Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Key Market Drivers

Increasing Pet Ownership

In recent years, pet ownership in Europe has been on the rise, and this trend is having a profound impact on various industries, including the veterinary pharmaceuticals market. The growing number of pets in households across the continent is not just a reflection of changing lifestyles but also a driving force behind the expansion of the veterinary pharmaceuticals sector. One of the most significant drivers of growth in the veterinary pharmaceuticals market is the increasing number of pets. Cats, dogs, rabbits, and small mammals are now an integral part of European households. According to the European Pet Food Industry Federation (FEDIAF), over 80 million European households have at least one pet. This burgeoning pet population necessitates a parallel growth in the market for veterinary pharmaceuticals to cater to their healthcare needs. With pets becoming cherished family members, there is a heightened awareness of the importance of pet health. Pet owners are increasingly proactive in seeking preventive healthcare measures for their furry companions. This includes vaccinations, regular check-ups, and the use of pharmaceuticals to prevent and treat various health conditions. This awareness has translated into a surge in demand for veterinary pharmaceutical products. Increasing pet ownership has led to a shift in the approach to pet healthcare. Pet owners are now more focused on preventive healthcare to ensure their pets live long and healthy lives. This shift has led to a growing demand for vaccines, anti-parasitic drugs, dental care products, and dietary supplements, all of which contribute significantly to the veterinary pharmaceuticals market. As pet ownership grows, so does the range of pet care services available. Veterinarians, pet clinics, and specialized pet pharmacies are on the rise. These service providers not only offer expert guidance but also dispense veterinary pharmaceuticals. The accessibility of these services encourages pet owners to seek professional advice and treatment, further stimulating the market. Pet retail stores have proliferated across Europe, offering a wide range of pet products, including pharmaceuticals. These retail outlets not only provide convenience for pet owners but also promote the use of healthcare products. The presence of veterinary pharmaceuticals on the shelves of pet stores enhances their visibility and encourages pet owners to make informed choices. The increase in pet ownership has spurred pharmaceutical companies to invest more in research and development tailored to the specific healthcare needs of pets. This has led to the creation of innovative medications, treatments, and dietary supplements that cater to a variety of pet health conditions.Rising Awareness of Animal Health

In an era marked by increasing urbanization and connectivity, Europeans are growing more conscious of the health and well-being of their animal companions. This heightened awareness of animal health, encompassing both pets and livestock, is proving to be a catalyst for the growth of the Europe Veterinary Pharmaceuticals Market. With pets often considered as integral family members, there's been a noticeable shift in the way their health is perceived. Pet owners are more invested than ever in ensuring the longevity and vitality of their furry friends. This increasing concern for pet wellness is driving the demand for a range of veterinary pharmaceutical products, including vaccines, antibiotics, supplements, and specialized treatments. Rising awareness of animal health has led to a significant shift towards preventive healthcare measures. Pet owners, for example, are now more inclined to follow vaccination schedules, engage in regular check-ups, and implement flea and tick control regimens. This proactive approach has led to a surge in the consumption of veterinary pharmaceuticals aimed at preventing diseases and maintaining overall health. As awareness of animal health deepens, pharmaceutical companies are responding with specialized products tailored to address specific health concerns. This includes medications for common ailments like arthritis, allergies, and heart disease in pets. The diversity of pharmaceutical solutions available today underscores the commitment to providing the best possible care for animals. Veterinary pharmaceutical companies, along with animal welfare organizations and veterinarians, are actively involved in education and awareness campaigns. These initiatives help pet owners and livestock farmers understand the importance of proper healthcare and the role of pharmaceuticals in safeguarding animal health. The dissemination of knowledge is a powerful driver of demand in the market. Technological advancements are playing a vital role in promoting awareness and improving animal healthcare. Online platforms, mobile apps, and telemedicine services are making it easier for pet owners to access information and consult with veterinarians. This digital transformation is enhancing the visibility of pharmaceutical products and fostering informed decision-making. In the livestock sector, concerns about animal welfare and sustainable farming practices are driving the need for pharmaceutical solutions. Farmers are increasingly opting for medications and vaccines that promote the well-being of their animals while adhering to ethical and regulatory standards.Livestock Industry Growth

Europe's livestock industry stands as a cornerstone of agriculture, supplying an array of essential products, from meat and dairy to wool and leather. This sector is experiencing consistent growth, and its expansion is significantly influencing the Europe Veterinary Pharmaceuticals Market. The European livestock industry has been steadily expanding to meet the rising demands for animal-derived products. Cattle, poultry, pigs, and sheep are reared in large numbers, creating a substantial need for healthcare products and medicines. This expansion of livestock herds directly fuels the growth of the veterinary pharmaceuticals market. Ensuring the health and well-being of livestock is paramount for the industry. Healthy animals are more productive, which is essential for meeting the growing demand for meat, milk, and eggs. Veterinary pharmaceuticals play a pivotal role in safeguarding the health of these animals and optimizing their productivity. Disease outbreaks can have devastating consequences in the livestock industry. To mitigate this risk, farmers and ranchers turn to vaccines, antibiotics, and other pharmaceutical products to prevent the spread of diseases. The use of these pharmaceuticals not only protects the animals but also ensures a consistent supply of safe food products. Livestock farmers often utilize growth-promoting pharmaceuticals to enhance the weight gain and feed efficiency of animals. These products contribute to higher yields and greater profitability in the industry. The quest for increased efficiency is driving the demand for such pharmaceuticals. In recent years, there has been a growing focus on ethical and sustainable livestock farming practices. Consumers and regulatory bodies alike are demanding higher standards of animal welfare. Veterinary pharmaceuticals are essential tools in promoting humane treatment and good health in animals raised for food. The European Union imposes stringent regulations on the use of veterinary pharmaceuticals to ensure food safety and animal welfare. Compliance with these regulations is crucial for livestock farmers. As a result, they rely on approved and regulated pharmaceutical products, further driving the growth of the market. The growth of the livestock industry has spurred investments in research and development within the veterinary pharmaceutical sector. Companies are working to develop innovative solutions that address specific challenges faced by livestock farmers, including disease management and sustainable production.Government Regulations and Compliance

The Europe Veterinary Pharmaceuticals Market is characterized by its stringent regulatory landscape, a reflection of the region's commitment to animal health, safety, and welfare. Government regulations and compliance standards are integral to this market, playing a pivotal role in ensuring the efficacy and safety of veterinary pharmaceuticals. European governments, through regulatory agencies like the European Medicines Agency (EMA), enforce rigorous quality standards for veterinary pharmaceuticals. These standards encompass manufacturing processes, product efficacy, and safety. Compliance with these stringent regulations instills confidence in both consumers and industry stakeholders. Government regulations mandate extensive testing and research to demonstrate the efficacy and safety of veterinary pharmaceuticals before they reach the market. This emphasis on scientific evidence assures consumers and veterinarians that these products are effective in treating or preventing diseases and pose minimal risks to animals and humans. Compliance with government regulations is fundamental in building and maintaining consumer trust. Pet owners and livestock farmers rely on veterinary pharmaceuticals to protect the health and well-being of their animals. Government oversight assures them that the products they use are reliable and meet high safety standards. Stringent regulatory requirements act as barriers to entry, ensuring that only companies with the resources and commitment to quality can participate in the market. This results in a competitive landscape populated by pharmaceutical companies that prioritize research, development, and quality control. Government regulations not only mandate compliance with existing standards but also encourage innovation. Pharmaceutical companies are incentivized to invest in research and development to create more effective and safer products. This innovation fosters the growth of the market by providing new solutions to emerging healthcare challenges. Compliance with European regulations positions veterinary pharmaceutical companies for international trade and export opportunities. Europe has a reputation for high-quality products and adherence to strict standards, making its products desirable in global markets. This opens up new avenues for growth and expansion.Key Market Challenges

Antimicrobial Resistance (AMR)The rise of antimicrobial resistance poses a significant challenge for the veterinary pharmaceuticals market. The prudent use of antibiotics in animals is essential to combat AMR, but finding effective alternatives and implementing responsible antibiotic stewardship practices remains a complex task.

Economic Considerations in Livestock Farming

Livestock farmers often face economic pressures that can affect their willingness to invest in veterinary pharmaceuticals. Market fluctuations, input costs, and global trade dynamics can impact the affordability and adoption of healthcare products for animals.Animal Welfare Concerns

Rising concerns about animal welfare are influencing public perception and regulatory decisions. Meeting these ethical standards while ensuring the health of animals can be challenging, especially for intensive farming operations.Research and Development Costs

Developing new veterinary pharmaceutical products is a costly and time-consuming process. Companies must invest heavily in research and clinical trials to bring innovative products to market, and not all investments result in successful products.Key Market Trends

Personalized Medicine for Pets

One of the most exciting trends on the horizon is the move toward personalized medicine for pets. Just as in human healthcare, advancements in genetics and diagnostics are enabling veterinarians to tailor treatments and preventive measures to an individual animal's unique genetic makeup. This trend promises more effective and precise healthcare for pets.Digital Health and Telemedicine

The digital revolution is extending its reach into veterinary medicine. Telemedicine platforms and digital health apps are becoming increasingly popular, offering pet owners convenient ways to connect with veterinarians for advice, diagnosis, and even prescription refills. These technologies are likely to become an integral part of the veterinary pharmaceutical ecosystem.Nutraceuticals and Functional Foods

The concept of "food as medicine" is gaining traction in veterinary care. Nutraceuticals and functional foods, designed to provide specific health benefits beyond basic nutrition, are on the rise. These products offer pet owners a natural and holistic approach to maintaining their pets' health.Biotechnology and Gene Editing

Biotechnology is poised to revolutionize veterinary pharmaceuticals. Innovative approaches like gene editing hold promise for developing new treatments and therapies for various animal health conditions. This trend may lead to breakthroughs in disease management and prevention.Segmental Insights

Animal Type Insights

Based on the category of Animal Type, the companion animals category had the highest share of revenue in 2022. This dominance can be attributed to the increasing occurrence of infections in pets and the growing awareness among pet owners. According to a study published in the BMC Veterinary Research Journal in 2021, the prevalence of common disorders in dogs in the UK was reported at 14.10% for dental issues and 12.58% for skin problems. Animal health Europe also reported a significant increase in the overall sale of veterinary medicines for pets, rising from 42.4% in 2020 to 47.3% in 2022.On the other hand, the livestock animals sector is projected to experience the most rapid CAGR during the forecast period. This growth is attributed to the increasing consumption of meat and the rising demand for higher quality and safety standards. In May 2021, Inovet, headquartered in Belgium, expanded its facilities in France to meet the ongoing high demand for livestock medicines and to increase production capacity. These new facilities include a sterile solution plant as well as new QC and R&D microbiology laboratories.

Furthermore, in October 2022, the Re-Livestock program, initiated by Horizon Europe, was launched to develop comprehensive strategies for various dairy, beef, and pig systems, as well as for different geographical regions, taking into account the impact of climate change. This program aims to bring together expertise and collaboration across a wide range of fields, including farm management, animal welfare, breeding, nutrition, environmental considerations, socioeconomic assessments, and policy analysis.

Mode of Administration Insights

Based on the category of Mode of Administration, the parenteral category secured the largest share of revenue in 2022. Parenteral administration involves directly introducing drugs into an animal's body through methods like intravenous, intramuscular, or subcutaneous injections. The advantage of this approach, which offers swift and targeted drug delivery, improved bioavailability, and precise control over dosages, led to its dominant position in the market. Market growth is being fueled by the rapid introduction and advancement of products. For example, in September 2022, Boehringer Ingelheim introduced Fencovis, the first vaccine designed to combat E. coli F5- and bovine rotavirus-induced calf diarrhea while also reducing the severity of coronavirus-induced calf diarrhea.According to information from the MSD Vet manual, the oral route of administration is commonly employed in companion and food animals. Various forms of dosages are utilized, including tablets, powders, capsules, boluses, granules, solutions, pastes, and suspensions. The oral method is also extensively used in cattle, pigs, and poultry for pharmaceutical administration. Innovative oral administration techniques for flea and tick control products are further enhancing pet care by providing pet owners with a simpler and more convenient means of administering treatments.

There is a growing interest in using modified-release delivery systems such as intraluminal boluses in ruminants to administer parasiticides, anti-bloat agents, production enhancers, and nutritional supplements. Among farmers, the practice of dipping livestock animals is one of the most popular modes of administration. This is due to the method's efficiency in applying treatments, particularly those aimed at combating ectoparasites. Furthermore, pour-on solutions and injectables help to mitigate potential environmental impacts.

Regional Insights

In 2022, the United Kingdom (UK) held the largest market share in terms of revenue. This dominance was facilitated by a provisional free-trade agreement reached between the European Union (EU) and the UK in January 2021, allowing for uninterrupted trade in goods without quotas or tariffs. Nevertheless, many details about the future relationship, particularly in the realm of trade in services, remained uncertain. This agreement prevented a potentially damaging "no-deal" Brexit scenario, which could have had a significant adverse impact on the UK's economy. The British Veterinary Association (BVA) actively campaigned against a no-deal Brexit, emphasizing the lack of time for a smooth transition and adjustment. The BVA also formulated a set of crucial recommendations aimed at securing the best possible Brexit outcome for animal health, encompassing areas such as animal welfare, veterinary medicines, the veterinary workforce, food hygiene and safety, research and development, and trade.Meanwhile, the Netherlands is expected to experience the most rapid CAGR during the forecast period. Several key factors contribute to this growth, including the high level of awareness among pet owners regarding their pets' health, stringent standards aimed at ensuring the health of livestock animals to safeguard food sources, and the presence of major companies such as Norbrook, Chanelle Pharma, and Boehringer Ingelheim. According to a survey conducted by GlobalPETS, between 2020 and 2022, 150,000 households in the Netherlands acquired new pets, including 80,000 dogs and 70,000 cats.

Report Scope:

In this report, the Europe Veterinary Pharmaceuticals Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Europe Veterinary Pharmaceuticals Market, By Animal Type:

- Companion Animals

- Livestock Animals

Europe Veterinary Pharmaceuticals Market, By Product:

- Parasiticides

- Anti-infectives

- Anti-inflammatory

- Analgesics

- Others

Europe Veterinary Pharmaceuticals Market, By Mode of Administration:

- Oral

- Parenteral

- Topical

- Others

Europe Veterinary Pharmaceuticals Market, By Distribution Channel:

- Veterinary Hospitals & Clinics

- Pharmacies & Retail Store

- Digital or E-commerce

Europe Veterinary Pharmaceuticals Market, By Region:

- Germany

- Italy

- United Kingdom

- France

- Spain

- Greece

- Portugal

- Bulgaria

- Finland

- Croatia

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Europe Veterinary Pharmaceuticals Market.Available Customizations:

Europe Veterinary Pharmaceuticals market report with the given market data, the publisher offers customizations according to a company's specific needs.This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Merck & Co., Inc.

- Vetoquinol SA

- Zoetis Inc.

- Boehringer Ingelheim International GmbH

- Elanco LLC

- Virbac SA

- Laboratorios Calier SA

- Bimeda Corporate

- Prodiet Farmaceutica SA

Table Information

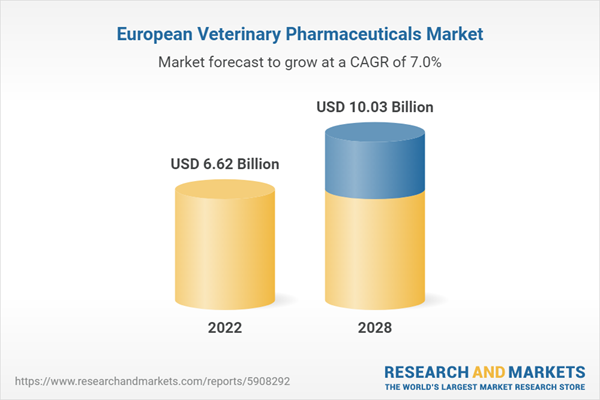

| Report Attribute | Details |

|---|---|

| No. of Pages | 132 |

| Published | October 2023 |

| Forecast Period | 2022 - 2028 |

| Estimated Market Value ( USD | $ 6.62 Billion |

| Forecasted Market Value ( USD | $ 10.03 Billion |

| Compound Annual Growth Rate | 7.0% |

| Regions Covered | Europe |

| No. of Companies Mentioned | 9 |