This report comes with 10% free customization, enabling you to add data that meets your specific business needs.

1h Free Analyst TimeSpeak directly to the analyst to clarify any post sales queries you may have.

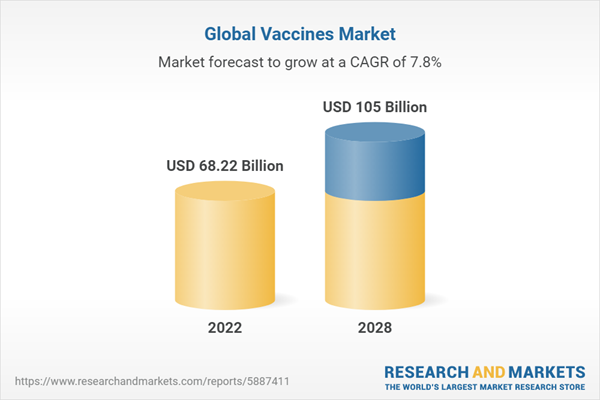

According to the research report, “Global Vaccine Market Outlook, 2028” the market is anticipated to cross USD 105 Billion by 2028, increasing from USD 68.22 Billion in 2022. The market is expected to grow with 7.81% CAGR by 2023-28. Governments investing huge capital in progressive healthcare systems are anticipated to expand the vaccine market size. Government healthcare programs deliver vaccines to infants to provide them with prevention from chronic diseases like tuberculosis, rotavirus, etc. The rise in new diseases like H1B1 infection, and swine flu (H1N1) is pushing the authorities to adopt new methods that help in preventing the diseases. For instance, in June, 2021, Merck and Sanofi received an approval for six-in-one pediatric combination vaccine in the U.S. In addition, rise in incidence of various infectious diseases and growth in awareness regarding early disease diagnosis & prevention drive the demand for protective vaccines; thereby, boosting the vaccines market growth. Rise in the demand for vaccines owing to high incidences of diseases worldwide which drive the market growth. The World Health Organization (WHO) estimates the around 325 million people, or nearly 4% of the world population, live with viral hepatitis. In addition, the advancements in vaccine technology are providing an opportunity to target new diseases support the market growth. There has been a development of a wide array of new vaccination technologies ranging from targeted attenuation techniques of live pathogens to the delivery of biologically engineered protein and peptide antigens as well as viral vector and nucleic-acid based antigens. Most of these technologies have highly promising results. Thus, there has been a significant increase in spending for the development of vaccine technology which propels the market growth.

Rapidly evolving technology has a profound impact on vaccine market trends. Developments like the introduction of genetic engineering and lab automation are helping vaccine manufacturers to develop low-cost vaccines, which may attract markets and eventually enable vaccine market access. Additionally, various initiatives taken by governments of emerging nations for launching mass vaccination drives may augment the overall vaccines industry worth in the future. The development of vaccines is a lengthy, complicated, and expensive process. As a result, most of the vaccines are usually costlier, which is acting as a key hurdle in the growth of the vaccines market. Similarly, lack of awareness and poor healthcare infrastructure across developing regions has also hampered vaccine market access. Vaccine manufacturing giants like Pfizer and GSK are vigorously investing in vaccine research and development for introducing new products with a highly effective nature. Besides this, they are holding various trials for establishing the safety and efficacy of vaccines. For instance, in January 2022, Pfizer Inc., and BioNTech SE initiated a clinical study to evaluate the safety, immunogenicity, and tolerability of an Omicron-based vaccine candidate in adults aged 18 to 55. The market is anticipated to thrive at a significant CAGR between 2022 and 2028. Also, the increasing understanding of emerging diseases has led to the development of numerous vaccines during the past years. The availability of efficient vaccines for influenza, DTP, as well as pancreatic cancer has driven the market growth. Furthermore, advancements in the technology helped to achieve milestones in the vaccine development including avian flu vaccine, nasal flu vaccine, therapeutic cancer vaccine and egg-free vaccine among others. Along with development and disease prevalence, the immunization programs, and supportive initiatives by the government authorities to improve immunization coverage will positively impact the vaccines industry landscape during the analysis period.

Based on the regions, North America is leading the global vaccine market with more than 35% market share in 2022.

North America is home to some of the world’s largest and most influential pharmaceutical companies, including Pfizer, Moderna, Johnson & Johnson, and Merck. These companies have the resources, expertise, and research infrastructure to develop and manufacture vaccines at scale. North American companies have a long history of investing in research and development (R&D) for vaccines. This has allowed them to be at the forefront of vaccine innovation, including the development of mRNA vaccines, which gained prominence during the COVID-19 pandemic. The United States, in particular, has a well-established regulatory framework for approving and monitoring vaccines. The U.S. Food and Drug Administration (FDA) plays a crucial role in ensuring the safety and efficacy of vaccines, which can boost confidence in their products globally. North American pharmaceutical companies often have access to significant financial resources, including private and public funding, which can support the development and production of vaccines. The region has a robust infrastructure for vaccine manufacturing, with numerous facilities capable of producing large quantities of vaccines efficiently. North America also benefits from well-established distribution networks and logistics infrastructure, which are critical for the timely delivery of vaccines, both domestically and internationally. North American pharmaceutical companies often collaborate with international organizations, governments, and non-profit organizations to expand access to vaccines in low- and middle-income countries. The healthcare sector is expected to witness significant growth in the region following the heavy investments by the government and several market players. Moreover, the robust healthcare infrastructure and research centers have heavily contributed to saving millions of lives. In the U.S. alone, vaccines have prevented over 21 million hospitalizations and 732,000 deaths among children born in the last 20 years, CDC. Apart from this, technological advancements are boosting the growth of vaccines market in the region. Recently, in October 2018, the U.S. FDA has agreed to consider the application of ‘Dengvaxia’ - a first licensed vaccine against dengue by Sanofi Pasteur. The U.S. Virgin Islands, Puerto Rico, and Guam are some of the regions with the highest prevalence of dengue across the U.S.

Based on the technology, conjugate vaccines are projected to lead the market during the forecast period with higher revenue generation in global vaccine market.

The global vaccine market is segmented into various technology types including conjugate vaccines, inactivated & subunit vaccines, live attenuated vaccines, recombinant vaccines and toxoid vaccines. The conjugate vaccines segment accounted for the leading share of the global vaccine market by vaccine type due to increased spending by government and private companies on its development. Rising preference for conjugate vaccines is due to their various additional features including greater antibody persistence and avidity. Conjugate vaccines are designed to address pathogens with polysaccharide capsules, such as certain bacteria. Polysaccharide capsules can be poorly immunogenic in infants and young children. Conjugate vaccines overcome this limitation by attaching the polysaccharides to carrier proteins, making them more immunogenic. This results in a stronger and more durable immune response, particularly in vulnerable populations. Many conjugate vaccines target bacteria that cause severe and potentially life-threatening diseases, such as Haemophilus influenzae type b (Hib), Streptococcus pneumoniae (pneumococcus), and Neisseria meningitidis (meningococcus). These vaccines have significantly reduced the incidence of these diseases, leading to improved public health outcomes. Conjugate vaccines are suitable for a broader age range, including infants, young children, and adults. This versatility allows for comprehensive vaccination programs and the protection of individuals across different age groups. Conjugate vaccines not only protect vaccinated individuals but also contribute to herd immunity. By reducing the prevalence of a pathogen in the population, even those who are not vaccinated benefit from decreased transmission rates, reducing their risk of infection. Conjugate vaccines against meningococcus and pneumococcus have been particularly successful in preventing meningitis and pneumonia, two severe and potentially deadly infections. Many countries have implemented successful immunization campaigns using conjugate vaccines, leading to a substantial reduction in vaccine-preventable diseases. These campaigns often target children and adolescents, who are at higher risk of certain bacterial infections. Conjugate vaccines are recommended by leading health authorities, including the World Health Organization (WHO) and national health agencies, due to their proven effectiveness and safety profile.

Intramuscular and subcutaneous route of administration for vaccines have grown with higher market growth throughout the historic time period in global vaccine market.

The intramuscular and subcutaneous administration segment accounted for the largest share of the market (excluding COVID-19 vaccines). Benefits such as, administration rate, precise control of dose and ease of administration makes the Intramuscular & Subcutaneous as one of the most prevalent route and thus drives the market. The segment is projected to witness higher market growth owing to benefits associated with it such as a low rate of reaction on injection sites and higher immune response compared to other routes of administration. The intramuscular injections are administered into muscles and subcutaneous injections are injected into the underneath skin and fat layer. Intramuscular injections are administrated for Hepatitis A, Hepatitis B, IPV, HPV, PCV-7, Hib, and influenza. However, the oral administration segment is expected to grow with significant CAGR during the forecast period. The advantages of orally administered vaccines such as elicitation of both mucosal and systemic immunities and elimination of injection-associated adverse events are a few factors driving market growth. Polio vaccine, rotavirus vaccine, and other such pediatric vaccines are generally administered via the oral route. Furthermore, on the basis of end user, the vaccines market is segmented into pediatric and adult users. The pediatric users segment accounted for the largest share of the market (excluding COVID 19 vaccines), while the adult user segment is estimated to register the highest CAGR during the forecast period. Factors such as, growing government initiatives and growing company initiatives to develop advanced pediatric vaccines for preventing diseases are expected to drive market growth for pediatric vaccines. Parenteral administration is highly preferred for administering vaccines and hence the segment dominated the vaccine market. Parenteral administration provides faster absorption, is more effective, and reduces the risk of contamination and vaccine degradation. Amongst the currently marketed vaccines, a wide majority are administered as either intramuscular or subcutaneous injections, which contributes to the segments’ dominance.

Based on the disease, Rotavirus is dominating the market in 2022 with higher market share in global vaccine market as these infections are a major contributor to child mortality, especially in regions with high disease prevalence.

Rotavirus is a leading cause of severe diarrhea and dehydration in infants and young children worldwide. It is responsible for a substantial number of hospitalizations and deaths, particularly in low- and middle-income countries where access to clean water and healthcare resources may be limited. By preventing rotavirus-related illnesses, vaccines have the potential to save numerous lives, making them a priority for global health organizations. Vaccination against rotavirus is considered a cost-effective public health intervention. The financial burden of treating severe rotavirus infections, including hospitalization and medical care, is substantial. Vaccination can significantly reduce these costs, both for individuals and healthcare systems. Organizations like the World Health Organization (WHO) and the United Nations Children's Fund (UNICEF) have prioritized rotavirus vaccination as part of their efforts to improve child health and reduce child mortality globally. Diarrheal diseases, including those caused by rotavirus, pose a substantial public health challenge. Rotavirus vaccines not only prevent rotavirus-related illness but also contribute to reducing the overall burden of diarrheal diseases, which is a leading cause of childhood morbidity and mortality. Many countries have incorporated rotavirus vaccination into their national immunization programs, often providing the vaccine for free or at a reduced cost. These recommendations and subsidies increase vaccine uptake. Several rotavirus vaccines are available and have been approved for use in various countries. These vaccines are produced by different manufacturers, contributing to their accessibility and availability. High vaccine coverage can lead to herd immunity, reducing the overall transmission of the rotavirus in communities and protecting even those who may not be vaccinated, such as infants too young to receive the vaccine. Ongoing research in the field of rotavirus vaccines has led to the development of more effective and affordable vaccines, further supporting their role in the global vaccine market. Vaccines can be categorized into monovalent and multivalent. Monovalent are designed to combat single diseases like malaria, Ebola, and dengue. Multivalent is used in the immunization of multiple diseases, including DTP, polio, and hepatitis. The growing prevalence of malaria, Ebola and others are driving the demand for monovalent vaccines. Ebola outbreak with no vaccination available has prompted the healthcare organizations to increase the research and development activities of monovalent vaccines.

Hospital pharmacy have become the major source of vaccines based on distribution channel segmentations owing to higher market share in 2022 in global vaccine market.

Hospitals are accessible healthcare facilities for patients, making it convenient for individuals to receive vaccines when seeking medical care for various reasons. Patients may receive vaccines during hospital visits for other medical conditions or for routine check-ups. Many hospitals, especially larger ones, have established immunization programs and clinics that offer a wide range of vaccines to both inpatients and outpatients. These programs often target various patient populations, including children, adults, and individuals with specific medical conditions. Hospitals are critical components of emergency response efforts during disease outbreaks and pandemics. During public health emergencies, hospitals play a central role in administering vaccines to healthcare workers, first responders, and high-risk individuals. Hospitals typically have the infrastructure and equipment necessary to store vaccines at the recommended temperature and humidity levels. Proper storage and handling are crucial to maintaining vaccine efficacy, and hospitals have well-established protocols for this purpose. Hospitals employ a large number of healthcare professionals, including pharmacists, nurses, and doctors, who are trained to administer vaccines safely and provide patients with the necessary information about immunization. Hospital pharmacies can administer vaccines to patients admitted to the hospital, ensuring that individuals receive necessary vaccinations during their stay, particularly for vaccines related to specific medical conditions or surgical procedures. Hospitals often collaborate with public health agencies and local health departments to promote vaccination campaigns. They may serve as vaccination sites during community-wide immunization efforts. Hospitals typically stock a wide range of vaccines, including routine childhood vaccines, adult vaccines, travel vaccines, and vaccines for specific medical conditions. This diversity allows hospitals to meet the diverse healthcare needs of their patient population. Hospital pharmacies adhere to strict quality assurance and safety standards, ensuring that vaccines are administered safely and accurately. This quality control contributes to public confidence in the vaccination process. Hospitals have established billing systems that can facilitate the reimbursement process for vaccine administration, making it financially feasible for both patients and the healthcare facility.

Market Drivers

- Pandemic Preparedness: The COVID-19 pandemic has been a catalyst for increased investment in vaccine research and development. Governments and organizations worldwide have recognized the urgency of developing vaccines at an unprecedented pace. This heightened sense of urgency has led to streamlined regulatory processes, collaborative research efforts, and investments in vaccine manufacturing capacity. Moreover, public awareness of the importance of vaccination has surged, which can have long-term positive effects on vaccine adoption for other diseases.

- Technological Advancements: mRNA and vector-based vaccine platforms, as exemplified by the COVID-19 vaccines, have gained prominence. These platforms allow for rapid vaccine development and production, reducing the timeline from years to months. Additionally, innovations in vaccine delivery methods, such as microneedle patches and nasal sprays, are enhancing vaccine accessibility and administration. The integration of artificial intelligence and machine learning in vaccine research is also helping identify potential candidates more efficiently.

Market Challenges

- Vaccine Hesitancy: Vaccine hesitancy remains a complex challenge, influenced by factors like misinformation, distrust of healthcare systems, and religious or cultural beliefs. Social media platforms play a significant role in the spread of vaccine misinformation. Overcoming this challenge requires multi-pronged strategies, including public health campaigns, accurate information dissemination, and trust-building initiatives involving healthcare professionals and communities.

- Access and Equity: Ensuring equitable access to vaccines across the globe is an ongoing challenge. High-income countries often secure vaccine supplies more easily, leaving lower-income countries at a disadvantage. Initiatives like COVAX aim to address this imbalance, but supply chain disruptions, export restrictions, and vaccine nationalism can hinder progress. Long-term solutions involve technology transfer, local vaccine production capacity building, and international cooperation to distribute vaccines fairly.

Market Trends

- Digitalization and Data Integration: Digital tools are transforming vaccine distribution and monitoring. Vaccine passports and digital health records enable individuals to prove their vaccination status, facilitating international travel and access to certain services. Real-time data analytics help health authorities track vaccine coverage, identify underserved areas, and respond to outbreaks swiftly. These trends enhance transparency and accountability in vaccination programs.

- Emerging Infectious Diseases: The threat of emerging infectious diseases continues to drive vaccine development efforts. The speed at which vaccines were developed for COVID-19 demonstrated the adaptability of vaccine platforms. Manufacturers are investing in versatile platforms that can be quickly tailored to new pathogens, reducing the response time to future outbreaks. Governments and organizations are also stockpiling vaccines and therapeutics for potential future pandemics as part of their preparedness efforts.

Competitive Landscape

The top market players, such as GlaxoSmithKline plc, Sanofi, Pfizer Inc., and Merck & Co., Inc., account for the majority of the market. These companies have a strong product portfolio, the capability of strategic decisions, and focus on resolving the unmet needs in eradicating complex diseases through vaccination. For instance, potential products such as Prevnar 13 of Pfizer and Polio/Pertussis/Hib of Sanofi are leading in the market. Constant exhaustive R&D resulting in approvals and launches of novel products worldwide is expected to maintain their position in the market. Furthermore, increasing demand for injection doses for viral as well as bacterial diseases is anticipated to fuel the company growth and market value in the human industry. Major companies profiled in the market include Merck & Co., Inc, BioNTech SE, Bavarian Nordic, GlaxoSmithKline PLC, Bharat Biotech International Limited , CSL, Charles River Laboratories, Creative Biogene, Daiichi Sankto Company Ltd, Emergent BioSolutions Inc. , Sanofi S.A, Serum Institute of India Pvt. Ltd, Sinovac , AstraZeneca plc , Novavax, Oxford Biomedica, Pfizer Inc, Takeda Pharmaceutical Company Limited, Inovio Pharmaceutical and Walvax Biotechnology Co., Ltd.Key Developments

- In September 2021, the Serum Institute of India planned to launch at least one vaccine every quarter beginning with Covishield, which is licensed from AstraZeneca.

- In 2021, Abbott launched a new inactivated quadrivalent vaccine for influenza in India that offers protection against four virus strains, in India.

- In 2021, GlaxoSmithKline plc announced that they submitted a Biologics License Application (BLA) to the USFDA for its experimental vaccination PRIORIX. Over 100 nations have recently granted licenses for the vaccine, initially registered in Germany.

- In 2021, MSD Pharmaceuticals, a wholly-owned subsidiary of Merck Sharp & Dohme, launched Gardasil 9, India’s first gender-neutral HPV vaccine..

Considered in this report:

- Geography: Global

- Historic year: 2017

- Base year: 2022

- Estimated year: 2023

- Forecast year: 2028

Aspects covered in this report:

- Global Vaccines market Outlook with its value and forecast along with its segments

- Region & Country-wise Transformers market analysis

- Various drivers and challenges

- On-going trends and developments

- Top profiled companies

- Strategic recommendation

Regions & Countries covered in the report

- North America (United States, Canada, Mexico)

- Europe (Germany, United Kingdom, France, Spain, Italy, Russia)

- Asia-Pacific (China, Japan, India, Australia, South Korea)

- South America (Brazil, Argentina, Colombia)

- Middle-East & Africa (UAE, Saudi Arabia, South Africa)

By Technology

- Conjugate vaccines

- Inactivated & Subunit vaccines

- Live Attenuated vaccines

- Recombinant vaccines

- Toxoid vaccines

- Viral vector vaccines

- Others

By Route of Administration

- Intramuscular and subcutaneous administration

- Oral administration

- Others

By End-User Type

- Pediatrics

- Adults

By Disease

- Pneumococcal diseases

- Cancer

- Influenza

- Rotavirus

- Diphtheria, Pertussis, and Tetanus (DTP)

- Human Papilloma Virus (HPV)

- Shingles

- Meningococcal diseases

- Hepatitis

- Varicella (Chicken Pox)

- Mumps

- Others

By Type

- Monovalent vaccines

- Multivalent vaccines

By Distribution Channel

- Hospital Pharmacy

- Retail Pharmacy

- Online Pharmacy

- Others

The approach of the report:

This report consists of a combined approach of primary as well as secondary research. Initially, secondary research was used to get an understanding of the market and list out the companies that are present in the market. The secondary research consists of third-party sources such as press releases, and annual reports of companies, analyzing the government-generated reports and databases. After gathering the data from secondary sources primary research was conducted by making telephonic interviews with the leading players about how the market is functioning and then conducting trade calls with dealers and distributors of the market. Post this we have started doing primary calls to consumers by equally segmenting consumers into regional aspects, tier aspects, age groups, and gender. Once we have primary data with us we started verifying the details obtained from secondary sources.Intended audience:

This report can be useful to industry consultants, manufacturers, suppliers, associations & organizations related to the Drone industry, government bodies, and other stakeholders to align their market-centric strategies. In addition to marketing & presentations, it will also increase competitive knowledge about the industry.Table of Contents

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 194 |

| Published | September 2023 |

| Forecast Period | 2022 - 2028 |

| Estimated Market Value ( USD | $ 68.22 Billion |

| Forecasted Market Value ( USD | $ 105 Billion |

| Compound Annual Growth Rate | 7.8% |

| Regions Covered | Global |