

2.8.2 Competitive Analysis

2.8.3 Market Size and Forecast

3 Global Deep Venous Disease Treatment Devices Market (by End User)

3.1 Opportunity Assessment

3.2 Growth-Share Matrix

3.3 Hospitals and Clinics

3.4 Ambulatory Surgery Centers

3.5 Home-Care

4 Region

4.1 North America Deep Venous Disease Treatment Devices Market

4.1.1 Key Findings and Opportunity Assessment

4.1.2 Market Dynamics

4.1.2.1 Impact Analysis

4.1.3 Market Sizing and Forecast

4.1.3.1 North America Deep Venous Disease Treatment Devices Market (by Product Type)

4.1.3.2 North America Deep Venous Disease Treatment Devices Market (by End User)

4.1.3.3 North America Deep Venous Disease Treatment Devices Market (by Country)

4.1.3.3.1 U.S.

4.1.3.3.1.1 U.S. Deep Venous Disease Treatment Devices Market (by Product Type)

4.1.3.3.1.2 U.S. Deep Venous Disease Treatment Devices Market (by End User)

4.1.3.3.2 Canada

4.1.3.3.2.1 Canada Deep Venous Disease Treatment Devices Market (by Product Type)

4.1.3.3.2.2 Canada Deep Venous Disease Treatment Devices Market (by End User)

4.2 Europe Deep Venous Disease Treatment Devices Market

4.2.1 Key Findings and Opportunity Assessment

4.2.2 Market Dynamics

4.2.2.1 Impact Analysis

4.2.3 Market Sizing and Forecast

4.2.3.1 Europe Deep Venous Disease Treatment Devices Market (by Product Type)

4.2.3.2 Europe Deep Venous Disease Treatment Devices Market (by End User)

4.2.3.3 Europe Deep Venous Disease Treatment Devices Market (by Country)

4.2.3.3.1 Germany

4.2.3.3.1.1 Germany Deep Venous Disease Treatment Devices Market (by Product Type)

4.2.3.3.1.2 Germany Deep Venous Disease Treatment Devices Market (by End User)

4.2.3.3.2 U.K.

4.2.3.3.2.1 U.K. Deep Venous Disease Treatment Devices Market (by Product Type)

4.2.3.3.2.2 U.K. Deep Venous Disease Treatment Devices Market (by End User)

4.2.3.3.3 France

4.2.3.3.3.1 France Deep Venous Disease Treatment Devices Market (by Product Type)

4.2.3.3.3.2 France Deep Venous Disease Treatment Devices Market (by End User)

4.2.3.3.4 Italy

4.2.3.3.4.1 Italy Deep Venous Disease Treatment Devices Market (by Product Type)

4.2.3.3.4.2 Italy Deep Venous Disease Treatment Devices Market (by End User)

4.2.3.3.5 Spain

4.2.3.3.5.1 Spain Deep Venous Disease Treatment Devices Market (by Product Type)

4.2.3.3.5.2 Spain Deep Venous Disease Treatment Devices Market (by End User)

4.2.3.3.6 Rest-of-Europe

4.2.3.3.6.1 Rest-of-Europe Deep Venous Disease Treatment Devices Market (by Product Type)

4.2.3.3.6.2 Rest-of-Europe Deep Venous Disease Treatment Devices Market (by End User)

4.3 Asia-Pacific Deep Venous Disease Treatment Devices Market

4.3.1 Key Findings and Opportunity Assessment

4.3.2 Market Dynamics

4.3.2.1 Impact Analysis

4.3.3 Market Sizing and Forecast

4.3.3.1 Asia-Pacific Deep Venous Disease Treatment Devices Market (by Product Type)

4.3.3.2 Asia-Pacific Deep Venous Disease Treatment Devices Market (by End User)

4.3.3.3 Asia-Pacific Deep Venous Disease Treatment Devices Market (by Country)

4.3.3.3.1 Japan

4.3.3.3.1.1 Japan Deep Venous Disease Treatment Devices Market (by Product Type)

4.3.3.3.1.2 Japan Deep Venous Disease Treatment Devices Market (by End User)

4.3.3.3.2 China

4.3.3.3.2.1 China Deep Venous Disease Treatment Devices Market (by Product Type)

4.3.3.3.2.2 China Deep Venous Disease Treatment Devices Market (by End User)

4.3.3.3.3 India

4.3.3.3.3.1 India Deep Venous Disease Treatment Devices Market (by Product Type)

4.3.3.3.3.2 India Deep Venous Disease Treatment Devices Market (by End User)

4.3.3.3.4 Australia

4.3.3.3.4.1 Australia Deep Venous Disease Treatment Devices Market (by Product Type)

4.3.3.3.4.2 Australia Deep Venous Disease Treatment Devices Market (by End User)

4.3.3.3.5 South Korea

4.3.3.3.5.1 South Korea Deep Venous Disease Treatment Devices Market (by Product Type)

4.3.3.3.5.2 South Korea Deep Venous Disease Treatment Devices Market (by End User)

4.3.3.3.6 Rest-of-Asia-Pacific

4.3.3.3.6.1 Rest-of-Asia-Pacific Deep Venous Disease Treatment Devices Market (by Product Type)

4.3.3.3.6.2 Rest-of-Asia-Pacific Deep Venous Disease Treatment Devices Market (by End User)

4.4 Rest-of-the-World Deep Venous Disease Treatment Devices Market

4.4.1 Key Findings and Opportunity Assessment

4.4.2 Market Dynamics

4.4.2.1 Impact Analysis

4.4.3 Market Sizing and Forecast

4.4.3.1 Rest-of-the-World Deep Venous Disease Treatment Devices Market (by Product Type)

4.4.3.2 Rest-of-the-World Deep Venous Disease Treatment Devices Market (by End User)

4.4.3.3 Rest-of-the-World Deep Venous Disease Treatment Devices Market (by Country)

4.4.3.3.1 Brazil

4.4.3.3.1.1 Brazil Deep Venous Disease Treatment Devices Market (by Product Type)

4.4.3.3.1.2 Brazil Deep Venous Disease Treatment Devices Market (by End User)

4.4.3.3.2 South Africa

4.4.3.3.2.1 South Africa Deep Venous Disease Treatment Devices Market (by Product Type)

4.4.3.3.2.2 South Africa Deep Venous Disease Treatment Devices Market (by End User)

4.4.3.3.3 Rest-of-Rest-of-the-World

4.4.3.3.3.1 Rest-of-Rest-of-the-World Deep Venous Disease Treatment Devices Market (by Product Type)

4.4.3.3.3.2 Rest-of-Rest-of-the-World Deep Venous Disease Treatment Devices Market (by End User)

5 Markets - Competitive Benchmarking & Company Profiles

5.1 Competitive Landscape

5.1.1 Key Strategies and Developments

5.1.1.1 Regulatory and Legal Activities

5.1.1.2 Partnerships, Alliances, and Business Expansions

5.1.1.3 New Offerings

5.1.1.4 Mergers and Acquisitions

5.1.1.5 Funding Activities

5.1.2 Key Development Analysis (Heat Map)

5.2 Company Profiles

5.2.1 Abbott Laboratories

5.2.1.1 Company Overview

5.2.1.2 Role of Abbott Laboratories in the Global Deep Venous Disease Treatment Devices Market

5.2.1.3 Product Portfolio

5.2.1.4 Financials

5.2.1.5 Recent Developments

5.2.1.6 Analyst Perspectives

5.2.2 AndraTec GmbH

5.2.2.1 Company Overview

5.2.2.2 Role of AndraTec GmbH in the Deep Venous Disease Treatment Devices Market

5.2.2.3 Product Portfolio

5.2.2.4 Recent Developments

5.2.2.5 Analyst Perception

5.2.3 AngioDynamics, Inc.

5.2.3.1 Company Overview

5.2.3.2 Role of AngioDynamics, Inc. in the Deep Venous Disease Treatment Devices Market

5.2.3.3 Product Portfolio

5.2.3.4 Financials

5.2.3.5 Recent Developments

5.2.3.6 Analyst Perception

5.2.4 Boston Scientific Corporation

5.2.4.1 Company Overview

5.2.4.2 Role of Boston Scientific Corporation in the Deep Venous Disease Treatment Devices Market

5.2.4.3 Product Portfolio

5.2.4.4 Financials

5.2.4.5 Recent Developments

5.2.4.6 Analyst Perception

5.2.5 Cardinal Health

5.2.5.1 Company Overview

5.2.5.2 Role of Cardinal Health in the Deep Venous Disease Treatment Devices Market

5.2.5.3 Product Portfolio

5.2.5.4 Financials

5.2.5.5 Analyst Perception

5.2.6 Cook Group

5.2.6.1 Company Overview

5.2.6.2 Role of Cook Group in the Deep Venous Disease Treatment Devices Market

5.2.6.3 Product Portfolio

5.2.6.4 Recent Developments

5.2.6.5 Analyst Perception

5.2.7 Innova Vascular, Inc.

5.2.7.1 Company Overview

5.2.7.2 Role of Innova Vascular, Inc. in the Deep Venous Disease Treatment Devices Market

5.2.7.3 Recent Developments

5.2.7.4 Analyst Perception

5.2.8 Koninklijke Philips N.V.

5.2.8.1 Company Overview

5.2.8.2 Role of Koninklijke Philips N.V. in the Deep Venous Disease Treatment Devices Market

5.2.8.3 Product Portfolio

5.2.8.4 Financials

5.2.8.5 Recent Developments

5.2.8.6 Analyst Perception

5.2.9 Medtronic plc

5.2.9.1 Company Overview

5.2.9.2 Role of Medtronic plc in the Deep Venous Disease Treatment Devices Market

5.2.9.3 Product Portfolio

5.2.9.4 Financials

5.2.9.5 Recent Developments

5.2.9.6 Analyst Perception

5.2.10 Nipro Corporation

5.2.10.1 Company Overview

5.2.10.2 Role of Nipro Corporation in the Deep Venous Disease Treatment Devices Market

5.2.10.3 Product Portfolio

5.2.10.4 Financials

5.2.10.5 Recent Developments

5.2.10.6 Analyst Perception

5.2.11 Penumbra, Inc.

5.2.11.1 Company Overview

5.2.11.2 Role of Penumbra, Inc. in the Deep Venous Disease Treatment Devices Market

5.2.11.3 Product Portfolio

5.2.11.4 Financials

5.2.11.5 Recent Developments

5.2.11.6 Analyst Perception

5.2.12 Stryker Corporation

5.2.12.1 Company Overview

5.2.12.2 Role of Stryker Corporation in the Deep Venous Disease Treatment Devices Market

5.2.12.3 Product Portfolio

5.2.12.4 Financials

5.2.12.5 Analyst Perception

5.2.13 Surmodics, Inc. (Vetex Medical Ltd.)

5.2.13.1 Company Overview

5.2.13.2 Role of Surmodics, Inc. in the Deep Venous Disease Treatment Devices Market

5.2.13.3 Product Portfolio

5.2.13.4 Financials

5.2.13.5 Recent Developments

5.2.13.6 Analyst Perception

5.2.14 Teleflex Incorporated

5.2.14.1 Company Overview

5.2.14.2 Role of Teleflex Incorporated in the Deep Venous Disease Treatment Devices Market

5.2.14.3 Product Portfolio

5.2.14.4 Financials

5.2.14.5 Recent Development

5.2.14.6 Analyst Perception

5.2.15 Terumo Corporation

5.2.15.1 Company Overview

5.2.15.2 Role of Terumo Corporation in the Deep Venous Disease Treatment Devices Market

5.2.15.3 Product Portfolio

5.2.15.4 Financials

5.2.15.5 Recent Developments

5.2.15.6 Analyst Perception

List of Figures

Figure 1: Global Deep Venous Disease Treatment Devices Market, Impact Analysis

Figure 2: Global Deep Venous Disease Treatment Devices Market (by Product), Share (%), 2022 and 2032

Figure 3: Global Deep Venous Disease Treatment Devices Market (by Region), $Million, 2022 and 2032

Figure 4: Global Deep Venous Disease Treatment Devices Market Segmentation

Figure 5: Global Deep Venous Disease Treatment Devices Market: Research Methodology

Figure 6: Primary Research Methodology

Figure 7: Bottom-Up Approach (Segment-Wise Analysis)

Figure 8: Top-Down Approach (Segment-Wise Analysis)

Figure 9: Global Deep Venous Disease Treatment Devices Market Size and Growth Potential (Realistic Scenario), $Million, 2020-2032

Figure 10: Global Deep Venous Disease Treatment Devices Market Size and Growth Potential (Optimistic Scenario), $Million, 2020-2032

Figure 11: Global Deep Venous Disease Treatment Devices Market Size and Growth Potential (Pessimistic/Conservative Scenario), $Million, 2020-2032

Figure 12: Regulatory and Legal Activities, January 2019-December 2022

Figure 13: Global Deep Venous Disease Treatment Devices Market, Patent Analysis (by Year), January 2018-December 2022

Figure 14: Global Deep Venous Disease Treatment Devices Market, Patent Analysis (by Country), January 2018-December 2022

Figure 15: Deep Venous Disease Treatment Devices (Ongoing Clinical Trials), by Interventions, 2022

Figure 16: Deep Venous Disease Treatment Devices (Ongoing Clinical Trials), by Company

Figure 17: Global Deep Venous Disease Treatment Devices Market, Pre-COVID-19 Phase, $Million, 2020-2032

Figure 18: Global Deep Venous Disease Treatment Devices Market, Impact Analysis

Figure 19: Global Deep Vein Thrombosis and Pulmoanry EmbolismIncidences, 2017-2021

Figure 20: Surgeries and Medical Procedures Considered to Increase the Risk of DVT

Figure 21: FDA Approvals (Rivaroxaban, Apixaban, Dabigatran, Edoxaban, and Betrixaban Active Ingredients), 2017-2021

Figure 22: Global Deep Venous Disease Treatment Devices Market (by Product)

Figure 23: Global Deep Venous Disease Treatment Devices Market, Incremental Opportunity (by Product), $Million, 2022-2032

Figure 24: Global Deep Venous Disease Treatment Devices Market, Growth-Share Matrix (by Product), 2022-2032

Figure 25: Global Deep Venous Disease Treatment Devices Market (Thrombectomy and Thrombolysis Device), Market Dynamics

Figure 26: Global Deep Venous Disease Treatment Devices Market (Thrombectomy and Thrombolysis Device), $Million, 2020-2032

Figure 27: Global Deep Venous Disease Treatment Devices Market (Thrombectomy and Thrombolysis Device), by Device, $Million, 2020-2032

Figure 28: Global Deep Venous Disease Treatment Devices Market (IVC Filter), Market Dynamics

Figure 29: Global Deep Venous Disease Treatment Devices Market (Inferior Vena Cava Filter), $Million, 2020-2032

Figure 30: Global Deep Venous Disease Treatment Devices Market (Inferior Vena Cava Filter), by Device, $Million, 2020-2032

Figure 31: Global Deep Venous Disease Treatment Devices Market (Peripheral Vascular Stent), Market Dynamics

Figure 32: Global Deep Venous Disease Treatment Devices Market (Peripheral Vascular Stent), $Million, 2020-2032

Figure 33: Global Deep Venous Disease Treatment Devices Market (Peripheral Vascular Stent), by Type, $Million, 2020-2032

Figure 34: Global Deep Venous Disease Treatment Devices Market (PTA Balloon Catheter), Market Dynamics

Figure 35: Global Deep Venous Disease Treatment Devices Market (PTA Balloon Catheter), $Million, 2020-2032

Figure 36: Global Deep Venous Disease Treatment Devices Market (PTA Balloon Catheter), by Material, $Million, 2020-2032

Figure 37: Global Deep Venous Disease Treatment Devices Market (Accessory Device), $Million, 2020-2032

Figure 38: Global Deep Venous Disease Treatment Devices Market (Accessory Device), by Type, $Million, 2020-2032

Figure 39: Global Deep Venous Disease Treatment Devices Market (Compression Device/Stockings), Market Dynamics

Figure 40: Global Deep Venous Disease Treatment Devices Market (Compression Device/Stockings), $Million, 2020-2032

Figure 41: Global Deep Venous Disease Treatment Devices Market (by End User)

Figure 42: Global Deep Venous Disease Treatment Devices Market Incremental Opportunity (by End User), $Million, 2022-2032

Figure 43: Global Deep Venous Disease Treatment Devices Market, Growth-Share Matrix (by End User), 2022-2032

Figure 44: Global Deep Venous Disease Treatment Devices Market (Hospitals and Clinics), $Million, 2020-2032

Figure 45: Global Deep Venous Disease Treatment Devices Market (Ambulatory Surgery Centers), $Million, 2020-2032

Figure 46: Global Deep Venous Disease Treatment Devices Market (Home-Care), $Million, 2020-2032

Figure 47: Global Deep Venous Disease Treatment Devices Market Share and CAGR (by Region), 2022 and 2023-2032

Figure 48: North America Deep Venous Disease Treatment Devices Market Incremental Opportunity (by Country), $Million, 2022-2032

Figure 49: North America Deep Venous Disease Treatment Devices Market, $Million, 2020-2032

Figure 50: North America Deep Venous Disease Treatment Devices Market (by Product Type), $Million, 2020-2032

Figure 51: North America Deep Venous Disease Treatment Devices Market (by End User), $Million, 2020-2032

Figure 52: North America Deep Venous Disease Treatment Devices Market (by Country), Share (%), 2022 and 2032

Figure 53: Prevalence of Deep Vein Thrombosis (DVT) and Pulmonary Embolsim (PE) in the U.S., 2022

Figure 54: U.S. Deep Venous Disease Treatment Devices Market, $Million, 2020-2032

Figure 55: U.S. Deep Venous Disease Treatment Devices Market (by Product Type), $Million, 2020-2032

Figure 56: U.S. Deep Venous Disease Treatment Devices Market (by End User), $Million, 2020-2032

Figure 57: Canada Deep Venous Disease Treatment Devices Market, $Million, 2020-2032

Figure 58: Canada Deep Venous Disease Treatment Devices Market (by Product Type), $Million, 2020-2032

Figure 59: Canada Deep Venous Disease Treatment Devices Market (by End User), $Million, 2020-2032

Figure 60: Europe Deep Venous Disease Treatment Devices Market Incremental Opportunity (by Country), $Million, 2022-2032

Figure 61: Europe Deep Venous Disease Treatment Devices Market, $Million, 2020-2032

Figure 62: Europe Deep Venous Disease Treatment Devices Market (by Product Type), $Million, 2020-2032

Figure 63: Europe Deep Venous Disease Treatment Devices Market (by End User), $Million, 2020-2032

Figure 64: Europe Deep Venous Disease Treatment Devices Market (by Country), Share (%), 2022 and 2032

Figure 65: Germany Deep Venous Disease Treatment Devices Market, $Million, 2020-2032

Figure 66: Germany Deep Venous Disease Treatment Devices Market (by Product Type), $Million, 2020-2032

Figure 67: Germany Deep Venous Disease Treatment Devices Market (by End User), $Million, 2020-2032

Figure 68: U.K. Deep Venous Disease Treatment Devices Market, $Million, 2020-2032

Figure 69: U.K. Deep Venous Disease Treatment Devices Market (by Product Type), $Million, 2020-2032

Figure 70: U.K. Deep Venous Disease Treatment Devices Market (by End User), $Million, 2020-2032

Figure 71: France Deep Venous Disease Treatment Devices Market, $Million, 2020-2032

Figure 72: France Deep Venous Disease Treatment Devices Market (by Product Type), $Million, 2020-2032

Figure 73: France Deep Venous Disease Treatment Devices Market (by End User), $Million, 2020-2032

Figure 74: Italy Deep Venous Disease Treatment Devices Market, $Million, 2020-2032

Figure 75: Italy Deep Venous Disease Treatment Devices Market (by Product Type), $Million, 2020-2032

Figure 76: Italy Deep Venous Disease Treatment Devices Market (by End User), $Million, 2020-2032

Figure 77: Spain Deep Venous Disease Treatment Devices Market, $Million, 2020-2032

Figure 78: Spain Deep Venous Disease Treatment Devices Market (by Product Type), $Million, 2020-2032

Figure 79: Spain Deep Venous Disease Treatment Devices Market (by End User), $Million, 2020-2032

Figure 80: Rest-of-Europe Deep Venous Disease Treatment Devices Market, $Million, 2020-2032

Figure 81: Rest-of-Europe Deep Venous Disease Treatment Devices Market (by Product Type), $Million, 2020-2032

Figure 82: Rest-of-Europe Deep Venous Disease Treatment Devices Market (by End User), $Million, 2020-2032

Figure 83: Asia-Pacific Deep Venous Disease Treatment Devices Market Incremental Opportunity (by Country), $Million, 2022-2032

Figure 84: Asia-Pacific Deep Venous Disease Treatment Devices Market, $Million, 2020-2032

Figure 85: Asia-Pacific Deep Venous Disease Treatment Devices Market (by Product Type), $Million, 2020-2032

Figure 86: Asia-Pacific Deep Venous Disease Treatment Devices Market (by End User), $Million, 2020-2032

Figure 87: Asia-Pacific Deep Venous Disease Treatment Devices Market (by Country), Share (%), 2022 and 2032

Figure 88: Japan Deep Venous Disease Treatment Devices Market, $Million, 2020-2032

Figure 89: Japan Deep Venous Disease Treatment Devices Market (by Product Type), $Million, 2020-2032

Figure 90: Japan Deep Venous Disease Treatment Devices Market (by End User), $Million, 2020-2032

Figure 91: China Deep Venous Disease Treatment Devices Market, $Million, 2020-2032

Figure 92: China Deep Venous Disease Treatment Devices Market (by Product Type), $Million, 2020-2032

Figure 93: China Deep Venous Disease Treatment Devices Market (by End User), $Million, 2020-2032

Figure 94: India Deep Venous Disease Treatment Devices Market, $Million, 2020-2032

Figure 95: India Deep Venous Disease Treatment Devices Market (by Product Type), $Million, 2020-2032

Figure 96: India Deep Venous Disease Treatment Devices Market (by End User), $Million, 2020-2032

Figure 97: Australia Deep Venous Disease Treatment Devices Market, $Million, 2020-2032

Figure 98: Australia Deep Venous Disease Treatment Devices Market (by Product Type), $Million, 2020-2032

Figure 99: Australia Deep Venous Disease Treatment Devices Market (by End User), $Million, 2020-2032

Figure 100: South Korea Deep Venous Disease Treatment Devices Market, $Million, 2020-2032

Figure 101: South Korea Deep Venous Disease Treatment Devices Market (by Product Type), $Million, 2020-2032

Figure 102: South Korea Deep Venous Disease Treatment Devices Market (by End User), $Million, 2020-2032

Figure 103: Rest-of-Asia-Pacific Deep Venous Disease Treatment Devices Market, $Million, 2020-2032

Figure 104: Rest-of-Asia-Pacific Deep Venous Disease Treatment Devices Market (by Product Type), $Million, 2020-2032

Figure 105: Rest-of-Asia-Pacific Deep Venous Disease Treatment Devices Market (by End User), $Million, 2020-2032

Figure 106: Rest-of-the-World Deep Venous Disease Treatment Devices Market Incremental Opportunity (by Country), $Million, 2022-2032

Figure 107: Rest-of-the-World Deep Venous Disease Treatment Devices Market, $Million, 2020-2032

Figure 108: Rest-of-the-World Deep Venous Disease Treatment Devices Market (by Product Type), $Million, 2020-2032

Figure 109: Rest-of-the-World Deep Venous Disease Treatment Devices Market (by End User), $Million, 2020-2032

Figure 110: Rest-of-the-World Deep Venous Disease Treatment Devices Market (by Country), Share (%), 2022 and 2032

Figure 111: Brazil Deep Venous Disease Treatment Devices Market, $Million, 2020-2032

Figure 112: Brazil Deep Venous Disease Treatment Devices Market (by Product Type), $Million, 2020-2032

Figure 113: Brazil Deep Venous Disease Treatment Devices Market (by End User), $Million, 2020-2032

Figure 114: South Africa Deep Venous Disease Treatment Devices Market, $Million, 2020-2032

Figure 115: South Africa Deep Venous Disease Treatment Devices Market (by Product Type), $Million, 2020-2032

Figure 116: South Africa Deep Venous Disease Treatment Devices Market (by End User), $Million, 2020-2032

Figure 117: Rest-of-Rest-of-the-World Deep Venous Disease Treatment Devices Market, $Million, 2020-2032

Figure 118: Rest-of-Rest-of-the-World America Deep Venous Disease Treatment Devices Market (by Product Type), $Million, 2020-2032

Figure 119: Rest-of-Rest-of-the-World Deep Venous Disease Treatment Devices Market (by End User), $Million, 2020-2032

Figure 120: Share of Key Developments and Strategies, January 2019-January 2023

Figure 121: Regulatory and Legal Activities (by Company), January 2019-January 2023

Figure 122: Partnerships, Alliances, and Business Expansions (by Company), January 2019-January 2023

Figure 123: New Offerings (by Company), January 2019-January 2023

Figure 124: Mergers and Acquisitions (by Company), January 2019-January 2023

Figure 125: Funding Activities (by Company), January 2019-January 2023

Figure 126: Key Development Analysis (Heat Map), January 2019-January 2023

Figure 127: Abbott Laboratories: Overall Product Portfolio

Figure 128: Abbott Laboratories: Overall Financials, $Million, 2019-2021

Figure 129: Abbott Laboratories: Net Revenue (by Business Segment), $Million, 2019-2021

Figure 130: Abbott Laboratories: Net Revenue (by Region), $Million, 2019-2021

Figure 131: Abbott Laboratories: R&D Expenditure, $Million, 2019-2021

Figure 132: AndraTec GmbH: Overall Product Portfolio

Figure 133: AngioDynamics, Inc.: Overall Product Portfolio

Figure 134: AngioDynamics, Inc.: Overall Financials, $Million, 2020-2022

Figure 135: AngioDynamics, Inc.: Revenue (by Segment), $Million, 2020-2022

Figure 136: AngioDynamics, Inc.: Revenue (by Region), $Million, 2020-2022

Figure 137: AngioDynamics, Inc.: R&D Expense, $Million, 2020-2022

Figure 138: Boston Scientific Corporation: Overall Product Portfolio

Figure 139: Boston Scientific Corporation: Overall Financials, $Million, 2019-2021

Figure 140: Boston Scientific Corporation: Revenue (by Segment), $Million, 2019-2021

Figure 141: Boston Scientific Corporation: R&D Expense, $Million, 2019-2021

Figure 142: Cardinal Health: Overall Product Portfolio

Figure 143: Cardinal Health: Overall Financials, $Million, 2020-2022

Figure 144: Cardinal Health: Revenue (by Segment), $Million, 2020-2022

Figure 145: Cardinal Health: Revenue (by Region), $Million, 2020-2022

Figure 146: Cook Group: Overall Product Portfolio

Figure 147: Koninklijke Philips N.V.: Product Portfolio

Figure 148: Koninklijke Philips N.V.: Overall Financials, $Million, 2019-2021

Figure 149: Koninklijke Philips N.V.: Revenue (by Segment), $Million, 2019-2021

Figure 150: Koninklijke Philips N.V.: Revenue (by Region), $Million, 2019-2021

Figure 151: Koninklijke Philips N.V.: R&D Expenditure, $Million, 2019-2021

Figure 152: Medtronic plc: Overall Product Portfolio

Figure 153: Medtronic plc: Overall Financials, $Million, 2020-2022

Figure 154: Medtronic plc: Revenue (by Segment), $Million, 2020-2022

Figure 155: Medtronic plc: Revenue (by Region), $Million 2020-2022

Figure 156: Medtronic plc: R&D Expense, $Million, 2020-2022

Figure 157: Nipro Corporation: Overall Product Portfolio

Figure 158: Nipro Corporation: Overall Financials, $Million, 2020-2022

Figure 159: Nipro Corporation: Revenue (by Segment), $Million, 2020-2022

Figure 160: Nipro Corporation: R&D Expense, $Million, 2020-2022

Figure 161: Penumbra, Inc.: Overall Product Portfolio

Figure 162: Penumbra, Inc.: Overall Financials, $Million, 2019-2021

Figure 163: Penumbra, Inc.: Revenue (by Segment), $Million, 2019-2021

Figure 164: Penumbra, Inc.: Revenue (by Region), $Million 2019-2021

Figure 165: Penumbra, Inc.: R&D Expense, $Million, 2019-2021

Figure 166: Stryker Corporation: Overall Product Portfolio

Figure 167: Stryker Corporation: Overall Financials, $Million, 2019-2021

Figure 168: Stryker Corporation: Revenue (by Segment), $Million, 2019-2021

Figure 169: Stryker Corporation: Subsegment Revenue (MedSurg and Neurotechnology), $Million 2019-2021

Figure 170: Stryker Corporation: Revenue (by Region), $Million 2019-2021

Figure 171: Stryker Corporation: R&D Expense, $Million, 2019-2021

Figure 172: Surmodics, Inc.: Overall Product Portfolio

Figure 173: Surmodics, Inc.: Overall Financials, $Million, 2020-2022

Figure 174: Surmodics, Inc.: Revenue (by Segment), $Million, 2020-2022

Figure 175: Surmodics, Inc.: R&D Expense, $Million, 2020-2022

Figure 176: Teleflex Incorporated: Overall Product Portfolio

Figure 177: Teleflex Incorporated: Overall Financials, $Million, 2019-2021

Figure 178: Teleflex Incorporated: Revenue (by Segment), $Million, 2019-2021

Figure 179: Teleflex Incorporated: Revenue (by Region), $Million 2019-2021

Figure 180: Teleflex Incorporated: R&D Expense, $Million, 2019-2021

Figure 181: Terumo Corporation: Overall Product Portfolio

Figure 182: Terumo Corporation: Overall Financials, $Million, 2020-2022

Figure 183: Terumo Corporation: Revenue (by Segment), $Million, 2020-2022

Figure 184: Terumo Corporation: Revenue (by Region), $Million 2020-2022

List of Tables

Table 1: Global Deep Venous Disease Treatment Devices Market, Quarterly Key Developments Analysis, January 2018-January 2023

Table 2: Key Questions Answered in the Report

Table 3: Parameters for Realistic, Optimistic, and Pessimistic Growth Scenarios

Table 4: Global Deep Venous Disease Treatment Devices Market, Product Benchmarking

Table 5: Global Deep Venous Disease Treatment Devices Market, Pipeline Companies

Table 6: Global Deep Venous Disease Treatment Devices (by Thrombectomy and Thrombolysis Device), Heat Map

Table 7: Global Deep Venous Disease Treatment Devices (by IVC Filter), Heat Map

Table 8: Global Deep Venous Disease Treatment Devices (by Peripheral Vascular Stent), Heat Map

Table 9: Global Deep Venous Disease Treatment Devices (by PTA Balloon Catheter), Heat Map

Table 10: Global Deep Venous Disease Treatment Devices (by Accessory Device), Heat Map

Table 11: Global Deep Venous Disease Treatment Devices (by Compression Device/Stockings), Heat Map

Table 12: North America Deep Venous Disease Treatment Devices Market, Impact Analysis

Table 13: Recalls for Deep Venous Disease Treatment Devices by the U.S. Food and Drug Administration (FDA)

Table 14: Europe Deep Venous Disease Treatment Devices Market, Impact Analysis

Table 15: Asia-Pacific Deep Venous Disease Treatment Devices Market, Impact Analysis

Table 16: Rest-of-the-World Deep Venous Disease Treatment Devices Market, Impact Analysis

Table 17: Abbott Laboratories.: Key Products and Features

Table 18: AndraTec GmbH: Key Products and Features

Table 19: AngioDynamics, Inc.: Key Products and Features

Table 20: Boston Scientific Corporation: Key Products and Features

Table 21: Cardinal Health: Key Products and Features

Table 22: Cook Group: Key Products and Features

Table 23: Koninklijke Philips N.V.: Key Products and Features

Table 24: Medtronic plc: Key Products and Features

Table 25: Nipro Corporation: Key Products and Features

Table 26: Penumbra, Inc.: Key Products and Features

Table 27: Stryker Corporation: Key Products and Features

Table 28: Surmodics, Inc.: Key Products and Features

Table 29: Teleflex Incorporated: Key Products and Features

Table 30: Terumo Corporation: Key Products and Features

Companies Mentioned

- Abbott Laboratories

- AndraTec GmbH

- AngioDynamics, Inc.

- Boston Scientific Corporation

- Cardinal Health

- Cook Group

- Innova Vascular, Inc.

- Koninklijke Philips N.V.

- Medtronic plc

- Nipro Corporation

- Penumbra, Inc.

- Stryker Corporation

- Surmodics, Inc. (Vetex Medical Ltd.)

- Teleflex Incorporated

- Terumo Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 240 |

| Published | March 2023 |

| Forecast Period | 2023 - 2032 |

| Estimated Market Value ( USD | $ 1239.2 Million |

| Forecasted Market Value ( USD | $ 2419.2 Million |

| Compound Annual Growth Rate | 7.7% |

| Regions Covered | Global |

| No. of Companies Mentioned | 15 |