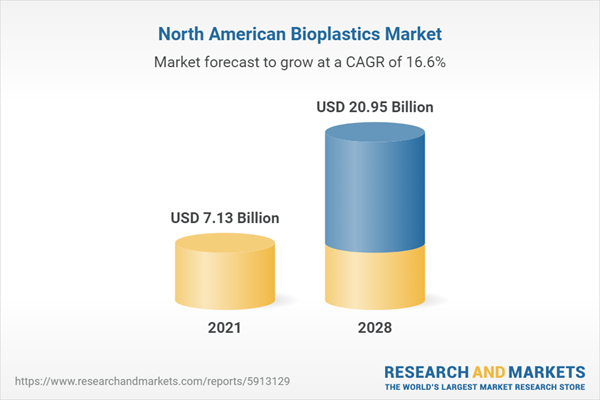

The North American bioplastics market is estimated to grow at a CAGR of 16.64% to reach US$20.952 billion in 2028 from US$7.133 billion in 2021.

During the forecast period, factors like rising urbanization, renewability of bio-based products across several sectors, and rising demand from the flexible packaging industry are anticipated to propel the expansion of the North American biodegradable plastic market.According to the U.S. Department of Energy Office of Scientific and Technical Information, it is projected that in 2019, landfills, burning, and recycling processes handled around 44 million tonnes (Mt) of plastic garbage. This sum represents around 7% of the total MSW handled that year. Of the total plastic trash processed in 2019, 70% was made up of containers and packaging, 24% of it was made up of durable items, and 6% was made up of non-durable products. It should be emphasized that demolition landfills, where modest volumes of MSW are also disposed of, are not included in this evaluation.

Increased demand for bio-based packaging

The increased demand for bio-based packaging in the food and consumer products sectors is predicted to cause a large increase in the U.S. market for biodegradable plastics throughout forecasting. In comparison to conventional plastics, bio bags, and bio-based plastics are easier to use, have a better tensile strength, and are environmentally beneficial. As a result, it is anticipated that demand for biodegradable plastics would increase over the projection period. The demand for bio-based bags or compostable bags used in the collection of food leftovers and other organic waste material is also anticipated to increase during the forecast period due to growing government efforts to reduce landfilling, such as the U.S. 2030 Food Loss and Waste Reduction Goal.There are various North American bioplastics manufacturers focusing on product innovation. For instance, a US-based chemical corporation with its main office in Kingsport, Tennessee, is Eastman Chemical Corporation. The business has introduced TREVA, an engineering bioplastic made of cellulose that delivers great performance and no environmental effects. TREVA is dimensionally stable, BPA-free, and chemically resistant.

Rising demand for sustainable plastic packaging and initiatives

Economic and environmental considerations as consumer spending rises over the projected period, plastic product makers could see strong demand. Plastic product producers will need more plastic, including some bioplastics, as plastic product sales increase. The demand for this sector will rise as more businesses continue to use bioplastics in their production processes because of growing environmental concerns. In March 2023, a declaration was made by the Biden administration when it set an aim to replace 90 per cent of plastics derived from fossil fuels with bioplastics. The problems that manufacturers of bioplastics and the plastics industry will confront in achieving these objectives are described by Steve Toloken in this week's Material Insights.North America Bioplastic Market for the Packaging segment is anticipated to grow ‘

Governments and other local regulatory bodies are also promoting the use of bioplastic for packaging. Additionally, Bioplastic packaging is widely utilized for the manufacturing of jars, containers, and bottles as well as for fresh food packaging work. The rising awareness among consumers related to the effects of non-biodegradable packaging on the environment is driving the market growth for sustainable packaging solutions. For instance-In 2022, Green dot plastics, a leading developer of bioplastic material expanded its Terratek BD line with compostable grades focusing on under-packaging applications.According to estimates from the European bioplastic association, the production capacity of bioplastics in North America is expected to increase to around 1.194 million tons by 2027. This indicates favourable outcomes for bioplastic applications in various industries till the forecast period.

Government guidelines supporting bioplastic packaging will boost market growth.

With the rapidly increasing demand for packaging needs under various industries such as food & beverages, pharmaceuticals, and consumer goods among others, the bioplastic market is expected to boost till the forecast period. Key developments by the top players will have a positive impact on market growth in the long term. For instance- In 2022, the partnership between Archer Daniels midland Co. (ADM), U.S. based food processing company, and LG Chem Ltd. aims to build two manufacturing plants in the U.S. The production facilities will aid the manufacturing of biodegradable plastics that can be widely used in food packaging applications.Moreover, the government guidelines supporting bioplastic packaging will boost market growth. For instance- the U.S. development agency (USDA) provides a range of support through its programs for research, development & consumer awareness of bioplastics. Additionally, bioplastics are expected to cover a larger market share compared to conventional plastic packaging due to their several unique properties. These characteristics include extended & preserve product shelf life, and antimicrobial covering among others.

The U.S bioplastics market is estimated to expand.

Bioplastics are made from renewable sources such as cornstarch, vegetable fat, sawdust, and recycled food waste owing to which they emit less carbon emission. The growing demand for biodegradable material in the U.S. coupled with technological innovations to reduce plastic waste is majorly driving the demand for bioplastics in the U.S. Also, bolstering growth in organic farming where bioplastics are applied for preserving moisture and soil nutrients is further propelling the market demand. For instance, according to the “Organic Survey” report issued by USDA’s National Agricultural Statistical Service, in 2021, the number of certified organic farms in the U.S. stood at 17, 445 which represented a 5% increase over the organic farm strength recorded in 2019.Besides product innovations and developments, favourable investment inflows by the government to boost bioplastic production are also acting as an additional driving factor. For instance, in December 2022, the US Department of Agriculture announced investments of US$9.5 million to elevate bioproduct production in the USA. The investment included supporting Virginia Polytechnic Institute and State University’s proposal of converting food waste into polyhydroxyalkanoate (PHA)-based bioplastics that could be used in packaging applications for a variety of consumer products.

Key Developments

- In January 2023, the IAEA is inviting research institutions to participate in its brand-new Coordinated Research Project (CRP), which is designed to improve the utilization of biomass for the radioactive synthesis of bioplastics and other chemicals. The IAEA's Nuclear Technology for Controlling Plastic Pollution (NUTEC Plastics) initiative is home to the project, Strengthening the Use of Biomass for Synthesis of Bioplastics and Other Compounds, using Radiation Technology.

- In January 2023, A $2.4 million USDA grant was given to Virginia Tech College of Agriculture and Life Sciences researchers to develop cheap bioplastics and lessen the number of plastic debris that is left on the land and in the ocean.

- In March 2023, Genecis, a bioplastics startup created by scientist Luna Yu, received funding from Amazon's Climate Pledge Fund as part of its pledge to encourage female climate tech entrepreneurs. Genecis produces PHA (polyhydroxyalkanoate), a biodegradable bioplastic that can replace traditional plastic packaging, using organic waste like table scraps.

- In March 2021, an additional £248, 000 in financing has been received by Biome Bioplastics to boost the commercialization of their biodegradable tree houses. This additional money was obtained after the original feasibility study to create and test a new generation of biodegradable tree huts was completed successfully.

Segmentation:

By Type

- Biodegradable bioplastic

- Polyester

- Polylactic Acid (PLA)

- Polyhydroxyalkanoates (PHA)

- Starch Blends

- Others (Cellulose Esters and others)

- Non-Biodegradable plastic

- Bio-PE (polyethylene)

- Bio-PET (polythene terephthalate)

- Bio-PA (polyamide)

- Others

By Application

- Construction

- Packaging

- Agriculture

- Textile

- Automotive

- FMCG

- Others

By Geography

- United States

- Canada

- Mexico

Table of Contents

Companies Mentioned

- BASF

- Corbion

- NatureWorks LLC

- Braskem

- Novamont S.p.A

- Cardia Bioplastics

- Biome Bioplastics

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 114 |

| Published | October 2023 |

| Forecast Period | 2021 - 2028 |

| Estimated Market Value ( USD | $ 7.13 Billion |

| Forecasted Market Value ( USD | $ 20.95 Billion |

| Compound Annual Growth Rate | 16.6% |

| Regions Covered | North America |

| No. of Companies Mentioned | 7 |