Plasma Fractionation: Introduction

Plasma fractionation is a process by which various proteins and other components are separated from human blood plasma for the production of therapeutic products. These products, derived from plasma proteins, play a crucial role in treating a wide range of life-threatening diseases and conditions, including immune deficiencies, haemophilia, and other bleeding disorders. Plasma-derived therapies are also utilized for critical care applications, such as emergency treatments for trauma, burns, and shock, as well as in surgical procedures.Plasma Fractionation Market Scenario

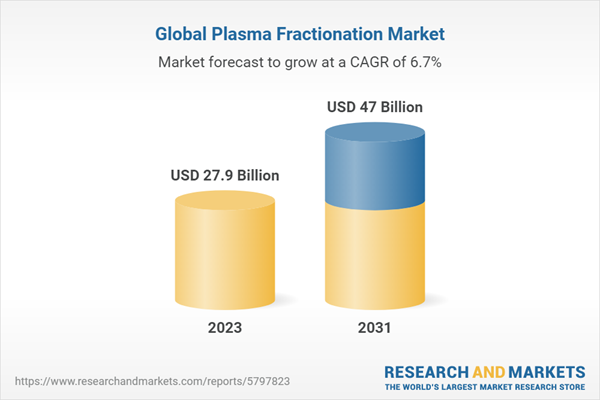

The global plasma fractionation market has experienced significant growth in recent years, fuelled by factors such as the increasing prevalence of chronic diseases, an aging population, and a growing demand for plasma-derived therapies. The market has also been driven by technological advancements in plasma fractionation techniques, which have improved the efficiency, safety, and scalability of the process. Additionally, a supportive regulatory environment and increasing investments in research and development have further contributed to the market's expansion.The adoption of plasma-derived therapies has been increasing steadily due to factors such as the rising prevalence of chronic diseases, an aging population, and a growing demand for these therapies. Technological advancements in plasma fractionation techniques, which have improved the efficiency, safety, and scalability of the process, have further contributed to the market's expansion.

North America: The largest market for plasma fractionation, driven by factors such as the high prevalence of chronic diseases, advanced healthcare infrastructure, and a strong focus on the development and adoption of plasma-derived therapies.

Europe: The second-largest market, with increasing demand for plasma fractionation due to a growing awareness of the importance of these therapies and supportive regulatory frameworks.

Asia-Pacific: Expected to witness the highest growth rate due to factors such as a rapidly aging population, increasing prevalence of chronic diseases, and growing investments in healthcare infrastructure.

Plasma Fractionation Market Segmentations

Market Breakup by Product

- Immunoglobulins

- Coagulation Factor Concentrates

- Albumin

- Protease Inhibitor

- Others

Market Breakup by Method

- Centrifugation

- Depth Filtration

- Chromatography

- Others

Market Breakup by Application

- Neurology

- Hematology

- Oncology

- Immunology

- Pulmonology

- Others

Market by End User

- Hospitals and Clinics

- Clinical Research Laboratories

- Academic Institutes

- Others

Market Breakup by Region

North America

- United States of America

- Canada

Europe

- United Kingdom

- Germany

- France

- Italy

- Others

Asia Pacific

- China

- Japan

- India

- ASEAN

- Australia

- Others

Latin America

- Brazil

- Argentina

- Mexico

- Others

Middle East and Africa

- Saudi Arabia

- United Arab Emirates

- Nigeria

- South Africa

- Others

Key Trends in the Plasma Fractionation Market

Some key trends of the market are as follows:- Growing demand for immunoglobulins: Immunoglobulins represent the largest segment of the plasma fractionation market, driven by their widespread use in the treatment of immune deficiencies and other diseases

- Technological advancements: The development of novel plasma fractionation techniques, such as chromatography and filtration, has improved the efficiency and safety of the process, supporting market growth

- Expanding indications for plasma-derived therapies: The ongoing research and development efforts are leading to new indications for plasma-derived therapies, further fueling market growth

Plasma Fractionation Market: Competitor Landscape

The key features of the market report include patent analysis, grants analysis, clinical trials analysis, funding and investment analysis, partnerships, and collaborations analysis by the leading key players. The major companies in the market are as follows:- CSL Plasma LLC

- Grifols, S.A

- Takeda Pharmaceutical Company Limited

- Biotest Group

- Baxter International Inc

- OCTAPHARMA AG

- KEDRION S.P.A

- LFB S.A

- BIOTEST AG

- SANQUIN

- BIO PRODUCTS LABORATORY LTD

- INTAS PHARMACEUTICALS LTD

- GC Pharma

- Emergent Biosolutions

- Japan Blood Products Organisation

Table of Contents

Companies Mentioned

- Csl Plasma LLC

- Grifols, S.A.

- Takeda Pharmaceutical Company Limited

- Biotest Group

- Baxter International Inc.

- Octapharma AG

- Kedrion S.P.A

- Lfb S.A.

- Biotest AG

- Sanquin

- Bio Products Laboratory Ltd.

- Intas Pharmaceuticals Ltd.

- Gc Pharma

- Emergent Biosolutions

- Japan Blood Products Organisation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 147 |

| Published | May 2023 |

| Forecast Period | 2023 - 2031 |

| Estimated Market Value ( USD | $ 27.9 Billion |

| Forecasted Market Value ( USD | $ 47 Billion |

| Compound Annual Growth Rate | 6.7% |

| Regions Covered | Global |

| No. of Companies Mentioned | 15 |