Vertical Profile is the fastest growing segment, North America is the largest regional market

Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Key Market Drivers

Increased investments in railway infrastructure modernization significantly drive the Global Track Geometry Measurement System Market. As global rail networks expand and undergo upgrades, the demand for precise track assessment rises to ensure structural integrity and operational efficiency. This includes new high-speed lines and extensive urban metro expansions. According to Railway Technology, in January 2025, 205 rail construction projects commenced in 2024, with a combined cost of $389.32 billion, directly fueling the need for advanced track monitoring systems. Heightened focus on railway safety and security also acts as a critical market determinant. Preventing derailments and incidents necessitates stringent safety measures, where track geometry measurement systems are essential for early detection of defects.Key Market Challenges

A notable challenge impeding market expansion for Track Geometry Measurement Systems (TGMS) is the substantial initial capital outlay required for acquiring and implementing these advanced solutions. This financial barrier can particularly affect smaller railway operators and those in developing economies, potentially limiting broader adoption. Despite various initiatives to modernize infrastructure, the high upfront costs of specialized diagnostic tools often compete with foundational investment priorities within constrained budgets.For instance, according to Europe's Rail Joint Undertaking, in 2023, €21.2 million was allocated to seven cutting-edge rail research and innovation projects. While this represents investment in progress for specific areas, the magnitude indicates that highly specialized, capital-intensive equipment like TGMS solutions face significant hurdles in securing substantial dedicated funding for widespread deployment.

Key Market Trends

The expansion of autonomous inspection platforms represents a pivotal shift in track geometry measurement, enhancing operational efficiency and worker safety. These systems enable more frequent and comprehensive data collection across rail networks, reducing the reliance on manual inspections and minimizing human exposure to hazardous track environments. The increasing demand for efficient monitoring is underscored by substantial growth in rail usage; according to the International Union of Railways (UIC), global rail passenger traffic volumes increased by 7% in 2024 compared to 2023, necessitating robust inspection capabilities. Such platforms, often integrating advanced sensor technologies, allow railway operators to maintain higher service levels and ensure infrastructure integrity with greater consistency.Key Market Players Profiled:

- Balfour Beatty PLC

- Bentley Systems, Inc.

- Egis Group

- ENSCO Inc.

- Fugro N.V.

- Siemens AG

- Infrastructure Technologies Inc.

- James Fisher and Sons plc

- Mott MacDonald Group

- Network Rail Infrastructure Limited

Report Scope:

In this report, the Global Track Geometry Measurement System Market has been segmented into the following categories:By Operation Type:

- Contact

- Contactless

By Measurement Type:

- Gauge

- Twist Cant and Cant Deficiency

- Vertical Profile

- Curvature

- Alignment

- Dynamic Cross-Level

By Component:

- Software

- Lighting Equipment

- Navigation Equipment

- Communication Equipment

- Power Supply Equipment

- Sensor

- Camera

- Data Storage & Desktop

By Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Track Geometry Measurement System Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The companies profiled in this Track Geometry Measurement System market report include:- Balfour Beatty PLC

- Bentley Systems, Inc.

- Egis Group

- ENSCO Inc.

- Fugro N.V.

- Siemens AG

- Infrastructure Technologies Inc.

- James Fisher and Sons plc

- Mott MacDonald Group

- Network Rail Infrastructure Limited

Table Information

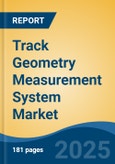

| Report Attribute | Details |

|---|---|

| No. of Pages | 181 |

| Published | November 2025 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 3.3 Billion |

| Forecasted Market Value ( USD | $ 4.9 Billion |

| Compound Annual Growth Rate | 6.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |