This report comes with 10% free customization, enabling you to add data that meets your specific business needs.

1h Free Analyst TimeSpeak directly to the analyst to clarify any post sales queries you may have.

With increasing world-population and welfare, the demand for the nutritional food is rising sharply. The high nutrition trend is gaining traction and will continue to evoke interest in the upcoming years. The consumers have become more aware about protein and other nutrient benefits in supporting active lifestyle. Also, there is a growing awareness of the negative health aspect of eating red meat with a growing number of people wish to either minimize or cut animal protein out of their diet altogether. In addition, most of these nutrients present in milk are in the forms that are easily absorbed by the human body.

Owing to all these factors, consumers across the globe regularly include milk and milk products into their diet, leading to their high demand and thereby the growth of the global dairy products market. Furthermore, significant product sales through online distribution channels during the COVID-19 pandemic also supported the market growth. Dairy products offer various health benefits as they are rich in calcium, riboflavin, vitamin D, vitamin A, niacin, potassium, and phosphorus. Regular consumption of dairy products improves bone and gut health and reduces the risks of Cardiovascular Diseases (CVDs) and type 2 diabetes. The rising demand for cheese in developing nations is also expected to drive the market. Earlier, cheese was considered unhealthy due to its association with a high amount of fats.

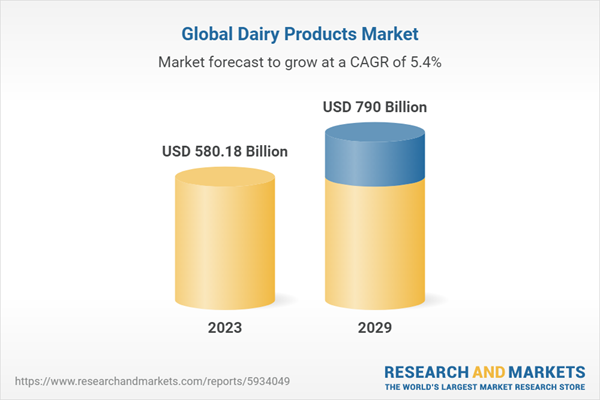

According to the research report, 'Global Dairy Products Market Outlook, 2029', the market is anticipated to cross USD 790 Billion by 2029, increasing from USD 580.18 Billion in 2023. The market is expected to grow with 5.35% CAGR by 2024-29. The primary reasons for the increasing adoption of dairy products are the sheer diversity they offer. From the creamy goodness of whole milk to the tangy richness of Greek yogurt and the intricate flavors of artisanal cheeses, consumers can choose from an array of options that suit their taste preferences and nutritional needs. Dairy products are renowned for their high-quality protein content.

Protein is essential for building and repairing tissues, supporting muscle development, and promoting a feeling of fullness. Athletes and fitness enthusiasts often turn to dairy for its protein-packed goodness, incorporating products like Greek yogurt and cottage cheese into their diets. Calcium, phosphorus, and magnesium are crucial minerals found abundantly in dairy products. These minerals play a fundamental role in maintaining strong and healthy bones, preventing conditions like osteoporosis. The adoption of dairy becomes especially important during childhood and adolescence when bone development is at its peak. The rise of interest in gut health has led to increased adoption of dairy products containing probiotics.

Yogurts, kefir, and certain cheeses contain beneficial bacteria that support a healthy gut micro-biome. Probiotics contribute to digestion, boost the immune system, and may even have positive effects on mental health. Dairy products are versatile ingredients in the kitchen, enhancing the flavors and textures of a wide range of dishes. From creamy Alfredo sauces and cheesy casseroles to decadent desserts, the adoption of dairy in culinary applications is not only delicious but also adds nutritional value to meals. The dairy industry has responded to changing consumer preferences by introducing innovative and alternative dairy products.

Plant-based milk alternatives, such as almond, soy, and oat milk, cater to individuals who are lactose intolerant or choose a vegan lifestyle. These alternatives offer a plethora of options for those looking to adopt dairy-like products without the use of animal-derived ingredients. Many consumers are becoming increasingly conscious of the environmental impact of their food choices. Some dairy producers are adopting sustainable and eco-friendly practices, such as organic farming and reduced carbon emissions, further contributing to the positive perception and adoption of dairy products.

Market Drivers

- Rising Health Consciousness: With a growing awareness of the importance of protein in a balanced diet, dairy products, being a rich source of high-quality proteins, are witnessing increased demand. Protein is crucial for muscle development, satiety, and overall health, and dairy products offer a convenient and palatable way to meet these nutritional needs. The aging population and rising concerns about osteoporosis and bone-related issues have led to a heightened demand for dairy products rich in calcium and other essential minerals. Consumers are recognizing the role of dairy in maintaining strong and healthy bones.

- Rapid Urbanization and Changing Lifestyles: Urbanization has resulted in busier lifestyles, driving the demand for convenient and portable food options. Dairy products, such as yogurt cups, cheese snacks, and single-serve milk products, are becoming popular choices for on-the-go consumers, providing a quick and nutritious solution for busy schedules. As disposable incomes rise, consumers are more willing to spend on premium and value-added dairy products. This includes specialty cheeses, organic and artisanal dairy items, and products with added health benefits, contributing to the overall growth of the dairy market.

Market Challenges

- Lactose Intolerance and Dairy Allergies: A significant challenge for the dairy industry is the increasing awareness of lactose intolerance, leading some consumers to seek non-dairy alternatives. This has prompted the development and promotion of lactose-free and plant-based dairy alternatives to cater to individuals with specific dietary restrictions. Allergies to dairy proteins are also a concern, leading to the development of allergen-free alternatives. This challenge necessitates innovation in product development and marketing to address the needs of those who cannot consume traditional dairy products.

- Environmental and Sustainability Concerns: The dairy industry faces scrutiny for its environmental impact, including greenhouse gas emissions and land use. Concerns about sustainability and ethical practices are leading to the development of more eco-friendly and sustainable approaches within the dairy sector, including efforts to reduce carbon emissions and adopt responsible farming practices. The rise of plant-based alternatives, driven by environmental concerns and the desire for cruelty-free products, poses a challenge to traditional dairy producers. The market for plant-based milk, cheese, and yogurt has grown significantly, impacting the market share of conventional dairy products.

Market Trends

- Plant-Based Dairy Alternatives: The growing trend toward plant-based diets and flexitarianism has led to an increased demand for plant-based dairy alternatives. Products made from almonds, soy, oats, and other plant sources are gaining popularity, offering a cruelty-free and environmentally sustainable option for consumers. The plant-based dairy sector is witnessing continuous innovation, with manufacturers developing new products, flavors, and formulations to mimic the taste and texture of traditional dairy. This trend is likely to continue as the market expands.

- Premiumization and Specialty Dairy Products: Consumers are showing a growing interest in unique and high-quality dairy products, leading to an increased demand for artisanal and specialty cheeses. Producers are capitalizing on this trend by offering unique flavor profiles, production methods, and branding to differentiate their products. The market is witnessing a surge in the demand for dairy products with added functional benefits, such as probiotics, omega-3 fatty acids, and vitamins. Functional dairy appeals to health-conscious consumers looking for products that offer more than just basic nutrition.

COVID-19 Impact

Lockdowns, restrictions on movement, and disruptions in transportation posed significant challenges to the dairy supply chain. These disruptions affected the timely delivery of raw materials, packaging, and finished products, leading to temporary shortages in some regions. Restrictions and safety measures implemented to curb the spread of the virus resulted in labor shortages, affecting dairy farms and processing plants. The shortage of skilled labor impacted production capacities, contributing to supply chain bottlenecks. The closure of restaurants, cafes, and foodservice establishments led to a decline in demand for certain dairy products meant for the hospitality sector.Conversely, there was an increase in demand for dairy products in retail channels as consumers shifted towards cooking and consuming meals at home. With lockdowns and social distancing measures in place, there was a surge in online shopping for groceries, including dairy products. E-commerce platforms became vital channels for consumers to access a wide range of dairy items without visiting physical stores. The dairy industry heavily relies on international trade, and disruptions in global logistics and trade routes affected the export and import of dairy products. Fluctuations in currency values and changing demand dynamics in different regions further influenced export volumes.

The dairy industry experienced price volatility for raw materials, such as milk, due to supply chain disruptions and changing demand patterns. Producers faced challenges in managing costs and maintaining stable pricing for their products. Some consumers opted for more budget-friendly options, influencing the demand for certain dairy products. Dairy products, known for their nutritional value, including vitamins, minerals, and proteins, gained attention as consumers sought to bolster their overall health. There was an increased interest in functional dairy products with added health benefits, such as probiotics and vitamins, to address specific health concerns. Producers responded to consumer demand by innovating and introducing products that align with emerging health trends.

The dominance of milk is attributed to the increased consumption of milk in households and various commercial units all over the globe. The nutritional properties of milk and the increased awareness regarding the health benefits of milk are driving the growth of this segment across the global market.

The market growth is due to rising milk consumption in developing countries as it is highly nutritious and offers protein and calcium. Moreover, milk consumption reduces the risk of osteoporosis among the elderly, which is expected to drive its demand at a substantial rate. Milk is the most consumed dairy item since ages as it is has one of the most essential nutrients, such as vitamins and minerals, especially calcium. Milk is one of the multi-purpose products that can be used in a wide range of foods, ranging from savory to sweet items. Milk is the primary raw material for a wide range of dairy products. It serves as the foundation for various products such as cheese, yogurt, butter, and more.

The diversity of dairy offerings often originates from milk processing, making it a central component of the entire dairy industry. Milk is a rich source of essential nutrients, including high-quality proteins, calcium, vitamins (such as B12 and D), and minerals (such as phosphorus). Its nutritional completeness makes it a valuable dietary component, especially for children, pregnant women, and individuals seeking a well-rounded source of essential nutrients. Milk can be processed into various forms to create a wide array of dairy products. These include liquid milk, cheese, yogurt, butter, cream, and more.

This versatility allows the dairy industry to cater to diverse consumer preferences, contributing to the widespread adoption of milk and milk-based products. Milk is a staple in the diets of many cultures around the world. It serves as a core ingredient in traditional dishes, beverages, and desserts. The cultural significance of milk contributes to its consistent demand across different regions and communities. Milk is produced globally, with dairy farming being prevalent in various countries. This widespread availability ensures a stable and consistent supply of milk, meeting the demands of both domestic and international markets. Milk has a neutral and palatable taste that appeals to a broad range of consumers.

Its versatility allows it to be consumed in various forms, such as plain, flavored, or as an ingredient in cooking and baking. The mild flavor makes it a suitable base for a variety of dairy products that cater to different taste preferences. Milk and its derivatives serve as key ingredients in a variety of processed foods, enhancing their taste, texture, and nutritional value. Milk proteins and fats are often used in the food industry for their functional properties, contributing to the popularity of milk as a foundational component in the production of diverse food products.

By distribution channel, the supermarket/hypermarket stores segment led the global dairy products market with remarkable revenue share in 2023 and is anticipated to retain its dominance throughout the forecast period.

The supermarkets attract a huge customer base due to the availability of wide variety of food and beverages products and household groceries. Therefore, consumers prefer to buy household essentials and groceries on weekly or monthly basis. Further, the supermarkets are located in urban and easy accessible areas. This sales channel generates a regular revenue stream for the dairy products manufacturers. On the other hand, the others segment is expected to be the fastest-growing segment due to the rising adoption of food delivery platforms among the consumers.

The rapid growth of the online food and grocery delivery platforms in the global market has boosted the sales of the dairy products and is expected to grow rapidly in the forthcoming years. Supermarket commanded commanded the largest share of the global market, as these stores offer one-stop shopping for consumers; a clean, comfortable, and extended opening hours; and much wider selection of household items along with dairy products. Major trends that are currently influencing retailing of milk products include premiumization, health and wellness, and increasing penetration of organized retailing in developing countries, which have resulted in the setting up of a wide number of grocery retail stores.

Supermarkets are generally large-scale stores that offer essential and convenience products. The major advantage of visiting a supermarket is that consumers can easily get all their essential items under one roof, saving them a lot of energy and time. However, internet retailing segment is expected to witness a significant growth during the forecast period. The fast growth of this type is mainly attributed to growing of omnichannel retailers and increasing digitalization.

The Asia Pacific region is expected to sustain its dominance throughout the forecast period as the region is characterized by huge population, increased demand for milk, increasing milk production, rising government initiatives for boosting milk production, rising disposable income, and rapid urbanization.

The Asia- Pacific dairy products market is developing and expanding at a significant pace. Among other regional markets, Asia Pacific is demonstrating signs of strong growth in the near future. The rapid growth of this market is mainly attributed to huge milk production and promotion by the government and dairy industry for the milk processing; rising population; increasing consumer disposable income; growing foreign investment; increasing demand for western dairy products such as yogurt, sour milk, etc.; rising number of convenience stores, supermarkets, department stores, and hypermarkets; and technological advancements in dairy processing.

The dairy industry of Asian countries has been recognized as the largest sector globally due to the large scale consumption of these products and their several benefits. This evolution of the dairy sector can be attributed to its vast local consumer base, rapid growth in population, and increasing trend of adopting western lifestyle. Moreover, consuming protein-rich foods is the prime focus of the diet of a health-conscious person in today’s times as modern consumers are seeking a variety of 'protein-rich items' to maintain a sustainable lifestyle. With over 1.3 Billion people, there is a massive consumer base for dairy products in India.

As the population continues to rise, the demand for essential nutrients provided by dairy products also accelerates. Besides this, the agricultural nature of the country ensures a significant presence of livestock, particularly cows and buffaloes. This abundance of milk-producing animals facilitates a steady supply of raw milk for dairy processing and production. Additionally, the Indian dairy industry has witnessed significant modernization and infrastructure development, which has enhanced milk collection, processing, and distribution capabilities.

The market is moderately fragmented with the presence of several local companies. These market players are striving to gain higher market share by adopting strategies, such as investments, partnerships, and acquisitions & mergers. Companies are also spending on the development of improved products. Moreover, they are also focusing on maintaining competitive pricing. Major companies focus more on product and package innovation and business expansion to strengthen their market position. For instance, in June 2020, Arla Foods amba introduced its popular yogurt product skyr bucket in a sustainable packaging format that would contribute to a 30% reduction in CO2 emission.

A lot of small-scale companies are focusing on product quality and clean label to attract more consumers. The market comprises local players, and the number of these players exceeds that of international players. Local companies are continuously trying to expand their inter-country food business footprint in new countries. Considering the increasing demand for various products, key players are making their products available in international markets by entering partnerships with other local players to launch new products in the respective markets. For example, in March 2022, Fonterra launched its New Zealand high-end cheese brand 'Kapiti' in China’s retail market, which is expected to meet the rising demand for high-end cheese products in China.

- May 2023: Aavin is a state government co-operative that announced the launch of its all-new milk products fortified with vitamins A and D. As per the company, these new launches are to estimate the demand for fortified milk products in the market.

- August 2022: Dairy Farmers of America (DFA) acquired two Extended Shelf-Life (ESL) processing facilities from Smith Foods. The two processing plants are in Pacific (Missouri) and Richmond (Indiana) in the U.S. These facilities became part of the DFA’s dairy brands division and operated as Pacific Dairy Solutions and Richmond Beverage Solutions.

- October 2022: Unilever partnered with ASAP to distribute its ice creams. Under the partnership, ASAP will also deliver ice cream and snacks from Unilever's virtual store, The Ice Cream Shop.

- July 2022: GCMMF launched over 100 products, including products from different categories. These products include milk items in several variants of ginger, tulsi, and turmeric. Out of these 100 products, most of the products are milk-based. Therefore, this product launch helped the company expand its business through the expansion of its product portfolio.

Considered in this report

- Historic year: 2018

- Base year: 2023

- Estimated year: 2024

- Forecast year: 2029

Aspects covered in this report

- Dairy Products market Outlook with its value and forecast along with its segments

- Various drivers and challenges

- On-going trends and developments

- Top profiled companies

- Strategic recommendation

By Product Type

- Milk

- Cheese

- Yogurt

- Desserts

- Butter

- cream

- Others

By Distribution Channel

- Supermarket/Hypermarket

- Specialty Stores

- Convenience Stores

- online retail

- Others

The approach of the report:

This report consists of a combined approach of primary and secondary research. Initially, secondary research was used to get an understanding of the market and list the companies that are present in it. The secondary research consists of third-party sources such as press releases, annual reports of companies, and government-generated reports and databases. After gathering the data from secondary sources, primary research was conducted by conducting telephone interviews with the leading players about how the market is functioning and then conducting trade calls with dealers and distributors of the market. Post this; we have started making primary calls to consumers by equally segmenting them in regional aspects, tier aspects, age group, and gender. Once we have primary data with us, we can start verifying the details obtained from secondary sources.Intended audience

This report can be useful to industry consultants, manufacturers, suppliers, associations, and organizations related to the Dairy Products industry, government bodies, and other stakeholders to align their market-centric strategies. In addition to marketing and presentations, it will also increase competitive knowledge about the industry.This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Danone S.A.

- Nestlé S.A.

- Fonterra Co-operative Group Limited

- Arla Foods

- The Kraft Heinz Company

- Royal FrieslandCampina N.V.

- Almarai Company

- General Mills Inc.

- Yakult Honsha Co. Ltd.

- Saputo Inc.

- Emmi AG

- Meiji Holdings Company Ltd.

- Ferrero SpA

- The Hain Celestial Group Inc.

- Unilever PLC

- Land O’lakes Inc.

- Valio Ltd

- The Bel Group

- Dairy Farmers of America

- Amul (Gujarat Cooperative Milk Marketing Federation Ltd)

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 165 |

| Published | January 2024 |

| Forecast Period | 2023 - 2029 |

| Estimated Market Value ( USD | $ 580.18 Billion |

| Forecasted Market Value ( USD | $ 790 Billion |

| Compound Annual Growth Rate | 5.3% |

| Regions Covered | Global |