Key Highlights

- Industrial couplings connect two shafts at their ends to transmit power. Industrial coupling effectively links two pieces of rotating equipment while allowing some end movement, degree of misalignment, or both. They form the major and integral part of the rotation mechanism of any electrical and industrial machinery.

- As companies are shifting toward Industry 4.0 to increase productivity and part quality, it is creating an opportunity for the coupling vendors to boost their production and cater to the growing demand from the industrial sector.

- Various developments are going on for the faster adoption of Industry 4.0. For instance, 13 new manufacturing sites have become a part of the World Economic Forum's Global Lighthouse Network as leaders in applying Fourth Industrial Revolution technologies to increase efficiency and productivity.

- The pandemic complicated the situation of automation adoption in various sectors. It changed the standard operating procedure by bringing in challenges of social distancing and contactless operation. Organizations were forced to limit their workforce and deal with the increasing demand.

- COVID-19 infected several essential workers globally, leading companies on the front lines to implement new safety processes. While the spread of the virus has been grave enough to warrant shutdowns, for instance, food production facilities, multiple other businesses have been able to continue operations with the addition of new health measures. However, the industries began functioning normally as the impact of the virus reduced. The post-pandemic world is also generating various opportunities for sectors such as healthcare, oil and gas, among others, which in turn is also augmenting the growth of the industrial couplings market.

Industrial Couplings Market Trends

Automotive Sector to Register a Significant Growth

- Industrial couplings are in massive demand in the automotive sector as numerous tools for testing and connecting a vehicle to a trough are used in the automotive industry. Furthermore, the rising adoption of electric vehicles globally is creating more opportunities for industrial couplings.

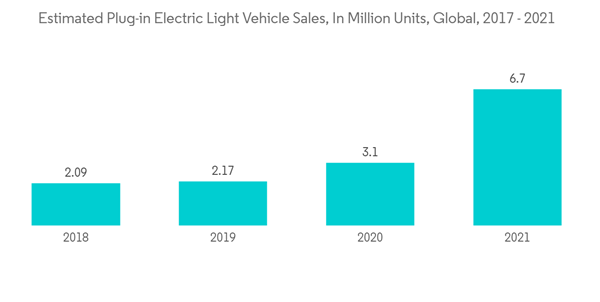

- According to statistics from International Energy Agency (IEA), in 2021, plug-in electric light vehicle (PEV) sales stood at around 6.7 million units. The market in China picked up steam after a slowdown in 2020, as vehicle manufacturing and demand were at a standstill due to the COVID-19 pandemic.

- Moreover, governments are also taking several initiatives to sustain the growth of the automotive sector. For instance, in June 2022, Egypt launched a national strategy for localizing the automotive industry. The strategy aims to strengthen Egypt's footprints in Africa's emerging vehicle markets and build substantial commercial and investment relations with main regional trade partners to ensure sustainable development growth for all sides.

- Additionally, the Ontario Government continues to invest in the province's auto parts supply chain with another round of investments through the Ontario Automotive Modernization Program (O-AMP) to position Ontario as a North American EV hub. Such developments are further accelerating the demand for industrial couplings.

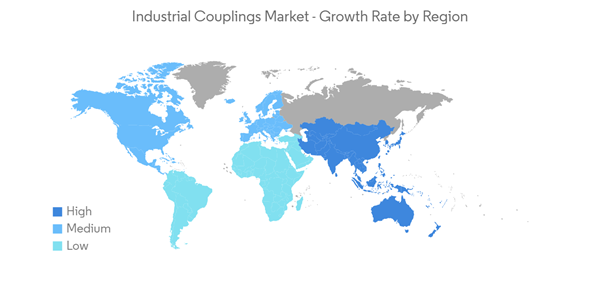

Asia-Pacific is Expected to Show a Significant Growth

- The industrial sector has emerged as one of the highest-growth sectors in the region. Various government initiatives, such as the 'Make in India' program, have further placed the region as one of the major hubs.

- Furthermore, Japan has been a pioneer in transforming into an automated industrial economy. The Industrial version 4.0 is being adopted at a rapid pace. The region has emerged as a manufacturing hub for factory automation products and supplies them to other regional markets in the Asian-Pacific region alongside international markets, propelling the demand for industrial couplings.

- The region is witnessing developments from various end users. For instance, in July 2022, Gilat Satellite Networks Ltd received an order of USD 7 million from a Tier-1 mobile network carrier in the Asian-Pacific region for a 4G cellular backhaul network expansion. Further, the ongoing developments in the 5G infrastructure in the region will also propel the growth of the market under study.

- Various international automotive companies are looking for strategic investments to expand their footprint in the emerging automotive sector in the region. For instance, in August 2021, Renault partnered with Geely Holding Group to establish the JV, which will build and sell Renault-branded gasoline-electric hybrid cars in China using Geely's technologies, supply chains, and manufacturing facilities. The venture would initially focus on China and South Korea but would likely be expanded to cover fast-growing Asian markets.

- A significant trend impacting the market studied is the focus on smart manufacturing practices. According to the data from IBEF, the Government of India set an ambitious target of increasing manufacturing output contribution to 25% of the gross domestic product by 2025, from 14.07% in 2021.

Industrial Couplings Market Competitor Analysis

The Industrial Couplings Market is moderately consolidated, with few local and international players active in the market. With the market expected to broaden and yield more opportunities, more players are expected to enter the market soon. The key players in the market studied include KTR Systems, Siemens AG, and Emerson Electric Co., among others. These major players have adopted various growth strategies, such as new product launches, mergers and acquisitions, expansions, partnerships, joint ventures, and others, to strengthen their position in this market.- June 2022 - KTR Systems GmbH announced the development of a new intermediate shaft coupling from the Rotex family. The shaft is made of aluminum and allows for shaft distances of up to 4,000 mm. The ROTEX ZRS is available in five sizes for torques up to 560 Nm.

Additional benefits of purchasing the report:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Altra Industrial Motion Corp.

- Baker Hughes Company

- Emerson Electric Co.

- Siemens AG

- Baldor Electric (ABB Ltd)

- Rexnord Corporation,

- KTR Systems

- Colossus

- John Crane Ltd.

- Industrial Clutch Parts Ltd.