Key Highlights

- The COVID-19 pandemic had a negative impact on the market due to the global lockdown and social distancing norms, which halted the research and production from the assembly lines of many OEMs. This led to the downfall of automobile sales as a whole and, consequently, the electric vehicle powertrain market. However, with the rising inclination towards electric vehicles worldwide, the market is expected to revive economically and grow significantly during the forecast period.

- For instance, in July 2023, IC Bus introduced the next-generation CE Series school bus, a redesigned and updated version of its flagship CE Series. The all-new CE Series' electric powertrain provides a quieter ride for drivers and passengers, as well as three levels of selectable regenerative braking for a smoother ride, battery efficiency, and operating experience. The electric powertrain option has a peak power of 255 kW (342 hp) and is ready for alternating current (AC) and direct current fast charging (DCFC).

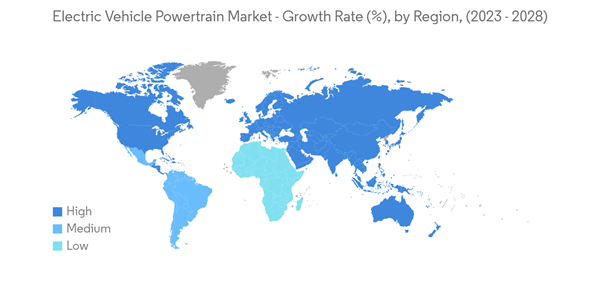

- Over the long term, the market for electric vehicles is expected to expand at a high rate, creating a high demand for automotive electric powertrains. There has been tremendous growth in electric vehicles all over the world. Major automotive component manufacturers have been investing in electric axle drives to capitalize on the increasing sales of electric and hybrid vehicles to increase their market share. Companies have been increasing production capacity, particularly in large electric vehicle markets, such as China, the United States, and the European region.

- Massive investments in electric vehicles by major automotive companies, such as Toyota, Honda, Tesla, General Motors, and Ford, are expected to drive the electric motor market in the near future. Additionally, the evolving partnerships between motor manufacturers and automotive companies are expected to expand the electric vehicle powertrain market globally.

- For instance, in July 2023, McLaren Applied Ltd. and BOLD announced a collaboration to create high-performance electric powertrains. McLaren Applied has joined forces with BOLD to capitalize on the latter's expertise in designing and manufacturing high-performance, lightweight battery pack systems.

- The electric motor market is expected to face challenges in procuring rare earth metals used in permanent magnets for synchronous motors, as the metals used in these motors are subject to export restrictions and supply risks. Apart from the growing activities in developing electric vehicles in the global market, depleting oil and gas reserves is also one of the major factors driving the automakers to shift from IC powertrain to electric powertrain.

EV Powertrain Market Trends

Increasing Sales of Electric Vehicles are Expected to Drive the Market

- The expanding market for electric and hybrid vehicles is a major driver for the automotive powertrain market. There has been tremendous growth in the electric vehicle market all over the world.

- The sales of electric vehicles are expected to rise, owing to a fall in the costs of batteries and technological improvements, like increased storage capacity, which has led to consumer adoption. As global temperatures are rising at an alarming rate, governments and industries worldwide have pledged to reduce greenhouse gas emissions.

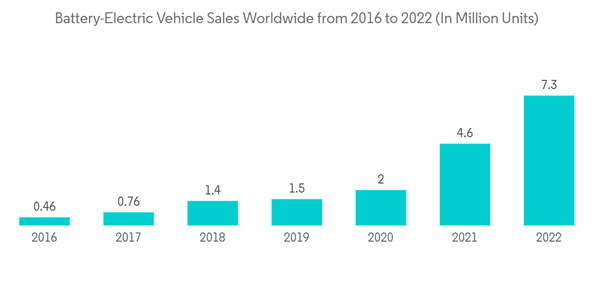

- Global plug-in vehicle sales reached 2,986,659 units in 2020, as opposed to a lower 2,123,872 units of total electric vehicles sold worldwide. Battery-electric vehicle sales reached an estimated 7.3 million in 2022, up from around 4.6 million in 2021. BEV sales have soared due to a number of factors, including an increased consumer interest in more sustainable transport and governmental regulations to curb direct transport emissions. In 2021, these sales more than doubled compared to 2020, and 2022 marks a new record in all-electric sales volume. This clearly shows the rising trend of electric vehicle growth in the market and the projected increase in market opportunities for the electric powertrain market.

- The transportation sector has been one of the major focus areas, as transportation and mobility account for the second-largest share in emissions after electricity generation. The production and sales of electric vehicles globally have been growing rapidly, owing to a favorable regulatory environment, such as subsidies and tax exemptions for the industry and consumers in the European and Asia-Pacific regions.

- Governments of major automotive markets, such as China and India, have pledged to allow only electric vehicles on their roads by 2030. Major automakers have also increased their investments in the development of electric vehicles to cater to the anticipated growth in demand for such cars in the coming decade.

- For instance, in July 2023, Volvo Trucks Malaysia introduced the region's first fully electric Heavy Duty Prime Mover. The Volvo FH Electric, FM Electric, and FMX Electric models are powered by an electric powertrain with two or three motors producing up to 490 kW and 2,400 Nm of torque depending on the application, and battery capacity ranging from 180 kWh to 540 kWh from two to six battery packs, claiming up to 300 km of travel range on a single full charge at 44 tons gross combination weight (GCW).

China is Expected to Become the Largest Market for Electric Vehicles

- The electric vehicle market witnessed healthy growth in recent years. The adoption of electric four-wheelers in mature Asian markets will continue to be strong. In absolute terms, China will become the largest EV market. On its current trajectory, China's adoption rate will reach 60%, and the country will account for more than 40% of total new EV sales by 2030. This spike in sales is attributable to the regulatory norms imposed by various organizations and governments to control emission levels and propagate zero-emission vehicles.

- In many ways, Asian countries are at the forefront of climate change. Asia is home to 93 of the top 100 most polluted cities and six of the top ten climate-vulnerable countries. The region faces relatively high energy demand as many countries continue to grow and urbanize. China alone consumes more than three times the total energy used in Europe, complicating the country's efforts to achieve net zero energy consumption.

- It forced the automakers to increase their expenditure on the R&D of electric vehicles, eventually allowing them to market electric cars in the future. This strategy strongly impacted people, as there was a considerable change in the purchase pattern from conventional IC engine vehicles to electric vehicles. The difference did not decrease the sales of IC engine vehicles but created a promising market for electric cars in the present and future.

- Asian brands account for a sizable portion of consumer automotive spending in the region, and similar trends are emerging in EVs. Chinese brands have established strong positions in the E4W market. China's BYD increased its market share by 5% in 2021, and Wuling's popular and affordable Hongguang Mini EV sold more than 400,000 units within a year of its debut. Between 2017 and 2021, Asia produced 13 of the top 20 selling EV brands.

- Governments across Asia-Pacific have initiated various schemes, encouraging buyers to choose electric vehicles over conventional ones. Countries like India, China, Korea, etc., have multiple incentives for people willing to buy electric cars.

- For instance, in May 2022, the Beijing government released the "Action Plan for Comprehensive Traffic Management in Beijing in 2022". According to the action plan, Beijing will popularise low-carbon energy modes of transportation, accelerating the transition from gasoline to electricity on vehicles such as buses, taxis, and other EVs.

- Therefore, the factors mentioned above are contributing to the growth of the electric vehicle powertrain market in the Asia-Pacific region.

EV Powertrain Industry Overview

Few players, such as Robert Bosch GmbH, ZF Friedrichshafen AG, Cummins Inc., Dana Incorporated, GKN PLC, and Magna International, dominate the electric vehicle powertrain market. The players are making partnerships, acquisitions, launching new products, and investing to be ahead of the competition.For instance, in June 2023, Zhongshan Broad-ocean Motor Co., Ltd. announced plans to build the "Broad-ocean Motor New Energy Vehicle Powertrain System and Parts (Chongqing) R&D and Manufacturing Site" in Chongqing's Yubei District. The project is planned to have a project company established in an area under the jurisdiction of the Chongqing Innovation Economy with a total investment of about CNY 1 billion (USD 139.9 Million) and a land area of about 73,333 square meters.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- GKN PLC (Melrose Industries PLC)

- Magna International Inc.

- Hitachi Automotive Systems Ltd

- Bosch Limited

- Cummins Inc.

- AVL List GmbH

- Mitsubishi Electric Corp

- BorgWarner Inc.