Key Highlights

- Consumers' increasing preference towards availing imported used cars from Japan, the emergence of online auto platforms, and low demand for new vehicles owing to their higher prices serve as the major determinants for the growth of the used car market in Tanzania.

- The market for new passenger cars in Tanzania is relatively smaller, with only 2,000-3,000 units being sold annually on average. In 2022, it was estimated that only 3,153 units of new vehicles were sold in Tanzania.

- The low demand for new cars is attributed to the higher price of these vehicles, which customers cannot afford, and therefore, prefer availing imported used cars, especially from Japan. Further, consumers' growing concerns about the increasing unemployment rate (as a % of the labor force), which rose to 2.8% in 2022 compared to 2.7% in 2021, negatively impact the purchasing power of consumers, thereby acting as a catalyst for the falling demand for new cars in Tanzania.

- One of the major challenges faced by the used car market is the increasing fuel prices across Tanzania, attributed to the removal of fuel subsidies, changing oil prices in the global market, and devaluation of Tanzanian shilling against US dollars.

- According to Tanzania's Energy and Water Utilities Regulatory Authority (EWURA), the cost of fuel increased by at least 17% in August 2023 compared to the previous month. A liter of petrol in the country's commercial capital, Dar es Salaam, was retailing at Tsh 3,199 (USD 1.30) in August 2023 from Tsh 2,736 (USD 1.11) the previous month.

- A liter of diesel in August 2023 was priced at Tsh 2,935 (USD 1.20) from Tsh 2,544 (USD 1.04) in July 2023. Increasing fuel prices negatively impact the demand for availing private transportation mediums. As the Tanzanian passenger car market is dominated by the used car sector, a rapid surge in fuel prices might potentially deter these customers from purchasing used cars.

- The government's aggressive strategy to promote the electrification of vehicle fleets to promote the reduction in carbon emissions will aid the demand for used cars across Tanzania during the forecast period. Consumers who are willing to purchase cheaper alternatives to new-energy vehicles are increasingly adopting the purchase of used vehicles for convenience in mobility. For instance, in April 2023, the government of Tanzania reaffirmed its support to promote e-investments in the mobility sector and enhance electric vehicle charging infrastructure across the country. According to UN-Habitat & the Urban Electric Mobility Initiative (UEMI), the electric vehicle parc in Tanzania touched 5,000 units as of April 2023, the highest in the East-African region. Even with the aggressive stance of the Tanzanian government to promote the adoption of electric vehicles (EVs), the higher cost of electric vehicles adds to the financial burden of the consumer attributed to its high battery cost, thereby, in turn, making the consumers opt for used cars in the coming years.

Tanzania Used Car Market Trends

Rising Adoption of Digital Technologies Will Foster the Growth of the Target Market

- The adoption of advanced technology by tech-savvy young individuals, the emergence of e-commerce marketplaces, and various companies' aggressive strategies to spend on online advertisements are boosting the demand for used cars sold through online platforms. These platforms assist consumers in making informed decisions as end-end information on vehicles is already listed, such as vehicle make, model, kilometers driven, engine capacity, condition, etc.

- Moreover, increasing Internet penetration rates and rising urbanization rates across Tanzania contribute to developing an efficient ecosystem wherein vehicle owners can reach out to buyers from different parts of a region and initiate a smooth online sales process without any need to visit a physical location.

- The Internet penetration rate in Tanzania stood at 31.6% in January 2023, an increase from January 2022, when the internet penetration rate stood at 31.0%. According to the World Bank, the urbanization rate in Tanzania stood at 37% in 2022, compared to 2018, when the urbanization rate stood at 34%. These consumers are highly tech-savvy, and most of them have the financial capability to make an informed decision to purchase a vehicle for their mobility. Owing to these factors, the online used car market in Tanzania is expected to showcase positive growth in the coming years.

- To gain a competitive advantage in the lucrative online used car market, various players from Japan are actively engaging in tapping the cross-border sales opportunity with a focus on exporting Japanese-made used cars to Tanzania, as customers in Tanzania have a high preference for Japanese brands such as Toyota.

- With the increasing nternet penetration and usage of online classified platforms for making purchasing decisions, consumers can buy second-hand cars from their foreign countries, which helps them get a better price for used car models. Tanzanian companies also have an opportunity to expand their business presence by providing cross-border sales service to countries such as Uganda, Zimbabwe, etc., which will assist them in enhancing their business performance.

- Further, improved offerings such as an enormous number of photos and videos of the used vehicles being sold through online platforms and easy online instant finance, insurance, and warranty service are expected to fuel the demand for used cars in Tanzania in the coming years.

Used Sports Utility Vehicles (SUVs) to Remain the Preferred Vehicle Type in Tanzania

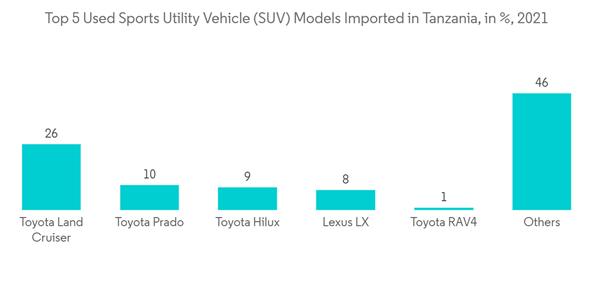

- Based on vehicle type, used SUVs remained the preferred choice of consumers willing to purchase used cars in the Tanzanian market. It is estimated that sales of used SUVs contribute to the majority share of approximately 36% of the overall used car sales.

- Some of the top-selling used SUV models in Tanzania were the Toyota Land Cruiser, Toyota Harrier, Toyota IST, Lexus LX, and Toyota RAV4, among others, as of 2023. Japanese-made used SUV models are the top choice of consumers in Tanzania.

- As per the listings in CarTanzania, a used car online classified platform, 56% of used car listings on their platform were in the price range of USD 100 to USD 4,300. The majority of the used cars sold are concentrated in the Dar Es Salaam region, contributing to the highest share of 90%.

- Further, consumers in Tanzania prefer diesel-operated used cars compared to their counterparts. It has been estimated that sales of diesel-operated used cars contributed to approximately 82% of the overall sales, followed by a petrol-operated used car with a share contribution of 18%.

- Although electric used cars have not gained much prominence for Tanzanian customers, with the aggressive push by the government to promote the adoption of electric vehicles, the market for used electric vehicles (EVs) will gain traction in the coming years. Foreign used car platforms such as SBT Japan have initiated the process of offering used EVs to Tanzanian customers. As the EV market matures in the coming years, the market for used EVs will witness rapid expansion. It is anticipated that used electric SUV models will gain massive traction in the coming years with the increasing investment in developing charging infrastructure in the country, coupled with lowering prices of used electric SUV cars.

Tanzania Used Car Industry Overview

The market is moderately fragmented and competitive, with the presence of various online used car platforms and international used car dealerships operating across Tanzania. Some of the major players include SBT Japan, Be Forward, Enhance Auto, CarTanzania, UsedCars.co.tz, Jiji, Garipesa, Car Junction Tanzania, and Bizupon, among others.These players compete based on various parameters such as used car prices, online presence, value-added offerings such as warranty and financing options, commissions charged, number of listings on their platform, and ready information available on their website about the performance and the condition of used vehicles, among others. Various companies operating in the ecosystem are actively engaging in enhancing their brand presence by forming partnerships to expand their business capability across Tanzania. For instance,

In October 2021, SBT Co., Ltd, a trading company specializing in the export of new and used vehicles from Japan to more than 150 countries, including Tanzania, announced a partnership with NTT Communications Corporation to initiate conducting a trial of a solution that allows prices and settlement details to be displayed in local currencies at guaranteed rates of exchange on SBT's cross-border e-commerce site.

In March 2021, SBI Motor Japan, a Japanese-based used and new car dealership company, established its first office in Dar es Salaam, Tanzania, and initiated the process of taking applications for new partnerships in the East African region.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.