Key Highlights

- The upcoming IT load capacity of the Europe data center Server market is expected to reach 18K MW by 2029.

- The region's construction of raised floor area is expected to increase 87.6 million sq. ft by 2029.

- The region's total number of racks to be installed is expected to reach 4.3 million units by 2029. The United Kingdom is expected to house the maximum number of racks by 2029.

- There are close to 210 submarine cable systems connecting the Europe, and many are under construction. One such submarine cable that is estimated to start service in 2025 is SeaMeWe-6, which stretches over 19,200 Kilometers with its landing point in Marseille, France.

Europe Data Center Server Market Trends

IT & Telecommunication Holds the Major Share.

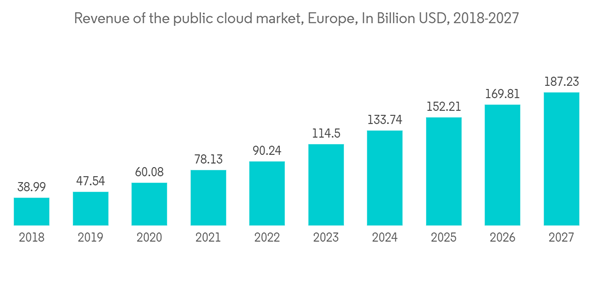

- The cloud and telecom segment is expected to drive significant demand in the region. The demand for cloud services is promising in Denmark, Sweden, the United Kingdom, Germany, and other developed countries. The need for cloud solutions continues to grow in Denmark, and the demand for cloud-based data protection and backup solutions is expected to get more robust. In June 2022, Keepit, a cloud backup service with headquarters in Copenhagen, raised USD 22.5 million in debt financing from Silicon Valley Bank (SVB) in association with Vaekstfonden.

- Further, more than 80% of all businesses in the Netherlands use cloud computing. Market newcomers like Google, Oracle, and Microsoft are heavily present in the nation and have adopted cloud services. During the forecast period, AWS will likely also enter the market by establishing its cloud region. In France, the government had set aside EUR 1.8 billion (USD 2.1 billion) for 2021 to finance research initiatives and expand the cloud computing market. The rising adoption of the cloud across most businesses is being driven by new technologies like artificial intelligence, big data, and blockchain among various end users.

- In the United Kingdom, Brexit created some uncertainty among cloud providers. Although during the Brexit transition period, they are subject to the EU GDPR (General Data Protection Regulation) and the UK Data Protection Act 2019, the future rules for data storage and retrieval of customer data are unclear. This has caused some mainland European companies to migrate their data requirements to Germany, the Netherlands, France, and other EU countries, but the reverse is also true as UK businesses are relocating their data to UK-based data centers. In line with consumer demand, the cloud computing segment is expected to shift inherently to include the use of multi-cloud in enterprises. The abovementioned factors are expected to result in the growth of the market over the forecast period.

- The rapidly increasing 5G wave is motivating telecom vendors to invest in the European data center market. Recently, Swedish network provider Net4Mobility, a joint venture between local carriers Tele2 and Telenor, announced plans to connect 90% of the nation's population to its 5G network by the end of 2023.

- Such developments, increasing adoption of cloud services, Expansion of 5G Networks, and the ongoing demand for online payments are, in turn, expected to boost the demand for the data center market from the IT and telecom segment, leading to major demand for the servers during the forecast period.

United Kingdom is Expected to Grow Significantly

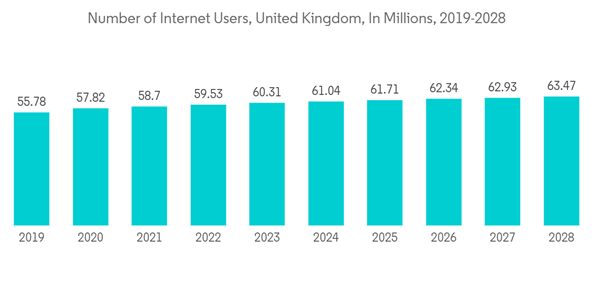

- The digital economy in the United Kingdom accounted for more than 7% of the country's GDP in 2022. This upward trend is set to continue, following the work-from-home culture creating demand for enterprise cloud and Software-as-a-Service (SaaS) utilities, as well as e-commerce, social networking, search, streaming video services, gaming, and mobile apps.

- The United Kingdom has one of the highest internet penetration rates in the world. As of January 2022, the country had approximately 67 million internet users and 53 million active social media users, accounting for over 84% of the total population.

- Further, the COVID-19 pandemic heightened the cloud's importance as industries adapted to support a more digital workforce. The UK cloud market is worth GBP 15 billion (USD 16.7 billion), and major hyperscalers generated around 81% of revenue in the UK public cloud infrastructure services. The COVID-19 impact boosted the cloud market in 2020.

- The adoption of over-the-top (OTT) technology in the country was quite high, and nearly 30.7% of TV households subscribed to a subscription video-on-demand (SVOD) package in 2021. YouTube and Facebook were the largest social video platforms in the United Kingdom, each reaching over 95% of UK internet users in 2021. Therefore, the UK data center market is expected to grow in the coming years. However, the availability and sustainability of power supply is a big challenge for all data center providers across the United Kingdom, and data center investors cited this as the single most important factor when choosing a new data center.

- Considering the above instances, the country is expected to create more demand for data storage in the coming years, creating more need for data center servers in the region.

Europe Data Center Server Industry Overview

The upcoming DC construction projects in the region will increase the demand for data center servers in the coming years. The Europe data center server market is moderately consolidated with a few major players, such as Dell Inc., Hewlett Packard Enterprise, Fujitsu, and Lenovo Group Limited, in the market. These major players, with a prominent market share, focus on expanding their regional customer base.In August 2023, Dell Inc. is transitioning its servers with Next-generation Dell PowerEdge Servers from open system authentication (OSA) to e-mail security appliance (ESA) with PowerEdge R760 powered by 4th-generation Intel Xeon Processors.

In January 2023, Cisco announced the launch of the 7th generation of UCS C-Series and X-Series servers, powered by 4th generation Intel Xeon Scalable processors. With support for the latest Intel processors, Cisco has launched two new blades for the X-Series: the Cisco UCS X210c M7 Compute Node and the Cisco UCS X410c M7 Compute Node.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.