Key Highlights

- The rising consumer focus on health and sports fitness is anticipated to drive the segment. The preference for soy in the supplements sector also propels segmental growth. Constant innovations played a key role in boosting the sales value of soy protein isolates in France. Low-viscosity SPIs are used in soy crisps, extruded snacks, cereals, etc.

- In addition, animal husbandry plays a noteworthy role in France's economy, and the nation's farmers are highly dependent on plant proteins due to their lower prices and abundant supply. Hence, constant research and innovations, mainly in the field of animal feed, are supporting the application of soy protein concentrates, which is projected to drive the segment.

- Additionally, manufacturers are investing in vegan, cruelty-free, organic, and sustainable protein sources. For instance, in April 2021, Fuji Oil Holdings Inc.'s Dutch subsidiary invested in the UNOVIS NCAP II Fund, which is a major fund specializing in food technology. The company plans to contribute to a sustainable society using its processing technologies of plant-based food materials to tackle the issues customers and consumers face across the world, including France.

- As a result, consumers who are concerned about the environment are attracted to soy-based products since it has a smaller environmental impact than animal agriculture. This factor enables immense innovation in plant-based space, attracting more consumers to try the differentiated product offerings.

France Soy Protein Market Trends

Increasing Innovation in Functional Protein Rich Food and Beverage Products

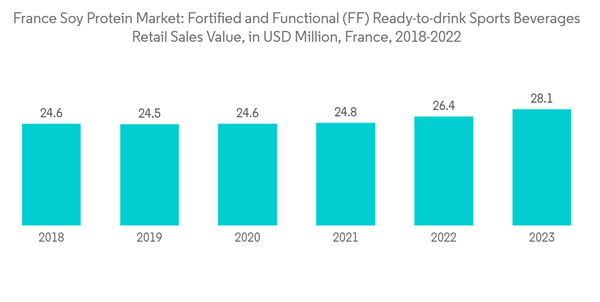

- The functional beverages segment is projected to have the strongest growth potential during the forecast period. This is primarily due to the high digestibility and faster absorption rate of soy protein than other proteins such as casein. Moreover, soy protein is a high-quality plant protein that consists of vital amino acids that are claimed to be good for maintaining muscle mass and maintaining overall health.

- Further, as an emulsifier, soy protein can stabilize the beverage and prevent the constituents from separating. In addition, it also provides the beverage with a better mouthfeel and helps a stable foam form. Hence, significant protein content in functional beverages' can be increased by adding soy protein, making them more healthy and filling.

- Additionally, since soy protein is stable over a wide pH range, it can be used in many different kinds of functional beverages. All these factors positively affect the soy protein market in the functional food and beverages segment.

Soy Protein Concentrate hold a Significant Market Share

- Soy protein concentrate is dominant among all plant protein types due to its high protein content, low viscosity, solubility, etc., which cater to extensive applications in all sectors. The food and beverages segment leads the market, majorly driven by the meat and dairy alternatives sectors. The wider use of soy proteins in the segment is further promoting growth. Manufacturers' cost-effective options are further encouraging feed companies to incorporate greater protein content in animal feed.

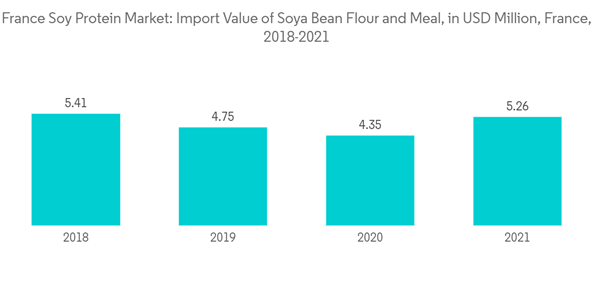

- Moreover, soy protein, mainly in the form of concentrates, is widely used in the diets of animals, birds, and fish. Its main characteristics, such as easy digestibility, improved shelf life, and protein enrichment, are driving its application in the food and beverage segment. As a result, France imports a significant amount of soy to extract soy protein concentrate. For instance, according to UN Comtrade, in 2021, the import value of soy flour in France accounted for USD 5.260 million, which is a significant increase from 2020, which accounted for USD 4.345 million. Therefore, all the above-mentioned factors drive the soy protein concentrate market in the country.

France Soy Protein Industry Overview

The France soy protein market is fragmented. The major players in this market are A. Costantino & C. spa, Archer Daniels Midland Company, DuPont de Nemours Inc, Kerry Group plc, and The Scoular Company (sorted alphabetically). Further, the companies have been introducing new and innovative ingredients using plant proteins with clean-label claims so as to make their product unique from the existing products. Owing to the rapidly developing nature of the market, new product innovation has become the most commonly used strategy among all, as it helps in understanding the changing needs of the various application industries in the market.Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.