Some of the primary reasons that drive the market are the growing prevalence of chronic disorders in the region, increased product offerings, and new insurer participation in the market. For instance, in November 2022, Cigna expanded its Medicare Advantage (MA) plan in Connecticut. This plan is beneficial for people who qualify for Medicare as they cover benefits that original Medicare does not. Furthermore, this market holds a high growth potential in the adult population due to the increasing cases of lifestyle-related disorders among adults and the growing awareness about the same. For instance, according to the International Diabetes Federation, in 2021, there were about 2.9 million diabetes cases in Canada and the number is projected to reach 3.4 million by 2045.

Key industry participants are focusing on implementing a number of strategies, including partnerships and collaborations, the launch of new products, and investments in regional insurance companies, to increase their presence and reach of their services. In March 2021, Highmark Inc. and HealthNow New York Inc. formed an agreement to affiliate, marking a significant step towards the integration of Blue Cross and Blue Shield health insurance plans to better serve the populations of the New York, Pennsylvania, Delaware, and West Virginia regions. This also led to the emergence of the fourth-largest BCBS insurer in the country.

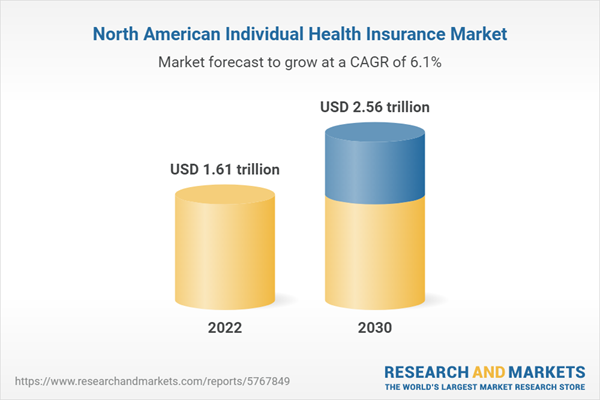

North America Individual Health Insurance Market Report Highlights

- The public type segment dominated the market in 2022 due to the widespread use of government-sponsored health insurance

- The private segment is predicted to register the fastest growth rate owing to the introduction of new products by private players in the market

- Based on demographics, the seniors segment held the largest revenue share in 2022. Senior citizens are more likely to buy individual health insurance plans to cover the rising costs of medical treatments, as they are at a higher risk of contracting various chronic conditions

- The U.S. accounted for the largest share of the overall market in 2022 while the South region in the U.S. dominated the country-wide market, as a substantial population is covered by individual health insurance in the region

Table of Contents

Chapter 1. Methodology and Scope1.1. Market Segmentation & Scope

1.1.1. Type

1.1.2. Demographics

1.1.3. Estimates and forecast timeline

1.2. Research Methodology

1.3. Information Procurement

1.3.1. Purchased database

1.3.2. internal database

1.3.3. Secondary sources

1.3.4. Primary research

1.3.5. Details of primary research

1.4. Information or Data Analysis

1.4.1. Data analysis models

1.5. Market Formulation & Validation

1.6. Model Details

1.6.1. Commodity flow analysis (Model 1)

1.6.1.1. Approach 1: Commodity flow approach

1.6.2. Volume price analysis (Model 2)

1.6.2.1. Approach 2: Volume price analysis

1.7. List of Secondary Sources

1.8. List of Primary Sources

1.9. Objectives

1.9.1. Objective 1

1.9.2. Objective 2

Chapter 2. Executive Summary

2.1. Market Outlook

2.2. Segment Outlook

2.2.1. Type outlook

2.2.2. Demographic outlook

2.3. Competitive Insights

Chapter 3. North America Individual Health Insurance Market Variables, Trends & Scope

3.1. Market Lineage Outlook

3.1.1. Parent market outlook

3.1.2. Related/ancillary market outlook

3.2. Penetration & Growth Prospect Mapping

3.3. Industry Value Chain Analysis

3.3.1. Reimbursement framework

3.4. Market Dynamics

3.4.1. Market driver analysis

3.4.1.1. Increasing prevalence of chronic diseases

3.4.1.2. Increase in insurer participation and new product offerings

3.4.2. Market restraint analysis

3.4.2.1. Presence of alternative health insurance plans

3.5. North America Individual Health Insurance Market Analysis Tools

3.5.1. Industry Analysis - Porter’s Five Forces

3.5.1.1. Supplier power

3.5.1.2. Buyer power

3.5.1.3. Substitution threat

3.5.1.4. Threat of new entrant

3.5.1.5. Competitive rivalry

3.5.2. PESTEL Analysis

3.5.2.1. Political landscape

3.5.2.2. Technological landscape

3.5.2.3. Economic landscape

3.5.3. Major Deals & Strategic Alliances Analysis

3.5.4. Market Entry Strategies

Chapter 4. North America Individual Health Insurance Market: Type Estimates & Trend Analysis

4.1. Definitions and Scope

4.1.1. Public

4.1.2. Private

4.2. Type Market Share, 2022 & 2030

4.3. Segment Dashboard

4.4. North America Individual Health Insurance Market by Type Outlook

4.5. Market Size & Forecasts and Trend Analyses, 2018 to 2030 for the following

4.5.1. Public

4.5.1.1. Public market estimates and forecast 2018 to 2030 (USD Billion)

4.5.2. Private

4.5.2.1. Private market estimates and forecast 2018 to 2030 (USD Billion)

Chapter 5. North America Individual Health Insurance Market: Demographics Estimates & Trend Analysis

5.1. Definitions and Scope

5.1.1. Minor

5.1.2. Adult

5.1.3. Senior

5.2. Demographic Market Share, 2022 & 2030

5.3. Segment Dashboard

5.4. North America Individual Health Insurance Market by Demographic Outlook

5.5. Market Size & Forecasts and Trend Analyses, 2018 to 2030 for the following

5.5.1. Minor

5.5.1.1. Minor market estimates and forecast 2018 to 2030 (USD Billion)

5.5.2. Adult

5.5.2.1. Adult market estimates and forecast 2018 to 2030 (USD Billion)

5.5.3. Senior

5.5.3.1. Senior market estimates and forecast 2018 to 2030 (USD Billion)

Chapter 6. North America Individual Health Insurance Market: Country Market Analysis, 2018 - 2030 (USD Billion)

6.1. Definitions & Scope

6.2. Country Market Share Analysis, 2022 & 2030

6.3. Country Market Dashboard

6.4. Country Market Snapshot

6.5. Country Market Share, 2022

6.6. Market Size, & Forecasts, and Trend Analysis, 2018 to 2030:

6.7. U.S.

6.8. Northeast

6.8.1. Northeast Market estimates and forecast, 2018 - 2030 (USD Billion)

6.8.2. Connecticut

6.8.2.1. Connecticut Market estimates and forecast, by product, 2018 - 2030 (Billion)

6.8.3. Massachusetts

6.8.3.1. Massachusetts Market estimates and forecast, by product, 2018 - 2030 (Billion)

6.8.4. Pennsylvania

6.8.4.1. Pennsylvania Market estimates and forecast, by product, 2018 - 2030 (Billion)

6.8.5. New Jersey

6.8.5.1. New Jersey Market estimates and forecast, by product, 2018 - 2030 (Billion)

6.8.6. New York

6.8.6.1. New York Market estimates and forecast, by product, 2018 - 2030 (Billion)

6.8.7. Others (Maine, New Hampshire, Rhode Island, Vermont)

6.8.7.1. Others Market estimates and forecast, by product, 2018 - 2030 (Billion)

6.9. Midwest

6.9.1. Midwest Market estimates and forecast, 2018 - 2030 (USD Billion)

6.9.2. Illinois

6.9.2.1. Illinois Market estimates and forecast, by product, 2018 - 2030 (Billion)

6.9.3. Indiana

6.9.3.1. Indiana Market estimates and forecast, by product, 2018 - 2030 (Billion)

6.9.4. Michigan

6.9.4.1. Michigan Market estimates and forecast, by product, 2018 - 2030 (Billion)

6.9.5. Ohio

6.9.5.1. Ohio Market estimates and forecast, by product, 2018 - 2030 (Billion)

6.9.6. Wisconsin

6.9.6.1. Wisconsin Market estimates and forecast, by product, 2018 - 2030 (Billion)

6.9.7. Iowa

6.9.7.1. lowa Market estimates and forecast, by product, 2018 - 2030 (Billion)

6.9.8. Minnesota

6.9.8.1. Minnesota Market estimates and forecast, by product, 2018 - 2030 (Billion)

6.9.9. Missouri

6.9.9.1. Missouri Market estimates and forecast, by product, 2018 - 2030 (Billion)

6.9.10. Others (Kansas, Nebraska, North Dakota, South Dakota)

6.9.10.1. Others Market estimates and forecast, by product, 2018 - 2030 (Billion)

6.10. South

6.10.1. South Market estimates and forecast, 2018 - 2030 (USD Billion)

6.10.2. Florida

6.10.2.1. Florida Market estimates and forecast, by product, 2018 - 2030 (Billion)

6.10.3. Georgia

6.10.3.1. Georgia Market estimates and forecast, by product, 2018 - 2030 (Billion)

6.10.4. Maryland

6.10.4.1. Maryland Market estimates and forecast, by product, 2018 - 2030 (Billion)

6.10.5. North Carolina

6.10.5.1. North Carolina Market estimates and forecast, by product, 2018 - 2030 (Billion)

6.10.6. South Carolina

6.10.6.1. South Carolina Market estimates and forecast, by product, 2018 - 2030 (Billion)

6.10.7. Virginia

6.10.7.1. Virginia Market estimates and forecast, by product, 2018 - 2030 (Billion)

6.10.8. Alabama

6.10.8.1. Alabama Market estimates and forecast, by product, 2018 - 2030 (Billion)

6.10.9. Kentucky

6.10.9.1. Kentucky Market estimates and forecast, by product, 2018 - 2030 (Billion)

6.10.10. Tennessee

6.10.10.1. Tennessee Market estimates and forecast, by product, 2018 - 2030 (Billion)

6.10.11. Louisiana

6.10.11.1. Louisiana Market estimates and forecast, by product, 2018 - 2030 (Billion)

6.10.12. Texas

6.10.12.1. Texas Market estimates and forecast, by product, 2018 - 2030 (Billion)

6.10.13. Others (Delaware, West Virginia, Mississippi, Arkansas, Oklahoma)

6.10.13.1. Others Market estimates and forecast, by product, 2018 - 2030 (Billion)

6.11. West

6.11.1. West Market estimates and forecast, 2018 - 2030 (USD Billion)

6.11.2. Arizona

6.11.2.1. Arizona Market estimates and forecast, by product, 2018 - 2030 (Billion)

6.11.3. Colorado

6.11.3.1. Colorado Market estimates and forecast, by product, 2018 - 2030 (Billion)

6.11.4. Nevada

6.11.4.1. Nevada Market estimates and forecast, by product, 2018 - 2030 (Billion)

6.11.5. California

6.11.5.1. California Market estimates and forecast, by product, 2018 - 2030 (Billion)

6.11.6. Oregon

6.11.6.1. Oregon Market estimates and forecast, by product, 2018 - 2030 (Billion)

6.11.7. Washington

6.11.7.1. Washington Market estimates and forecast, by product, 2018 - 2030 (Billion)

6.11.8. Others (Idaho, Montana, New Mexico, Utah, Wyoming, Alaska, Hawaii)

6.11.8.1. Others Market estimates and forecast, by product, 2018 - 2030 (Billion)

6.12. Canada

6.13. Newfoundland and Labrador (NL)

6.13.1. Newfoundland and Labrador (NL) Market estimates and forecast, 2018 - 2030 (USD Billion)

6.14. Prince Edward Island (PE)

6.14.1. Prince Edward Island (PE) Market estimates and forecast, 2018 - 2030 (USD Billion)

6.15. Nova Scotia (NS)

6.15.1. Nova Scotia (NS) Market estimates and forecast, 2018 - 2030 (USD Billion)

6.16. New Brunswick (NB)

6.16.1. New Brunswick (NB) Market estimates and forecast, 2018 - 2030 (USD Billion)

6.17. Quebec (QC)

6.17.1. Quebec (QC) Market estimates and forecast, 2018 - 2030 (USD Billion)

6.18. Ontario (ON)

6.18.1. Ontario (ON) Market estimates and forecast, 2018 - 2030 (USD Billion)

6.19. Manitoba (MB)

6.19.1. Manitoba (MB) Market estimates and forecast, 2018 - 2030 (USD Billion)

6.20. Saskatchewan (SK)

6.20.1. Saskatchewan (SK) Market estimates and forecast, 2018 - 2030 (USD Billion)

6.21. Alberta (AB)

6.21.1. Alberta (AB) Market estimates and forecast, 2018 - 2030 (USD Billion)

6.22. British Columbia (BC)

6.22.1. British Columbia (BC) Market estimates and forecast, 2018 - 2030 (USD Billion)

6.23. Others

6.23.1. Others Market estimates and forecast, 2018 - 2030 (USD Billion)

Chapter 7. Competitive Landscape

7.1. Recent Developments & Impact Analysis, By Key Market Participants

7.2. Company/Competition Categorization

7.2.1. Innovators

7.3. Vendor Landscape

7.3.1. List of key distributors and channel partners

7.3.2. Key customers

7.3.3. Key company market share analysis, 2022

7.3.4. Cigna

7.3.4.1. Company overview

7.3.4.2. Financial performance

7.3.4.3. Product benchmarking

7.3.4.4. Strategic initiatives

7.3.5. United Health Group Incorporated

7.3.5.1. Company overview

7.3.5.2. Financial performance

7.3.5.3. Product benchmarking

7.3.5.4. Strategic initiatives

7.3.6. Elevance Health (formerly Anthem, Inc.)

7.3.6.1. Company overview

7.3.6.2. Financial performance

7.3.6.3. Product benchmarking

7.3.6.4. Strategic initiatives

7.3.7. Health Care Service Corporation

7.3.7.1. Company overview

7.3.7.2. Financial performance

7.3.7.3. Product benchmarking

7.3.7.4. Strategic initiatives

7.3.8. Kaiser Foundation Health Plan, Inc

7.3.8.1. Company overview

7.3.8.2. Financial performance

7.3.8.3. Product benchmarking

7.3.8.4. Strategic initiatives

7.3.9. Independence Holding Company (IHC Group)

7.3.9.1. Company overview

7.3.9.2. Financial performance

7.3.9.3. Product benchmarking

7.3.9.4. Strategic initiatives

7.3.10. Manulife Financial Corporation

7.3.10.1. Company overview

7.3.10.2. Financial performance

7.3.10.3. Product benchmarking

7.3.10.4. Strategic initiatives

7.3.11. Sun Life Financial Inc

7.3.11.1. Company overview

7.3.11.2. Financial performance

7.3.11.3. Product benchmarking

7.3.11.4. Strategic initiatives

7.3.12. The Canada Life Assurance Company

7.3.12.1. Company overview

7.3.12.2. Financial performance

7.3.12.3. Product benchmarking

7.3.12.4. Strategic initiatives

7.3.13. Scotia Insurance

7.3.13.1. Company overview

7.3.13.2. Financial performance

7.3.13.3. Product benchmarking

7.3.13.4. Strategic initiatives

7.3.14. Green Shield Canada

7.3.14.1. Company overview

7.3.14.2. Financial performance

7.3.14.3. Product benchmarking

7.3.14.4. Strategic initiatives

List of Tables

Table 1 List of Abbreviations

Table 2 North America individual health insurance market, by type, 2018 - 2030 (USD Billion)

Table 3 North America individual health insurance market, by demographics, 2018 - 2030 (USD Billion)

Table 4 Northeast individual health insurance market, by type, 2018 - 2030 (USD Billion)

Table 5 Northeast individual health insurance market, by demographics, 2018 - 2030 (USD Billion)

Table 6 Midwest individual health insurance market, by type, 2018 - 2030 (USD Billion)

Table 7 Midwest individual health insurance market, by demographics, 2018 - 2030 (USD Billion)

Table 8 South individual health insurance market, by type, 2018 - 2030 (USD Billion)

Table 9 South individual health insurance market, by demographics, 2018 - 2030 (USD Billion)

Table 10 West individual health insurance market, by type, 2018 - 2030 (USD Billion)

Table 11 West individual health insurance market, by demographics, 2018 - 2030 (USD Billion)

Table 12 Newfoundland and Labrador (NL) individual health insurance market estimates and forecasts, 2018 - 2030 (Billion)

Table 13 Prince Edward Island (PE) individual health insurance market estimates and forecasts, 2018 - 2030 (Billion)

Table 14 Nova Scotia (NS) individual health insurance market estimates and forecasts, 2018 - 2030 (Billion)

Table 15 New Brunswick (NB) individual health insurance market estimates and forecasts, 2018 - 2030 (Billion)

Table 16 Quebec (QC) individual health insurance market estimates and forecasts, 2018 - 2030 (Billion)

Table 17 Ontario (ON) individual health insurance market estimates and forecasts, 2018 - 2030 (Billion)

Table 18 Manitoba (MB) individual health insurance market estimates and forecasts, 2018 - 2030 (Billion)

Table 19 Saskatchewan (SK) individual health insurance market estimates and forecasts, 2018 - 2030 (Billion)

Table 20 Alberta (AB) individual health insurance market estimates and forecasts, 2018 - 2030 (Billion)

Table 21 British Columbia (BC) individual health insurance market estimates and forecasts, 2018 - 2030 (Billion)

Table 22 Others individual health insurance market estimates and forecasts, 2018 - 2030 (Billion)

List of Figures

Fig. 1 Market research process

Fig. 2 Data triangulation techniques

Fig. 3 Primary research pattern

Fig. 4 Market research approaches

Fig. 5 Value-chain-based sizing & forecasting

Fig. 6 QFD modeling for market share assessment

Fig. 7 Market formulation & validation

Fig. 8 North America individual health insurance market: market outlook

Fig. 9 North America individual health insurance market competitive insights

Fig. 10 Parent market outlook

Fig. 11 Related/ancillary market outlook

Fig. 12 Penetration and growth prospect mapping

Fig. 13 Industry value chain analysis

Fig. 14 North America individual health insurance market Driver Impact

Fig. 15 North America individual health insurance market Restraint Impact

Fig. 16 North America individual health insurance market Strategic Initiatives Analysis

Fig. 17 North America individual health insurance market: Type Movement Analysis

Fig. 18 North America individual health insurance market: Type outlook and key takeaways

Fig. 19 Public market estimates and forecast, 2018 - 2030

Fig. 20 Private market estimates and forecast, 2018-2030

Fig. 21 North America individual health insurance market: Demographics Movement Analysis

Fig. 22 North America individual health insurance market: Demographics outlook and key takeaways

Fig. 23 Minors Market Estimates and Forecast, 2018-2030

Fig. 24 Adults Estimate and Forecast, 2018-2030

Fig. 25 Seniors Estimate and Forecast, 2018-2030

Fig. 26 Participant Categorization- North America individual health insurance market

Fig. 27 Market share of key market players North America individual health insurance market

Companies Mentioned

- Cigna

- United Health Group Incorporated

- Elevance Health (formerly Anthem, Inc.)

- Health Care Service Corporation

- Kaiser Foundation Health Plan, Inc

- Independence Holding Company (IHC Group)

- Manulife Financial Corporation

- Sun Life Financial Inc

- The Canada Life Assurance Company

- Scotia Insurance

- Green Shield Canada

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 110 |

| Published | March 2023 |

| Forecast Period | 2022 - 2030 |

| Estimated Market Value ( USD | $ 1.61 trillion |

| Forecasted Market Value ( USD | $ 2.56 trillion |

| Compound Annual Growth Rate | 6.1% |

| Regions Covered | North America |

| No. of Companies Mentioned | 11 |