This report comes with 10% free customization, enabling you to add data that meets your specific business needs.

1h Free Analyst TimeSpeak directly to the analyst to clarify any post sales queries you may have.

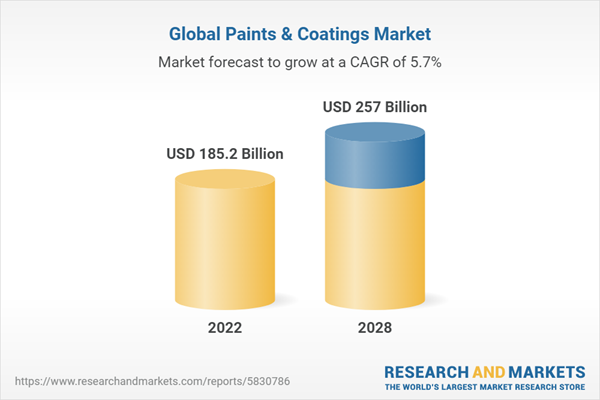

According to the research report, Global Paints & Coatings Market Outlook, 2028 the market is anticipated to cross USD 257 Billion by 2028, increasing from USD 185.20 Billion in 2022. The market is expected to grow with 5.73% CAGR by 2023-28. With green technologies firming up across industries and regulations compelling manufacturing companies to strictly comply with concerned guidelines, the dynamics of paints and coatings market will continue to experience a change. Hundreds of smaller companies not operating their businesses in line with the government regulations retreated from the market in the last few years. Production-demand equations have been balanced in paints and coatings market has been a good balance of production and demand across the regions, with only minor quantities of high-value products being traded. The paints and coatings industry typically grows in tandem with economy of the country. In this light, paints and coatings market is poised for a sustained growth outlook is expected in developing economies over the coming years. Paints and coatings are widely used in the construction, automotive & transportation, and wood industries. Also, the product is used in various applications in decorating residential and non-residential infrastructures & buildings, industrial equipment, automobile & marine, industrial wood, and others. There is an increasing trend of high-tech coatings that include cationic electro-coating materials, covering all the corners and crevices of multifaceted metal parts, thereby protecting them from corrosion. High-performance ceramic increases the lifespan of aircraft turbine engines as well as automotive.

The global paints & coatings market is segmented into five major regions including North America, Europe, Asia-Pacific, South America and Middle East & Africa. Among them, Asia-Pacific is dominating the market with more than 45% market share in 2022. The region encompasses a diverse range of economies with different levels of economic development and multiple industries. The development of the market is mainly attributed to the high economic growth rate followed by heavy investment across industries. Key players are expanding their paints and coatings production in Asia Pacific, especially in China and India. The advantages of shifting production to the region are the low cost of production and the ability to better cater to the emerging local markets. On the other hand, North America and Europe are other notable markets for paints & coatings. The market for paints & coatings in these regions is mature. It is estimated to grow at a sluggish pace during the forecast period, due to the enactment of stringent regulations on VOC emissions in these regions. Furthermore, the South America and Middle East & Africa together accounted for a relatively minor share of 11.30% in the global market in 2022. However, the market in these regions is projected to grow at a rapid pace during the forecast period.

From the past decade, innovative formulation technologies have significantly facilitated to cater to numerous new and diverse consumer demands. Anticorrosive protection, low-VOC content coats, and nano-coatings are few of the recent innovations available in the present market. The introduction of nanotechnology has played a significant role in the industry. Apart from developing zero or low-VOC content formulations, industry players have used this technology to develop nano paints & coatings. This includes the introduction of ceramic or metals in various types of formulations. The integrations carried out can be in the form of granules, free powder, or particles, which are then inserted in the finished product matrix. Some of the recent innovations that nanotechnology has enabled the formulators to develop include products that can conduct electricity or exhibit UV protective or self-healing properties. Apart from these, they are also highly resistant to scratch, mar wear, and corrosion. Hence, these advancements in technology and the introduction of new products are expected to augment future growth across the industry over the forecast period. However, strict governmental and environmental regulations, such as the Clean Air Act, the Occupational Safety and Health Administration (OSHA), and EU legislation, are restraining the market growth of the solvent-based product. However, these regulations are propelling the adoption of water- and powder-based paints and coatings, which is expected to positively impact market growth. Companies, such as Jotun, Arkema S.A., Axalta Coating Systems, and RPM International, Inc., are now focusing on developing eco-friendly coatings, such as water- and powder-based, to reduce their ecological footprints, which is further expected to boost the market growth in the coming years.

Based on the product type, waterborne coatings hold the largest market share due to increased usage in automobiles, furniture, plastic, wood, and printing inks industries. Waterborne coatings have benefits such as no VOC emissions, quick-dry, and easier application, which are the driving factors for this segment’s growth. On the other end, solvent-borne coatings are made of organic compounds used for humid and harsh environments, such as industrial metals and equipment and exterior coatings of buildings. Additionally, powder coatings are an emerging trend as they do not have a liquid carrier and produce thicker coatings without sagging, no solvent content, and release a very less amount of volatile organic compounds (VOC) into the atmosphere. They are used for various applications, including coatings of complex parts of automobiles, engines, and industrial machinery. Powder coat finishes resist corrosion, scratches, chemicals, detergents, and abrasion. A powder coating is a dry finishing process in which the finely grounded particles of pigments and resins are electrostatically charged and sprayed on to electrically grounded parts. The powder-based industrial coatings offer low VOC emission, providing superior performance and cost efficiency for applications that require maximum abrasion resistance and hardness. Powder coatings contain 100% of solid components (binders, pigments, and additives) in the form of finely atomized powder. They do not contain solvents. There are two types of powder coatings, thermoplastic and thermosetting. They can be used in a variety of commercial and industrial applications such as in mailboxes, bathroom fixtures, ornamental fencing, vacuum cleaners, aluminum extrusions microwave ovens, garbage disposals, kitchen appliances, fans, dishwashers, desk accessories, wheelchairs, gasoline pumps, vending/ice-making machines, and toolboxes.

Rapid urbanization across developing regions has led to a surge in construction activities that have created a growing demand for Paints and Coatings. This coupled with adverse weather conditions including heat waves, cold waves and hailstorms have adversely affected the paint quality required by building exteriors. This has added further impetus for an increased demand of high-quality Paints and Coatings from both developed and emerging markets globally. Paints are now being increasingly used as they offer better aesthetics when compared to other options such as coatings and textiles. Paints are also used in various other applications, including marine coatings for ships, consumer electronics, automobiles and furniture among others. This has led to increased demand across several industries globally. Moreover, anti-corrosion paints are used in the oil and gas industry which further contributes to demand for Paints and Coatings. In addition, paints provide unmatched aesthetic value to various finished products such as automobiles, furniture and cell phones among others. Surging consumer awareness and preference for odour-free, chemical-free, and lesser harmful paints have been directing manufacturing brands to adopt a shift to green technologies in both residential and commercial spaces. Furthermore, consumers are also looking for digital interfaces, thus expecting a major disruption in the flow of traditional distribution channels in the industry. Digital transformation is expected to open new revenue generation streams for companies in paints and coatings market. Furthermore, there is a growing trend of direct-to-consumer, and brands such as Clare and Backdrop are likely to pose a significant threat to traditionally operating companies. These brands are likely to make a substantial impact on slow growth categories to eventually capture the traditional consumer base.

Based on the applications, industrial segment accounted for the largest revenue share in 2022 with over 43%. Industries such as machinery manufacturing, automotive, oil and gas, marine, aerospace, and consumer goods are using these substances. In addition, growth in these industries is expected to drive demand for paints and coatings in the industrial segment. Architectural coating is a surface coating or paint which is applied on a structure or building exterior and it can be in form of decorative coatings, roof coatings, wall paints, or deck finishes. Increasing renovation and refurbishment activities in residential, non-residential, and commercial architectures in countries such as the U.S., Canada, Germany, Japan, Turkey, and Australia are expected to drive revenue growth of the architectural and decorative segment. The maritime and aircraft sectors in industrial segment employ paints and coatings. In commercial aircraft, for an airplane to be commercially viable, weight reduction is a top priority. Building lighter aircraft benefits the industry and aircraft operator. Weight reduction can lead to greater fuel savings, improved financial and sustainability performance, and longer aircraft ranges for airlines. The aerospace, architectural and construction, automotive and electronics, marine, medical, military, optical, pharmaceutical, semiconductor, and textile industries all employ industrial paint.

On the other hand, the architectural segment is expected to grow with prominent CAGR by 2023-28. In architectural applications, coatings and paints are mainly used for decorative purposes for residential and non-residential structures to protect them from environmental harm, UV radiation, and others. Increasing use of these materials in diverse industries such as construction and automotive is expected to drive this market's growth. High demand for paints and coatings in the automotive industry, owing to their colors stability, continuous protective film formation, corrosion resistance, abrasion and scratch resistance, flexibility, and durability will boost the market prospects. The growth in coil segments can be linked to the high production of sheets of various materials such as polymers, steel, and copper. Coils are used in semiconductors, household wires, cables, automotive, building & construction, etc. These materials are also applied to commercial and military ships for protection from environmental effects such as water, UV radiation, and thermal instability. Industrial material is also covered through paints coatings that provide heat and fire resistance, electrical resistance to machinery, and industrial wood. Increasing product demand in marine and industrial applications will further boost the market growth.

Based on resin type, the market is segmented into acrylic, alkyd, epoxy, polyester, polyurethane, fluoro-polymers, vinyl and others. Amongst these, acrylic resin accounts for the largest market share owing to its drying rate, adhesion, flexibility, and relative resistance properties, making it suitable for usage in paints and coatings. The increasing use of acrylic for architectural coatings of interior and exterior walls, windows, and panels is the major factor driving the product demand. However alkyd resins are mainly used for decorative gloss paints in residential homes and commercial offices. PU resins have good gloss, scratch resistance, and excellent adhesion and thermal stability. As a result of its properties, the demand for PU resin coatings is expected to contribute to the market size substantially. Epoxy resins have major applications in floor coatings, where epoxy thinner, a mixture of solvents and alcohols is utilized for coatings. Epoxy coatings are broadly used due to their exceptional chemical resistance, low porosity, anti-sagging, corrosion-resistant, strong adhesion, durability, and bond strength. Ceramic coatings have hydrophobic properties, which ensure substances do not stick to the exterior of any vehicle such as snow or bird droppings. Chemical polymer solution that is applied to the exterior of a car to protect it against external paint damage is known as an industry-grade ceramic coating. On 24 January 2021, ANT LAB launched a range of new automotive ceramic coating products such as 10H ceramic coating, MATTE ceramic coating, and Paint Protection Film (PPF) ceramic coating.

Recent Developments:

- In December 2022, AkzoNobel N.V. has completed the acquisition of the wheel liquid coatings business of Lankwitzer Lackfabrik GmbH, a deal which strengthens the company’s performance coatings portfolio. The acquired business will complement AkzoNobel’s existing powder coatings offering and expand the range of innovative products the company supplies.

- In April 2022, PPG today announced that it has completed its acquisition of the powder coatings manufacturing business of Arsonsisi, an industrial coatings company based in Milan, Italy.

- In November 2022, The Sherwin-Williams Company acquired Oskar Nolte GmbH and Klumpp Coatings GmbH. This acquisition creates opportunities to accelerate their profitable growth in the global industrial wood market and fits company strategy of acquiring complementary, high-quality and differentiated businesses.

- In February 2022, AkzoNobel Powder Coatings introduced the Interpon Futura Collection, which includes three new, on-trend color palettes such as Merging World, Healing Nature, and Soft Abstraction. The collection emits no solvents or volatile organic compounds and contributes to AkzoNobel's overall sustainability program.

- In February 2022, PPG agreed to acquire the powder coatings division of Arsonsisi, an industrial coatings company situated in Milan, Italy. Arsonsisi is a prominent producer of architectural and industrial specialty powder coatings.

- In February 2022, H.B. Fuller Company acquired Apollo, the U.K.’s independent manufacturer of liquid adhesives, coatings, and primers for the roofing, industrial, and construction industries.

- In February 2022, The Sherwin-Williams Company signed an agreement with the state of North Carolina, Iredell County, and the city of Statesville to significantly expand its architectural paint and coatings manufacturing capacity and establish a larger distribution facility in Statesville, North Carolina. Sherwin-Williams plans to invest a minimum of USD 300 million in the project.

- In February 2022, PPG announced to acquire Powder Coating Manufacturing Business in Arsonsisi, an industrial coating company based in Milan, Italy. This acquisition will help the company in backward integration.

Covid-19 Impacts:

The paints and coatings market has been negatively impacted due to the wake of the COVID-19 pandemic owing to its dependence on building & construction, automotive & transportation, industrial, aerospace, and other sectors. However, the building and construction and transportation activities have been back on track and operating at full capacity post-COVID-19 period, which is expected to enhance the paints and coatings demand. Paints are compounds that are used to improve the aesthetics of the substrate on which it is applied, while coatings are used principally to prevent substrate deterioration or for corrosion protection purposes. Paints and coatings provide specific properties such as anti-fouling, flame retardancy, and anti-microbial properties in architectural, industrial, automotive, aerospace, and other end use sectors.Major Companies present in the market:

Akzo Nobel N.V, PPG Industries, Inc., The Sherwin-Williams Company, Cabot Corporation, Wacker Chemie AG, BASF SE, Hempel A/S, Kansai Paint Co.,Ltd., Noroo paint & coatings Co., Ltd., RPM International Inc, Henkel AG & Co. KGaA, Nippon Paint Holdings Co., Ltd, Axalta Coating Systems Ltd., Terraco Group Limited, Jotun Group, Benjamin Moore & Co., Sika AG, DAW SE, Berger Paints Ltd , Asian Paints Ltd.Considered in this report

- Geography: Global

- Historic year: 2017

- Base year: 2022

- Estimated year: 2023

- Forecast year: 2028

Aspects covered in this report

- Global Paints & Coatings market with its value and forecast along with its segments

- Region-wise Paints & Coatings market analysis

- Various drivers and challenges

- On-going trends and developments

- Top profiled companies

- Strategic recommendation

Regions & Countries covered in the report:

- North America (United States, Canada, Mexico)

- Europe (Germany, United Kingdom, France, Spain, Italy, Russia)

- Asia-Pacific (China, Japan, India, Australia, South Korea)

- South America (Brazil, Argentina, Colombia)

- Middle-East & Africa (UAE, Saudi Arabia, South Africa)

By Product Type

- Waterborne Coatings

- Solvent-borne Coatings

- Powder Coatings

- UV Cured Coatings

- Others Segment Includes (Speciality Coating (Primer, Topcoat, Undercoat, etc.), Electron Beam Cure coating, High Solids Coatings, etc.)

By Application Type

- Architectural

- Industrial

Protective Coatings

Automotive (OEM and After) Coatings

Other Transportation Coatings

Wood Coatings

Marine Coatings

Coil Coatings

Packaging Coatings

Aerospace Coatings

Rail Coatings

General Industrial Coatings

Others Coatings

The approach of the report:

This report consists of a combined approach of primary and secondary research. Initially, secondary research was used to get an understanding of the market and list the companies that are present in it. The secondary research consists of third-party sources such as press releases, annual reports of companies, and government-generated reports and databases. After gathering the data from secondary sources, primary research was conducted by conducting telephone interviews with the leading players about how the market is functioning and then conducting trade calls with dealers and distributors of the market. Post this; we have started making primary calls to consumers by equally segmenting them in regional aspects, tier aspects, age group, and gender. Once we have primary data with us, we can start verifying the details obtained from secondary sources.Intended audience

This report can be useful to industry consultants, manufacturers, suppliers, associations, and organisations related to the Paints & Coatings industry, government bodies, and other stakeholders to align their market-centric strategies. In addition to marketing and presentations, it will also increase competitive knowledge about the industry.Table of Contents

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | June 2023 |

| Forecast Period | 2022 - 2028 |

| Estimated Market Value ( USD | $ 185.2 Billion |

| Forecasted Market Value ( USD | $ 257 Billion |

| Compound Annual Growth Rate | 5.7% |

| Regions Covered | Global |