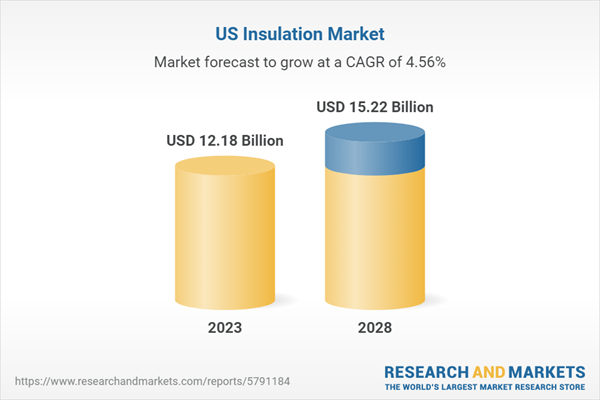

The US insulation market in 2022 stood at US$11.64 billion, and is likely to reach US$15.22 billion by 2028. Insulation is a vital material used to reduce the transfer of heat, sound, or electricity in various applications. Insulation provides benefits, which include lower energy costs, decreased greenhouse gas emissions, improved indoor comfort, reduced noise pollution, and increased safety.

The focus on energy conservation and sustainability in recent years has boosted demand for insulation materials in the US market. Building codes and regulations mandating higher levels of insulation in new construction projects have further contributed to the growth of the insulation market. The use of insulation in the residential, commercial, and industrial sectors is essential for creating more sustainable, cost-effective solutions while enhancing comfort and promoting safety. The US insulation market is projected to grow at a CAGR of 4.56% during the forecast period of 2023-2028.

Market Segmentation Analysis:

- By Material Type: The market report has segmented the US insulation market into four segments namely, foam, glass-wool, stone-wool, and others. In 2022, the foam segment dominates the market share as the foam insulation is propelled by heightened cognizance of energy-conservation measures. This substance offers superior insulating traits, contributing to elevated energy preservation and augmented living conditions. Consequently, the foam insulation sector thrives, dominating other insulation materials in the market, as individuals and businesses increasingly recognize its benefits in promoting eco-friendly, cost-effective, and comfortable living spaces.

- By End Market: Based on the end market, the US insulation market can be segmented into three segments: residential, commercial, and industrial. The residential insulation sector commands the largest market share in 2022 and is projected to be the fastest expanding segment, owing to heightened energy efficiency awareness. Improved insulation attributes yield greater energy conservation and enhanced comfort, bolstering US residential insulation demand. Factors such as increased consciousness of climate change, government initiatives like ENERGY STAR, and accessible insulation materials and technologies fuel this growth. The aging housing stock further drives market expansion from 2023-2028, as homeowners invest in retrofitting, boosting efficiency and reducing costs and emissions.

- By Building Type: The US insulation market can be divided into three segments based on building type: Renovation, and New Build. The Renovation segment of the US insulation market is expected to be the fastest-growing due to heightened energy efficiency awareness, and aging property stock. Renovation insulation, entailing insulation upgrades during refurbishment, bolsters energy efficiency, thermal comfort, and acoustic performance. Consequently, energy consumption and expenses decline. This thriving sector reflects a rising trend in retrofitting and modernizing older buildings to improve their overall performance, comfort, and cost-effectiveness in response to market demands and sustainability concerns.

The US Insulation Market Dynamics:

- Growth Drivers: The increase in construction activities in the US has driven the insulation market, as more buildings require energy-efficient insulation materials. This growth can be attributed to population growth, urbanization, economic development, and infrastructure expansion. The demand for insulation in residential, commercial, and industrial buildings has risen to meet energy regulations and sustainability goals. The growth in construction spending has directly impacted the demand for insulation materials in the US. Further, the market is expected to grow owing to rapid urbanization, rapid change in climate, surge in renovation activities of old buildings, growing awareness of energy conservation, etc. in recent years.

- Challenges: Raw material price volatility poses a significant challenge for the US insulation market, as fluctuations in raw material prices can lead to higher production costs and affect profitability for insulation manufacturers. Managing this volatility is crucial for maintaining stable production costs and sustaining growth in the industry. Additionally, other factors like regulatory and environmental concerns, etc. are other challenges to the market.

- Market Trends: The growing inclination towards the adoption of smart and energy-efficient building concepts in the US is a trend that is expected to drive growth in the insulation market. This trend reflects the increasing awareness of the importance of sustainability, energy conservation, and occupant comfort in the built environment. The pursuit of green building certifications, such as LEED and ENERGY STAR, emphasizes the use of cutting-edge insulation materials to achieve rigorous energy efficiency standards. This trend stimulates innovation in insulation products and presents opportunities for insulation manufacturers to address the changing requirements of smart and energy-efficient building projects. More trends in the market are believed to grow the insulation market during the forecasted period, which may include increasing penetration of artificial intelligence and machine learning, emerging industrial robotics, adoption of renewable energy, rising demand for temperature-sensitive products, advancement in transportation sector, etc.

Impact Analysis of COVID-19 and Way Forward:

The COVID-19 pandemic has had a negative impact on the US insulation market, resulting project delays, labor shortages, and supply chain disruptions, with a shift towards home renovation projects and a preference for more cost-effective insulation options, prompting insulation businesses to adjust their products and sales methods. The post-COVID impact on the US insulation market is expected to result in a shift towards sustainable and energy-efficient materials, increased demand in the residential sector, continued adoption of digital technologies, and potential supply chain challenges.

Competitive Landscape and Recent Developments:

The US insulation market is competitive with a mix of global and local players. The market is moderately fragmented, allowing room for small to medium-sized businesses to succeed. Companies compete on product quality, performance, price, innovation, and customer service. Compliance with regional building codes and energy-efficiency criteria is critical, and investment in R&D is crucial for developing new insulation materials. Companies use various distribution methods, including direct sales, distributors, retailers, and e-commerce platforms, to gain a competitive advantage. The industry has seen several mergers and acquisitions (M&A) in recent years, as companies strive to expand their market presence and diversify their product portfolios.

Further, key players in the US insulation market are:

- Owens Corning

- Compagnie de Saint-Gobain S.A.

- Rockwool International A/S

- Huntsman Corporation

- Dow Inc.

- BASF SE

- Kingspan Group PLC

- Armacell International S.A.

- Covestro AG

- Berkshire Hathaway (Johns Manville)

- Carlisle Companies Incorporated

- Knauf Group (Knauf Insulation)

- GAF Materials Corporation

- Hood Companies, Inc.(Atlas Roofing Corporation)

The US insulation market, distinguished by a combination of international and domestic participants, presents a moderately fragmented environment ripe with opportunities for small to medium-sized businesses. Companies vie for dominance based on quality, performance, price, innovation, and customer service, all while complying with regional building codes and energy-efficiency requirements. Key strategies for success include investing in research and development and leveraging a variety of distribution channels, such as direct sales and e-commerce platforms. In recent times, the industry has seen a surge in mergers and acquisitions, as businesses aim to broaden their market presence and diversify their product offerings. These strategic moves not only foster growth but also strengthen competitive positioning within the sector. For instance, on August 1, 2022, Holcim announced its acquisition of SES Foam, a US-based spray foam producer projected to generate sales revenues of US$200 million in 2022. This acquisition bolsters Holcim's portfolio of sustainable building solutions and enhances the company's focus on energy efficiency. SES Foam is well-regarded for its value-added services provided to contractors, encompassing technical instruction and business consulting. Such moves exemplify the ongoing evolution and competitiveness of the US insulation market, driving progress and innovation in the industry.

Table of Contents

1. Executive Summary

Companies Mentioned

- Owens Corning

- Compagnie de Saint-Gobain S.A.

- Rockwool International A/S

- Huntsman Corporation

- Dow Inc.

- BASF SE

- Kingspan Group PLC

- Armacell International S.A.

- Covestro AG

- Berkshire Hathaway (Johns Manville)

- Carlisle Companies Incorporated

- Knauf Group (Knauf Insulation)

- GAF Materials Corporation

- Hood Companies, Inc.(Atlas Roofing Corporation)

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 110 |

| Published | May 2023 |

| Forecast Period | 2023 - 2028 |

| Estimated Market Value ( USD | $ 12.18 Billion |

| Forecasted Market Value ( USD | $ 15.22 Billion |

| Compound Annual Growth Rate | 4.6% |

| Regions Covered | United States |

| No. of Companies Mentioned | 14 |