Specialty films are a category of high-performance plastic films designed to meet specific requirements and applications. Unlike standard plastic films, they offer unique characteristics such as enhanced resistance to chemicals, heat, or moisture, improved mechanical properties, or special optical effects. Utilized in various industries, including electronics, healthcare, food packaging, and construction, specialty films contribute to the efficiency and functionality of products. They are typically customized to the client's specifications and needs, making them invaluable for innovative solutions. Their development often involves cutting-edge technology and materials science, reflecting the ongoing advancements in various sectors. The demand for specialty films is growing due to their ability to provide versatile solutions to complex problems.

The expansion of globalization and the emergence of new markets, particularly in developing regions, have significantly contributed to the growth of the specialty film industry. As international trade barriers reduce and markets become more interconnected, opportunities for specialty films have expanded across various sectors, including automotive, construction, and healthcare. Along with this, changes in consumer preferences and lifestyles are creating demand for innovative products, impacting the market. For instance, a shift towards convenient, ready-to-eat meals has necessitated specialty packaging that maintains quality and freshness. Therefore, the trend of personalization has also led to the development of specialty films tailored to individual needs and preferences, contributing to the market. In addition, the automotive industry's evolution and focus on lightweight materials and fuel efficiency have fostered the utilization of specialty films. These films are utilized in various vehicle components for weight reduction, aesthetics, safety, and performance enhancement. Moreover, the growth in smart cities and the emphasis on energy-efficient buildings are creating a positive market outlook.

Specialty Films Market Trends/Drivers:

Increased Product Demand in Packaging Applications

The specialty films industry has seen substantial growth due to increased demand for packaging applications, particularly in the food and pharmaceutical sectors. The need for maintaining product integrity, freshness, and safety has prompted the use of product variants with enhanced barrier properties against moisture, oxygen, and contaminants. Additionally, the demand for sustainable and recyclable materials is influencing the development of eco-friendly product variants. The rise in consumer awareness regarding hygiene and health, along with stringent regulatory requirements, further pushes the utilization of specialty films in packaging. This trend is supported by globalization, which has opened new markets and broadened the scope for specialty packaging solutions. Together, these factors have formed a significant driver for the growth of the specialty film industry.Stringent Regulatory Compliance and Sustainability Concerns

The specialty films industry is influenced by stringent regulatory compliance and growing concerns regarding environmental sustainability. Along with this, governments and regulatory bodies are implementing rules that enforce the use of materials meeting specific quality, safety, and environmental standards. This has pushed the industry to develop specialty films that are not only high-performing but also comply with ecological concerns. In addition, regulations in the food industry are driving innovation in eco-friendly, recyclable, and biodegradable specialty films. In Apart from this, consumer awareness regarding environmental impacts has also supported this trend, leading to greater demand for sustainable options. This confluence of regulatory compliance and sustainability concerns has become a vital force shaping the direction and growth of the industry.Technological Advancements and Innovation

Technological advancements have played a critical role in driving the specialty films industry. Innovations in polymer science and materials engineering have led to the creation of films with highly specific attributes such as improved thermal resistance, anti-microbial properties, and enhanced mechanical strength. Research and development activities have fueled the creation of more sophisticated and diverse specialty films. These technological innovations are allowing manufacturers to cater to unique requirements across industries, such as healthcare, food and beverage, electronics, and automotive. Furthermore, the development of new manufacturing techniques, such as nano-layering and co-extrusion, has further facilitated customization. This adaptability has created a positive impact on various sectors, ensuring that specialty films meet or exceed industry standards and regulations. Continuous technological progression promises future growth and variety in the specialty films market, making it an essential driver in this industry.Specialty Films Industry Segmentation:

This report provides an analysis of the key trends in each segment of the global specialty films market report, along with forecasts at the global, regional and country levels from 2025-2033. The report categorizes the market based on resin, function, and end use industry.Breakup by Resin:

- Polyester

- Nylon

- Polyacrylamide

- Fluoropolymer

- Polyimide

- Polyolefin

- Others

Polyester dominates the market

The report has provided a detailed breakup and analysis of the market based on the resin. This includes polyester, nylon, polyacrylamide, fluoropolymer, polyimide, polyolefin, and others. According to the report, polyester represented the largest segment.Polyester resin stands as a pivotal component within the specialty film industry, driven by the escalating demand for lightweight, durable, and flexible packaging solutions. Along with this, the steady expansion of end-use sectors such as food and beverages, healthcare, and electronics underscores the significance of polyester resin-based product variants in safeguarding and enhancing product integrity. Cost-effectiveness, coupled with the resin's high tensile strength and resistance to moisture and chemicals, solidifies its position as a preferred choice for manufacturers aiming to ensure product longevity while adhering to stringent quality standards. As sustainable practices continue to gain prominence, polyester resin's recyclability and potential for reduced environmental impact contribute to its appeal, aligning with the growing eco-conscious consumer preferences. These intricate interplays of demand dynamics and material characteristics underscore the undeniable role of market drivers in propelling polyester resin's pivotal role within the specialty films landscape.

Breakup by Function:

- Barrier

- Conduction and Insulation

- Microporous

- Safety and Security

- Others

Barrier function holds the largest share in the market

A detailed breakup and analysis of the market based on the function has also been provided in the report. This includes barrier, conduction and insulation, microporous, safety and security, and others. According to the report, barrier function accounted for the largest market share.In the dynamic landscape of the overall industry, the imperative role of barrier function emerges as a paramount market driver. The relentless pursuit of extending shelf life, preserving product freshness, and safeguarding against external contaminants fuels the demand for specialty films boasting exceptional barrier properties. This need is particularly pronounced in sectors, such as food packaging, pharmaceuticals, and electronics, where maintaining product integrity is non-negotiable. Barrier function, epitomized by attributes such as oxygen and moisture resistance, UV protection, and aroma retention, has become synonymous with product quality and safety. The escalating consumer awareness regarding health and sustainability further accentuates this trend, compelling manufacturers to integrate advanced materials and technologies into their offerings. As regulatory requirements evolve and consumer preferences continue to shift, the significance of barrier-enhanced product variants as a market driver remains steadfast, embodying both practicality and innovation within an ever-evolving industry landscape.

Breakup by End Use Industry:

- Packaging

- Personal Care

- Electrical and Electronics

- Transportation

- Construction

- Medical

Packaging dominates the market

The report has provided a detailed breakup and analysis of the market based on the end use industry. This includes packaging, personal care, electrical and electronics, transportation, construction, and medical. According to the report, packaging represented the largest segment.The packaging end use segment stands as a pivotal driving force within the specialty films industry, propelled by a confluence of factors that shape its trajectory. As consumer preferences shift towards convenience and aesthetics, packaging plays an increasingly pivotal role in influencing purchasing decisions. Specialty films, renowned for their versatility and ability to cater to diverse packaging needs, emerge as a preferred choice for manufacturers seeking to create impactful and functional packaging solutions. Moreover, the rising demand for sustainable practices fuels innovation in the sector, driving the adoption of product variants that minimize environmental impact while maintaining product integrity. The ever-expanding e-commerce landscape further amplifies the significance of packaging, necessitating films with heightened protective properties to ensure safe transit and delivery of goods. As regulations evolve and quality standards become more stringent, the packaging end use within the specialty films industry remains at the forefront of innovation, combining aesthetics, functionality, and sustainability to meet the evolving needs of consumers and industries.

Breakup by Region:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Asia Pacific exhibits a clear dominance, accounting for the largest specialty films market share

The report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Asia Pacific represented the largest share.The specialty films industry in the Asia Pacific region is propelled by the region's robust economic expansion, coupled with a burgeoning middle-class population, fuels increased consumer spending and demand for advanced packaging, electronics, and automotive solutions - key sectors reliant on specialty films. Rapid urbanization and changing lifestyles further bolster this demand, as consumers seek products with enhanced functionality and aesthetic appeal. Additionally, the Asia Pacific region's status as a manufacturing hub draws attention to the need for specialized films that protect, preserve, and enhance the quality of goods during storage, transportation, and use.

The drive towards sustainability and eco-conscious practices resonates strongly in the region, prompting manufacturers to develop environmentally friendly specialty films that align with stringent regulatory norms and consumer preferences. As technological advancements continue to reshape industries, the specialty films sector in the Asia Pacific remains poised for growth, driven by a fusion of economic dynamism, evolving consumer needs, and a commitment to innovation.

Competitive Landscape:

The global specialty films market is experiencing significant growth due to escalating strategic initiatives to meet the evolving demands of industries and consumers. Several are focused on research and development efforts to innovate and enhance the performance characteristics of specialty films. This includes improving barrier properties, durability, transparency, and eco-friendliness to cater to various end-use applications. Along with this, companies are investing in sustainable practices by developing specialty films with reduced environmental impact, including recyclable and biodegradable options. They are also collaborating with suppliers and partners to ensure the sourcing of raw materials aligns with sustainability goals. In addition, manufacturers are expanding their product portfolios to offer a diverse range of specialty films tailored to specific industries such as packaging, electronics, automotive, and construction. Customization and personalization of films to cater to unique customer requirements are also common strategies. Furthermore, companies are adopting advanced manufacturing technologies to increase efficiency, reduce production costs, and maintain high-quality standards. They are also expanding their global presence through strategic partnerships, acquisitions, and establishing distribution networks, which is creating a positive market outlook.The report has provided a comprehensive analysis of the competitive landscape in the global specialty films market. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- 3M Company

- Avery Dennison Corporation

- Covestro AG

- DuPont de Nemours Inc.

- Evonik Industries AG

- Honeywell International Inc.

- Inteplast Group Corporation

- Kaneka Corporation

- Mondi plc

- Saudi Basic Industries Corporation (Saudi Arabian Oil Co.)

- Toray Industries Inc.

- Ube Industries Ltd

Key Questions Answered in This Report

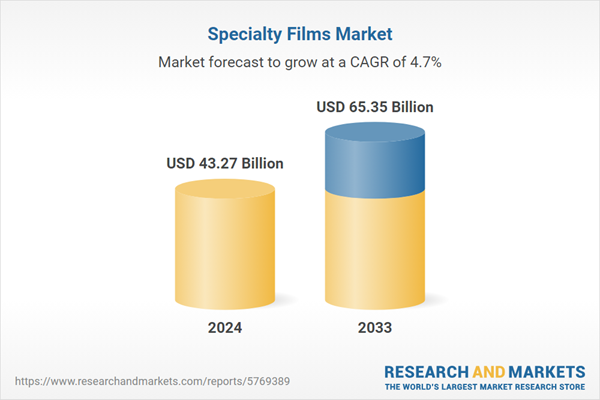

1. How big is the specialty films market?2. What is the future outlook of the specialty films market?

3. What are the key factors driving the specialty films market?

4. Which region accounts for the largest specialty films market share?

5. Which are the leading companies in the global specialty films market?

Table of Contents

Companies Mentioned

- 3M Company

- Avery Dennison Corporation

- Covestro AG

- DuPont de Nemours Inc.

- Evonik Industries AG

- Honeywell International Inc.

- Inteplast Group Corporation

- Kaneka Corporation

- Mondi plc

- Saudi Basic Industries Corporation (Saudi Arabian Oil Co.)

- Toray Industries Inc.

- Ube Industries Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 137 |

| Published | May 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 43.27 Billion |

| Forecasted Market Value ( USD | $ 65.35 Billion |

| Compound Annual Growth Rate | 4.7% |

| Regions Covered | Global |

| No. of Companies Mentioned | 12 |