Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Despite these strengths, market growth faces a notable obstacle due to the technology's high operating temperature requirements, which generally range between 270°C and 350°C. This thermal characteristic necessitates complex management systems and robust insulation, increasing manufacturing intricacy and limiting the battery's suitability for portable electronics and light-duty transportation. Consequently, the technology's competitive landscape is narrowed. Data from the Long Duration Energy Storage Council indicates that in 2024, the global development pipeline for long-duration energy storage technologies - the specific sector including sodium-nickel chloride solutions - amounted to 0.22 terawatts.

Market Drivers

The urgent need for grid operators to manage the intermittency of wind and solar power generation is driving the demand for utility-scale renewable energy storage, acting as the primary catalyst for the Global Sodium-Nickel Chloride Battery Market. Unlike lithium-ion options, sodium-nickel chloride batteries are particularly well-suited for these stationary applications because they require zero maintenance and perform reliably in harsh environmental conditions without the need for auxiliary cooling systems. This resilience is essential for stabilizing power grids that depend heavily on variable renewable energy. According to an article by CIC energiGUNE in January 2024, titled '2024: The big year for sodium batteries?', the International Energy Agency predicts a nearly 350% increase in sodium-based battery production capacity to address these growing storage requirements, highlighting the technology's critical role in supporting a decarbonized energy infrastructure.In addition to technical performance, the market benefits from a stable supply chain and abundant raw materials, which encourages industrial adoption. By utilizing widely available precursor materials, sodium-nickel chloride battery manufacturers are protected from the price volatility and geopolitical risks often associated with critical minerals like lithium and cobalt. This material security ensures scalable production and predictable project costs. As noted in the December 2024 'The world nickel market in 2024' article by Stainless Steel World, the International Nickel Study Group forecast a global nickel surplus of 109,000 tonnes for the year, confirming the strong availability of essential cathode materials. Furthermore, the Long Duration Energy Storage Council reported in 2024 that scaling up long-duration energy storage could generate annual system cost savings of up to $540 billion by 2040, reinforcing the economic justification for these technologies.

Market Challenges

A major hurdle impeding the broader commercialization of the Global Sodium-Nickel Chloride Battery Market is the necessity for high operating temperatures, typically between 270°C and 350°C. Maintaining the electrolyte in a molten state requires heavy insulation and sophisticated thermal management systems, which inevitably adds to the unit's weight, volume, and production costs. This complexity severely restricts the technology's versatility, making it impractical for rapid-growth, high-volume sectors such as portable consumer electronics and light-duty electric vehicles, where lightweight and compact energy solutions are essential requirements.Because of these technical limitations, the total addressable market for sodium-nickel chloride batteries is largely confined to niche sectors like heavy industrial applications and stationary grid storage. The inability to compete in the mass consumer and mobility markets leads to a much slower adoption rate compared to ambient-temperature battery technologies. This struggle for market share is evident in recent deployment data; according to the China Electricity Council, in 2024, alternative battery chemistries - including sodium-based systems - comprised less than 4% of newly installed electrochemical energy storage capacity, underscoring the challenges high-temperature systems face in challenging established market incumbents.

Market Trends

To improve competitiveness, manufacturers are shifting from legacy tubular cell designs to planar cell geometries, a strategic move intended to facilitate automated mass production and optimize packing efficiency. This technological evolution enables stackable cell structures that significantly lower manufacturing costs and complexity compared to labor-intensive tubular models. Adopting these flat-plate architectures is essential for achieving the economies of scale required to rival lithium-ion costs in the stationary storage sector. As reported by Mining.com.au in the September 2025 article 'Altech enters into sodium nickel chloride battery market', Altech Batteries is spearheading this shift by securing funding for its CERENERGY project in Germany, aiming for an annual production capacity of 120 megawatt-hours utilizing this advanced cell format.Concurrently, there is a growing trend of adopting sodium-nickel chloride batteries for critical infrastructure backup, particularly within telecommunications facilities and data centers that demand unwavering reliability in high-temperature environments. Unlike traditional battery systems that require energy-intensive air conditioning to avoid overheating, these batteries are being chosen for their inherent safety and ability to function efficiently without complex cooling equipment, allowing for co-location with heat-generating servers. According to the December 2025 ESS News article 'Sodium nickel chloride battery factory proposed for New Mexico', Desert Mountain Energy Corporation has launched a joint venture to build a manufacturing plant dedicated to supporting the backup power requirements of a nearby data center complex, with future plans to expand operations to a gigawatt-level capacity.

Key Players Profiled in the Sodium-Nickel Chloride Battery Market

- Aquion Energy

- NGK Insulators Ltd.

- SAFT Groupe SAS

- General Electric Company

- Hangzhou Eumo Technology Co. Ltd.

- HiNa Battery Technology Co., Ltd.

- Natron Energy, Inc.

- Faradion Ltd.

- Altris AB

- FZ Sonick S.A.

Report Scope

In this report, the Global Sodium-Nickel Chloride Battery Market has been segmented into the following categories:Sodium-Nickel Chloride Battery Market, by End User:

- Residential

- Commercial

- Electric Vehicles

- Industrial

- Others

Sodium-Nickel Chloride Battery Market, by Product Type:

- Less Than 300 kW

- 300-600 kW

- 600-900 kW

- More Than 900 kW

Sodium-Nickel Chloride Battery Market, by Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Sodium-Nickel Chloride Battery Market.Available Customization

The analyst offers customization according to your specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The key players profiled in this Sodium-Nickel Chloride Battery market report include:- Aquion Energy

- NGK Insulators Ltd

- SAFT Groupe SAS

- General Electric Company

- Hangzhou Eumo Technology Co. Ltd

- HiNa Battery Technology Co., Ltd.

- Natron Energy, Inc.

- Faradion Ltd.

- Altris AB

- FZ Sonick S.A.

Table Information

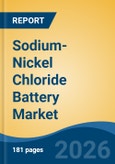

| Report Attribute | Details |

|---|---|

| No. of Pages | 181 |

| Published | January 2026 |

| Forecast Period | 2025 - 2031 |

| Estimated Market Value ( USD | $ 4.05 Billion |

| Forecasted Market Value ( USD | $ 6.86 Billion |

| Compound Annual Growth Rate | 9.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |