This report comes with 10% free customization, enabling you to add data that meets your specific business needs.

1h Free Analyst TimeSpeak directly to the analyst to clarify any post sales queries you may have.

Insulin delivery devices have evolved significantly over the years, transforming the landscape of diabetes management. From traditional syringes to innovative smart pens and pumps, these devices are not only making insulin administration more accessible but also enhancing the overall quality of life for individuals with diabetes.

Insulin is delivered to diabetic patients via insulin delivery devices such as syringes, pens, pumps, and jet injectors. The rising number of diabetics as a result of age, obesity, and unhealthy lifestyles is one of the primary reasons driving market growth. Obesity is thought to be a major cause in the development of diabetes in people. More than 1 billion people worldwide are obese (650 million adults, 340 million adolescents and 39 million children), where the number is still increasing. WHO estimates that by 2025, approximately 167 million people, including adults and children, will become less healthy because they are overweight or obese.

Insulin is a hormone produced by the pancreas that regulates blood glucose levels and stores blood sugar for later use. Diabetes is a chronic health disorder that affects how the human body converts food into energy. It is mostly caused by an increase in blood sugar levels due to the body's inability to produce enough insulin.

As a result, diabetic patients are given insulin externally to maintain healthy bodily function, which is predicted to drive future demand for insulin delivery devices. The adoption of bad lifestyle behaviors is expected to be a major contributor to the increasing prevalence of diabetes. Other factors that could improve insulin delivery device sales in the future include an older population, a high prevalence of obesity, poor eating habits, a greater emphasis on healthcare, and advantageous reimbursement policies.

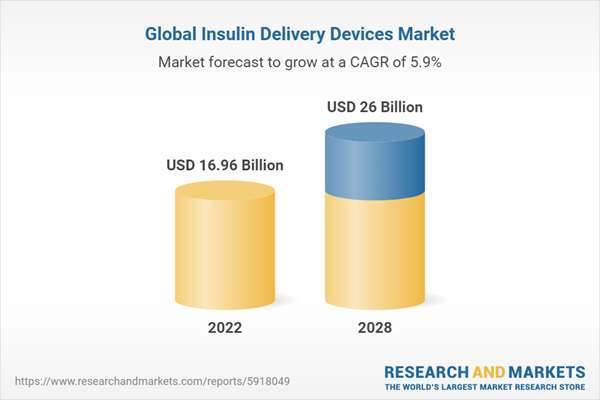

According to the research report, “Global Insulin Delivery Devices Market Outlook, 2028”, the market is anticipated to cross USD 26 Billion by 2028, increasing from USD 16.96 Billion in 2022. The market is expected to grow with more than 5.87% CAGR by 2023-28. This high incidence is primarily due to the adoption of an unhealthy and sedentary lifestyle because insulin delivery devices offer a more effective and improved way for people to manage their diabetes. With a rising patient population, the market is expected to grow significantly because of the increased desire for these devices due to their improved durability and reduced need for multiple injections. Furthermore, the prevalence of diabetes is significantly higher among the elderly. The development of sophisticated insulin administration technologies, such as smart insulin pens and insulin pumps, has aided market expansion.

These devices provide more precise insulin delivery and help patients manage their diabetes more effectively. Government initiatives to encourage diabetes prevention and management have contributed to the expansion of the market for insulin delivery devices. Several countries, for example, have created programs to increase diabetes treatment and care access. The government has also enacted laws to protect the safety and efficacy of insulin delivery devices. This increase is attributed to a variety of variables, including rising diabetes prevalence, technological breakthroughs in insulin delivery devices, and more diabetes awareness. Positive government initiatives and enhanced R&D are also considerations. The market for insulin delivery devices is expected to grow steadily over the forecast period due to a variety of factors. Insulin pumps are expected to dominate the market, with the largest market being North America.

The growing consumer awareness of the availability of various delivery devices, the rising prevalence of hyperglycemia, increased awareness about diabetes management and the importance of insulin delivery devices, and the rapid adoption of insulin therapy for diabetes management is driving the growth of the insulin delivery device market. The growing senior population, which is more prone to diabetes and requires insulin administration, advantageous reimbursement policies for insulin delivery devices in various healthcare systems, and rising FDA support all contribute to the expansion of the insulin delivery device market.

North America dominated the market for insulin delivery devices and accounted for the largest revenue share in 2022 owing to the rising diabetic population and the accessibility of technologically advanced devices.

North America, particularly the United States, has a high prevalence of diabetes. The region has witnessed a steady increase in the number of individuals diagnosed with diabetes; both type 1 and type 2. The substantial diabetic population creates a robust market for insulin and, consequently, insulin delivery devices. North America is at the forefront of technological innovation in healthcare. The region has a strong healthcare infrastructure, including research institutions and pharmaceutical companies that drive advancements in insulin delivery device technologies. The development and adoption of smart insulin pens, continuous glucose monitoring systems, and other advanced devices contribute to the region's leadership. There is a high level of awareness and education about diabetes management in North America.

Healthcare professionals and patients alike are well-informed about the importance of precise insulin delivery and the role of various devices in achieving optimal glycemic control. This awareness drives the demand for innovative insulin delivery solutions. North America generally has better market access to healthcare products, and patients often have relatively better affordability for advanced medical devices. Insulin delivery devices, including smart pens and pumps, can be more readily accessible to a larger portion of the population compared to some other regions. The regulatory environment in North America, particularly in the United States, is generally conducive to the development and commercialization of medical devices. Regulatory agencies, such as the U.S. Food and Drug Administration (FDA), play a crucial role in ensuring the safety and efficacy of insulin delivery devices, while also facilitating their timely approval and market entry.

The insulin pens segment held the largest revenue share in 2022 owing factors such as its high adoption rate, user-friendly design, and rising popularity among consumers.

The insulin pumps segment is projected to expand attributable to the multiple benefits related to the use of insulin pens such as affordable price, user-friendly design, and technological advancements among others. The introduction of new smart insulin pens equipped with Bluetooth or other wireless connectivity, allowing them to connect to smartphone apps has resulted in rising popularity among consumers. These apps can track insulin doses, provide reminders for insulin injections, and help users monitor their insulin regimen and blood sugar levels over time. These devices commonly allow advanced settings, such as dose recommendations, data sharing, and touchscreen interfaces. Data sharing with healthcare providers enables them to modify the treatment to the specific needs of each patient.

The market growth is due to the ease of use of the insulin pen and its flexibility to incorporate insulin injections into a busy lifestyle which improves diabetes control with less effort while maintaining the quality of life for diabetic patients. Various other factors such as user-friendly design, rising popularity, and adoption rate among the patient population are also anticipated to contribute to the segmental growth of the insulin delivery devices market. Moreover, the rising focus of manufacturers on developing smart insulin pens integrated with real-time continuous glucose monitoring data to provide efficient diabetes management for patients is likely to boost the segmental market. For instance, in 2020, Medtronic launched InPen™ integrated with real-time Guardian Connect™ CGM data which is the first and only FDA-cleared smart insulin pen on the market for people on multiple daily injections (MDI).

In addition to that, the growing focus of manufacturers on promoting innovation and advancements is another major factor yielding the high share. For instance, in January 2014, Novo Nordisk launched a new device, NovoPen Echo in the U.S. This is the first device of its kind, available in the U.S., with a memory function and half-unit dosage features. Thus, product advancements are expected to propel the demand for insulin pens in the near future.

Based on the end users, the home care segment dominated the insulin delivery devices market and accounted for the largest revenue share in 2022, which is anticipated to maintain its position during the forecast period.

The high growth rate of this segment can be attributed to the greater focus on the training patients for effective use of devices for self-administration of insulin, growing diabetic population and increasing diabetic healthcare expenditure. The use of insulin devices at home saves on visiting costs, hospital or clinic fees, and waiting time. The advanced devices, including pumps, pens, and injectors, are small in size, highly portable, and can be used anywhere at any time. Thus, greater access to these devices and their higher user-friendliness has made insulin users opt for self-care diabetes management options. For instance, the American Diabetes Association operates Diabetes Self-Management Support (DSMS) program and recently initiated Diabetes Support Initiative to assist & educate diabetic patients in self-managing the diabetes.

Similarly, the Building Community Supports for Diabetes Care initiative offers support to diabetes patients and encourages people to opt for diabetes care at homecare settings, intending to limit the expenses. This increasing trend towards providing diabetes management care in home settings has gained significant popularity, due to factors such as the desire to reduce frequent visits to hospitals, patient convenience, and affordable cost. Insulin delivery devices that are user-friendly, portable, and ideal for home use have experienced an increase in demand. The segment's growth is primarily driven by the growing awareness of diabetes and the adoption of insulin devices at home.

Using insulin delivery systems at home can reduce waiting times, clinic or hospital fees, and visits. Modern technology is available in pens, pumps, and injectors. They are all compact, portable, and can be used anywhere and anytime. Insulin users choose self-care solutions for diabetes control because these devices are more accessible and easier to use.

Based on the indication, the diabetes epidemic has played a significant role in the growth of the insulin delivery devices industry with major market share in 2022.

The most fundamental driver of the insulin delivery devices industry's growth is the global increase in diabetes prevalence. Both type 1 and type 2 diabetes have become more widespread, creating a substantial and growing patient population that requires insulin therapy. Improvements in healthcare infrastructure, access to medical services, and awareness campaigns have led to higher rates of diabetes diagnosis. As more individuals are identified as having diabetes, the demand for insulin and associated delivery devices naturally rises. Advances in technology have transformed insulin delivery devices, making them more user-friendly, precise, and connected.

The development of smart insulin pens, continuous glucose monitoring systems, and advanced insulin pumps has attracted individuals with diabetes who seek more convenient and efficient ways to manage their condition. Modern insulin delivery devices offer greater convenience and flexibility compared to traditional methods.

Patients often prefer the ease of use, discreetness, and portability of devices like insulin pens and pumps. This preference for convenience has driven the industry to innovate and create more user-centric solutions. The integration of continuous glucose monitoring (CGM) systems with insulin delivery devices has become a significant trend. This integration provides real-time data on blood glucose levels, enabling users to make informed decisions about insulin dosages. The combination of insulin delivery and glucose monitoring addresses the need for comprehensive diabetes management. Changes in lifestyle and increased urbanization contribute to the rise in diabetes cases. Sedentary lifestyles, unhealthy dietary habits, and environmental factors associated with urban living are linked to an increased risk of developing type 2 diabetes. As urbanization continues globally, the demand for insulin and delivery devices is likely to persist.

The aging population is more prone to developing diabetes, particularly type 2 diabetes. As the global population continues to age, the prevalence of diabetes is expected to increase. Older individuals often require insulin therapy, contributing to the demand for insulin and associated delivery devices.

Major Drivers

- Increasing Diabetes Prevalence: The global rise in diabetes prevalence is a significant driver for the insulin delivery devices market. The growing number of individuals diagnosed with diabetes, both type 1 and type 2, necessitates effective and convenient methods of insulin delivery. This driver creates a consistent and expanding demand for insulin and delivery devices, encouraging innovation in technology and driving market growth.

- Technological Advancements and Innovation: Ongoing technological advancements and innovations in insulin delivery devices contribute to the market's growth. The development of smart insulin pens, connected devices, and the integration of continuous glucose monitoring systems enhance the precision and convenience of insulin administration. Improved technology not only addresses the evolving needs of individuals with diabetes but also attracts a broader user base, promoting the adoption of advanced insulin delivery solutions globally.

Major Challenges

- Affordability and Accessibility: Affordability and accessibility remain significant challenges, particularly in lower-income regions. Advanced insulin delivery devices, while beneficial, may be cost-prohibitive for some

- Regulatory Hurdles and Compliance: Regulatory processes for medical devices can be complex and time-consuming. Achieving compliance with varying regulatory standards across different regions poses a challenge for manufacturers in terms of product development and market entry. Delays in regulatory approvals may hinder the timely introduction of innovative insulin delivery devices to the market, limiting options for patients and healthcare providers.

Major Trends

- Integration of Continuous Glucose Monitoring (CGM): The integration of insulin delivery devices with continuous glucose monitoring systems is a prominent trend. Connected solutions provide real-time data, allowing for more precise insulin dosing decisions. This trend enhances overall diabetes management, improves glycemic control, and reduces the risk of hypoglycemia. Integrated systems are expected to gain further popularity as technology continues to advance.

- Rise of Personalized and Digital Healthcare: The trend towards personalized healthcare, driven by digital solutions, is influencing the insulin delivery devices market. AI algorithms, mobile applications, and wearable technologies are increasingly being used to tailor insulin dosage recommendations to individual patient needs. Personalized and digital healthcare not only improves treatment outcomes but also enhances patient engagement and adherence to insulin therapy, contributing to better long-term health outcomes.

COVID-19 Impact

The impact of COVID-19 pandemic was devastating for almost all the industries across the globe. However, the global insulin delivery devices market witnessed a positive impact of this pandemic. One of the major factors behind this affirmative impact was the growing population of diabetics and increasing obesity. The demand for protective equipment involving insulin delivery devices like insulin pumps, pens, syringes, among others suddenly got a boost due to the outbreak situation of this pandemic. This pandemic created a major threat among populace which is also the factor for the increasing demand of protective equipment, thus directing towards the growth of revenue trajectory of this market.In the expansion of insulin delivery devices, COVID-19 pandemic plays a very considerable role in the year 2020. In addition, prominent market players operating in this market have taken an advantage of this positive impact to streamline their revenues and expand their footprints in various parts of the globe.

Competitive Landscape

The market for insulin delivery devices is ruled by three major players, namely, Novo Nordisk, Eli Lilly, and Sanofi. These leaders are constantly adopting developmental strategies such as collaborations, acquisitions, partnerships, mergers, marketing agreements, and new product launches to strengthen their portfolios. For instance, Eli Lilly developed a biosimilar version of insulin glargine, Rezvoglar KwikPen that received FDA approval in December 2021. Also, in November 2021, Sanofi partnered with Roche, to increase the adoption of disposable insulin pens. Further, these players are collaborating with local players to improve their market reach. The insulin delivery devices market is consolidated due to only a few major companies operating globally and regionally.The competitive landscape includes an analysis of a few international and local companies that hold market shares and are well known, including Globus Tours, Topdeck Travel, World Expeditions, Recreational Equipment, Inc, Thomson Family Adventures, International Expedition, Make My Trip Pvt.Ltd., Austin Adventures, G Adventures, Cox & Kings Ltd., Intrepid Travel, ROW Adventures, Expedia, Inc., Lindblad Expeditions, Abercrombie & Kent, MT Sobek - Mountain Travel-Sobek, TUI Group, Logistur DMC, CVC Corp and Wild Frontiers, among others.

Key Developments

- In 2023, Novo Nordisk entered negotiations of acquiring BIOCORP, which specialized in the design and development of medical devices. This was done for the development of FlexTouch Pen with Mallya, an add-on Bluetooth device.

- In 2023, Lilly and IABL, the largest healthcare provider collaborated to provide high-quality and affordable insulin in Bangladesh.

- In 2023, Embecta Corp. opened a new global headquarters office at 300 Kimball Drive, Suite 300, IN Parsippany, N.J. The site is expected to be home to members of the leadership team, global support functions and North American commercial organization to develop and provide solutions that make life better for people coping with diabetes.

- In 2023, Eli Lilly announced price reductions of 70% for its most prescribed insulins and an expansion of its Insulin Value Program that caps patients out-of-pocket cost at USD 35 or less per month.

- In 2023, Novo Nordisk launched the first smart insulin pens NovoPen 6 and NovoPen Echo Plus available in the UK.

- In 2022, Medtronic entered into a set of definitive agreements to acquire EOFlow Co. Ltd., a manufacturer of the EOPatch device- a tubeless, wearable and fully disposable insulin delivery device.

- In 2022, Medtronic, a global leader, launched the world’s first infusion set for insulin pumps labeled for up to 7-day wear. It reduces insulin loss, maintains the flow and provides stability to the wear time.

Considered in this report:

- Geography: Global

- Historic year: 2017

- Base year: 2022

- Estimated year: 2023

- Forecast year: 2028

Aspects covered in this report:

- Global Insulin Delivery Devices market with its value and forecast along with its segments

- Region & Country-wise Insulin Delivery Devices market analysis

- Various drivers and challenges

- On-going trends and developments

- Top profiled companies

- Strategic recommendation

Regions & Countries covered in the report

- North America (United States, Canada, Mexico)

- Europe (Germany, United Kingdom, France, Spain, Italy, Russia)

- Asia-Pacific (China, Japan, India, Australia, South Korea)

- South America (Brazil, Argentina, Colombia)

- Middle-East & Africa (UAE, Saudi Arabia, South Africa)

By Product

- Insulin Pens

- Insulin Pumps

- Insulin Pen Needles

- Insulin Syringes

- Others Insulin Delivery Devices (Insulin transdermal patches, insulin inhalers, insulin jet injection)

By Indication

- Diabetes

- Pregnancy

- Cardiovascular Disorders & Hypertension

- Respiratory Diseases

- Hearing Disorders

- Cancer

- Movement Disorders

- Wound Care

- Other Indications (sleep disorders, kidney disorders, neurovascular diseases, and HIV)

By End User

- Home Care

- Hospitals & Clinics

- Others

The approach of the report:

This report consists of a combined approach of primary as well as secondary research. Initially, secondary research was used to get an understanding of the market and list out the companies that are present in the market. The secondary research consists of third-party sources such as press releases, and annual reports of companies, analyzing the government-generated reports and databases. After gathering the data from secondary sources primary research was conducted by making telephonic interviews with the leading players about how the market is functioning and then conducting trade calls with dealers and distributors of the market. Post this we have started doing primary calls to consumers by equally segmenting consumers into regional aspects, tier aspects, age groups, and gender. Once we have primary data with us we started verifying the details obtained from secondary sources.Intended audience:

This report can be useful to industry consultants, manufacturers, suppliers, associations & organizations related to the Tea industry, government bodies, and other stakeholders to align their market-centric strategies. In addition to marketing & presentations, it will also increase competitive knowledge about the industry.This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Novo Nordisk A/S

- Sanofi S.A.

- Eli Lilly and Company

- Medtronic plc

- Terumo Corporation

- Becton, Dickinson and Company

- Insulet Corporation

- Biocon Limited

- Tandem Diabetes Care

- Wockhardt Ltd.

- B. Braun Melsungen AG

- SOOIL Development Co., Ltd

- Medline Industries, LP

- MannKind Corporation

- Owen Mumford Ltd

- Debiotech SA

- F. Hoffmann-La Roche AG,

- Ypsomed AG

- LifeScan, Inc

- Hindustan Syringes & Medical Devices Ltd

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 190 |

| Published | November 2023 |

| Forecast Period | 2022 - 2028 |

| Estimated Market Value ( USD | $ 16.96 Billion |

| Forecasted Market Value ( USD | $ 26 Billion |

| Compound Annual Growth Rate | 5.8% |

| Regions Covered | Global |