Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

As part of its Green Plan 2030, Singapore has committed to phasing out internal combustion engine (ICE) vehicles and expanding its electric vehicle (EV) infrastructure, including incentives for commercial fleet electrification. This has encouraged logistics, construction, and waste management companies to adopt electric trucks to meet corporate sustainability goals and lower operating costs.

Advancements in battery technology and the development of efficient charging networks are also playing a critical role in reducing range anxiety and making electric trucks more viable for urban and regional operations. Furthermore, Singapore’s compact urban landscape is ideal for electric truck deployment, especially for last-mile and intra-city logistics. The rise of e-commerce and on-demand delivery services is generating increased demand for low-emission, high-efficiency transport solutions, boosting adoption of light and medium-duty electric trucks. Strategic partnerships among OEMs, energy providers, and fleet operators are accelerating pilot programs and vehicle rollouts.

In addition, government support through grants, tax exemptions, and preferential road access is further catalyzing market growth. Although high upfront costs and limited vehicle availability pose initial challenges, the total cost of ownership for electric trucks is becoming more attractive due to lower fuel and maintenance expenses. The market is also benefiting from Singapore's smart city initiatives and integration of digital fleet management systems, enhancing operational efficiency and vehicle utilization. Heavy-duty electric trucks are expected to gain traction gradually as battery capacities improve and public charging infrastructure expands. Overall, the Singapore electric truck market is poised for sustained growth, supported by policy momentum, technological innovation, and the country’s broader commitment to climate action and clean mobility.

Key Market Drivers

Government Policies and Regulatory Push for Decarbonization

One of the most significant drivers of the electric truck market in Singapore is the proactive and forward-looking stance of the government toward decarbonization and clean mobility. Under the Singapore Green Plan 2030 and its broader ambition to achieve net-zero emissions by 2050, authorities have introduced a range of policy measures aimed at accelerating the adoption of electric vehicles, including commercial electric trucks.These initiatives include financial incentives such as the Commercial Vehicle Emissions Scheme (CVES), which provides up to SGD 30,000 in rebates for qualifying electric commercial vehicles, and the Early Turnover Scheme (ETS), encouraging fleet operators to replace older, polluting diesel trucks with cleaner electric alternatives. Additionally, Singapore has set ambitious targets, such as ceasing the registration of new internal combustion engine (ICE) vehicles by 2030, which directly influences fleet owners and logistics companies to start transitioning to electric models. A recent survey by the Sustainable Energy Association of Singapore (Seas) found that 37% of Singapore companies experienced minimal impact from the carbon tax hike.

Only 24.5% of companies reconsidered their long-term sustainability strategies due to the increased tax, and approximately 20% have increased efforts to reduce emissions and invest in energy-efficient technologies. The survey also indicated that only 3.8% of companies have purchased carbon credits, suggesting the tax hike may not be sufficient to drive demand for them.The government is also investing heavily in charging infrastructure, with plans to deploy 60,000 EV charging points across the island by 2030, thus easing range concerns and making EVs more accessible. Regulatory support, preferential access, and long-term policy clarity create a stable investment environment and reduce the risk for early adopters, making government action one of the most critical enablers of electric truck deployment in Singapore.

Key Market Challenges

High Upfront Costs and Limited Model Availability

Despite the long-term benefits of electric trucks in terms of lower operating and maintenance costs, one of the most persistent challenges in the Singapore market is the high upfront cost of acquisition. Electric trucks, particularly those in the medium- and heavy-duty segments, remain significantly more expensive than their internal combustion engine (ICE) counterparts, primarily due to the high cost of lithium-ion battery systems and limited local manufacturing. For fleet operators and logistics companies that operate on tight margins, this cost disparity can be a deterrent - even when government incentives like the Commercial Vehicle Emissions Scheme (CVES) and Early Turnover Scheme (ETS) are factored in.Moreover, the availability of electric truck models suited to Singapore’s climate, road conditions, and operational requirements is still limited. While several global OEMs are making progress in expanding their electric commercial vehicle portfolios, many models are either not yet homologated for Singapore or have long delivery lead times due to limited global supply. This lack of variety restricts options for buyers looking for specific payload capacities, configurations, or duty cycles. As a result, potential adopters may delay fleet electrification until a broader, more competitively priced range of vehicles becomes available, posing a major barrier to market growth in the short term.

Key Market Trends

Integration of Digital Fleet Management and Telematics with Electric Trucks

A significant trend influencing the electric truck landscape in Singapore is the increasing integration of advanced digital fleet management systems and telematics with electric vehicles. As businesses transition to electric mobility, the need for data-driven operations is becoming more pronounced to optimize range, charging cycles, and overall efficiency. Electric trucks are often equipped with embedded IoT sensors and telematics modules that monitor battery health, energy consumption patterns, regenerative braking behavior, and route efficiency in real time.These systems allow fleet managers to make informed decisions on vehicle deployment, charging schedules, and preventive maintenance - minimizing downtime and maximizing return on investment. In Singapore, where space and resources are constrained, the use of intelligent fleet platforms is helping companies fine-tune logistics networks, track energy usage per delivery, and benchmark carbon reduction performance.

Additionally, digital tools are being used to predict optimal routes based on vehicle charge status, traffic conditions, and delivery priorities, further enhancing operational precision. Local logistics providers, especially those servicing e-commerce and urban distribution, are leading the charge by adopting cloud-based fleet intelligence software customized for electric vehicle needs. This digitization trend is not just about managing trucks - it’s about transforming entire supply chains into smarter, greener systems, aligned with Singapore’s Smart Nation and Industry 4.0 visions.

Key Market Players

- VINCAR PTE LTD (Sokon Group)

- JARDINE CYCLE & CARRIAGE LIMITED (Maxus Inc.)

- BYD Singapore (BYD Co. Ltd)

- VOLVO GROUP SINGAPORE (PTE.) LTD

- Goldbell Engineering Pte. Ltd. (Mitsubishi FUSO).

- Daimler South East Asia Pte Ltd (Daimler Truck AG)

- DONGFENG COMMERCIAL VEHICLE PTE. LTD

- ISUZU MOTORS ASIA LIMITED

- SCANIA SINGAPORE PTE. LTD.

- MAN TRUCK & BUS SINGAPORE PTE.

Report Scope:

In this report, the Singapore Electric Truck market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Singapore Electric Truck Market, By Vehicle Type:

- Light Duty Truck

- Medium Duty Truck

- Heavy Duty Truck

Singapore Electric Truck Market, By Fuel Type:

- BEV

- HEV

- PHEV

- FCEV

Singapore Electric Truck Market, By Range:

- Up to 150 Miles

- 151-250 Miles

- 251-500 Miles

- Above 500 Miles

Singapore Electric Truck Market, By Region:

- Central

- East

- West

- North

- North-East

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Singapore Electric Truck market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- VINCAR PTE LTD (Sokon Group)

- JARDINE CYCLE & CARRIAGE LIMITED (Maxus Inc.)

- BYD Singapore (BYD Co. Ltd)

- VOLVO GROUP SINGAPORE (PTE.) LTD

- Goldbell Engineering Pte. Ltd. (Mitsubishi FUSO).

- Daimler South East Asia Pte Ltd (Daimler Truck AG)

- DONGFENG COMMERCIAL VEHICLE PTE. LTD

- ISUZU MOTORS ASIA LIMITED

- SCANIA SINGAPORE PTE. LTD.

- MAN TRUCK & BUS SINGAPORE PTE.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 70 |

| Published | September 2025 |

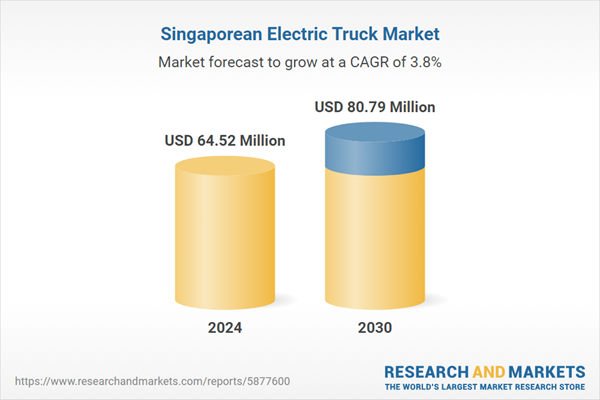

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 64.52 Million |

| Forecasted Market Value ( USD | $ 80.79 Million |

| Compound Annual Growth Rate | 3.8% |

| Regions Covered | Singapore |

| No. of Companies Mentioned | 10 |