Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Key Market Drivers

Increased Disease Prevalence

The United Kingdom is experiencing a significant rise in the prevalence of various diseases and medical conditions. This surge in disease rates is not only a public health concern but also a driving force behind the growth of the Imaging Services Market in the country. The United Kingdom, like many developed nations, is facing an aging population and changes in lifestyle that have contributed to a substantial increase in disease prevalence. Chronic diseases such as cancer, diabetes, cardiovascular disorders, and musculoskeletal conditions are becoming increasingly common. This surge in diseases presents both challenges and opportunities for the healthcare industry, particularly in the field of medical imaging. One of the primary ways increased disease prevalence fuels the growth of the Imaging Services Market is through the need for early detection and diagnosis. Many diseases, including cancer and heart disease, have significantly better outcomes when detected at an early stage. Medical imaging techniques like magnetic resonance imaging (MRI), computed tomography (CT), and ultrasound play a pivotal role in identifying and characterizing these conditions at an early and treatable stage. As the understanding of disease biology advances, there is a growing emphasis on personalized or precision medicine. Tailoring treatment plans to individual patients requires detailed diagnostic information, often obtained through advanced imaging techniques. For instance, molecular imaging methods can help identify specific molecular markers in tumors, enabling targeted therapies that can be more effective with fewer side effects. Imaging services are not limited to diagnosis alone; they also play a crucial role in monitoring disease progression. For patients living with chronic conditions, regular imaging scans can help healthcare providers assess the effectiveness of treatment, make necessary adjustments, and provide a proactive approach to disease management. This continuous monitoring is essential for maintaining patients' quality of life and improving long-term outcomes. The rising prevalence of diseases has spurred increased research and clinical trials. Imaging services are indispensable in clinical trials for evaluating the safety and efficacy of new treatments and drugs. Additionally, imaging techniques can provide valuable data for researchers studying disease mechanisms and potential therapeutic targets, further contributing to advancements in healthcare. The increase in disease prevalence has also led to greater public awareness and a shift in healthcare-seeking behavior. People are more proactive about their health, seeking regular check-ups and diagnostic tests to catch potential health issues early. This trend has driven up the demand for imaging services as patients and physicians recognize the importance of early detection and monitoring.Aging Population

The United Kingdom, like many developed nations, is experiencing a significant demographic shift characterized by an aging population. This phenomenon presents unique challenges and opportunities for the healthcare sector, particularly in the realm of diagnostic and medical imaging services. The United Kingdom's demographic landscape is undergoing a remarkable transformation. People are living longer, and birth rates are declining, resulting in a growing proportion of elderly citizens. According to the Office for National Statistics (ONS), the number of people aged 65 and over is steadily increasing, with projections indicating a further rise in the coming decades. This "silver surge" has profound implications for healthcare services, including imaging. As individuals age, their risk of developing various health issues and chronic conditions increases. Conditions such as cardiovascular diseases, cancer, neurodegenerative disorders, and orthopedic problems become more prevalent in older populations. These conditions often necessitate diagnostic imaging for accurate diagnosis, treatment planning, and ongoing monitoring. One of the most significant ways the aging population drives the growth of the Imaging Services Market is through the need for early detection and disease management. Medical imaging modalities such as X-rays, magnetic resonance imaging (MRI), computed tomography (CT), and ultrasound are indispensable for identifying age-related health problems at an early and treatable stage. For example, mammography is crucial for breast cancer screening among older women. Elderly patients often present with complex care needs that require comprehensive diagnostic evaluations. Imaging services play a vital role in assessing the severity of medical conditions, guiding surgical interventions, and monitoring the effectiveness of treatments. In particular, musculoskeletal imaging is essential for assessing bone density, joint health, and the progression of conditions like osteoporosis and arthritis. The aging population has also led to a greater emphasis on preventive medicine and wellness. Older individuals are increasingly proactive about their health, seeking regular check-ups and screenings. This trend has contributed to a surge in demand for imaging services as patients and healthcare providers recognize the importance of early detection and risk assessment. The growth of the aging population has fueled research into geriatric medicine and care. Imaging plays a crucial role in clinical research related to age-related conditions, contributing to advancements in treatment options, drug development, and the understanding of disease mechanisms. The United Kingdom Imaging Services Market is poised for substantial growth as the aging population continues to expand. Meeting the healthcare needs of this demographic shift requires not only advanced imaging technologies but also a focus on patient-centered care and accessibility. The demand for high-quality diagnostic and monitoring services will persist, making investment in state-of-the-art imaging equipment and skilled healthcare professionals essential.Technological Advancements

The United Kingdom Imaging Services Market is undergoing a remarkable transformation, largely driven by rapid technological advancements in the field of medical imaging. The convergence of cutting-edge technologies is revolutionizing the way diseases are diagnosed, monitored, and treated. The healthcare sector in the United Kingdom is witnessing a radiantly promising future, thanks to a slew of groundbreaking technological innovations in imaging services. These advancements are not only improving diagnostic accuracy but also enhancing patient comfort, workflow efficiency, and healthcare outcomes. One of the most significant technological advancements in the Imaging Services Market is the development of high-resolution imaging techniques. Magnetic Resonance Imaging (MRI) and Computed Tomography (CT) scans have evolved to provide exceptional image quality with higher spatial and temporal resolution. This level of detail is invaluable in diagnosing complex medical conditions with precision. In the realm of radiology, dose optimization techniques have emerged as a critical advancement. These techniques, such as low-dose CT scans, focus on minimizing radiation exposure while maintaining diagnostic accuracy. This not only reduces the risk to patients but also makes imaging services safer and more appealing. The introduction of three-dimensional (3D) and four-dimensional (4D) imaging has transformed the way healthcare providers perceive and interact with medical images. These technologies offer multidimensional views, enhancing the ability to visualize and analyze anatomical structures and physiological functions. Applications range from prenatal ultrasounds to neurosurgical planning. Perhaps one of the most transformative innovations in the Imaging Services Market is the integration of Artificial Intelligence (AI). AI-powered algorithms can analyze medical images with extraordinary speed and precision. These algorithms assist radiologists in detecting anomalies, identifying patterns, and even predicting disease progression. AI's potential in radiology is limitless, ranging from automating routine tasks to aiding in complex diagnoses. The COVID-19 pandemic accelerated the adoption of telemedicine and remote imaging services. Patients can now consult with specialists and undergo imaging procedures without physical visits to healthcare facilities. This innovation not only improves accessibility but also enhances the reach of healthcare services, especially in remote or underserved areas. Portable and handheld imaging devices are becoming increasingly sophisticated, allowing for point-of-care imaging in various healthcare settings. These devices enable quicker diagnoses and decision-making, reducing the need for patients to travel to centralized imaging centers. Technological advancements in imaging are aligning with the concept of personalized medicine. Imaging can now provide detailed information about a patient's unique anatomy and pathology, allowing for tailored treatment plans and targeted therapies.Telemedicine and Remote Imaging

The United Kingdom's healthcare landscape is undergoing a profound transformation, with telemedicine and remote imaging services emerging as powerful drivers of change. These innovative approaches to healthcare delivery are not only enhancing patient access and convenience but are also playing a pivotal role in boosting the growth of the UK Imaging Services Market. Telemedicine involves the remote diagnosis and treatment of patients through telecommunications technology, bridging geographical distances and expanding access to healthcare services. In the context of medical imaging, telemedicine facilitates consultations with radiologists and access to imaging services without the need for in-person visits to healthcare facilities. Telemedicine eliminates the geographical barriers that once limited access to specialized imaging services. Patients, particularly those in rural or underserved areas, can now receive expert consultations and imaging services remotely, reducing travel time and costs. Telemedicine allows healthcare providers to efficiently triage patients based on their imaging needs. Primary care physicians can consult with radiologists to determine the necessity of imaging, ensuring that resources are allocated where they are most needed. Remote imaging services enable quicker diagnoses. Patients experiencing acute symptoms can receive timely imaging evaluations, leading to faster treatment initiation and better outcomes. Telemedicine and remote imaging play a crucial role in the management of chronic conditions. Patients with ongoing healthcare needs can have their conditions monitored remotely, reducing the burden of frequent in-person visits. Telemedicine allows for remote consultations with specialized radiologists and other healthcare professionals. This is particularly valuable in cases where rare or complex conditions require expert input. Patients and healthcare providers can consult with radiologists and imaging specialists regardless of their physical location. This ensures that patients receive the best possible care without unnecessary delays. Medical images can be securely transmitted to remote radiologists for interpretation. This not only expedites the diagnostic process but also facilitates second opinions, improving diagnostic accuracy. Telemedicine allows for real-time collaboration between healthcare professionals, enabling multidisciplinary discussions about patient care and treatment plans. The combination of telemedicine and remote imaging services reduces waiting times for consultations and imaging appointments. This is especially critical in cases where early diagnosis is essential. Telemedicine can reduce healthcare costs by minimizing travel expenses and optimizing resource allocation. It ensures that patients receive the right level of care at the right time.Key Market Challenges

Growing Demand and Capacity Issues

One of the primary challenges facing the Imaging Services Market in the UK is the increasing demand for diagnostic imaging services. The aging population and the rising prevalence of chronic diseases have resulted in a higher need for imaging services. As a consequence, many healthcare facilities are struggling to meet the growing demand, leading to longer waiting times for imaging appointments.Workforce Shortages

The shortage of skilled professionals, including radiologists and radiologic technologists, poses a significant challenge. The demand for their expertise is outstripping the supply, leading to overworked staff, burnout, and potential errors in image interpretation. Addressing this shortage is crucial for maintaining the quality and efficiency of imaging services.Funding and Budget Constraints

Public healthcare systems, including the UK's National Health Service (NHS), often face budget constraints that can impact their ability to invest in advanced imaging technology and infrastructure. This limitation may lead to outdated equipment, longer waiting lists, and compromised patient care.Radiation Exposure Concerns

Radiation exposure from imaging procedures is a growing concern. Patients, healthcare professionals, and regulatory bodies are increasingly focused on minimizing radiation doses while maintaining diagnostic quality. Striking the right balance between safety and diagnostic accuracy is a complex challenge.Key Market Trends

Artificial Intelligence (AI) Integration

Artificial Intelligence (AI) is poised to play a central role in the future of medical imaging. AI algorithms can analyze vast amounts of imaging data rapidly and with remarkable accuracy. Radiologists and other healthcare professionals will increasingly leverage AI for image interpretation, enabling quicker and more precise diagnoses. AI will also aid in automating routine tasks, reducing the burden on healthcare staff and enhancing efficiency.3D and 4D Imaging

The era of three-dimensional (3D) and four-dimensional (4D) imaging is dawning. These advanced imaging techniques provide multidimensional views of anatomical structures and physiological functions. Applications range from detailed fetal monitoring during pregnancy to enhanced visualization of complex organs and blood flow dynamics. These technologies will provide healthcare professionals with a deeper understanding of patient conditions.Augmented Reality (AR) and Virtual Reality (VR)

AR and VR technologies are making inroads into the Imaging Services Market. These immersive technologies enable physicians to visualize and interact with medical images in three-dimensional virtual environments. Surgeons can use AR and VR to plan complex procedures, while medical students can gain a deeper understanding of anatomy through interactive learning experiences.

Molecular Imaging

Molecular imaging techniques, such as positron emission tomography (PET) and single-photon emission computed tomography (SPECT), are evolving rapidly. These methods allow for the visualization of biochemical processes in the body at a molecular level. Molecular imaging will continue to advance research, drug development, and personalized treatment plans.Segmental Insights

Modality Insights

Based on the category of Modality, MRI dominated the market in terms of revenue share in 2022. This service stands out due to its superior ability to provide clear images of soft tissues compared to other imaging methods. It plays a crucial role in diagnosing a wide range of diseases and conditions, making it a valuable tool for effective surgical treatment planning. Anticipated technological advancements are also expected to drive increased demand for MRI services.In January 2020, InHealth Group partnered with Siemens Healthineers to introduce syngo Virtual Cockpit technology at Frimley Park Hospital. This innovation facilitates remote scanning and the rapid exchange of specialized expertise among MRI scanners, resulting in improved access to clinical experts, heightened efficiency, and enhanced patient experience.

Furthermore, CT scans are projected to experience significant growth in the foreseeable future. The primary advantage of this imaging technique lies in its ability to provide detailed images of bones, blood vessels, and soft tissues. Additionally, CT services are cost-effective and require less time compared to alternative modalities. With a growing emphasis on cancer prevention and early detection, various population-level screening programs are being implemented, with CT scans playing a pivotal role, especially in lung health checks.

End-use Insights

The hospital sector commanded the largest portion of the market share in 2022 due to the adoption of advanced imaging technologies. An illustrative example of this is seen at Hexham General Hospital, which, in collaboration with Northumbria Healthcare NHS Foundation Trust, introduced the Inhealth MRI scanner in September 2021. Since its installation, the hospital has been able to accommodate over 300 patients each month for crucial diagnostic scans. Moreover, the increasing incidence of various medical conditions, such as cancer and cardiac disorders, is also poised to stimulate growth in this sector. According to data from the International Agency for Research on Cancer, the United Kingdom witnessed approximately 457,960 new cancer cases in 2020, with projections indicating an increase to 1,514,320 cases by 2030.The diagnostic imaging centers category is anticipated to experience substantial growth in the upcoming forecast period, primarily due to the rising trend of collaborations and takeovers involving diagnostic imaging centers and other healthcare entities. For example, in March 2021, Affidea Group, a prominent European provider of diagnostic imaging, outpatient, and cancer care services, acquired Fortius Clinic, the largest orthopedic group in the United Kingdom. Additionally, the convenience of having multiple imaging modalities under one roof and favorable reimbursement policies for imaging procedures are expected to exert a beneficial influence on this end-user segment.

Regional Insights

London is poised to dominate the United Kingdom Imaging Services Market for several compelling reasons. Firstly, London is home to a dense population and a vast network of healthcare facilities, creating a significant demand for imaging services. The city boasts world-class medical institutions, including renowned hospitals and research centers, which attract patients from across the country and even internationally. Furthermore, London's economic strength and higher disposable income levels compared to other regions in the UK ensure that residents and healthcare providers have the means to access and invest in advanced imaging technologies. The city's strategic location and well-developed infrastructure also facilitate the efficient delivery of imaging services. Additionally, London's status as a hub for innovation and healthcare excellence encourages the adoption of cutting-edge imaging modalities and techniques, further cementing its dominance in the United Kingdom's imaging services market.Report Scope:

In this report, the United Kingdom Imaging Services Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:United Kingdom Imaging Services Market, By Modality:

- X-Rays

- CT Scans

- MRI Scans

- Ultrasound

- Nuclear Medicine Scans

United Kingdom Imaging Services Market, By End-use:

- Hospitals

- Diagnostic Imaging Centers

- Others

United Kingdom Imaging Services Market, By Region:

- Scotland

- South-East

- London

- South-West

- East-Anglia

- Yorkshire & Humberside

- East Midlands

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the United Kingdom Imaging Services Market.Available Customizations:

United Kingdom Imaging Services market report with the given market data, the publisher offers customizations according to a company's specific needs.This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Alliance Medical Ltd

- InHealth Group

- Unilab Corp

- Medica Group PLC

- TIC International Corp

- Affidea Group BV

- Vista Health

- Medical Imaging Partnership Ltd

- Rutherford Health Plc

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 80 |

| Published | October 2023 |

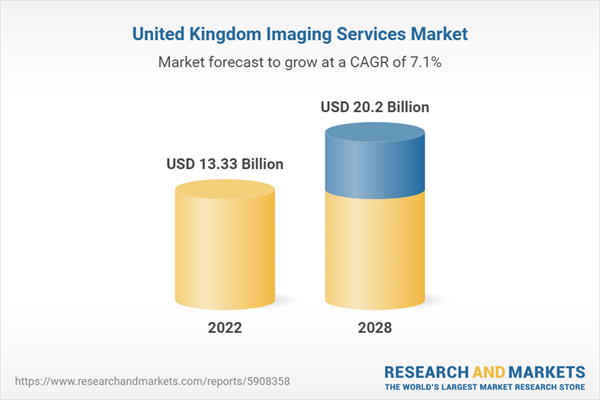

| Forecast Period | 2022 - 2028 |

| Estimated Market Value ( USD | $ 13.33 Billion |

| Forecasted Market Value ( USD | $ 20.2 Billion |

| Compound Annual Growth Rate | 7.0% |

| Regions Covered | United Kingdom |

| No. of Companies Mentioned | 9 |