1 Introduction

1.1 Study Objectives

1.2 Market Definition

1.2.1 Inclusions and Exclusions

Table 1 Synthetic Fuels Market: Inclusions and Exclusions

1.3 Market Scope

Figure 1 Synthetic Fuels Market Segmentation

1.3.1 Regional Scope

1.3.2 Years Considered

1.4 Currency Considered

1.5 Units Considered

1.6 Limitations

1.7 Stakeholders

2 Research Methodology

2.1 Research Data

Figure 2 Synthetic Fuels Market: Research Design

2.1.1 Secondary Data

2.1.1.1 Key Data from Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data from Primary Sources

2.1.2.2 Breakdown of Primary Interviews

2.1.2.3 Key Industry Insights

2.2 Matrix Considered for Demand Side

Figure 3 Main Matrix Considered for Assessing Demand for Synthetic Fuels

2.3 Market Size Estimation

2.3.1 Bottom-Up Approach

Figure 4 Market Size Estimation: Bottom-Up Approach

2.3.2 Top-Down Approach

Figure 5 Market Size Estimation: Top-Down Approach

2.4 Methodology for Supply-Side Sizing of Synthetic Fuels Market

2.5 Analysis of Supply-Side Sizing of Synthetic Fuels Market

2.5.1 Calculations Based on Supply-Side Analysis

2.5.2 Growth Forecast

2.6 Market Breakdown and Data Triangulation

Figure 6 Synthetic Fuels Market: Data Triangulation

2.7 Impact of Recession

2.8 Research Assumptions

2.9 Research Limitations

2.10 Risk Analysis

3 Executive Summary

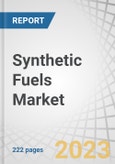

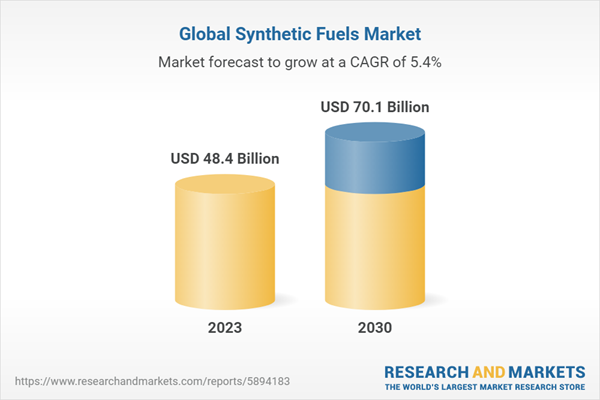

Table 2 Synthetic Fuels Market Snapshot: 2023 Vs. 2030

Figure 7 Methanol to Liquid (Mtl) to Hold Largest Market During Forecast Period

Figure 8 Transportation Segment to Register Highest CAGR During Forecast Period

Figure 9 Diesel Segment to Account for Largest Market During Forecast Period

Figure 10 North America to Witness Highest CAGR During Forecast Period

4 Premium Insights

4.1 Attractive Opportunities for Players in Synthetic Fuels Market

Figure 11 Synthetic Fuels Market Driven by Increase in Demand from Aerospace & Defense, Marine, and Other Sectors

4.2 Synthetic Fuels Market, by Region

Figure 12 Asia-Pacific to Account for Largest Market During Forecast Period

4.3 Synthetic Fuels Market, by Fuel Type

Figure 13 Power to Liquid Fuel to Register Highest CAGR During Forecast Period

4.4 Synthetic Fuels Market, by End Use

Figure 14 Transportation Segment Accounted for Largest Market Share in 2023

4.5 Synthetic Fuels Market, by Application

Figure 15 Kerosene to Register Highest CAGR During Forecast Period

5 Market Overview

5.1 Market Dynamics

Figure 16 Drivers, Restraints, Opportunities, and Challenges in Synthetic Fuels Market

5.1.1 Drivers

5.1.1.1 Investment by Private Players Boosting Research and Development

5.1.1.2 Diversification in Primary Energy Mix

5.1.2 Restraints

5.1.2.1 High Cost of Synthetic Fuel

5.1.2.2 Growing Market for Electric Vehicles and Alternative Fuel

5.1.3 Opportunities

5.1.3.1 High Potential Use of Synthetic Fuels in Various Applications

5.1.3.2 Introduction of Carbon Pricing Mechanism and Tax Credits for Synthetic Fuel Production

5.1.4 Challenges

5.1.4.1 Difficulty in Achieving Economies of Scale in Synthetic Fuel Production

5.2 Value Chain Analysis

Figure 17 Value Chain Analysis of Synthetic Fuels Market

5.3 Ecosystem Mapping

Figure 18 Ecosystem Mapping of Synthetic Fuels Market

Table 3 Ecosystem of Synthetic Fuels Market

5.4 Porter's Five Forces Analysis

Figure 19 Porter's Five Forces Analysis of Synthetic Fuels Market

Table 4 Impact of Porter's Five Forces on the Synthetic Fuels Market

5.4.1 Bargaining Power of Suppliers

5.4.2 Threat of New Entrants

5.4.3 Threat of Substitutes

5.4.4 Bargaining Power of Buyers

5.4.5 Intensity of Competitive Rivalry

5.5 Pricing Analysis

5.5.1 Average Selling Price Trend, by Region

Figure 20 Synthetic Fuels Market: Average Selling Price Trend, by Region

5.5.2 Indicative Price Trend, by Fuel Type

Figure 21 Synthetic Fuels Market: Indicative Price Trend, by Fuel Type

5.6 Tariff and Regulatory Landscape

5.6.1 Regulatory Bodies, Government Agencies, and Other Organizations

Table 5 North America: Regulatory Bodies, Government Agencies, and Other Organizations

Table 6 Europe: Regulatory Bodies, Government Agencies, and Other Organizations

Table 7 Asia-Pacific: Regulatory Bodies, Government Agencies, and Other Organizations

Table 8 Rest of the World: Regulatory Bodies, Government Agencies, and Other Organizations

5.6.2 Market Regulations and Standards

Table 9 Regulations and Standards for Fuels

5.7 Key Conferences and Events (2023-2024)

Table 10 Synthetic Fuels Market: Key Conferences and Events (2023-2024)

5.8 Key Stakeholders and Buying Criteria

5.8.1 Key Stakeholders in the Buying Process

Figure 22 Influence of Stakeholders on the Buying Process for Top Three End Uses

Table 11 Influence of Stakeholders on the Buying Process for Top Three End Uses (%)

Figure 23 Key Buying Criteria for Top Three End Uses

Table 12 Key Buying Criteria for Top Three End Uses

5.9 Patent Analysis

5.9.1 Methodology

Figure 24 List of Major Patents for Synthetic Fuels

5.9.2 Jurisdiction Analysis

Figure 25 Us Accounted for Highest Patent Count

5.9.2.1 Major Patents

Table 13 List of Recent Patents by General Electric

Table 14 List of Recent Patents by Exxonmobil

Table 15 List of Recent Patents by Basf Se

5.10 Technology Analysis

5.10.1 Synthetic Biology Project Paves the Way for Carbon-Negative Biofuels

5.10.2 Pioneering Carbon-Neutral Synthetic Fuel for Net-Zero Aviation

5.11 Case Study Analysis

5.11.1 Porsche's Carbon-Neutral Synthetic Fuels from Thin Air

5.11.2 Honeywell's Uop Efining Technology Pioneers Sustainable Aviation Fuel

5.12 Trade Data

5.12.1 Export Scenario

Table 16 Export Data on Hs Code: 27101951: Mineral Fuels, Mineral Oils, and Products of Their Distillation; Bituminous Substances; Mineral Waxes (USD Thousand)

5.12.2 Import Scenario

Table 17 Import Data on Hs Code: 27101951: Mineral Fuels, Mineral Oils, and Products of Their Distillation; Bituminous Substances; Mineral Waxes (USD Thousand)

5.13 Trends/Disruptions Impacting Customer Business

5.13.1 Revenue Shifts and New Revenue Pockets for Synthetic Fuel Manufacturers/Suppliers

Figure 26 Revenue Shift for Synthetic Fuel Manufacturers

6 Synthetic Fuels Market, by Feedstock

6.1 Introduction

Figure 27 Synthetic Fuels Market, by Feedstock

6.2 Natural Gas

6.3 Methanol

6.4 Power

6.5 Other Feedstocks

7 Synthetic Fuels Market, by Process

7.1 Introduction

7.2 Fischer-Tropsch Synthesis

7.3 Methanol Synthesis

7.4 Electrolysis

Figure 28 Synthetic Fuels Market, by Process (Electrolysis)

7.5 Coal Liquefaction

8 Synthetic Fuels Market, by Fuel Type

8.1 Introduction

Figure 29 Methanol to Liquid Segment to be Largest Market During Forecast Period

Table 18 Synthetic Fuels Market, by Fuel Type, 2019-2022 (USD Million)

Table 19 Synthetic Fuels Market, by Fuel Type, 2023-2030 (USD Million)

Table 20 Synthetic Fuels Market, by Fuel Type, 2019-2022 (Million Liter)

Table 21 Synthetic Fuels Market, by Fuel Type, 2023-2030 (Million Liter)

8.2 Gas to Liquid Fuel

8.2.1 Increasing Demand for High Energy Density Fuel to Promote Market Growth

Table 22 Gas to Liquid: Synthetic Fuels Market, by Region, 2019-2022 (USD Million)

Table 23 Gas to Liquid: Synthetic Fuels Market, by Region, 2023-2030 (USD Million)

8.3 Methanol to Liquid

8.3.1 Clean-Burning and High-Octane Rating Offered by Methanol to Boost Market

Table 24 Methanol to Liquid: Synthetic Fuels Market, by Region, 2019-2022 (USD Million)

Table 25 Methanol to Liquid: Synthetic Fuels Market, by Region, 2023-2030 (USD Million)

8.4 Power to Liquid Fuel

8.4.1 Very Low Lifecycle Emissions to Drive Demand

Table 26 Power to Liquid: Synthetic Fuels Market, by Region, 2019-2022 (USD Million)

Table 27 Power to Liquid: Synthetic Fuels Market, by Region, 2023-2030 (USD Million)

8.5 Other Fuel Types

Table 28 Others: Synthetic Fuels Market, by Region, 2019-2022 (USD Million)

Table 29 Others: Synthetic Fuels Market, by Region, 2023-2030 (USD Million)

9 Synthetic Fuels Market, by Application

9.1 Introduction

Figure 30 Diesel Segment to Lead Synthetic Fuels Market During Forecast Period

Table 30 Synthetic Fuels Market, by Application, 2019-2022 (USD Million)

Table 31 Synthetic Fuels Market, by Application, 2023-2030 (USD Million)

9.2 Gasoline

9.2.1 Compatibility with Existing Internal Combustion Engines & Infrastructure to Boost Demand

9.3 Diesel

9.3.1 Reduced Sulfur Emissions Aided by Low Sulfur Content to Drive Market

9.4 Kerosene

9.4.1 Enhanced Energy Security and Sustainability to Create Growth Opportunities

10 Synthetic Fuels Market, by End Use

10.1 Introduction

Figure 31 Transportation Segment to Grow at Highest CAGR During Forecast Period

Table 32 Synthetic Fuels Market, by End Use, 2019-2022 (USD Million)

Table 33 Synthetic Fuels Market, by End Use, 2023-2030 (USD Million)

10.2 Transportation

10.2.1 Growing Vehicle Production Worldwide to Drive Demand

10.3 Industrial

10.3.1 Aim to Reduce Carbon Emissions and Achieve Carbon Neutrality to Boost Demand

10.4 Chemical & Others

10.4.1 Increasing Preference for Sustainable and Eco-Friendly Practices to Propel Demand

11 Synthetic Fuels Market, by Market Maturity

11.1 Introduction

11.2 Prototyping/Introductory

11.3 Emerging

11.4 Mature

12 Synthetic Fuels Market, by Environmental Impact

12.1 Introduction

12.2 Carbon-Neutral/Capture Technologies

12.3 Low-Carbon/Conventional

13 Synthetic Fuels Market, by Region

13.1 Introduction

Figure 32 Asia-Pacific to Lead Synthetic Fuels Market During Forecast Period

Table 34 Synthetic Fuels Market, by Region, 2019-2022 (USD Million)

Table 35 Synthetic Fuels Market, by Region, 2023-2030 (USD Million)

13.2 North America

13.2.1 Recession Impact

Figure 33 North America: Synthetic Fuels Market Snapshot

Table 36 North America: Synthetic Fuels Market, by Country, 2019-2022 (USD Million)

Table 37 North America: Synthetic Fuels Market, by Country, 2023-2030 (USD Million)

Table 38 North America: Synthetic Fuels Market, by Fuel Type, 2019-2022 (USD Million)

Table 39 North America: Synthetic Fuels Market, by Fuel Type, 2023-2030 (USD Million)

Table 40 North America: Synthetic Fuels Market, by End Use, 2019-2022 (USD Million)

Table 41 North America: Synthetic Fuels Market, by End Use, 2023-2030 (USD Million)

13.2.2 US

13.2.2.1 Robust Investments, Technological Innovation, and Government Support to Drive Market

Table 42 US: Synthetic Fuels Market, by Fuel Type, 2019-2022 (USD Million)

Table 43 US: Synthetic Fuels Market, by Fuel Type, 2023-2030 (USD Million)

13.2.3 Canada

13.2.3.1 Investments and Global Partnerships to Drive Market

Table 44 Canada: Synthetic Fuels Market, by Fuel Type, 2019-2022 (USD Million)

Table 45 Canada: Synthetic Fuels Market, by Fuel Type, 2023-2030 (USD Million)

13.2.4 Mexico

13.2.4.1 Strategic Initiatives, Partnerships, and Investments to Drive Market

Table 46 Mexico: Synthetic Fuels Market, by Fuel Type, 2019-2022 (USD Million)

Table 47 Mexico: Synthetic Fuels Market, by Fuel Type, 2023-2030 (USD Million)

13.3 Europe

13.3.1 Recession Impact

Figure 34 Europe: Synthetic Fuels Market Snapshot

Table 48 Europe: Synthetic Fuels Market, by Country, 2019-2022 (USD Million)

Table 49 Europe: Synthetic Fuels Market, by Country, 2023-2030 (USD Million)

Table 50 Europe: Synthetic Fuels Market, by Fuel Type, 2019-2022 (USD Million)

Table 51 Europe: Synthetic Fuels Market, by Fuel Type, 2023-2030 (USD Million)

Table 52 Europe: Synthetic Fuels Market, by End Use, 2019-2022 (USD Million)

Table 53 Europe: Synthetic Fuels Market, by End Use, 2023-2030 (USD Million)

13.3.2 Germany

13.3.2.1 Private Investments and Commitment to Green Energy Solutions to Drive Market

Table 54 Germany: Synthetic Fuels Market, by Fuel Type, 2019-2022 (USD Million)

Table 55 Germany: Synthetic Fuels Market, by Fuel Type, 2023-2030 (USD Million)

13.3.3 UK

13.3.3.1 Alignment with Decarbonization Policies, Low-Carbon Fuel Adoption, Investments, and Technological Advancements to Drive Market

Table 56 UK: Synthetic Fuels Market, by Fuel Type, 2019-2022 (USD Million)

Table 57 UK: Synthetic Fuels Market, by Fuel Type, 2023-2030 (USD Million)

13.3.4 Russia

13.3.4.1 Government and Industry Backing to Drive Market

13.3.5 France

13.3.5.1 Tax Incentives and Industry Collaborations to Drive Market

Table 58 France: Synthetic Fuels Market, by Fuel Type, 2019-2022 (USD Million)

Table 59 France: Synthetic Fuels Market, by Fuel Type, 2023-2030 (USD Million)

13.3.6 Rest of Europe

Table 60 Rest of Europe: Synthetic Fuels Market, by Fuel Type, 2019-2022 (USD Million)

Table 61 Rest of Europe: Synthetic Fuels Market, by Fuel Type, 2023-2030 (USD Million)

13.4 Asia-Pacific

13.4.1 Recession Impact

Figure 35 Asia-Pacific: Synthetic Fuels Market Snapshot

Table 62 Asia-Pacific: Synthetic Fuels Market, by Country, 2019-2022 (USD Million)

Table 63 Asia-Pacific: Synthetic Fuels Market, by Country, 2023-2030 (USD Million)

Table 64 Asia-Pacific: Synthetic Fuels Market, by Fuel Type, 2019-2022 (USD Million)

Table 65 Asia-Pacific: Synthetic Fuels Market, by Fuel Type, 2023-2030 (USD Million)

Table 66 Asia-Pacific: Synthetic Fuels Market, by End Use, 2019-2022 (USD Million)

Table 67 Asia-Pacific: Synthetic Fuels Market, by End Use, 2023-2030 (USD Million)

13.4.2 China

13.4.2.1 Government Support and Investments in Synthetic Fuel Technologies, Such as Mto and Saf, to Drive Market

Table 68 China: Synthetic Fuels Market, by Fuel Type, 2019-2022 (USD Million)

Table 69 China: Synthetic Fuels Market, by Fuel Type, 2023-2030 (USD Million)

13.4.3 Japan

13.4.3.1 Green Growth Strategy, Advanced Hydrogen Tech, and Maritime Focus to Drive Market

Table 70 Japan: Synthetic Fuels Market, by Fuel Type, 2019-2022 (USD Million)

Table 71 Japan: Synthetic Fuels Market, by Fuel Type, 2023-2030 (USD Million)

13.4.4 India

13.4.4.1 Strategic Initiatives, Research Progress, and Government Support to Drive Market

Table 72 India: Synthetic Fuels Market, by Fuel Type, 2019-2022 (USD Million)

Table 73 India: Synthetic Fuels Market, by Fuel Type, 2023-2030 (USD Million)

13.4.5 South Korea

13.4.5.1 Government Policies, Research, and Corporate Partnerships to Drive Market

Table 74 South Korea: Synthetic Fuels Market, by Fuel Type, 2019-2022 (USD Million)

Table 75 South Korea: Synthetic Fuels Market, by Fuel Type, 2023-2030 (USD Million)

13.4.6 Rest of Asia-Pacific

Table 76 Rest of Asia-Pacific: Synthetic Fuels Market, by Fuel Type, 2019-2022 (USD Million)

Table 77 Rest of Asia-Pacific: Synthetic Fuels Market, by Fuel Type, 2023-2030 (USD Million)

13.5 Rest of World

13.5.1 Recession Impact

Table 78 Rest of World: Synthetic Fuels Market, by Region, 2019-2022 (USD Million)

Table 79 Rest of World: Synthetic Fuels Market, by Region, 2023-2030 (USD Million)

Table 80 Rest of World: Synthetic Fuels Market, by Fuel Type, 2019-2022 (USD Million)

Table 81 Rest of World: Synthetic Fuels Market, by Fuel Type, 2023-2030 (USD Million)

Table 82 Rest of World: Synthetic Fuels Market, by End Use, 2019-2022 (USD Million)

Table 83 Rest of World: Synthetic Fuels Market, by End Use, 2023-2030 (USD Million)

14 Competitive Landscape

14.1 Introduction

14.2 Strategies Adopted by Key Players

Table 84 Overview of Strategies Adopted by Key Manufacturers

14.3 Revenue Analysis

Figure 36 Revenue Analysis of Key Companies (2018-2022)

14.4 Market Share Analysis

14.4.1 Ranking of Key Market Players, 2022

Figure 37 Ranking of Top Five Players in Synthetic Fuels Market, 2022

14.4.2 Market Share of Key Players

Figure 38 Synthetic Fuels Market Share Analysis

Table 85 Synthetic Fuels Market: Degree of Competition

14.5 Company Evaluation Quadrant (Tier 1)

14.5.1 Stars

14.5.2 Emerging Leaders

14.5.3 Pervasive Players

14.5.4 Participants

Figure 39 Company Evaluation Quadrant: Synthetic Fuels Market (Tier 1 Companies)

14.5.5 Company Footprint

Figure 40 Synthetic Fuels Market: Company Footprint

Table 86 Synthetic Fuels Market: End Use Footprint

Table 87 Synthetic Fuels Market: Company Region Footprint

14.6 Start-Up/Sme Evaluation Quadrant

14.6.1 Progressive Companies

14.6.2 Responsive Companies

14.6.3 Dynamic Companies

14.6.4 Starting Blocks

Figure 41 Start-Up/Sme Evaluation Quadrant: Synthetic Fuels Market

14.6.5 Competitive Benchmarking

Table 88 Synthetic Fuels Market: Detailed List of Key Start-Ups/SMEs

Table 89 Synthetic Fuels Market: Competitive Benchmarking of Key Start-Ups/SMEs

14.7 Competitive Scenarios and Trends

14.7.1 Deals

Table 90 Synthetic Fuels Market: Deals (2019-August 2023)

14.7.2 Other Developments

Table 91 Synthetic Fuels Market: Expansions, Investments, and Innovations (2019-August 2023)

15 Company Profiles

Business Overview, Products/Solutions/Services Offered, Recent Developments, Analyst's View, Key Strengths, Strategic Choices, Weaknesses and Competitive Threats

15.1 Key Players

15.1.1 Shell

Table 92 Shell: Company Overview

Figure 42 Shell: Company Snapshot

Table 93 Shell: Products Offered

Table 94 Shell: Deals

Table 95 Shell: Others

15.1.2 Sasol

Table 96 Sasol: Company Overview

Figure 43 Sasol: Company Snapshot

Table 97 Sasol: Products Offered

Table 98 Sasol: Deals

15.1.3 Chn Energy Investment Group Co., Ltd.

Table 99 Chn Energy Investment Group Co., Ltd.: Company Overview

Table 100 Chn Energy Investment Group Co., Ltd: Products Offered

Table 101 Chn Energy Investment Group Co., Ltd.: Deals

Table 102 Chn Energy Investment Group Co., Ltd.: Others

15.1.4 Chevron Renewable Energy Group

Table 103 Chevron Renewable Energy Group: Company Overview

Table 104 Chevron Renewable Energy Group: Products Offered

Table 105 Chevron Renewable Energy Group: Deals

Table 106 Chevron Renewable Energy Group: Others

15.1.5 ExxonMobil Corporation

Table 107 Exxonmobil Corporation: Company Overview

Figure 44 Exxonmobil Corporation: Company Snapshot

Table 108 Exxonmobil Corporation: Products Offered

Table 109 Exxonmobil Corporation: Deals

15.1.6 Totalenergies

Table 110 Totalenergies: Company Overview

Figure 45 Totalenergies: Company Snapshot

Table 111 Totalenergies: Products Offered

Table 112 Totalenergies: Deals

15.1.7 Neste

Table 113 Neste: Company Overview

Figure 46 Neste: Company Snapshot

Table 114 Neste: Products Offered

Table 115 Neste: Deals

Table 116 Neste: Others

15.1.8 Petro Sa

Table 117 Petro Sa: Company Overview

Table 118 Petro Sa: Products Offered

15.1.9 Linde Engineering

Table 119 Linde Engineering: Company Overview

Figure 47 Linde Engineering: Company Snapshot

Table 120 Linde Engineering: Products Offered

15.1.10 Synthesis Energy Systems, Inc.

Table 121 Synthesis Energy Systems, Inc.: Company Overview

Table 122 Synthesis Energy Systems, Inc.: Products Offered

15.1.11 Dakota Gasification Company

Table 123 Dakota Gasification Company: Company Overview

Figure 48 Dakota Gasification Company: Company Snapshot

Table 124 Dakota Gasification Company: Products Offered

15.1.12 Topsoe

Table 125 Topsoe: Company Overview

Figure 49 Topsoe: Company Snapshot

Table 126 Topsoe: Products Offered

Table 127 Topsoe: Deals

Table 128 Topsoe: Others

15.1.13 Maire Tecnimont S.P.A.

Table 129 Maire Tecnimont S.P.A.: Company Overview

Figure 50 Maire Tecnimont S.P.A.: Company Snapshot

Table 130 Maire Tecnimont S.P.A.: Products Offered

Table 131 Maire Tecnimont S.P.A.: Deals

15.1.14 Sunfire GmbH

Table 132 Sunfire GmbH: Company Overview

Table 133 Sunfire GmbH: Products Offered

Table 134 Sunfire GmbH: Deals

15.1.15 Rwe

Table 135 Rwe: Company Overview

Figure 51 Rwe: Company Snapshot

Table 136 Rwe: Products Offered

Table 137 Rwe: Deals

15.1.16 Qatarenergy

Table 138 Qatarenergy: Company Overview

Figure 52 Qatarenergy: Company Snapshot

Table 139 Qatarenergy: Products Offered

Table 140 Qatarenergy: Deals

Table 141 Qatarenergy: Others

15.1.17 Inner Mongolia Yitai Coal Co., Ltd.

Table 142 Inner Mongolia Yitai Coal Co., Ltd.: Company Overview

Figure 53 Inner Mongolia Yitai Coal Co., Ltd.: Company Snapshot

Table 143 Inner Mongolia Yitai Coal Co., Ltd.: Products Offered

15.2 Other Players

15.2.1 Norsk E-Fuel

Table 144 Norsk E-Fuel: Company Overview

Table 145 Norsk E-Fuel: Products Offered

Table 146 Norsk E-Fuel: Deals

Table 147 Norsk E-Fuel: Others

15.2.2 Prometheus Fuels

Table 148 Prometheus Fuels: Company Overview

Table 149 Prometheus Fuels: Products Offered

Table 150 Prometheus Fuels: Deals

15.2.3 Skynrg

Table 151 Skynrg: Company Overview

Table 152 Skynrg: Products Offered

15.2.4 Synhelion Sa

Table 153 Synhelion Sa: Company Overview

Table 154 Synhelion Sa: Products Offered

Table 155 Synhelion Sa: Deals

15.2.5 Saf+ Consortium

Table 156 Saf+ Consortium: Company Overview

Table 157 Saf+ Consortium: Products Offered

Table 158 Saf+ Consortium: Deals

15.2.6 Virent, Inc.

Table 159 Virent, Inc.: Company Overview

Table 160 Virent, Inc.: Products Offered

Details on Business Overview, Products/Solutions/Services Offered, Recent Developments, Analyst's View, Key Strengths, Strategic Choices, Weaknesses and Competitive Threats Might Not be Captured in Case of Unlisted Companies.

16 Adjacent and Related Markets

16.1 Introduction

16.2 Limitations

16.3 Synthetic Fuels Interconnected Markets

16.3.1 Aviation Fuel Market

16.3.1.1 Market Definition

16.3.1.2 Market Overview

16.4 Aviation Fuel Market, by Fuel Type

16.4.1 Conventional Fuel

16.4.1.1 Aviation Turbine Fuel

16.4.1.2 Jet a

16.4.1.2.1 Extensive Use of Jet a Fuel in US

16.4.1.3 Jet A1

16.4.1.3.1 Rising Demand for Jet A1 Fuel Outside US

16.4.2 Avgas

16.4.2.1 Demand for Aviation Gasoline for Piston Engine Aircraft

16.5 Sustainable Fuel

16.5.1 Biofuel

16.5.1.1 Drop-In Capability with No Changes in Aircraft Infrastructure to Drive Demand

16.5.2 Hydrogen Fuel

16.5.2.1 Advantage of Being True Zero-Carbon Solution to Drive Demand

Table 161 Current Hydrogen-Powered Aircraft Developments

16.5.3 Power-To-Liquid

16.5.3.1 Benefits Like Very Low Lifecycle Emissions to Drive Demand

16.5.4 Gas-To-Liquid

16.5.4.1 Technological Advancements to Drive Demand

Table 162 Aviation Fuel Market, by Fuel Type, 2018-2021 (USD Million)

Table 163 Aviation Fuel Market, by Fuel Type, 2022-2030 (USD Million)

17 Appendix

17.1 Discussion Guide

17.2 Knowledgestore: The Subscription Portal

17.3 Customization Options