Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Key Market Drivers

Energy Resilience and Reliability

One of the key factors driving the growth of the global distributed generation (DG) market is the rising demand for enhanced energy resilience and reliability. Energy resilience refers to the ability of a system to withstand and recover quickly from disruptions, including natural disasters, cyberattacks, and grid failures. Distributed generation plays a vital role in achieving these objectives by decentralizing energy production and reducing dependence on centralized power plants and long-distance transmission lines.In regions prone to extreme weather events like hurricanes, wildfires, or severe storms, conventional power infrastructure can be susceptible to damage, resulting in widespread power outages. DG systems, such as solar panels, wind turbines, and backup generators, provide locally generated power that can continue operating even when the main grid is offline. This ensures that critical facilities such as hospitals, emergency response centers, and essential infrastructure remain functional during emergencies, thus saving lives and minimizing economic losses.

Moreover, with the increasing frequency and severity of climate-related disasters, governments, businesses, and homeowners are investing in DG systems to strengthen their energy resilience. This driving force has led to a significant surge in the adoption of DG technologies, especially in disaster-prone regions.

Decentralized Energy Generation and Energy Independence

The global DG market is driven by two key factors. Firstly, there is a growing demand for decentralized energy generation and energy independence. Unlike traditional energy systems that rely on centralized power plants and extensive transmission networks, DG systems allow end-users to produce electricity on-site. This reduces dependence on centralized utilities and transmission grids, offering benefits such as lower energy costs, increased energy security, and reduced carbon footprint. This shift towards energy independence is particularly attractive to commercial, industrial, and residential customers alike.Secondly, the desire for energy independence aligns with broader societal goals of sustainability and reduced environmental impact. by enabling individuals to generate their own clean energy through technologies like solar panels, small-scale wind turbines, and home battery storage systems, the DG market supports a more self-sustaining energy ecosystem. This has led to increased adoption of DG systems worldwide, driving growth in the market.

Overall, the demand for decentralized energy generation and energy independence has become a significant driver in the DG market, promoting sustainability and contributing to a more resilient and efficient energy landscape.

Environmental Sustainability and Carbon Reduction Goals

Environmental sustainability and the pursuit of carbon reduction goals represent a significant driving force in the global distributed generation market. Concerns regarding climate change, air quality, and greenhouse gas emissions have prompted governments, businesses, and individuals to seek cleaner and more sustainable energy sources.Distributed generation (DG) technologies, particularly those based on renewable energy sources like solar, wind, and hydroelectric power, are considered crucial for reducing carbon emissions and mitigating the effects of climate change. Electricity generation from renewable sources results in minimal to no direct greenhouse gas emissions, making them a responsible choice from an environmental standpoint.

Numerous countries and regions have set ambitious targets for renewable energy adoption and carbon reduction. Consequently, incentives, subsidies, and favorable policies have been implemented to encourage the deployment of DG systems. These initiatives range from feed-in tariffs for surplus electricity production to renewable energy certificates that incentivize clean energy generation.

Businesses and corporations are also embracing sustainability goals and increasingly integrating DG systems into their operations. Large corporations are investing in renewable energy projects, such as solar farms and wind installations, to power their facilities and reduce their carbon footprint.

The alignment of DG technologies with environmental sustainability objectives and carbon reduction goals has accelerated their adoption in the global energy landscape. As the world continues to prioritize clean energy and carbon neutrality, the DG market is expected to experience further growth, driven by a shared commitment to a more sustainable and environmentally friendly future.

Key Market Challenges

Integration into Existing Grids and Grid Stability

One of the key challenges confronting the global distributed generation (DG) market is the seamless integration of DG sources into existing electrical grids, ensuring grid stability. DG systems, encompassing solar panels, wind turbines, and combined heat and power (CHP) units, generate electricity at or near the point of consumption. While this distributed approach offers numerous advantages, it also presents challenges for grid operators.An important issue is the intermittent nature of many DG sources, such as solar and wind. Their output varies with weather conditions and time of day, posing difficulties in balancing supply and demand on the grid. Grid stability can be compromised if there is an oversupply of electricity from DG sources during periods of low demand or an undersupply during peak demand. This challenge becomes more pronounced as the proportion of DG in the energy mix increases.

To tackle this challenge, grid operators need to invest in advanced grid management systems, energy storage solutions, and demand response programs. Energy storage, in particular, plays a critical role in mitigating the variability of DG sources by storing surplus energy when available and releasing it when needed. However, the deployment of such technologies necessitates substantial investments and regulatory adjustments to incentivize measures that promote grid stability.

Moreover, the integration of DG sources into the grid entails intricate technical and regulatory considerations, including grid interconnection standards, voltage regulation, and grid protection. Collaboration between grid operators and policymakers is crucial in developing clear guidelines and standards to facilitate the seamless integration of DG systems while upholding grid reliability.

Regulatory and Policy Barriers

One of the major challenges in the global distributed generation market is the intricate regulatory and policy landscape. Regulations and policies vary significantly across regions and countries, and they can either facilitate or impede the growth of DG systems.For example, some regions have favorable net metering policies that enable DG system owners to receive credits or compensation for surplus electricity supplied to the grid. These policies incentivize the adoption of DG systems and promote renewable energy generation. However, in other areas, regulatory barriers like restrictive permitting processes, grid access fees, or low feed-in tariffs can discourage investment in DG technologies.

Furthermore, regulatory uncertainty and frequent policy changes can pose challenges for DG system developers and investors. Long-term planning and investment in DG projects become riskier when regulations are subject to frequent alterations or political shifts.

To address these challenges, policymakers need to establish clear and stable regulatory frameworks that encourage the deployment of DG technologies. This includes designing policies that provide fair compensation for DG system owners, streamline permitting processes, and remove barriers to grid interconnection. International cooperation and the sharing of best practices can also help align policies and regulatory approaches to support the global growth of distributed generation.

Financing and Cost-Effectiveness

Financing and cost-effectiveness are significant challenges for the global distributed generation market. While the costs of renewable energy technologies like solar panels and wind turbines have considerably decreased in recent years, the upfront capital investment required for DG systems can still be a barrier for many potential adopters.Accessing affordable financing options can be particularly challenging for residential and small-scale commercial customers. Financing models like power purchase agreements (PPAs) and leasing arrangements have helped mitigate this challenge by allowing customers to install DG systems with little or no upfront cost. However, expanding access to such financing options and tailoring them to local market conditions remains a challenge in many regions.

Moreover, the cost-effectiveness of DG systems can vary depending on factors such as the local energy market, energy prices, and available incentives. DG technologies must compete with traditional centralized power generation sources, and their cost-effectiveness can be influenced by subsidies, tax incentives, and electricity rates.

To address these challenges, governments and financial institutions can play a crucial role by offering incentives, subsidies, or low-interest loans to encourage the adoption of DG systems. Additionally, fostering competition among DG system providers and supporting research and development efforts to further reduce the cost of these technologies can enhance their cost-effectiveness and make them more accessible to a broader range of customers.

In conclusion, the global distributed generation market presents significant potential to transform the energy landscape by promoting renewable energy sources and enhancing energy resilience. However, addressing integration challenges, navigating complex regulatory environments, and improving financing options are critical steps in realizing the full benefits of distributed generation. Policymakers, grid operators, and industry stakeholders must collaborate to overcome these challenges and unlock the growth potential of distributed generation worldwide.

Key Market Trends

Increasing Adoption of Renewable Energy Sources in Distributed Generation

One of the notable trends in the global distributed generation market is the growing adoption of renewable energy sources. Distributed generation has become synonymous with renewable energy technologies like solar photovoltaic (PV) panels, wind turbines, and small-scale hydropower systems. This trend is driven by several factors that contribute to the global shift towards cleaner and more sustainable energy generation.Firstly, the declining costs of renewable energy technologies have made distributed generation solutions economically appealing. Solar and wind power, in particular, have witnessed significant cost reductions in recent years, making them competitive with or even cheaper than conventional fossil fuel-based electricity generation in many regions.

Secondly, the increasing environmental awareness and concerns about climate change have resulted in a strong preference for clean energy sources. Governments, businesses, and individuals are increasingly motivated to reduce their carbon footprint and mitigate the effects of global warming. Distributed generation enables them to actively participate in the transition to clean energy by generating their own electricity from renewable sources.

Furthermore, supportive policies and incentives such as feed-in tariffs, tax credits, and renewable energy certificates encourage the deployment of renewable distributed generation systems. Governments worldwide recognize the significance of distributed renewable energy as a means to achieve sustainability and carbon reduction goals, thereby driving further growth in this trend.

As the renewable energy sector continues to expand and innovation in distributed generation technologies advances, this trend is expected to persist. Distributed generation is poised to play a pivotal role in the global effort to transition towards a more sustainable and low-carbon energy landscape.

Energy Storage Integration for Grid Resilience and Flexibility

Another significant trend in the global distributed generation market is the integration of energy storage solutions. Energy storage, in the form of batteries and other storage technologies, is increasingly vital for enhancing grid resilience, managing intermittent renewable energy generation, and optimizing distributed generation systems.Energy storage provides a means to capture excess electricity generated by distributed sources during periods of low demand and release it when demand is high. This capability helps mitigate the variability of renewable energy sources like solar and wind, making the electricity supply more reliable and predictable.

One of the key drivers of this trend is the growing recognition of the importance of grid resilience. Combined with energy storage systems, distributed energy resources can provide backup power during grid outages, natural disasters, and emergencies. This capability is crucial for critical facilities such as hospitals, data centers, and emergency response centers.

Moreover, declining costs of energy storage technologies, coupled with advancements in battery chemistry and manufacturing, are making energy storage more accessible and cost-effective. This has led to increased deployment of residential, commercial, and industrial energy storage systems, further driving the trend.

In addition, grid operators are acknowledging the value of distributed generation and energy storage for grid stability and peak demand management. Utilities are increasingly implementing demand response programs and virtual power plants that aggregate distributed generation resources and energy storage to optimize grid operations.

As energy storage technology continues to evolve and costs continue to decrease, the integration of energy storage with distributed generation systems is expected to be a defining trend in the global energy landscape.

Segmental Insights

Technology Insights

The Solar PV Cells segment holds a significant market share in the Global Distributed Generation Market. The solar photovoltaic (PV) cells segment represents a significant and rapidly expanding portion of the global distributed generation market. Distributed generation with solar PV cells involves the decentralized production of electricity from sunlight using solar panels installed on rooftops, in residential and commercial areas, and in utility-scale solar farms.One of the most notable trends in the solar PV cells segment is the continuous decrease in the cost of solar panels and the ongoing technological advancements. The declining cost of solar PV modules has made distributed solar generation increasingly affordable and appealing to homeowners, businesses, and utilities. Technological innovations, such as higher efficiency solar cells and improved manufacturing processes, contribute to enhanced energy production and system durability, making solar PV an even more competitive choice.

Distributed generation with solar PV cells has witnessed strong adoption in residential and commercial sectors. Homeowners and businesses are increasingly opting for solar panels to reduce energy expenses, achieve energy independence, and minimize their carbon footprint. The distributed nature of these installations allows energy to be generated where it is most needed, thereby reducing transmission and distribution losses.

Apart from residential and commercial installations, utility-scale solar PV projects play a significant role in the distributed generation market. These large-scale solar farms generate electricity that is directly supplied to the grid. They play a crucial role in meeting renewable energy targets and curbing greenhouse gas emissions. Many utilities are investing in utility-scale solar projects to diversify their energy portfolios and transition to cleaner energy sources.

Application Insights

The On-Grid segment holds a significant market share in the Global Distributed Generation Market. This segment is characterized by distributed generation systems that primarily generate electricity for grid consumption but may also allow for the export of excess power to the grid. Solar photovoltaic (PV) systems are a dominant force within the on-grid distributed generation segment. The decreasing cost of solar panels, advancements in PV technology, and favorable policies, such as net metering, have driven the widespread adoption of rooftop solar systems for residential, commercial, and industrial applications. Solar PV continues to be a prominent choice for on-grid distributed generation, contributing to the growth of this segment.On-grid distributed generation systems play a crucial role in enhancing grid stability and energy resilience. They can act as a buffer during peak demand periods, reducing strain on the central grid and preventing blackouts. Additionally, in regions prone to extreme weather events or grid disruptions, on-grid distributed generation can provide backup power to critical facilities, ensuring uninterrupted operations during outages.

On-grid distributed generation systems are increasingly integrated into demand response programs and grid optimization efforts. Smart grid technologies enable grid operators to communicate with distributed resources, such as solar PV systems and controllable loads, to balance supply and demand in real-time. This integration helps optimize grid operations, reduce energy costs, and enhance overall grid efficiency.

Regional Insights

The North America region is expected to dominate the market during the forecast period. North America plays a critical role in the global distributed generation market, characterized by a diverse energy landscape, significant renewable energy potential, and an increasing focus on sustainability. Solar photovoltaic (PV) technology holds a dominant position in North America's distributed generation market. The decreasing cost of solar panels, along with federal and state incentives, and favorable net metering policies, have driven widespread adoption. Both residential and commercial customers are investing in rooftop solar installations, contributing to the growth of the solar PV segment.Energy storage, particularly battery technology, is being increasingly integrated with distributed generation systems in North America. Homeowners, businesses, and utilities are deploying battery storage to optimize energy usage, reduce peak demand charges, and enhance grid resilience. This trend is supported by declining battery costs and the imperative for grid stability.

North American utilities are investing in grid modernization to accommodate distributed generation. This presents opportunities for technology providers, including smart metering, grid management, and demand response solution providers, to support these initiatives.

The energy storage market in North America is experiencing rapid expansion. Battery manufacturers, energy management system developers, and project integrators have significant opportunities to offer solutions for residential, commercial, and utility-scale energy storage projects.

Various policies, such as net metering, renewable portfolio standards, and incentive programs, have been implemented by states in North America to support distributed generation. These policies create a diverse range of opportunities and challenges.

Key Market Players

- Siemens AG

- General Electric Company

- Mitsubishi Heavy Industries Ltd

- Schneider Electric SE

- Fuel Cell Energy Inc

- Caterpillar Inc.

- Vestas Wind Systems A/S

- Rolls-Royce Power Systems AG

- Toyota Turbine and Systems Inc.

- Capstone Turbine Corporation

Report Scope

In this report, the Global Distributed Generation Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Global Distributed Generation Market, by Technology:

- Reciprocating Engines

- Fuel Cells

- Solar PV Cells

- Wind Turbines

Global Distributed Generation Market, by Application:

- On-Grid

- Off-Grid

Global Distributed Generation Market, by End-User:

- Residential

- Industrial

- Commercial

Global Distributed Generation Market, by Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Distributed Generation Market.Available Customizations

The following customization option is available based on your specific needs: Detailed analysis and profiling of additional market players (up to five).This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Siemens AG

- General Electric Company

- Mitsubishi Heavy Industries Ltd.

- Schneider Electric SE

- Fuel Cell Energy Inc.

- Caterpillar Inc.

- Vestas Wind Systems A/S

- Rolls-Royce Power Systems AG

- Toyota Turbine and Systems Inc.

- Capstone Turbine Corporation

Table Information

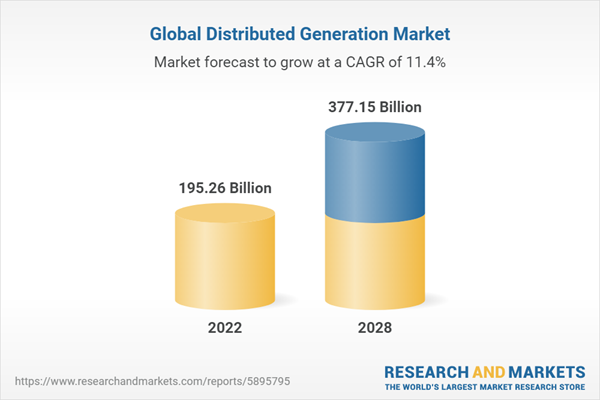

| Report Attribute | Details |

|---|---|

| No. of Pages | 189 |

| Published | October 2023 |

| Forecast Period | 2022 - 2028 |

| Estimated Market Value ( USD | $ 195.26 Billion |

| Forecasted Market Value ( USD | $ 377.15 Billion |

| Compound Annual Growth Rate | 11.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |