Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

In industrial uses, talc functions as a lubricant, thickening agent, filler, and carrier. It is extensively employed in the ceramics, paper, plastics, rubber, paints and coatings, food, and pharmaceutical industries. In the personal care and cosmetics sector, talc is a core ingredient in baby powders, body powders, and various skin-care formulations due to its softness and moisture-absorbing capabilities.

Its ability to retain fragrance and provide a smooth texture makes it a preferred additive in cosmetic products. The automotive industry significantly contributes to talc demand, particularly through the use of talc-reinforced polypropylene. This composite material is used in manufacturing lightweight, durable automotive components that improve fuel efficiency, reduce emissions, and offer superior mechanical performance. The growing automotive refinish and OEM components markets further support talc consumption.

In the medical field, talc is utilized in pleurodesis, a procedure to prevent recurrent pleural effusions or pneumothorax. It is also used in some pharmaceutical formulations and as a food additive. Emerging economies such as China, India, Brazil, Thailand, and South Africa are experiencing rapid industrialization, driving the demand for talc across construction, automotive, and consumer goods industries. These regions are witnessing increased consumption of talc-based products due to growing manufacturing sectors and rising middle-class populations. The global talc market is poised for steady growth, driven by its multifunctional characteristics and increasing applications in end-use industries. Its integration into lightweight composites and its continued role in cosmetics and industrial sectors are expected to sustain demand in the coming years.

Key Market Drivers

Growing Demand of Talc in Pharmaceutical Industry

Talc, a naturally occurring magnesium silicate mineral, is gaining significant traction in the pharmaceutical sector due to its exceptional physical and chemical properties. Traditionally recognized for its softness, purity, and fine particle size, talc has evolved into a critical ingredient across various pharmaceutical applications. As the demand for high-quality excipients grows, talc’s unique characteristics position it as an indispensable component in modern drug formulation and delivery. In pharmaceutical manufacturing, talc serves several functional roles. It acts as a lubricant, aiding in the smooth processing and compression of tablets.As a glidant, talc enhances the flowability of powdered substances, improving consistency and efficiency in drug production. Its chemically inert nature ensures it does not interfere with active pharmaceutical ingredients (APIs), making it suitable for sensitive formulations. India’s pharmaceutical industry, currently valued at approximately USD 58 billion, is projected to grow significantly, reaching USD 125 billion by 2030 and USD 425 billion by 2047. This robust expansion is expected to drive demand for high-quality excipients, including talc, which plays a critical role in pharmaceutical formulations. As the industry advances in drug manufacturing, delivery systems, and exports, the need for talc as a lubricant, glidant, and moisture-absorbing agent is set to increase substantially, positioning it as a key material in supporting the sector's rapid growth.

Talc is widely used in topical applications and dermatological products such as medicated powders. Its natural absorbency makes it ideal for moisture control, helping manage skin conditions and enhance hygiene. In addition, its soothing properties and inert nature make it compatible with a range of natural and herbal ingredients, aligning with the rising consumer preference for plant-based or alternative medicines. The mineral’s utility extends into advanced drug delivery systems, such as inhalers and controlled-release tablets. Talc’s lubricating properties contribute to precise dosing and consistent performance of dry powder inhalers, a growing segment in respiratory treatments. These applications are critical as the pharmaceutical industry moves toward personalized medicine and targeted therapies.

As regulatory bodies across the globe emphasize safe and consistent pharmaceutical practices, talc’s established reputation for purity and stability has become a key advantage. Pharmaceutical-grade talc complies with stringent regulatory standards and is subject to rigorous quality controls, making it a preferred choice among formulators. The global shift toward health-conscious living, combined with innovations in drug delivery and increasing demand for high-performance excipients, is set to drive continued growth in talc utilization within the pharmaceutical industry. As a result, talc is no longer viewed merely as a filler or additive, but as a strategic enabler of innovation and quality in pharmaceutical development.

Key Market Challenges

Regulatory Compliance and Health Concerns

The talc industry operates within a complex regulatory landscape, with diverse regions and countries imposing varying standards and requirements. Regulatory compliance spans a wide spectrum, encompassing quality control, purity levels, labeling, and environmental considerations. This complexity arises from the wide-ranging applications of talc, each subject to its own set of regulations. One notable regulatory concern in the talc market revolves around asbestos contamination. Talc deposits often occur in close proximity to asbestos deposits, thereby raising concerns of cross-contamination. Asbestos, a known carcinogen, poses significant health risks when present in talc-based products. The challenge lies in ensuring that talc utilized in consumer goods is free from asbestos contamination, necessitating stringent testing and quality assurance measures.Key Market Trends

Technological Advancements

The global talc market, a pivotal component in various industries, is undergoing a significant transformation driven by rapid technological advancements. From the realm of cosmetics to automotive manufacturing, the applications of talc are diverse and far-reaching, and these innovations are reshaping its production, processing, and utilization. Technological advancements have revolutionized these processes, rendering them more precise, efficient, and environmentally sustainable. Digital technologies such as Geographic Information Systems (GIS) and remote sensing have empowered geologists to identify potential talc deposits with heightened accuracy, thereby reducing the necessity for invasive exploration methods and minimizing ecological impact.Data analytics and predictive modeling are being leveraged to optimize mining operations. Real-time monitoring of mining equipment, predictive maintenance, and automation are enhancing safety and productivity in talc mines. This integration of technology not only enhances operational efficiency but also promotes sustainability by minimizing waste and resource consumption.

Key Market Players

- IMI Fabi SpA

- LITHOS Industrial Mineral GmbH

- Minerals technology Inc.

- Nippon Talc Co., Ltd.

- Superior Materials Inc.

- Laizhou Talc Industry Corp.

- Haichen Minchem Co.

- Liaoning qianhe Talc Group

- Sun Minerals Sdn Bhd

- Arihant Chemicals & Resins (India) Private Limited

Report Scope:

In this report, the Global Talc Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Talc Market, By Type of Deposition:

- Talc Chlorite

- Talc Carbonate

- Others

Talc Market, By Application:

- Ceramics

- Paper & Pulp

- Pharmaceutical

- Paints & Coatings

- Plastics

- Others

Talc Market, By region:

- North America

- United States

- Canada

- Mexico

- Asia-Pacific

- China

- India

- South Korea

- Australia

- Japan

- Europe

- Germany

- France

- United Kingdom

- Spain

- Italy

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Talc Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- IMI Fabi SpA

- LITHOS Industrial Mineral GmbH

- Minerals technology Inc.

- Nippon Talc Co., Ltd.

- Superior Materials Inc.

- Laizhou Talc Industry Corp.

- Haichen Minchem Co.

- Liaoning qianhe Talc Group

- Sun Minerals Sdn Bhd

- Arihant Chemicals & Resins (India) Private Limited

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 184 |

| Published | August 2025 |

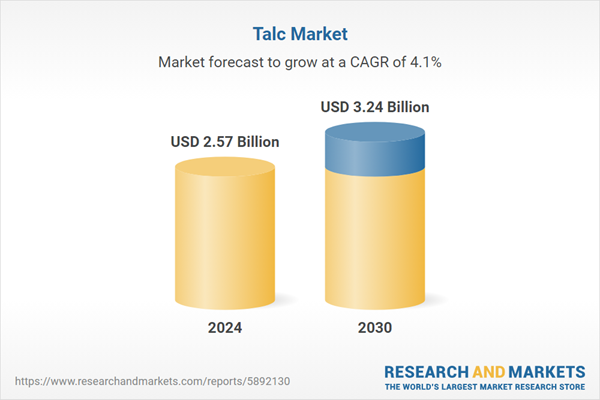

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 2.57 Billion |

| Forecasted Market Value ( USD | $ 3.24 Billion |

| Compound Annual Growth Rate | 4.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |