COVID-19 significantly impacted market growth. The pandemic affected early childhood education and care due to temporary and permanent setting closures, reduced demand for early childhood education and care (ECEC) places, and workforce challenges. For instance, according to a study published by the National Day Nurseries Association (NDNA) and Education Policy Institute (EPI) in October 2021, it was observed that, in England, about 73% of the early education and care centers were partially or fully closed between August and November 2020 while 12% fully and 25% partially closed at least once between March and May 2021. In addition, as per the same source, about 232 nurseries were closed between April 2020 and March 2021, which has affected over 11,000 children in England. This has impacted the market growth during the pandemic period. However, with the released restrictions and resumed childcare service centers, the studied market has returned to its original growth pace.

Factors such as the increasing number of single parents, rising demand for early childcare education, growing adoption of new learning technologies, and increasing onsite care facilities are expected to boost the market growth over the forecast period.

The number of single-parent families is rising worldwide, which increases the demand for daycare or other childcare services for their early education and well-being, as they find it difficult to provide the required attention to their kids. This is expected to fuel the market growth over the forecast period. For instance, according to the 2022 statistics published by the United States CBS, about 57% of millennial children were born to unmarried mothers, and 15 million single-mother families were reported in the United States in 2022. Also, as per 2021 statistics published by the United Kingdom government, about 2.96 million single-parent families were reported in the United Kingdom.

Additionally, adopting innovative techniques and tools to educate children has increased the demand for childcare services and centers, bolstering market growth. For instance, in February 2023, under the New Education Policy (NEP), the childcare centers launched an activity-based learning tool, Jaadui Pitara, that allows kids to study while playing.

Furthermore, the rising initiatives to promote onsite childcare services and centers are expected to increase market growth over the forecast period. For instance, in August 2022, the Kerala state government launched its new project, 'Workplace Child Care Center,' a creche in the Public Service Commission (PSC) office, to promote breastfeeding and to normalize it in public spaces. Also, in July 2021, Podium, the communication and payments platform for local businesses, launched Little Founders, an onsite child care center at its headquarters in Utah. The center provides children with a safe, healthy, and educational environment, addresses a critical need for high-quality, affordable childcare, and offers vital flexibility for working parents.

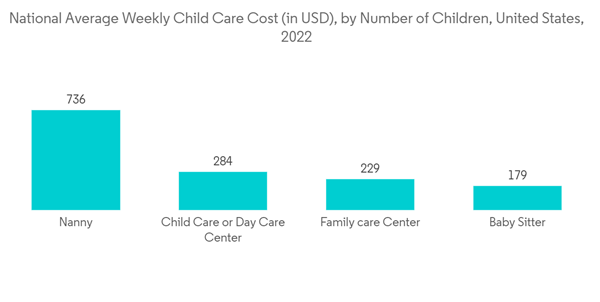

Therefore, the studied market is expected to grow over the forecast period due to the factors above, the rising number of single-parent families, the adoption of new learning tools, and the increasing launches of onsite childcare centers. However, the high cost of childcare services and the lack of service providers are likely to impede the market's growth over the forecast period.

Child Care Market Trends

Early Education and Daycare Segment is Expected to Witness Significant Growth Over the Forecast Period

The early education and daycare segment is expected to witness significant growth in the childcare market over the forecast period owing to factors such as the increasing development of advanced learning techniques for children and the growing government initiatives.The growing number of new learning software and tools to make learning fun for children in the foundation stage are anticipated to fuel the segment's growth. For instance, in March 2023, Duolingo launched Duolingo ABC, a specially designed free-to-use app to assist children between the ages of three and eight years in learning how to read and write in English in India. The app offers over 700 concise lessons covering the alphabet, phonics, and sight words.

Furthermore, the rising government initiatives to promote early education and daycare services for children are expected to increase segment growth over the forecast period. For instance, in December 2022, the Dawoodi Bohra community and Deepalaya launched a project, 'Rise - Early Childhood Care and Development Center' to provide early childhood education and skills and nutritional and health support to underprivileged children in slum areas in New Delhi, India. The program supports around 100 children aged two to six years whose parents are daily wage workers in the adjoining factories and construction sites.

Therefore, the studied segment is expected to grow over the forecast period due to the launches of new learning tools for children and rising government initiatives and funding.

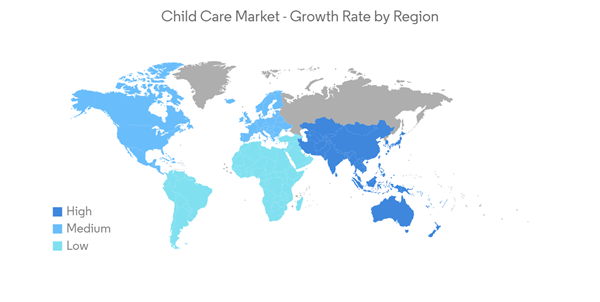

North America is Expected to Have the Significant Market Share Over the Forecast Period

North America is expected to hold a significant share of the childcare market owing to factors such as the increasing demand for early daycare and education services, the rising number of single mothers, the adoption of new learning technologies for children, and growing government initiatives.According to 2022 statistics published by the United States Census Bureau, approximately 11 million single-parent homes with children under 18, about 80% of which were headed by single mothers in the United States. Additionally, per the 2022 statistics published by the Canadian government, about 1.84 million single-parent families lived in Canada in 2022. Thus, the high number of single-parent families in the region increases the demand for daycare and other childcare services to raise their children and give them proper education during their growth periods. This is anticipated to augment the market growth over the forecast period.

Furthermore, the rising government initiatives and funding to support child care and education are also contributing to the market growth in the region. For instance, in September 2022, the Maine Department of Health and Human Services (DHHS) distributed USD 13.6 million in American Rescue Plan Act funds to improve Maine families' access to safe, affordable, and high-quality child care. The Early Childhood Educator Workforce Pay Supplement Program in Maine aims to raise the general standard of care for young children, increase early childhood educators' regular salaries through monthly stipends, and encourage their continued education. Also, in July 2022, Governor Kathy Hochul confirmed awarding nearly USD 70 million in grant funding to newly licensed, registered, or approved childcare programs in the state's "child care deserts," or regions without enough childcare spaces. The funding supports staff in acquiring COVID-19 vaccines and assists new childcare providers in underprivileged communities with program development, start-up and personnel expenditures, staff recruitment, training, and retention. Such funding is expected to increase the number of childcare providers and their services across the region, thereby contributing to market growth.

Therefore, the studied market is expected to grow over the forecast period due to the factors above, such as the rising number of single-parent families and growing government initiatives.

Child Care Industry Overview

The childcare market is fragmented owing to the presence of large and small players in the market. Some of the key players in the market are Bright Horizons Family Solutions, Inc., KinderCare Education, Learning Care Group, Inc., Cadence Education, Fortune Kindergarten, and Goodstart Early Learning, among others.Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.