Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

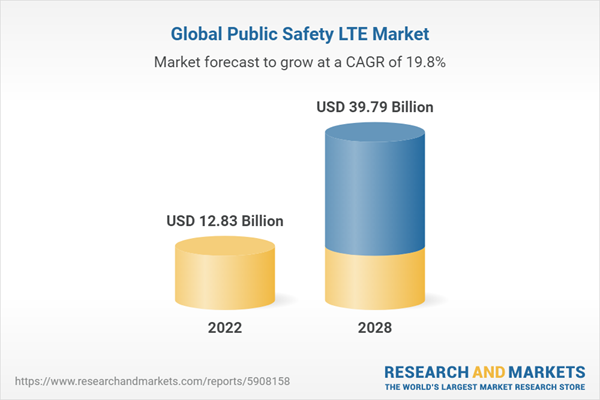

Global Public Safety LTE market has witnessed significant growth in recent years, driven by the widespread digital transformation occurring across various industries worldwide. Notably, sectors such as law enforcement, emergency medical services, and retail have increasingly recognized the strategic importance of mission-critical communication capabilities.

This growth has been underpinned by heavy investments in innovation, resulting in enhanced features and more reliable connectivity for first responders. Public safety LTE platforms have emerged as core components supporting these advancements. In today's complex communications environment, the ability to transmit data and voice in real-time through secure LTE networks is critical.

Integrated public safety LTE solutions offer agencies centralized network management and unified command and control. This provides visibility across jurisdictions and enables seamless inter-agency collaboration during emergencies. Vendors have also focused on developing ruggedized devices suitable for harsh field conditions.

As public safety networks continue to incorporate the latest technologies such as IoT, cloud, and analytics, they are delivering more actionable insights. This allows agencies to make more informed decisions and improve response effectiveness. Going forward, 5G-enabled capabilities such as network slicing promise lower latency and support for bandwidth-intensive applications.

With public safety organizations globally prioritizing mission-critical communications modernization, analysts remain optimistic about the long-term prospects of this market. As network capabilities enhance further, public safety LTE solutions will continue playing a pivotal role in connecting first responders and keeping communities safe.

Key Market Drivers

Need for Reliable Mission-Critical Communications

A major factor driving growth in the global public safety LTE market is the rising need among agencies for reliable mission-critical communication capabilities. Traditional land mobile radio (LMR) networks have limitations around coverage, capacity and functionality. LTE offers higher data speeds, seamless interoperability across jurisdictions and support for broadband applications. It allows real-time transmission of high-quality video, images and location data. LTE networks can prioritize emergency calls and ensure service continuity. Their scalability also supports communication needs during large-scale incidents and natural disasters. With public safety operations becoming more complex, LTE is increasingly becoming the preferred platform.Advances in LTE Network Technology

Technological advances are another key growth driver. The integration of IoT, cloud, analytics and other technologies has enhanced the capabilities of LTE networks. Features like geolocation, telematics and sensor data help agencies gain valuable insights. Devices now offer push-to-talk over LTE functionality for seamless voice communication. The deployment of LTE in new frequency bands like the recently opened mid-band 5G spectrum will further boost coverage, capacity and speeds. Upgrades like network slicing in 5G will deliver ultra-reliable communication.Government Initiatives for Modernization

Favorable government initiatives and investments are also fueling market growth. Given the critical nature of their functions, public safety agencies now have communication modernization as a top priority. Federal grants and programs in countries are expediting the replacement of aging LMR infrastructure with LTE networks. This is allowing agencies to access the latest broadband capabilities while improving interoperability.Key Market Challenges

Spectrum Allocation and Interoperability Hurdles

One of the foremost challenges confronting the Global Public Safety LTE (PS-LTE) Market is the allocation and management of suitable spectrum resources. The efficient operation of LTE networks, particularly those dedicated to public safety, hinges on access to sufficient and appropriately allocated spectrum. However, securing dedicated spectrum for PS-LTE networks remains a complex and often protracted process, as regulatory authorities grapple with the allocation of scarce spectrum resources amidst competing demands from various industries. Spectrum fragmentation is another issue, with different regions and countries adopting distinct frequency bands for PS-LTE, hampering international interoperability-a critical requirement for responding to cross-border emergencies and natural disasters. The lack of global harmonization in spectrum allocation hinders the seamless exchange of data and communication among public safety agencies and limits the potential benefits of PS-LTE networks. Addressing these spectrum-related challenges necessitates international cooperation, spectrum sharing agreements, and coordinated efforts to ensure that PS-LTE networks have access to the necessary spectrum resources.Cost Constraints and Budgetary Pressures

The adoption of advanced Public Safety LTE (PS-LTE) solutions is a capital-intensive endeavor, and cost constraints represent a significant hurdle for many public safety agencies and organizations worldwide. Deploying and maintaining a robust PS-LTE network infrastructure involves substantial investments in hardware, software, and ongoing operational expenses. These costs encompass the procurement of LTE-compatible devices, base stations, and core network elements, as well as expenses related to network monitoring, maintenance, and personnel training. Public safety agencies often face budgetary limitations and must compete for funding alongside other critical public services. The COVID-19 pandemic has further exacerbated fiscal pressures, prompting governments to reevaluate spending priorities. Consequently, many public safety organizations find themselves in a delicate balancing act, striving to modernize their communication infrastructure while staying within budgetary constraints. To overcome this challenge, innovative funding models, partnerships between public and private sectors, and careful cost-benefit analyses are essential to ensure the sustained growth and viability of the Global PS-LTE Market while accommodating the financial realities of public safety agencies.Key Market Trends

Integration of Public Safety LTE with 5G Networks

A noteworthy trend in the Global Public Safety LTE (PS-LTE) Market is the integration of PS-LTE with 5G networks. As 5G technology continues its global rollout, public safety agencies are recognizing its transformative potential for enhancing emergency response capabilities. The convergence of PS-LTE and 5G networks promises ultra-fast data transmission, reduced latency, and superior connectivity for public safety applications. It enables real-time data sharing, high-definition video streaming, and the deployment of Internet of Things (IoT) devices for improved situational awareness and incident response. This trend is reshaping how public safety agencies handle emergencies, enabling them to leverage advanced technologies like augmented reality (AR) and virtual reality (VR) for training and operations. The seamless integration of PS-LTE with 5G networks not only enhances communication during crises but also future-proofs public safety infrastructure, positioning it to harness the full potential of emerging technologies for years to come.Mission-Critical Push-to-Talk (MCPTT) Services Gain Traction

Another significant trend in the Global PS-LTE Market is the growing adoption of Mission-Critical Push-to-Talk (MCPTT) services. MCPTT represents a game-changing evolution in voice communication for public safety agencies. It delivers near-instantaneous, secure, and reliable push-to-talk voice communication over LTE networks, akin to traditional two-way radio systems but with the added advantages of multimedia sharing and enhanced coverage. MCPTT services empower first responders with seamless voice communication, enabling effective coordination during emergencies and critical incidents. This trend is being driven by the increasing availability of MCPTT-compatible devices and the standardization of MCPTT protocols, making it easier for public safety agencies to transition from legacy systems to advanced LTE-based communication. As MCPTT continues to gain traction, it is poised to become a cornerstone of public safety LTE networks, enhancing the efficiency and effectiveness of emergency response operations.Enhanced Security and Encryption Protocols

In an era marked by cybersecurity threats and data privacy concerns, an essential trend in the Global PS-LTE Market is the emphasis on enhanced security and encryption protocols. Public safety agencies deal with sensitive information and must ensure the confidentiality, integrity, and availability of their communication networks. To address these concerns, LTE vendors are investing in cutting-edge security solutions, including end-to-end encryption, secure authentication mechanisms, and intrusion detection systems. Additionally, public safety LTE networks are adopting secure-by-design principles, ensuring that security is an integral part of network architecture. This trend is propelled by the need to safeguard critical infrastructure and data from cyber threats, ensuring that public safety LTE networks remain resilient and trustworthy in the face of evolving security challenges. As security becomes a top priority, the Global PS-LTE Market is witnessing a transformation in network design and implementation to fortify defenses and ensure secure communication for first responders.Segmental Insights

Infrastructure Type Insights

The Evolved Node B (eNodeB) segment dominated the global public safety LTE market in 2022 and is expected to maintain its dominance during the forecast period. The eNodeB segment accounted for the largest share of more than 40% of the total market revenue in 2022. This is because eNodeB is the core component of LTE networks that connects user equipment and mobile terminals to the core network. It is responsible for radio resource management, mobility management, scheduling and transmission of user data. With the increasing adoption of LTE networks for public safety communications globally, the demand for eNodeB infrastructure from network operators is also growing. Most countries are upgrading and expanding their existing land mobile radio networks to LTE-based critical communication networks, which requires a large number of eNodeB installations. Moreover, the need for enhanced coverage, higher bandwidth and seamless connectivity is further propelling the demand. The eNodeB segment is expected to continue dominating during the forecast period as well, as more network deployments and upgrades are planned. The Evolved Packet Core segment is anticipated to be the fastest growing segment during the forecast period, owing to the rising need for network scalability, flexibility and advanced capabilities among network operators.Deployment Model Insights

The commercial LTE networks segment dominated the global public safety LTE market in 2022 and is expected to maintain its dominance during the forecast period. The commercial LTE networks segment accounted for over 60% share of the total market revenue in 2022. This is because most countries currently rely on commercial cellular networks for providing LTE connectivity to their public safety agencies and first responders. Public safety networks require nationwide coverage to effectively handle emergency situations. Commercial networks provide extensive coverage across cities, rural and remote areas through their existing infrastructure and spectrum resources. This makes them a cost-effective and viable option for delivering critical communications compared to building separate private networks. Also, commercial operators have already made significant investments in upgrading their networks to 4G/LTE technologies. Leveraging these networks allows public safety agencies to reap the benefits of advanced LTE features without having to develop dedicated network infrastructure from scratch. However, the private LTE networks segment is anticipated to witness the fastest growth during the forecast period. This is owing to the rising need among agencies for mission-critical capabilities, security of communications, network priority and preemption during emergencies, which commercial networks may not be able to guarantee.Regional Insights

North America dominated the global public safety LTE market in 2022 and is expected to maintain its dominance during the forecast period. The region accounted for over 35% of the total market share in 2022. This is due to the early and large-scale adoption of LTE technology for public safety communications in countries like the United States and Canada. Both these countries have mandated the transition from legacy land mobile radio systems to broadband LTE networks for critical communications. As a result, North American network operators and public safety agencies have been actively investing in deploying nationwide public safety LTE networks over the past few years. For example, the FirstNet network in the US is one of the largest public safety LTE networks globally. Moreover, the presence of major market players and availability of local manufacturing facilities make it convenient for countries in the region to deploy LTE infrastructure. The demand is further augmented by the rising need for real-time data sharing, situational awareness and remote monitoring applications among agencies. The region also has a well-established annual budget for public safety communications. All these factors have ensured North America's leadership position in the global market. However, the Asia Pacific region is anticipated to register the highest growth during the forecast period owing to ongoing and planned LTE deployments across densely populated countries like China and India.Report Scope:

In this report, the Global Public Safety LTE Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Public Safety LTE Market, By Infrastructure Type:

- Evolved Node B (eNodeB)

- Evolved Packet Core (EPC)

- Others

Public Safety LTE Market, By Deployment Model:

- Private LTE Networks

- Commercial LTE Networks

Public Safety LTE Market, By End-User Industry:

- Law Enforcement

- Emergency Medical Services (EMS)

- Firefighting Services

- Disaster Management Agencies

- Public Utilities

- Transportation and Logistics

- Others

Public Safety LTE Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe

- France

- United Kingdom

- Italy

- Germany

- Spain

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Kuwait

- Turkey

- Egypt

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Public Safety LTE Market.Available Customizations:

Global Public Safety LTE Market report with the given market data, the publisher offers customizations according to a company's specific needs.This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Motorola Solutions, Inc

- General Dynamics Corporation

- Airbus SE

- Nokia Corporation

- Harris Corporation

- Cisco Systems, Inc.

- Huawei Technologies Co. Ltd.

- Samsung Electronics Co. Ltd.

- Bittium Corporation

- Hytera Communications Corporation Limited

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 181 |

| Published | October 2023 |

| Forecast Period | 2022 - 2028 |

| Estimated Market Value ( USD | $ 12.83 Billion |

| Forecasted Market Value ( USD | $ 39.79 Billion |

| Compound Annual Growth Rate | 19.7% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |