Many non-emergency procedures have been halted due to the COVID-19 pandemic. This has resulted in a significant decrease in cancer screening. During the pandemic, health care facilities were screening for cancer and taking numerous precautions while doing the procedure. However, the number of procedures was reduced due to the restriction. The screening remained under-utilized among asymptomatic women. From the study published by the American College of Radiology in June 2022, it has been observed that mammography procedures have been uptp 90% of the pre-pandemic utilization during the 2021 COVID recovery period but could not match the number of screenings done before the pandemic in the United States. One of the major concerns in the oncology sector of the United States is that cancer diagnostics have reduced by around 50% and even in the year 2022, it has not reached to complete the pre-covid stage. This indicates that the COVID-19 pandemic has hit the mammography market significantly.

Additionally, the Breast Cancer Organization conducted a survey in the year 2021 on how the pandemic has affected breast cancer care in the United States through an online questionnaire. More than 600 people responded, amongst which 42% of the patients were having an active screening treatment and around 83% were residents of the country. The survey concluded that approximately 11% of the routine mammograms were delayed and nearly 30% chose to change their treatment owing to concerns related to COVID-19. This has restrained the growth of the mammography market.

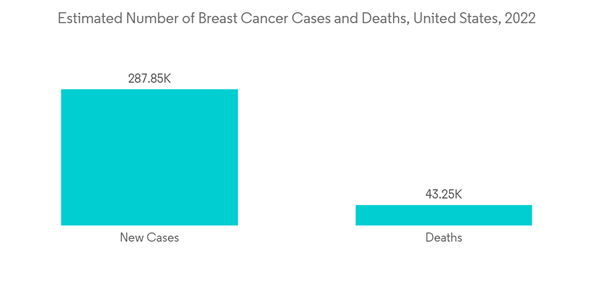

The United States mammography market is majorly driven by higher incidences and mortality rates for breast cancer among the population. For instance, as per the data published by the American Cancer Society, in 2022, approximately 287,850 new invasive breast cancer patients will be diagnosed in the United States and 51,400 insitu breast carcinoma cases will be identified in the year 2022. Such a higher number of breast cancer cases is expected to drive the demand for breast cancer diagnostics, in turn, boosting the growth of the mammography market within the country.

Furthermore, numerous companies are undertaking initiatives and are found launching programs for increasing awareness regarding breast cancer and the tests associated with it. For instance, the National Breast Cancer Foundation (NBCF), in the United States, is an organization that offers breast cancer education and also provides free mammograms to the woman in need. The organization is engaged in conducting several programs, such as Breast Health Awareness, Patient Navigation, Beyond The Shock, and The National Mammography Program, among others. Such initiatives undertaken by several organizations as well as the companies are anticipated to increase the awareness among the population, as a result, the market is expected to experience growth over the analysis period.

US Mammography Market Trends

Digital Systems are Expected to Hold Significant Share in Product Type Segment

In digital mammography, the X-ray film is replaced by solid-state detectors, which convert X-rays into electrical signals, and these electrical signals are used to produce images of breasts. Digital system mammography is highly preferred in hospitals, specialty clinics, and diagnostic centers in the country. These are advanced forms of mammography in which digital receptors and computers are being used to examine the presence of tumors in breast tissues instead of X-ray films. Digital mammography is also quicker for the patient since no film images need to be developed, and radiologists can further optimize images using computers to detect micro-calcifications that might be missed on traditional film mammograms.According to the data from Breast Cancer Foundation 2021 estimates, the amount funded for breast cancer research is USD 47.5 million for the year 2021-2022 which is only from the Breast Cancer Foundation. In addition, for the year 2020, around USD 768 was invested by all the National Institutes of Health (NIH) in the country for breast cancer. The growing funding for breast cancer increases the research and development of digital breast cancer screening methods in the country, boosting the segment growth. Furthermore, Medicare also covers newer digital mammograms, boosting the increasing usage of these advanced screening methods and boosting the segment growth.

Hence, owing to the aforementioned factors, the digital systems segment is expected to witness significant growth in future

US Mammography Industry Overview

The United States mammography market is highly competitive, owing to the presence of several major players in the market. The major market players are focusing on technological advancements and reducing the side effects of the procedures. Some of the major players in the market are Analogic Corporation, Canon Medical Systems Corporation, Fujifilm Corporation, GE Healthcare, Hologic Inc., Koninklijke Philips NV, and Siemens Healthineers.Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.