Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

At the heart of this remarkable growth is the transformative impact of RTLS solutions. These solutions offer more than just real-time location tracking; they provide a comprehensive suite of operational solutions, fortified tools, and innovative approaches that significantly boost efficiency and productivity across diverse industry sectors. The multifaceted applications of RTLS span from optimizing asset tracking and workforce management to enhancing security protocols and redefining logistics and supply chain operations.

One noteworthy aspect of the RTLS market's evolution is the surging demand for streamlined and interactive solutions. This demand is driven by the seamless integration of Global Real-time Location System technologies into everyday business operations. Innovative solutions, such as Internet of Things (IoT)-integrated platforms and interactive applications, have redefined the utility of digital twins. These advancements align seamlessly with transformative business strategies, enabling enterprises to strategically leverage technology to enhance operational experiences and drive efficiency to new heights.

The integration of IoT in RTLS platforms has been particularly transformative. It allows for the seamless connectivity of devices and assets in real time, providing a holistic view of operations. This real-time data exchange empowers businesses to make informed decisions promptly, optimize resource allocation, and respond rapidly to changing conditions. Consequently, it enables companies to improve customer experiences, reduce downtime, and enhance overall operational agility.

However, amid the rapid evolution of the RTLS market, addressing certain challenges remains imperative. Two of the most pressing challenges are regulatory compliance and security considerations. Striking a balance between innovation and operational effectiveness while upholding data integrity and privacy is essential. Regulatory frameworks vary across industries and regions, necessitating a nuanced approach to compliance. Additionally, ensuring the security of sensitive location data is paramount, especially given the potential consequences of data breaches or misuse.

In the dynamic landscape of industrial technology, the Global Real-time Location System market plays a pivotal role in enabling modernization. It fosters adaptability and streamlines processes, reshaping traditional paradigms for interconnected and innovative operations. Businesses are leveraging RTLS solutions to not only gain a competitive edge but also to stay ahead of evolving customer expectations and industry trends.

The impact of RTLS extends across multiple industry verticals. In the healthcare sector, RTLS is revolutionizing patient care and asset tracking, ensuring that critical medical equipment and personnel are where they are needed most. In logistics and supply chain management, real-time location data enhances visibility and reduces inefficiencies, leading to cost savings and improved customer satisfaction. Moreover, the manufacturing industry is embracing RTLS to optimize production processes, monitor equipment health, and ensure the timely delivery of products.

In conclusion, the Global Real-time Location System market's remarkable growth and transformative impact underscore its crucial role in shaping the future of various industries. Its ability to drive efficiency, productivity, and innovation positions it as a driving force in the ongoing transformation of business operations. As businesses across the globe increasingly recognize the value of real-time location data and its potential to reshape their operational landscapes, the RTLS market is poised for continued growth and innovation in the years to come. It represents not only a technology solution but a catalyst for operational excellence and a key enabler of the digital transformation journey for enterprises worldwide.

Key Market Drivers

Driver 1: Increasing Demand for Enhanced Asset Tracking and Management

In today's fast-paced business environment, efficient asset tracking and management have become paramount for organizations across various industries. The Global Real-time Location System (RTLS) Market is witnessing significant growth driven by the escalating demand for enhanced asset tracking capabilities. Companies are increasingly adopting RTLS solutions to gain real-time visibility into the location and status of their valuable assets, such as equipment, inventory, and vehicles. This level of visibility enables businesses to optimize asset utilization, reduce downtime, and improve overall operational efficiency. With RTLS technology, organizations can precisely track the movement of assets within facilities, ensuring they are where they are needed, minimizing loss, and streamlining resource allocation. The need for efficient asset management and the potential for substantial cost savings are key factors propelling the adoption of RTLS solutions across industries like manufacturing, logistics, healthcare, and retail.Driver 2: Growing Emphasis on Workplace Safety and Security

Ensuring workplace safety and security has become a top priority for organizations worldwide, driven by regulatory requirements, evolving threats, and a heightened focus on employee well-being. This increased emphasis on safety and security is a significant driver for the Global RTLS Market. RTLS technology provides organizations with the tools needed to enhance the safety and security of their premises. It enables real-time monitoring and tracking of personnel, allowing for rapid response in emergency situations. For instance, in healthcare settings, RTLS helps track the location of patients, staff, and critical medical equipment, ensuring timely responses to emergencies and reducing the risk of adverse events. Similarly, in manufacturing and industrial environments, RTLS systems can enhance worker safety by monitoring their location and proximity to hazardous zones. The demand for robust safety and security solutions is fueling the adoption of RTLS across industries, making it an essential component of modern workplace management strategies.Driver 3: Advancements in Internet of Things (IoT) Integration

The Global RTLS Market is benefiting from the ongoing advancements in Internet of Things (IoT) integration. IoT technology is becoming increasingly integrated with RTLS solutions, unlocking new possibilities for real-time location tracking and data analytics. This integration allows organizations to create interconnected ecosystems where devices, assets, and people communicate seamlessly. The IoT-enabled RTLS systems collect and transmit valuable location data to centralized platforms, enabling organizations to make data-driven decisions, optimize processes, and enhance customer experiences. For example, in the retail industry, IoT-integrated RTLS can provide insights into customer traffic patterns, enabling retailers to improve store layouts and product placements. In logistics, it allows for real-time monitoring of shipments and the optimization of delivery routes. As IoT integration continues to evolve, the Global RTLS Market is poised for further expansion, offering organizations advanced tools to drive operational excellence and stay competitive in today's digital age.Key Market Challenges

Data Privacy and Security Concerns

The Global Real-time Location System (RTLS) Market is not without its challenges, and one of the foremost among them is the rising concern over data privacy and security. As RTLS technology becomes increasingly integrated into various industries and applications, the collection and utilization of real-time location data raise significant privacy and security considerations.Privacy Concerns: One of the primary challenges lies in striking a balance between the benefits of RTLS, such as enhanced asset tracking and improved operational efficiency, and the protection of individuals' privacy. In settings like healthcare, where RTLS is used to track the location of patients, staff, and equipment, ensuring the privacy of sensitive health information is critical. Similarly, in workplace environments, tracking employees' movements can raise privacy concerns. Businesses and organizations must implement stringent privacy policies and data protection measures to address these concerns and comply with relevant regulations like GDPR (General Data Protection Regulation).

Security Risks: The real-time location data generated by RTLS systems can be highly valuable, making it an attractive target for cyberattacks and unauthorized access. Security breaches could compromise the integrity of location data, disrupt operations, or even pose safety risks in certain applications. Ensuring the security of RTLS systems and the data they generate is imperative. This involves implementing robust cybersecurity measures, encryption protocols, and access controls to safeguard sensitive information.

Addressing data privacy and security concerns requires a collaborative effort between RTLS providers, businesses, and regulatory bodies. Stricter regulations and standards for data protection and security may emerge to mitigate these challenges. RTLS solution providers need to invest in robust security measures and educate their clients on best practices to minimize risks and build trust in the technology.

Initial Implementation Costs and ROI

Another significant challenge facing the Global RTLS Market is the upfront costs associated with implementing these systems and the perceived return on investment (ROI). While RTLS technology offers substantial benefits in terms of improved operational efficiency, asset tracking, and safety, the initial investment required for hardware, software, and integration can be substantial.Hardware and Infrastructure Costs: RTLS systems often require the deployment of specialized hardware components such as tags, readers, sensors, and networking infrastructure. These costs can vary depending on the scale and complexity of the deployment. For smaller businesses or organizations with limited budgets, these upfront expenses may pose a barrier to adoption.

ROI Perception: Demonstrating the ROI of RTLS systems can also be challenging. While the technology offers long-term benefits, including cost savings, process optimization, and improved asset utilization, organizations may struggle to quantify these advantages upfront. The ROI might not be immediately apparent, leading to hesitation in adopting RTLS solutions.

To address this challenge, RTLS providers must work closely with their clients to perform comprehensive ROI assessments and provide clear value propositions. They should highlight not only the immediate benefits but also the long-term advantages, such as improved operational efficiency and competitive advantages. Offering flexible pricing models and financing options can also help mitigate the initial cost barrier and make RTLS adoption more accessible to a broader range of businesses and industries. Additionally, sharing success stories and case studies that showcase real-world ROI can build confidence among potential adopters and demonstrate the tangible benefits of RTLS technology.

Key Market Trends

Trend 1: Integration of IoT and RTLS for Enhanced Asset Management

In the Global Real-time Location System (RTLS) market, a prominent trend is the seamless integration of RTLS with Internet of Things (IoT) technology. This synergy allows organizations to gain real-time insights into the location and status of assets, both indoors and outdoors. IoT-enabled RTLS solutions offer businesses unprecedented visibility and control over their assets, leading to improved operational efficiency, reduced downtime, and cost savings.With IoT sensors and RTLS working in tandem, companies can monitor the movement and conditions of valuable assets such as equipment, vehicles, and inventory in real time. This trend is particularly valuable in industries like manufacturing, logistics, and healthcare, where precise tracking and monitoring are essential for optimizing processes and ensuring compliance.

Trend 2: Expansion of RTLS Applications Beyond Traditional Industries

The Global RTLS market is experiencing a notable shift as its applications expand beyond traditional industries like healthcare and manufacturing. Emerging sectors such as retail, hospitality, and smart cities are increasingly adopting RTLS solutions to enhance customer experiences and streamline operations.In retail, for instance, RTLS is revolutionizing inventory management, enabling retailers to track product movement on store shelves and optimize restocking processes. In the hospitality industry, hotels are using RTLS to improve guest services by providing location-based services and personalizing experiences. Additionally, smart city initiatives are leveraging RTLS for urban planning, traffic management, and public safety.

Trend 3: Rise in Demand for Privacy-Enhanced RTLS Solutions

As the Global RTLS market continues to grow, there is a growing concern over data privacy and security. In response to this, a significant trend is the development and adoption of privacy enhanced RTLS solutions. These solutions prioritize the protection of user and location data while still delivering the accuracy and functionality expected from RTLS technology.Privacy-enhanced RTLS solutions use encryption, anonymization, and access controls to safeguard sensitive location information. This is crucial in industries where privacy regulations are stringent, such as healthcare and finance. Companies are increasingly seeking RTLS providers that can demonstrate robust data protection measures to ensure compliance with evolving data privacy laws like GDPR and HIPAA.

In conclusion, the Global RTLS market is evolving rapidly, driven by the integration of IoT, diversification of applications, and a heightened focus on data privacy. Staying ahead of these trends will be essential for businesses seeking to leverage RTLS technology effectively and gain a competitive edge in their respective industries.

Segmental Insights

Technology Insights

In 2022, the Global Real-time Location System (RTLS) Market was predominantly dominated by the RFID (Radio-Frequency Identification) segment, and this dominance is anticipated to persist throughout the forecast period. RFID technology continued to hold a commanding position due to its versatility, cost-effectiveness, and widespread adoption across various industries. RFID-based RTLS solutions offer precise asset tracking and management capabilities, making them particularly well-suited for sectors like healthcare, manufacturing, logistics, and retail. The ability to track assets, personnel, and inventory in real time using RFID tags and readers has been a driving force behind its continued dominance. Moreover, RFID technology has evolved, offering improved range, accuracy, and integration capabilities, further solidifying its position as the preferred choice for real-time location tracking. As industries increasingly rely on data-driven decision-making and process optimization, RFID-based RTLS is poised to maintain its leading role in shaping the RTLS market landscape well into the foreseeable future.End-User Industry Insights

In 2022, the Global Real-time Location System (RTLS) Market was predominantly dominated by the Healthcare sector, and this dominance is projected to persist throughout the forecast period. The healthcare industry's strong foothold in the RTLS market can be attributed to the increasing adoption of RTLS solutions to enhance patient care, improve operational efficiency, and ensure the safety and security of medical assets. RTLS technology has revolutionized healthcare by enabling precise tracking of patients, staff, and critical equipment within hospitals and healthcare facilities, reducing response times during emergencies, minimizing asset loss, and enhancing patient experience through location-based services. As healthcare systems worldwide continue to emphasize patient outcomes and resource optimization, the demand for RTLS solutions within the healthcare sector is expected to remain robust, solidifying its dominant position in the market over the coming years. Additionally, ongoing technological advancements in RTLS tailored for healthcare applications are further expected to bolster its prominence in this industry..Regional Insights

In 2022, the Global Real-time Location System (RTLS) Market witnessed North America as the dominant region, and this dominance is anticipated to continue throughout the forecast period. North America's prominence in the RTLS market can be attributed to several factors, including robust technological infrastructure, high adoption rates across various industries, and a strong focus on improving operational efficiency. The region boasts a mature healthcare sector that extensively utilizes RTLS for asset and patient tracking, alongside the manufacturing, logistics, and transportation industries where RTLS plays a pivotal role in optimizing supply chains and ensuring asset visibility. Furthermore, the region's early adoption of IoT and advanced wireless technologies has paved the way for the widespread integration of RTLS solutions. With ongoing advancements in RTLS technology and a commitment to digital transformation, North America is expected to maintain its dominant position in the global RTLS market, serving as a key driver of market growth in the foreseeable future. The presence of numerous RTLS solution providers and a supportive regulatory environment further contribute to the region's leadership in this dynamic and rapidly expanding market.Key Market Players

- Zebra Technologies Corporation.

- STANLEY HEALTHCARE.

- CenTrak Inc

- UBISENSE GROUP PLC

- SONITOR TECHNOLOGIES AS

- AEROSCOUT INDUSTRIA

- DECAWAVE LIMITED

- MidmarkRtls Solutions Inc

- AiRISTA Flow Inc

- SECOM Co., Ltd

Report Scope

In this report, the Global Real-time Location System market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Global Real-time Location System Market, by Product Type:

- RTLS Hardware

- RTLS Software

- RTLS Services

Global Real-time Location System Market, by Technology:

- RFID (Radio-Frequency Identification

- Ultra-Wideband (UWB)

- GPS (Global Positioning System

Global Real-time Location System Market, by End-User Industry:

- Healthcare

- Manufacturing

- Transportation and Logistics

- Government and Defense

- Education

- Mining and Oil & Gas

- Others

Global Real-time Location System Market, by Region:

- North America

- Europe

- South America

- Middle East & Africa

- Asia Pacific

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Real-time Location System Market.Available Customizations

The following customization option is available based on your specific needs: Detailed analysis and profiling of additional market players (up to five).This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Zebra Technologies Corporation.

- STANLEY HEALTHCARE.

- CenTrak Inc.

- UBISENSE GROUP PLC

- SONITOR TECHNOLOGIES AS

- AEROSCOUT INDUSTRIA

- DECAWAVE LIMITED

- MidmarkRtls Solutions Inc.

- AiRISTA Flow Inc.

- SECOM Co. Ltd

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 183 |

| Published | October 2023 |

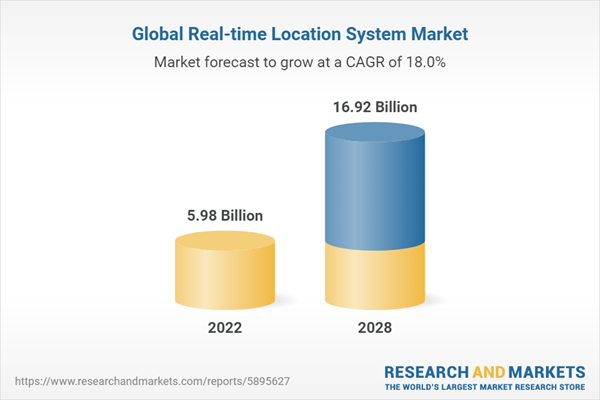

| Forecast Period | 2022 - 2028 |

| Estimated Market Value ( USD | $ 5.98 Billion |

| Forecasted Market Value ( USD | $ 16.92 Billion |

| Compound Annual Growth Rate | 17.9% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |