Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

However, honey remains a sought-after commodity, with a diverse range of flavors and types produced across different regions, reflecting the unique floral sources available to bees. The global honey industry is witnessing growing demand for raw and unprocessed honey, driven by consumer preferences for natural and locally sourced foods. This shift has encouraged sustainable beekeeping practices and increased awareness about the importance of protecting pollinators. Additionally, international trade in honey has become a significant economic driver for many countries, fostering global cooperation and regulations to ensure the quality and authenticity of honey products. Flobal honey production is not only about a sweet treat but also a vital part of our ecosystems, economies, and agricultural systems. Balancing the desire for honey's rich flavors with the need to protect honeybee populations and their habitats is a crucial challenge for the future.

Key Market Drivers

Consumer Demand for Natural and Healthy Foods

One of the primary drivers of the global honey industry is the increasing consumer demand for natural and healthy food products. Honey, being a natural sweetener with various potential health benefits, including antioxidant properties and potential allergy relief, has gained popularity as a healthier alternative to refined sugar and artificial sweeteners.This growing awareness of the health benefits associated with honey consumption has led to a surge in demand for honey products, both in developed and emerging markets.According to the USDA’s Sugar & Sweeteners Outlook, U.S. honey demand reached a record 618 million pounds in 2021, up 8% from 2020, and averaging an annual increase of 10.7 million pounds since 1991. Consumers are increasingly seeking unprocessed, raw, and organic honey options, as they perceive these products to be more wholesome and purer. This trend has driven honey producers to adapt their practices to meet these demands, including sustainable beekeeping techniques and transparent labeling to assure consumers of the product's authenticity.

Key Market Challenges

Declining Honeybee Populations and Colony Collapse Disorder (CCD)

One of the most critical challenges facing the global honey industry is the ongoing decline in honeybee populations, often attributed to Colony Collapse Disorder (CCD). CCD is a phenomenon where entire bee colonies, including worker bees, queens, and broods, suddenly disappear. While the exact cause of CCD is still not fully understood, a combination of factors is believed to contribute to it. The European Court of Auditors noted that autumn and winter colony losses in EU Member States can reach up to 50%, even 100% in some regions, significantly affecting honey output. Pesticides, especially neonicotinoids, are a major concern, as they have been linked to bee mortality and colony health issues.Loss of forage habitat due to urbanization and agricultural expansion also reduces the availability of food sources for bees. Climate change further exacerbates the problem, leading to extreme weather events, disrupted flowering patterns, and increased stress on bee colonies. The decline in honeybee populations is a significant challenge for the honey industry because honeybees are not only honey producers but also vital pollinators of many agricultural crops. A reduction in bee populations can lead to lower crop yields, affecting global food production and supply chains.

Key Market Trends

Rising Demand for Raw and Unprocessed Honey

A prominent trend in the global honey market is the increasing consumer preference for raw and unprocessed honey. Consumers are becoming more health-conscious and seek natural and minimally processed food products. Raw honey, which is minimally processed and typically not heated or filtered, is seen as a healthier alternative to refined sugars and artificial sweeteners.Raw honey retains more of its natural flavors, aromas, and beneficial compounds, including enzymes and antioxidants, compared to highly processed honey. This trend is driving beekeepers and honey producers to offer raw honey varieties to meet consumer demand. To cater to this trend, many producers are adopting transparent labeling practices, providing information about the honey's source, processing methods, and certifications. The popularity of raw honey extends beyond local markets, with global consumers seeking unique raw honey varieties from different regions and floral sources.

Key Market Players

- Dabur India Ltd.

- Barkman Honey LLC

- New Zealand Honey Co.

- Oha Honey LP

- Dutch Gold Honey, Inc.

- Streamland Biological Technology Ltd.

- Beeyond the Hive

- Billy Bee Honey Products

- Little Bee Impex

- Capilano Honey Ltd.

Report Scope:

In this report, the Global Honey Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Honey Market, By Processing:

- Organic

- Conventional

Honey Market, By Packaging:

- Bottle

- Glass Jar

- Tub

- Others

Honey Market, By Sales Channel:

- Departmental Stores

- Pharmacies

- Hypermarkets/Supermarkets

- Online

- Others

Honey Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe

- France

- United Kingdom

- Italy

- Germany

- Spain

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Turkey

- Egypt

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Honey Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Dabur India Ltd.

- Barkman Honey LLC

- New Zealand Honey Co.

- Oha Honey LP

- Dutch Gold Honey, Inc.

- Streamland Biological Technology Ltd.

- Beeyond the Hive

- Billy Bee Honey Products

- Little Bee Impex

- Capilano Honey Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 185 |

| Published | September 2025 |

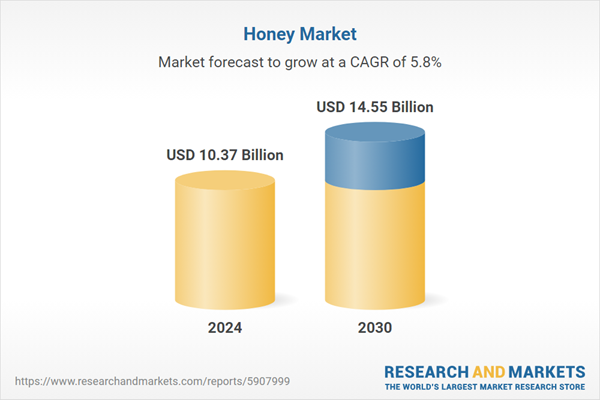

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 10.37 Billion |

| Forecasted Market Value ( USD | $ 14.55 Billion |

| Compound Annual Growth Rate | 5.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |