Purified terephthalic acid is commonly utilized in the production of polyester coatings, which find application in several sectors, including general metal applications, home appliances, vehicles, and coil coatings. Consequently, purified terephthalic acid segment is anticipated to capture approximately 1/4th share of the market by 2030. The global need for pure terephthalic is driven by several features, including strong chemical and stain resistance, excellent weatherability, effective glass transition balancing, and suitable temperature ranges for high flexibility. Ethyl acetate, which is derived from the reaction between ethanol and acetic acid, is extensively utilized as both a diluent and a solvent. The chemical is in high demand mostly because of its reduced toxicity and affordability. Ethyl acetate, which is derived from ethanol, finds application in the formulation of paints and perfumes characterized by rapid evaporation and the ability to impart a lingering aroma upon contact with the skin. Some of the factors impacting the market are Rising popularity of processed foods, Growth in the textile industry, and Increasing competition from alternatives.

Acetic acid's antimicrobial properties make it a suitable preservative for various food products. As the demand for processed foods grows, so does the need for preservatives to extend shelf life and maintain food quality, leading to increased usage of acetic acid. This acid is a primary vinegar component, frequently used as a flavoring and pickling agent in many cuisines worldwide. As global consumers continue to demand variety, convenience, and longer shelf life in their food products, the market stands to benefit. The textile industry is a significant end-user of acetic acid, and its growth directly influences the demand for acetic acid. It is used in dyeing, particularly with protein fibers like wool and silk. It helps in achieving better dye uptake and brightness. The growing textile market, therefore, implies increased dyeing and, consequently, more demand for acetic acid. Especially in developing economies, the rising middle class seeks better living standards, which include improved clothing quality and variety. This demographic change translates to growth in the textile industry and, by extension, acetic acid consumption. Thus, the expansion of the textile industry will substantially support the development of the market.

However, Acetic acid, known for its versatility, has been pivotal in chemical synthesis, textile manufacturing, and food preservation. However, in the wake of technological advancements and changing industrial dynamics, alternative solutions are making inroads, vying for a share of the pie. One significant area where acetic acid has traditionally held sway is chemical synthesis. Though acetic acid remains a cornerstone in many industries, innovation, environmental consciousness, and shifting consumer preferences are introducing formidable competitors. Therefore, the market faces challenges from emerging alternatives that could impede its growth trajectory.

Type Outlook

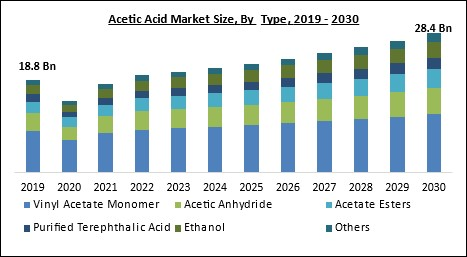

Based on the type, the market is segmented into vinyl acetate monomer, acetic anhydride, acetate esters, purified terephthalic acid, and ethanol. The vinyl acetate monomer segment dominated the market with the highest revenue share in 2022. Its high share is owed to the increasing demand for paints and coatings, paper coatings, and printed products, which drive the demand for vinyl acetate monomer. Acetic acid is a primary raw material used to produce vinyl acetate monomer, further used to make polyvinyl acetate. This is further used in the manufacturing of paints and coatings.Regional Outlook

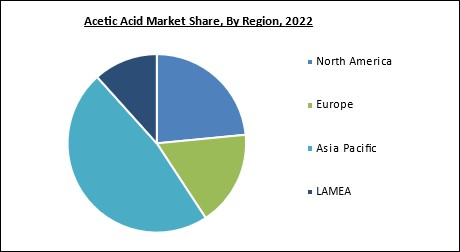

Based on the region, the market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The Asia Pacific region dominated the market with the largest revenue share in 2022. The observed expansion can be ascribed to the rising need for acetic acid across diverse sectors, including construction, pharmaceuticals, automotive, and textiles. The rise in the product can be attributed to the growth of the pharmaceutical sector in the region. Acetic acid plays a significant role in the synthesis and formulation of pharmaceutical compounds. Consumers' growing reliance on medicinal tablets is expected to contribute to the overall increase in demand for this product within the region.The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Eastman Chemical Company, Celanese Corporation, The Dow Chemical Company (Dow Corning Ltd.), Indian Oil Corporation Ltd., Gujarat Narmada Valley Fertilizers & Chemicals Limited, Daicel Corporation, Airedale Chemical Holdings Limited, Helm AG, SABIC (Saudi Arabian Oil Company), and LyondellBasell Industries Holdings B.V.

Scope of the Study

By Type (Volume, Kilo Tonnes, USD Million, 2019-2030)

- Vinyl Acetate Monomer

- Acetic Anhydride

- Acetate Esters

- Purified Terephthalic Acid

- Ethanol

- Others

By Geography (Volume, Kilo Tonnes, USD Million, 2019-2030)

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- Russia

- UK

- France

- Italy

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Egypt

- Rest of LAMEA

Key Market Players

List of Companies Profiled in the Report:

- Eastman Chemical Company

- Celanese Corporation

- The Dow Chemical Company (Dow Corning Ltd.)

- Indian Oil Corporation Ltd.

- Gujarat Narmada Valley Fertilizers & Chemicals Limited

- Daicel Corporation

- Airedale Chemical Holdings Limited

- Helm AG

- SABIC (Saudi Arabian Oil Company)

- LyondellBasell Industries Holdings B.V.

Unique Offerings

- Exhaustive coverage

- The highest number of Market tables and figures

- Subscription-based model available

- Guaranteed best price

- Assured post sales research support with 10% customization free

Table of Contents

Companies Mentioned

- Eastman Chemical Company

- Celanese Corporation

- The Dow Chemical Company (Dow Corning Ltd.)

- Indian Oil Corporation Ltd.

- Gujarat Narmada Valley Fertilizers & Chemicals Limited

- Daicel Corporation

- Airedale Chemical Holdings Limited

- Helm AG

- SABIC (Saudi Arabian Oil Company)

- LyondellBasell Industries Holdings B.V.