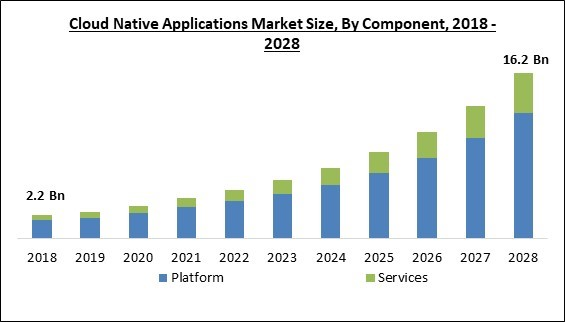

The Global Cloud Native Applications Market size is expected to reach $16.2 billion by 2028, rising at a market growth of 22.9% CAGR during the forecast period.

The term 'cloud-native'describes creating and operating applications that use the distributed computing capabilities offered by the cloud delivery model. Cloud-native apps are created and designed to benefit from the cloud's scalability, dependability, and flexibility. One can easily bring their ideas to market due to built-in cloud-native applications. Users need responsiveness, zero downtime, a cloud-native approach to operating applications, and cutting-edge functionality. This underlines that the cloud is the foundation of the strategic transformation that accelerates the pace of business.

Due to cloud-native technologies, modern businesses may now run and create scalable applications in dynamic, contemporary environments, including hybrid clouds, private clouds, and public clouds. Many large corporations are developing massively scalable cloud-native platforms. Most businesses today integrate cutting-edge innovations like machine learning, artificial intelligence, and big data analytics into their routine operations.

Cloud-native applications are necessary for enterprises to design and run applications across public, private, and hybrid clouds at scale, given the rise in cloud computing demand and the volume of cloud traffic. As a result, companies must alter how they design, develop, and use applications to succeed in quick-moving software-driven marketplaces. Building, executing, and improving apps using well-established methods and technology for cloud computing is known as 'cloud-native application development.'These are applications created for cloud computing architecture.

Due to their interoperability & workload portability, cloud native applications often rely on open source and standards-based technology, which helps reduce vendor lock-in and leads to greater portability. In addition, cloud native applications also offer several advantages, like independent building up of the applications so they are managed & deployed separately, resilient architecture aids survival & remaining online regardless of the event of an infrastructure outage, and cloud native applications owing to interoperability & workload portability.

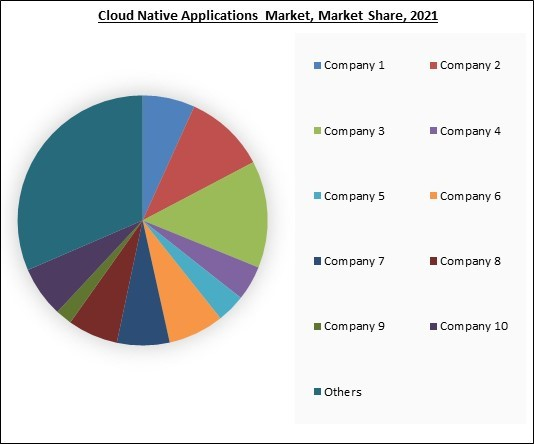

The leading players in the market are competing with diverse innovative offerings to remain competitive in the market. The illustration shows the percentage of revenue shared by some of the leading companies in the market. The leading players of the market are adopting various strategies in order to cater demand coming from the different industries. The key developmental strategies in the market are Acquisitions.

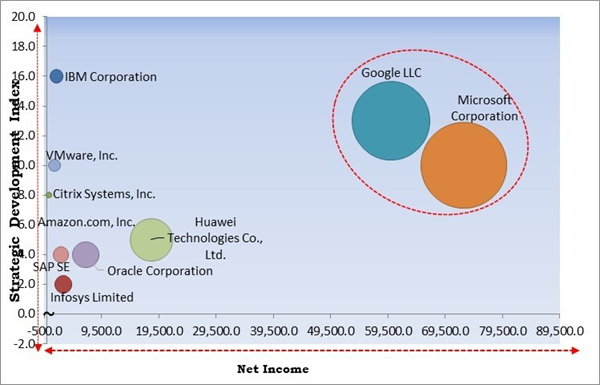

The major strategies followed by the market participants are Partnerships. Based on the Analysis presented in the Cardinal matrix; Microsoft Corporation and Google, LLC is the major forerunner in the Cloud Native Applications Market. Companies such as Adobe, Inc., VMware, Inc., and Infosys Limited are some of the key innovators in Cloud Native Applications Market.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Amazon.com, Inc., Google LLC (Alphabet, Inc.), IBM Corporation, Infosys Limited, VMware, Inc., Microsoft Corporation, Oracle Corporation, SAP SE, Citrix Systems, Inc. (Cloud Software Group, Inc.), and Huawei Technologies Co., Ltd. (Huawei Investment & Holding Co., Ltd.)

The term 'cloud-native'describes creating and operating applications that use the distributed computing capabilities offered by the cloud delivery model. Cloud-native apps are created and designed to benefit from the cloud's scalability, dependability, and flexibility. One can easily bring their ideas to market due to built-in cloud-native applications. Users need responsiveness, zero downtime, a cloud-native approach to operating applications, and cutting-edge functionality. This underlines that the cloud is the foundation of the strategic transformation that accelerates the pace of business.

Due to cloud-native technologies, modern businesses may now run and create scalable applications in dynamic, contemporary environments, including hybrid clouds, private clouds, and public clouds. Many large corporations are developing massively scalable cloud-native platforms. Most businesses today integrate cutting-edge innovations like machine learning, artificial intelligence, and big data analytics into their routine operations.

Cloud-native applications are necessary for enterprises to design and run applications across public, private, and hybrid clouds at scale, given the rise in cloud computing demand and the volume of cloud traffic. As a result, companies must alter how they design, develop, and use applications to succeed in quick-moving software-driven marketplaces. Building, executing, and improving apps using well-established methods and technology for cloud computing is known as 'cloud-native application development.'These are applications created for cloud computing architecture.

Due to their interoperability & workload portability, cloud native applications often rely on open source and standards-based technology, which helps reduce vendor lock-in and leads to greater portability. In addition, cloud native applications also offer several advantages, like independent building up of the applications so they are managed & deployed separately, resilient architecture aids survival & remaining online regardless of the event of an infrastructure outage, and cloud native applications owing to interoperability & workload portability.

COVID-19 Impact Analysis

As a result of the new insights organizations has gained regarding work-from-home (WFH) and data accessibility during the lockdown period, the demand for space &services in data centers has increased. In addition to the policy-level push for automation, the implementation of automation is increasing. Even when things return to 'normal,'the work style will continue to rely heavily on data centers, as demand for e-commerce, digital payments, and big data will continueto rise. These trends positively impacted the market due to the pandemic outbreak.Market Growth Factors

Rising adoption in IT and BFSI sector

Businesses are emulating this trend, notably for telecom apps based on microservices, containers, and state-optimized design. The rising need for cloud-native systems in this business can be attributed, among other things, to the increased rate of software changes and releases. Using the integrated characteristics of the Network Functions Virtualization Infrastructure (NFVI) layer and modifying the software architecture, businesses can also automate cloud data center resources. In addition, cost reductions, rapid implementation, and consumer involvement contribute to this market's revenue expansion.The leading players in the market are competing with diverse innovative offerings to remain competitive in the market. The illustration shows the percentage of revenue shared by some of the leading companies in the market. The leading players of the market are adopting various strategies in order to cater demand coming from the different industries. The key developmental strategies in the market are Acquisitions.

Growing awareness regarding benefits of cloud native applications

Cloud-native applications can leverage the most recent cloud technologies and services, giving customers new functionality and features that traditional apps cannot. If a company's primary data center is collapsed or damaged, cloud-native applications can be swiftly and simply installed in a new location. Cloud-native applications can be deployed on a range of cloud platforms, allowing enterprises to select the platform that matches their needs the most effective. As users become more aware of these benefits offered by cloud native applications, the adoption is rising significantly and thus leading to market expansion.Market Restraining Factors

Budget overruns being an obstacle to market expansion

Cloud-native application development methodologies and architectures are more sophisticated than conventional applications. As a result, cloud-native applications have more moving elements and necessitate a more complex development approach than monolithic programs built with a single codebase. Thus, organizations that adopt cloud-native must install tools and processes that allow them to handle the complexity associated with both the development and deployment of the application and management process, which increases the system's running cost. Thus, the cost overrun may hamper the market growth in the near future.Component Outlook

Based on component, the cloud native applications market is segmented into platforms and services. A cloud-native platform is developed, optimized, and operated only in the cloud. Since the platform is designed in the cloud, cloud-based tools are rapid and flexible. This technology offers dependable performance, seamless interconnectivity, and improved business continuity. Cloud-native applications are entirely developed in the cloud and give developers new and innovative deployment methods to quickly evolve the businesses' overall architecture.Deployment Type Outlook

On the basis of deployment type, the cloud native applications market is divided into public cloud and private cloud. The private cloud segment covered a considerable revenue share in the cloud native applications market in 2021. Private cloud users can choose the hardware &software they want to acquire. Customers who use private clouds can alter servers whatever they choose and can alter software as necessary with add-ons or via custom development. Since all workloads are run behind the clients' own firewall, there is better visibility over access and security management, which is the main factor supporting the segment’s expansion.Organization Size Outlook

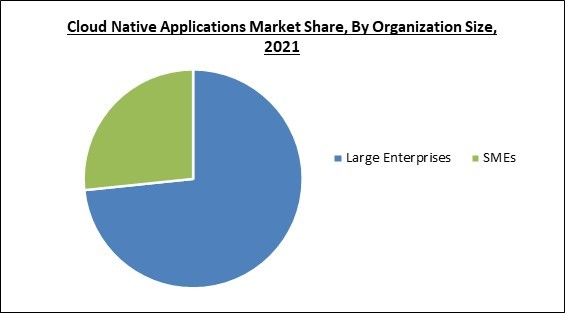

By organization size, the cloud native applications market is classified into small & medium-sized enterprises (SMEs) and large enterprises. In 2021, the large enterprise segment dominated the cloud native applications market with the maximum revenue share. Large organizations were early users of CNA and related professional or managed services. Large enterprises have adopted cloud-based technologies over traditional on-premises offerings in high proportions. Many departments or teams within these organizations are responsible for distinct operations.Vertical Outlook

Based on the vertical, the cloud native applications market is bifurcated into BFSI, IT & telecom, government & public sector, retail & ecommerce, healthcare & life sciences, manufacturing and others. The IT & telecom segment recorded a remarkable revenue share in the cloud native applications market in 2021. The growing use of Fifth Generation (5G) technologies in the telecommunications sector is a major driver driving market revenue growth. Moreover, numerous operators and manufacturers are adopting cloud-native applications due to their multiple benefits.Regional Outlook

Region-wise, the cloud native applications market is analyzed across North America, Europe, Asia Pacific, and LAMEA. In 2021, the North America region led the cloud native applications market by generating maximum revenue share. Along with many other cutting-edge technologies, North America ranks among the regions with the most developed edge and cloud computing infrastructure. The use of cloud technology and rising levels of digitalization have been fairly noticeable throughout the region. With public and private deployment options, IT investment in system infrastructure is dramatically moving away from conventional solutions and into the cloud. Businesses are using cloud services quickly for new initiatives or to replace outdated systems.The Cardinal Matrix - Cloud Native Applications Market Competition Analysis

The major strategies followed by the market participants are Partnerships. Based on the Analysis presented in the Cardinal matrix; Microsoft Corporation and Google, LLC is the major forerunner in the Cloud Native Applications Market. Companies such as Adobe, Inc., VMware, Inc., and Infosys Limited are some of the key innovators in Cloud Native Applications Market.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Amazon.com, Inc., Google LLC (Alphabet, Inc.), IBM Corporation, Infosys Limited, VMware, Inc., Microsoft Corporation, Oracle Corporation, SAP SE, Citrix Systems, Inc. (Cloud Software Group, Inc.), and Huawei Technologies Co., Ltd. (Huawei Investment & Holding Co., Ltd.)

Strategies Deployed in Cloud Native Applications Market

Partnerships, Collaborations and Agreements:

- Feb-2023: Infosys came into partnership with ng-voice, a complete containerized and cloud-native IMS solution provider for the telecom market. Under this partnership, the companies would work together for delivering exceptional managed services and cloud-native software solutions while promoting innovation and providing tailored customer experiences to ng-clients.

- Oct-2022: Microsoft extended its partnership with Databricks, an enterprise software company. The expansion would advance Microsoft's Analytics platform to an Open and Governed Data Lakehouse foundation. With the help of this foundation, customers would be able to combine their most demanding investments in business intelligence, machine learning, and artificial intelligence on a single data analytics foundation, such as an open and controlled data lakehouse. The foundation would also give customers the ability to democratize analytics data products responsibly to speed up the adoption of digital transformation inside their businesses.

- Oct-2022: Oracle partnered with GitHub, a DevOps software package that can develop, protect, and operate software (OCI). The partnership enables users to run GitLab's DevOps platform on Oracle Cloud Infrastructure. OCI and GitLab's DevOps platform work well together and have the following advantages: performance, platform breadth, security, value, hybrid and multi-cloud environments, and GovCloud regions.

- Jul-2022: Oracle came into a partnership with Claro, a Mexican company. This partnership aimed to jointly provide Oracle Cloud Infrastructure (OCI) services to public and private sector organizations and enterprises in Colombia. Under this partnership, Claro would become the host partner for an Oracle Cloud region in Colombia, which would allow Claro to provide OCI platform services with professional and managed services to assist users to adopt cloud solutions.

- Jul-2022: Huawei Technologies together with Sunline, introduced the joint cloud-native digital loan solution. Developed on Huawei Cloud, this solution uses the Sunline 2020 EDSP enterprise-level microservices banking framework to create a revolutionary experience, capabilities, speed, architecture, and basis.

- May-2022: Amazon Web Services, a subsidiary of Amazon.com, Inc. announced a collaboration with IBM, for providing a wide range of its software catalog as Software-as-a-Service (SaaS) on AWS. The collaboration would deliver fast and easy access to IBM software that has data and AI, automation, and security & sustainability capabilities, built on Red Hat OpenShift Service on AWS (ROSA), and runs cloud-native on AWS, to clients.

- May-2022: Google Cloud, a division of Google, Inc. came into partnership with SAP SE for combining ERP, SAP S/4 HANA Cloud, and Google Workspace. These integrations would help SAP S/4HANA users working with large data sets to make use of Google Workspace's real-time collaboration features, allowing teams to access SAP data simultaneously and move projects along more effectively.

- Mar-2022: VMware extended its partnership with Google Cloud for helping customers in accelerating cloud transformation and app modernization. Clients can benefit from Google Cloud VMware Engine by using the VMware Cloud Universal programme. Enterprise clients would benefit from increased financial flexibility, more options, and the opportunity to upgrade their enterprise applications in Google Cloud and speed up their cloud migrations.

Product Launches and Product Expansions:

- Jul-2022: Huawei Cloud introduced Cloud Native Core Banking Solution for offering a permanent cloud-native platform for offloading mainframes, powering digital banks, and building new core systems for traditional banks. High availability, massive concurrency, and agile application iteration are all features of the system. A disaster recovery (DR) with RPO = 0 and RTO 2 minutes serves as an example of its high availability. The GaussDB satisfies financial regulatory criteria with an intra-city AZ RTO of less than 10s.

- Dec-2021: IBM launched the IBM Z and Cloud Modernization Center, a digital front door for a wide range of resources, training, tools, and ecosystem partners for enabling IBM Z clients in accelerating the modernization of their data, applications, and processes in an open hybrid cloud architecture. With the help of this center, clients can better understand how to retain their present IT infrastructure while concentrating on the design and implementation of a hybrid cloud readiness plan for their core IBM Z-based apps and data.

- Mar-2021: IBM unveiled IBM Cloud Satellit that would help enterprise clients in launching consistent cloud services anywhere, in any environment, across any cloud. With the help of IBM Cloud Satellite, customers would have easier access to the company's cloud services and minimal latency, while still enjoying the same levels of security, data privacy, interoperability, and open standards seen in hybrid cloud environments. This provides industries with access to a secure and consistent set of cloud services.

Acquisition and Mergers:

- Feb-2022: IBM completed the acquisition of Neudesic, a cloud services consultancy. The acquisition expanded IBM's hybrid multi-cloud services suite and further strengthen its AI and hybrid cloud strategy.

- Jul-2021: Microsoft announced the acquisition of CloudKnox Security, a provider of complete visibility into privileged access. The acquisition helped Microsoft Azure Active Directory clients with continuous monitoring, granular visibility, and automated remediation of multi and hybrid cloud permissions.

- Jan-2021: Citrix Systems announced an agreement to acquire Wrike, a provider of workgroup collaboration software-as-a-service (SaaS). Following the acquisition, Citrix will offer the most complete cloud-based work platform in the market, enabling all teams and employees to collaborate and complete all work types most effectively and efficiently as possible irrespective of work channel, device, or location.

- Dec-2020: Google took over Actifio, an information technology company for facilitating businesses in data recovery and protection. The acquisition showcases Google Cloud's dedication to assisting businesses in safeguarding workloads both locally and remotely. Actifio's business continuity solutions would assist Google Cloud clients in preventing data loss and downtime due to external attacks, network failures, human errors, and other disturbances as enterprises throughout industries improve their disaster preparedness strategy and infrastructure resiliency.

- Dec-2020: IBM signed an agreement to acquire Nordcloud, a company focused on application transformation, cloud implementation, and managed services. The acquisition would add in-depth expertise and will drive the client's digital transformations, as well as assist the adoption of IBM's hybrid cloud platform.

Scope of the Study

By Component

- Platform

- Services

By Deployment Mode

- Public Cloud

- Private Cloud

By Organization Size

- Large Enterprises

- SMEs

By Vertical

- BFSI

- IT & Telecom

- Government & Public Sector

- Manufacturing

- Healthcare & Lifesciences

- Retail & eCommerce

- Others

By Geography

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Key Market Players

List of Companies Profiled in the Report:

- Amazon.com, Inc.

- Google LLC (Alphabet, Inc.)

- IBM Corporation

- Infosys Limited

- VMware, Inc.

- Microsoft Corporation

- Oracle Corporation

- SAP SE

- Citrix Systems, Inc. (Cloud Software Group, Inc.)

- Huawei Technologies Co., Ltd. (Huawei Investment & Holding Co., Ltd.)

Unique Offerings

- Exhaustive coverage

- The highest number of Market tables and figures

- Subscription-based model available

- Guaranteed best price

- Assured post sales research support with 10% customization free

Table of Contents

Chapter 1. Market Scope & Methodology

Chapter 2. Market Overview

Chapter 3. Competition Analysis - Global

Chapter 4. Global Cloud Native Applications Market by Component

Chapter 5. Global Cloud Native Applications Market by Deployment Mode

Chapter 6. Global Cloud Native Applications Market by Organization Size

Chapter 7. Global Cloud Native Applications Market by Vertical

Chapter 8. Global Cloud Native Applications Market by Region

Chapter 9. Company Profiles

Companies Mentioned

- Amazon.com, Inc.

- Google LLC (Alphabet, Inc.)

- IBM Corporation

- Infosys Limited

- VMware, Inc.

- Microsoft Corporation

- Oracle Corporation

- SAP SE

- Citrix Systems, Inc. (Cloud Software Group, Inc.)

- Huawei Technologies Co., Ltd. (Huawei Investment & Holding Co., Ltd.)