The growing use of portable, desktop, and network-attached storage hard disk drives to store operating systems, software programs, and other items on magnetic disks is expected to fuel the global hard disk drive market expansion.

Moreover, the development of smart, connected technologies is boosting the demand for storage drives to store different data types. Therefore, the recent change in technical trends in the customer electronics industry is expected to aid in the global hard disk drive (HDD) market growth.

Further, to strengthen their manufacturing base and lessen their dependency on imports, several nations are launching programs that should propel market expansion further. For instance, to encourage domestic electronics manufacturing, India suddenly banned the import of personal computers, includinglaptopsand tablets, in August 2023. Additionally, several Indian businesses are looking to produce their laptops. Reliance Jio, for example, recently announced the release of a new laptop model. Similarly, New Delhi-based startup Primebook is making a laptop specifically for Indian students.

Global hard disk drive market drivers

High demand in cloud data centers

Climate The demand for data storage devices is anticipated to rise shortly due to the nearly triple increase in Internet protocol traffic in public cloud data centers. As a result, the hard disk drive market is anticipated to experience significant growth in the upcoming years. This market is expanding due to the growing adoption of cloud storage and other enterprise applications. Furthermore, one of the reasons for the growth in HDD shipments and sales is the stability of the laptop market.Companies embracedcloud computingsolutions quickly in response to the sudden shift to remote work and the need for reliable and scalable infrastructure. Hybrid cloud became popular as businesses tried to combine the benefits of public cloud services with the administration and security of on-premises or private facilities.Global hard disk drive market geographical outlook

The growing use of network-attached hard drives and portable devices for operating systems, applications, and other data storage on hard disks will affect the market. These are mostly found in a wide range of consumer and electronic goods. They comprise a reprogrammable rotating magnetic disk with a magnetic writing head and are mainly used for storing and retrieving digital information, including computer data.Data centres are a company component. They store, manage, back up, and recover data in productivity applications such as e-commerce transactions and business applications. The market will benefit from the United States' growing data centre population.

For example, Cloudscene reports that as of 2023, the United States held the largest share of data center locations worldwide, with 5,375 data centers. Germany and the United Kingdom both had 522 and 517 data center locations, respectively.

Reasons for buying this report:

- Insightful Analysis: Gain detailed market insights covering major as well as emerging geographical regions, focusing on customer segments, government policies and socio-economic factors, consumer preferences, industry verticals, other sub-segments.

- Competitive Landscape: Understand the strategic maneuvers employed by key players globally to understand possible market penetration with the correct strategy.

- Market Drivers & Future Trends: Explore the dynamic factors and pivotal market trends and how they will shape up future market developments.

- Actionable Recommendations: Utilize the insights to exercise strategic decision to uncover new business streams and revenues in a dynamic environment.

- Caters to a Wide Audience: Beneficial and cost-effective for startups, research institutions, consultants, SMEs, and large enterprises.

What do businesses use our reports for?

Industry and Market Insights, Opportunity Assessment, Product Demand Forecasting, Market Entry Strategy, Geographical Expansion, Capital Investment Decisions, Regulatory Framework & Implications, New Product Development, Competitive IntelligenceReport Coverage:

- Historical data & forecasts from 2022 to 2030

- Growth Opportunities, Challenges, Supply Chain Outlook, Regulatory Framework, Customer Behaviour, and Trend Analysis

- Competitive Positioning, Strategies, and Market Share Analysis

- Revenue Growth and Forecast Assessment of segments and regions including countries

- Company Profiling (Strategies, Products, Financial Information, and Key Developments among others)

The global hard disk drive market is analyzed into the following segments:

By Type

- Internal HDD

- External HDD

By End-User

- Enterprises

- Nearline Storage

- Consumer Use

By Storage

- Below 1TB

- 1TB and above

By Geography

- North America

- South America

- Europe

- Middle East and Africa

- Asia-Pacific

Table of Contents

Companies Mentioned

- Seagate Technology Holdings PLC

- Western Digital Corporation

- Toshiba Memory Corporation

- Hewlett Packard Enterprise Development LP

- Sony Corporation

- Transcend Information Inc.

- Schneider Electric

- Lenovo

- ADATA Technology Co., Ltd.

- Buffalo Americas Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 140 |

| Published | December 2024 |

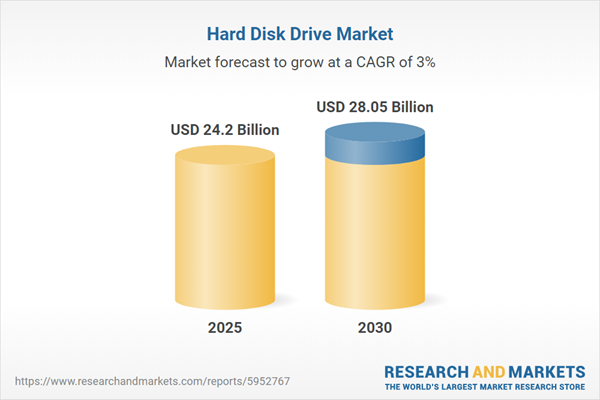

| Forecast Period | 2025 - 2030 |

| Estimated Market Value ( USD | $ 24.2 Billion |

| Forecasted Market Value ( USD | $ 28.05 Billion |

| Compound Annual Growth Rate | 3.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |