Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Split air conditioners dominate the market due to their advanced features, flexibility, and space-saving designs. Additionally, growing disposable incomes and advancements in smart technologies are propelling the demand for more innovative and automated air conditioning systems across the region. An increasing number of households in Germany are adopting air conditioning to cope with the country's increasingly hot summers. In 2024, 19% of households now use air conditioning, up from 13% the previous year. This growing residential adoption is a significant driver of market expansion.

Key Market Drivers

Climate Change and Rising Temperatures

Climate change has been a significant driver in the growing demand for air conditioners across Europe. As global temperatures rise due to climate change, Europe has been experiencing hotter summers with increasing frequency. The rise in heatwaves, especially in Southern Europe, has led to heightened awareness about the importance of climate control systems like air conditioners. Historically, countries in the Mediterranean, such as Spain, Italy, and Greece, have been the main consumers of air conditioning systems, but this trend is now extending to Northern Europe as well. A survey revealed that 13% of German households have installed air conditioning, while another 16% are considering purchasing one. Many respondents cited warmer summers in Germany, which make it difficult to maintain a comfortable indoor environment without air conditioning, thus driving the market for AC systems.Regions that were once not considered hotspots for air conditioning, such as parts of the UK, Germany, and the Netherlands, have seen a marked increase in demand for cooling solutions. This shift is driven by the desire for a comfortable indoor climate, particularly in homes, offices, and public spaces. The effects of climate change are pushing consumers to invest in more efficient cooling technologies to combat rising heat levels and ensure comfort during extreme temperatures. Additionally, the growing frequency of climate-related events is expected to further fuel the demand for air conditioners in the coming years.

Technological Advancements and Energy Efficiency

Technological advancements in air conditioning systems have significantly boosted their adoption in Europe. Modern air conditioners are more energy-efficient, environmentally friendly, and equipped with smart features that make them more appealing to European consumers. The integration of inverter technology, for example, allows air conditioners to operate at variable speeds, adjusting cooling output according to demand, thereby reducing energy consumption. This not only helps in reducing utility bills but also aligns with growing environmental concerns and sustainability goals.Another key technological development is the introduction of smart air conditioners that can be controlled remotely through mobile applications, voice commands, or home automation systems. These smart units offer increased comfort, convenience, and energy savings, making them more attractive to tech-savvy consumers who seek seamless integration with their smart homes. Furthermore, the adoption of eco-friendly refrigerants that have a lower global warming potential (GWP) is becoming increasingly common in Europe. The development of next-generation refrigerants and energy-efficient cooling technologies has become crucial for reducing the environmental impact of air conditioners.

Urbanization and Changing Consumer Lifestyles

Urbanization is another significant driver for the growth of the air conditioners market in Europe. As more people move to urban centers for work and education, the demand for modern housing and commercial properties with air conditioning systems increases. Urban areas tend to have higher temperatures due to the urban heat island effect, where the concentration of buildings, vehicles, and industrial activities raises local temperatures. Air conditioning is increasingly being seen as a necessary appliance to maintain comfortable living and working environments in these urban spaces.Additionally, the changing lifestyles of European consumers are contributing to the demand for air conditioners. With an increasing number of people working from home or spending more time indoors due to lifestyle changes or health concerns (e.g., COVID-19 pandemic), the need for improved indoor air quality and comfort has become more apparent. Consumers are seeking reliable cooling solutions for their homes, offices, and retail spaces. Air conditioning systems that offer better air quality, enhanced comfort, and greater convenience are becoming essential to meeting these demands.

Key Market Challenges

Regulatory and Compliance Complexities

The European Union has implemented strict environmental regulations aimed at reducing carbon emissions and promoting energy efficiency. While these regulations are essential for meeting climate goals, they also pose challenges for manufacturers and consumers in the air conditioning market. The EU’s Ecodesign and Energy Labelling Regulations, along with the ongoing push for the use of low-GWP (Global Warming Potential) refrigerants, require air conditioning manufacturers to meet stringent standards. While this encourages innovation and the development of more sustainable systems, it can also create compliance burdens.Manufacturers must continually invest in research and development to ensure their products comply with evolving regulations. Meeting these standards requires adopting new technologies, which can increase production costs and time-to-market. Additionally, the regulations require companies to phase out harmful refrigerants, which could necessitate redesigning systems to accommodate new, environmentally friendly alternatives. The phase-out of refrigerants with high GWP, such as R-22, can also lead to challenges in the maintenance and servicing of older air conditioning units still in operation.

Maintenance and Servicing of Air Conditioning Units

Proper maintenance and servicing are essential to ensure that air conditioning systems operate efficiently and have a long lifespan. However, the maintenance of air conditioning units can pose significant challenges, particularly in residential settings and in countries with less developed service infrastructure.One issue is the shortage of skilled technicians who are knowledgeable about newer technologies, such as eco-friendly refrigerants and inverter-driven systems. As air conditioners become more advanced, there is a growing need for technicians who are trained to service these systems. This can be particularly difficult in remote areas or regions with limited access to professional HVAC (heating, ventilation, and air conditioning) services.

Key Market Trends

Rising Popularity of Sustainable Refrigerants

Sustainability is an overarching theme in the Europe air conditioners market, and one of the key factors driving this trend is the shift towards eco-friendly refrigerants. Traditional refrigerants, such as R-22 and R-410A, have a high global warming potential (GWP) and contribute to ozone depletion. To address these environmental concerns, the European Union has mandated the phase-out of high-GWP refrigerants and encouraged the use of more sustainable alternatives.As a result, manufacturers are increasingly adopting low-GWP refrigerants, such as R-32 and R-290 (propane), which have significantly less impact on global warming. These refrigerants offer similar cooling performance to traditional refrigerants but with a much lower environmental footprint. The shift towards sustainable refrigerants is not only driven by regulatory pressures but also by consumer demand for more eco-friendly products.

Increased Demand for Portable and Compact Units

With limited space in many urban environments, particularly in cities across Europe, there is an increasing demand for portable and compact air conditioning units. These systems offer flexibility and convenience for consumers who live in apartments, rented spaces, or homes with limited room for traditional window or split air conditioning units. Portable air conditioners can be moved from room to room, providing targeted cooling where it is needed most, without requiring permanent installation.Portable air conditioners have gained popularity in markets where consumers may not want to commit to more expensive, permanent air conditioning systems. They are also popular among renters who may not have the option to install permanent units in their living spaces. Additionally, compact air conditioning systems, such as those designed for smaller rooms or apartments, are gaining traction as more people live in urban environments with limited square footage.

Segmental Insights

End Use Insights

The residential segment was the dominating force in the Europe air conditioners market, driven by increasing consumer demand for comfort and improved indoor air quality. As temperatures rise and heatwaves become more frequent, more homeowners are opting for air conditioning to maintain comfortable living conditions. Additionally, with higher disposable incomes and a growing trend towards energy-efficient solutions, consumers are investing in advanced, eco-friendly air conditioners. The residential sector’s dominance is further supported by regulatory incentives and a preference for smart, energy-saving systems. This segment is expected to continue its growth as climate change impacts weather patterns across Europe.Country Insights

Germany was the dominating region in the Europe air conditioners market, driven by its large, industrialized economy and advanced infrastructure. The country experiences a growing demand for air conditioning due to increasing urbanization, rising temperatures, and changing climate patterns. Additionally, Germany is a hub for energy-efficient technologies, with consumers prioritizing eco-friendly, energy-saving air conditioners. Strict government regulations, such as those promoting sustainable refrigeration and energy efficiency, further boost the market. Germany's robust economy, high consumer purchasing power, and environmental consciousness make it a key player in shaping the air conditioners market in Europe.Key Market Players

- Daikin Industries Limited

- Toshiba Corporation

- Mitsubishi Corporation

- Electrolux AB

- Carrier Global Corporation

- Danfoss A/S

- Samsung Electronics (UK) Limited

- Whirlpool Corporation

- Robert Bosch GmbH

- Lennox International Inc

Report Scope:

In this report, the Europe Air Conditioners Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Europe Air Conditioners Market, By Product Type:

- Splits

- VRFs

- Chillers

- Windows

- Others

Europe Air Conditioners Market, By End Use:

- Residential

- Commercial/Industrial

Europe Air Conditioners Market, By Country:

- Germany

- United Kingdom

- France

- Italy

- Netherlands

- Spain

- Russia

- Switzerland

- Rest of Europe

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Europe Air Conditioners Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Daikin Industries Limited

- Toshiba Corporation

- Mitsubishi Corporation

- Electrolux AB

- Carrier Global Corporation

- Danfoss A/S

- Samsung Electronics (UK) Limited

- Whirlpool Corporation

- Robert Bosch GmbH

- Lennox International Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 131 |

| Published | February 2025 |

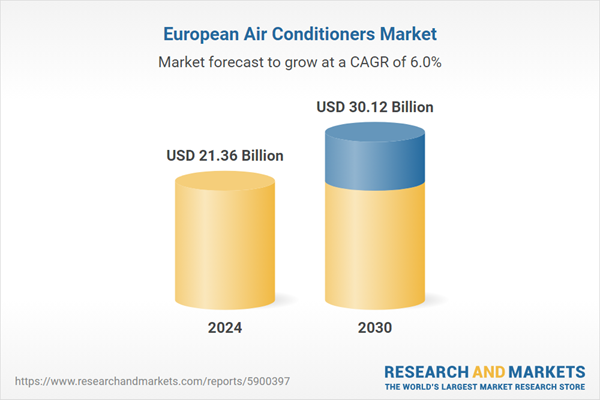

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 21.36 Billion |

| Forecasted Market Value ( USD | $ 30.12 Billion |

| Compound Annual Growth Rate | 5.9% |

| Regions Covered | Europe |

| No. of Companies Mentioned | 10 |