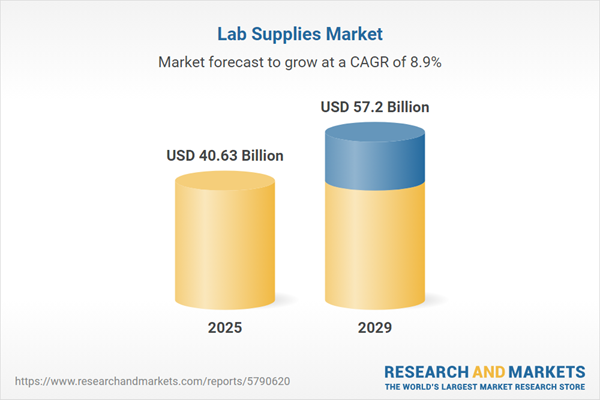

The lab supplies market size is expected to see strong growth in the next few years. It will grow to $57.2 billion in 2029 at a compound annual growth rate (CAGR) of 8.9%. The growth in the forecast period can be attributed to rise in life sciences research, increased focus on environmental testing, expanding role of point-of-care testing, global response to health emergencies, advancements in genomic medicine. Major trends in the forecast period include focus on biodegradable materials, stringent quality and safety standards, collaboration with research institutions, global supply chain optimization, emphasis on single-use technologies.

The increase in the number of testing laboratories globally is expected to drive the growth of the lab supplies market in the future. A testing laboratory is a facility where diagnostic tests or research activities are conducted. These laboratories utilize lab supplies to perform reactions and contain chemicals. The rising number of testing laboratories leads to greater demand for lab supplies, thus fueling the lab supplies market. For instance, in April 2023, the International Laboratory Accreditation Cooperation (ILAC), an Australia-based international organization for accreditation bodies, reported that from September 2022 to April 2023, ILAC Full Members accredited between 85,000 and 88,000 laboratories, 13,000 to 13,900 inspection bodies, 600 to 604 proficiency testing providers (PTP), and 250 to 260 reference material producers (RMP) across 154 organizations in 129 economies worldwide. Consequently, the rise in testing laboratories worldwide is driving the growth of the lab supplies market.

Increasing healthcare expenditure is anticipated to propel the growth of the lab supplies market in the coming years. Healthcare expenditure refers to the total spending on healthcare and related activities, including private and public health insurance, health research, and public health initiatives. The lab supplies market supports healthcare objectives by supplying essential tools for medical research, diagnostics, treatment, and quality assurance. For example, in September 2024, statistics published by Cross River Therapy, a US-based provider of ABA therapy services, indicated that the U.S. pharmaceutical industry generated $550 billion in revenue, with Americans spending $576.9 billion on medicine in 2021. Projected spending is expected to rise to between $605 billion and $635 billion by 2025. Therefore, increasing healthcare expenditure is driving the growth of the lab supplies market.

The lab supplies market is witnessing a significant trend towards product innovations. Leading companies in the market are introducing novel and advanced products to maintain their competitive positions. For example, in October 2022, Q2 Solutions, a clinical trial laboratory services organization based in the US, introduced the first self-collection safety lab panel for participants in US clinical trials. This innovative product leverages self-collection technology, allowing clinical trial participants to provide blood specimens conveniently from their homes. The clinical-grade remote sampling system ensures decentralized laboratory testing without compromising sample quality. The solution includes user-friendly at-home self-collection kits with instructions and videos, a direct-to-patient delivery method, and streamlined specimen processing and shipping requirements.

Major players in the market are introducing novel and advanced technologies to maintain their market standing. The infusion of innovative technologies in the lab supplies market contributes to heightened efficiency, precision, and capabilities, propelling advancements in research, diagnostics, and experimentation. For example, in June 2023, Eaton Corporation, a multinational power management company based in Ireland, inaugurated its inaugural Supply Chain Digital Incubation Lab in Pune, India. This lab is a pivotal component of Eaton's initiatives toward digital transformation and innovation, with the objective of nurturing supply chain innovation. Serving as both a physical and virtual laboratory, it becomes a space where concepts and technologies related to supply chain management undergo measurement, evaluation, and testing, with the potential for subsequent commercialization. This venture underscores Eaton's dedication to integrating digitalization and Industry 4 technologies into its operations, ultimately enhancing internal productivity and elevating the overall customer experience.

In January 2023, Calibre Scientific Inc., a developer, manufacturer, and distributor of consumable products in the life sciences and diagnostics markets based in the United States, completed the acquisition of Dynalab Corp. for an undisclosed sum. Through this acquisition, Calibre Scientific enhances its existing product portfolio in the laboratory supplies market and extends its global distribution network by incorporating a substantial market. Dynalab Corp., situated in the United States, is engaged in the distribution and manufacturing of laboratory plastics, consumables, equipment, supplies, and customized fabricated products for application across scientific, industrial, agricultural, water, pharmaceutical, and educational sectors.

Major companies operating in the lab supplies market include Thermo Fisher Scientific Inc., Abbott Laboratories, Danaher Corporation, Siemens Healthineers, Fujifilm Holdings Corporation, Becton Dickinson and Company, GE Healthcare, Corning Inc., Agilent Technologies Inc., Avantor, MilliporeSigma, PerkinElmer Inc., VWR International, Sartorius AG, Mettler Toledo, Shimadzu Corporation, Waters Corporation, Bio-Rad Laboratories Inc., Bruker Corporation, Qiagen N.V., Eppendorf AG, Pace Analytical Services LLC, LabWare Inc., Labworks LLC, Cole-Parmer, Spectrum Chemical Manufacturing Corp, LabVantage Solutions Inc., Autoscribe Informatics, Lab Pro Inc., BrandTech Scientific Inc.

North America was the largest region in the lab supplies market in 2024. The regions covered in the lab supplies market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the lab supplies market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

Laboratory supplies encompass equipment and instruments employed in scientific research or practical science education. These tools serve the purposes of containing chemicals, facilitating reactions, and measuring the outcomes in laboratory settings.

Lab supplies primarily comprise equipment and disposables. Disposables, which encompass items such as syringes, tubing, catheters, bags, and gloves, are single-use instruments that are discarded after use. These are applied in diverse fields such as biochemistry, endocrinology, microbiology, genetic testing, among others, by various end-users, including academic institutes, clinical and diagnostic laboratories, pharmaceutical and biotechnology companies, and more.

The lab supplies market research report is one of a series of new reports that provides lab supplies market statistics, including lab supplies industry global market size, regional shares, competitors with a lab supplies market share, detailed lab supplies market segments, market trends and opportunities, and any further data you may need to thrive in the lab supplies industry. This lab supplies market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

The lab supplies market consists of sales of lab instruments and analytical machinery. Values in this market are ‘factory gate’ values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Lab Supplies Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on lab supplies market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for lab supplies? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The lab supplies market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Product: Equipment; Disposables2) By Application: Biochemistry; Endocrinology; Microbiology; Genetic Testing; Other Applications

3) By End Users: Academic Institutes; Clinical and Diagnostic Laboratories; Pharmaceutical and Biotechnology Companies; Other End Users

Subsegments:

1) By Equipment: Laboratory Instruments; Analytical Equipment; Safety Equipment; Storage Equipment2) By Disposables: Glassware; Plasticware; Consumables; Biohazard Bags and Containers

Key Companies Mentioned: Thermo Fisher Scientific Inc.; Abbott Laboratories; Danaher Corporation; Siemens Healthineers; Fujifilm Holdings Corporation

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

- Thermo Fisher Scientific Inc.

- Abbott Laboratories

- Danaher Corporation

- Siemens Healthineers

- Fujifilm Holdings Corporation

- Becton Dickinson and Company

- GE Healthcare

- Corning Inc.

- Agilent Technologies Inc.

- Avantor

- MilliporeSigma

- PerkinElmer Inc.

- VWR International

- Sartorius AG

- Mettler Toledo

- Shimadzu Corporation

- Waters Corporation

- Bio-Rad Laboratories Inc.

- Bruker Corporation

- Qiagen N.V.

- Eppendorf AG

- Pace Analytical Services LLC

- LabWare Inc.

- Labworks LLC

- Cole-Parmer

- Spectrum Chemical Manufacturing Corp

- LabVantage Solutions Inc.

- Autoscribe Informatics

- Lab Pro Inc.

- BrandTech Scientific Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 175 |

| Published | March 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 40.63 Billion |

| Forecasted Market Value ( USD | $ 57.2 Billion |

| Compound Annual Growth Rate | 8.9% |

| Regions Covered | Global |

| No. of Companies Mentioned | 30 |