Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Key Market Drivers

Increasing Demand for Renewable Energy

The global push towards sustainable and clean energy sources has become a significant driver for the Photovoltaic Mounting System Market. With the growing awareness of the environmental impact of traditional energy sources, there is a heightened demand for renewable energy solutions, with solar power being a prominent player in this shift. Photovoltaic mounting systems play a pivotal role in harnessing solar energy by providing the necessary infrastructure to support solar panels.Governments worldwide are implementing policies and incentives to promote the adoption of solar energy, contributing to the expansion of the Photovoltaic Mounting System Market. Initiatives such as feed-in tariffs, tax credits, and subsidies make solar power more economically viable for businesses and homeowners, driving the installation of photovoltaic systems. This increasing demand for renewable energy solutions, coupled with supportive governmental policies, is propelling the global Photovoltaic Mounting System Market to new heights.

Technological Advancements in Mounting System Designs

Another key driver for the Photovoltaic Mounting System Market is the continuous innovation and technological advancements in mounting system designs. As the solar industry matures, manufacturers are focusing on developing mounting solutions that enhance efficiency, durability, and ease of installation. Innovations such as smart tracking systems, lightweight materials, and modular designs are reshaping the landscape of photovoltaic mounting systems.Smart tracking systems, for instance, enable solar panels to follow the sun's trajectory throughout the day, optimizing energy capture. This results in increased energy output and improved overall system efficiency. Lightweight materials reduce the load on support structures, making installation easier and cost-effective. Modular designs allow for greater flexibility in system configuration, adapting to different terrains and environmental conditions.

These technological advancements not only improve the performance of photovoltaic systems but also contribute to the overall growth of the market by attracting more customers looking for cutting-edge and efficient solutions.

Declining Costs of Photovoltaic Systems

The decreasing costs of photovoltaic systems, including both solar panels and mounting systems, are a significant driver fueling market expansion. Over the years, advancements in manufacturing processes, economies of scale, and increased competition have led to a substantial reduction in the overall cost of solar power generation.Lower costs make solar energy more accessible and financially viable for a broader range of consumers, including residential, commercial, and industrial sectors. As the cost of solar panels decreases, the demand for efficient and cost-effective photovoltaic mounting systems increases. This interdependence between the cost of solar components and the mounting infrastructure drives the growth of the Photovoltaic Mounting System Market, making it an attractive option for investors, developers, and end-users alike.

In conclusion, the increasing demand for renewable energy, technological advancements in mounting system designs, and the declining costs of photovoltaic systems are three key drivers propelling the global Photovoltaic Mounting System Market towards a future marked by sustainable energy solutions and widespread adoption of solar power.

Key Market Challenges

Regulatory and Policy Uncertainties

One of the primary challenges facing the Global Photovoltaic Mounting System Market is the uncertainty surrounding regulatory frameworks and policies related to solar energy. The inconsistency in government regulations and policies can significantly impact the market's growth and development. For instance, changes in subsidy programs, feed-in tariffs, or tax incentives can influence the economic feasibility of photovoltaic projects, directly affecting the demand for mounting systems.Regulatory uncertainties create an unpredictable business environment, making it challenging for investors, manufacturers, and developers to plan long-term strategies. The lack of a stable regulatory framework may deter potential investors, slowing down the overall expansion of the Photovoltaic Mounting System Market. Harmonizing and stabilizing policies across different regions and countries is crucial to providing a conducive environment for sustained market growth.

Land Availability and Land-Use Conflicts

A significant challenge faced by the Photovoltaic Mounting System Market is the competition for land and potential conflicts arising from land use. Large-scale solar projects require substantial land areas, and as the demand for solar energy increases, securing suitable land becomes a critical issue. This challenge is particularly evident in densely populated regions where available land is limited, and there is often competition between agriculture, urban development, and solar energy projects.Balancing the need for clean energy generation with other land-use priorities poses a challenge for the Photovoltaic Mounting System Market. Striking a balance between agricultural needs, biodiversity conservation, and solar energy development requires careful planning and collaboration between various stakeholders. Resolving land-use conflicts and developing innovative solutions, such as solar installations on non-arable land or integrating solar arrays with existing infrastructure, is crucial for the sustained growth of the market.

Technological and Design Limitations

Despite ongoing technological advancements, the Photovoltaic Mounting System Market faces challenges related to technological and design limitations. The efficiency and performance of solar installations heavily depend on the design and capabilities of the mounting systems. Factors such as terrain, climate, and local environmental conditions can influence the effectiveness of these systems.Certain geographical locations with extreme weather conditions or complex terrains may pose challenges in designing mounting systems that can withstand such conditions. Additionally, integrating solar installations into urban environments or areas with specific architectural constraints can be challenging. As the market strives for more efficient and versatile mounting solutions, overcoming these technological and design limitations becomes paramount to ensuring the widespread adoption of photovoltaic systems globally.

In conclusion, regulatory and policy uncertainties, land availability and use conflicts, and technological and design limitations are three substantial challenges that the Photovoltaic Mounting System Market must address to sustain its growth and make solar energy a mainstream and reliable source of power globally.

Key Market Trends

Increasing Emphasis on Bifacial Photovoltaic (PV) Modules and Tracking Systems

A notable trend shaping the Global Photovoltaic Mounting System Market is the increasing emphasis on bifacial PV modules and tracking systems. Bifacial solar panels have the ability to capture sunlight from both the front and rear sides, maximizing energy yield. This trend aligns with the industry's constant pursuit of enhancing overall system efficiency and optimizing energy output. Bifacial modules are gaining popularity due to their higher energy conversion rates and improved performance under various environmental conditions.Photovoltaic mounting systems designed for bifacial modules require careful consideration of ground reflectivity, tilt angles, and spacing to harness the full potential of both sides of the solar panels. Additionally, tracking systems, such as single-axis and dual-axis trackers, are becoming more prevalent. These systems enable solar panels to follow the sun's path throughout the day, ensuring that they are always oriented for maximum sunlight exposure. As the cost of these technologies decreases and their benefits become more widely recognized, the Photovoltaic Mounting System Market is experiencing a shift towards the integration of bifacial modules and tracking systems, contributing to increased overall system efficiency and energy yield.

Integration of Smart Technologies and Digital Solutions

The integration of smart technologies and digital solutions is a significant trend shaping the future of the Global Photovoltaic Mounting System Market. As the solar industry evolves, there is a growing focus on incorporating digital innovations to enhance monitoring, control, and maintenance of photovoltaic systems. Smart technologies offer real-time data analytics, remote monitoring, and predictive maintenance capabilities, providing operators and system owners with valuable insights into the performance of their solar installations.Photovoltaic mounting systems are now being designed to accommodate sensors, communication devices, and data analytics platforms. These technologies enable proactive maintenance, reducing downtime and optimizing the overall efficiency of solar power plants. Additionally, the use of artificial intelligence (AI) and machine learning algorithms is becoming more prevalent in the optimization of photovoltaic systems, allowing for dynamic adjustments based on weather conditions, energy demand, and grid requirements.

The integration of smart technologies not only improves the operational efficiency of photovoltaic systems but also contributes to the development of smart grids and the overall advancement of the renewable energy sector. This trend is expected to continue as the industry embraces the digital transformation, making the Photovoltaic Mounting System Market more sophisticated, responsive, and capable of adapting to the evolving energy landscape.

Segmental Insights

Product Type Insights

The Rooftop-mounted segment emerged as the dominating segment in 2023. The rooftop-mounted segment has experienced substantial growth, fueled by the increasing adoption of solar energy for residential, commercial, and industrial applications. Rooftop installations offer a decentralized approach to power generation, allowing end-users to produce their own electricity and reduce reliance on the traditional grid. The residential sector has been a key driver of rooftop-mounted installations, with homeowners increasingly opting for solar panels on their roofs to generate clean and sustainable energy. On the commercial and industrial fronts, businesses are leveraging rooftop solar installations to meet sustainability goals, reduce energy costs, and secure a reliable power supply.Technological advancements play a pivotal role in the rooftop-mounted segment. Innovations in photovoltaic modules, lightweight materials, and mounting system designs have made rooftop installations more efficient and aesthetically pleasing. Bifacial solar panels, which can capture sunlight from both the front and rear sides, are gaining popularity in rooftop applications. Additionally, integrated smart technologies, such as monitoring systems and predictive maintenance tools, enhance the performance and reliability of rooftop-mounted photovoltaic systems.

The residential sector has witnessed a surge in rooftop-mounted installations, driven by incentives, rebates, and the decreasing cost of solar panels. Homeowners are increasingly recognizing the long-term financial benefits of investing in rooftop solar, not only through reduced electricity bills but also through potential incentives and tax credits offered by governments. Innovations in mounting system designs cater specifically to residential applications, focusing on ease of installation, aesthetics, and safety. Companies in the Photovoltaic Mounting System Market are developing solutions that are compatible with different roof types, making them accessible to a broader range of homeowners.

End-User Insights

The Commercial segment is projected to experience rapid growth during the forecast period. The commercial segment has witnessed a significant increase in the adoption of photovoltaic mounting systems, driven by a combination of environmental consciousness, cost savings, and government incentives. Businesses are increasingly recognizing the benefits of harnessing solar energy to meet sustainability goals, reduce operational costs, and secure a reliable power supply. The installation of solar panels on commercial rooftops is a common practice, providing an additional source of revenue through energy savings and potentially allowing businesses to sell excess energy back to the grid in regions with favorable regulatory frameworks.Industrial facilities are embracing photovoltaic mounting systems as an essential part of their energy strategy. Large manufacturing plants and warehouses often have extensive roof spaces suitable for solar installations. Mounting systems designed for industrial applications must consider factors such as load-bearing capacity, wind resistance, and the integration of smart technologies for optimal performance. The industrial sector benefits not only from reduced electricity bills but also from enhanced energy resilience and the ability to meet corporate social responsibility (CSR) targets. In some cases, industrial facilities may deploy ground-mounted systems on available land, further diversifying the range of applications within the commercial segment.

The economic viability of photovoltaic installations in the commercial segment is a crucial factor influencing adoption. Businesses often evaluate the return on investment, considering factors such as the initial capital expenditure, available incentives, and long-term energy savings. Advances in mounting system designs, improved efficiency of solar panels, and decreasing overall system costs contribute to the favorable economics of commercial solar installations. Additionally, financial mechanisms like power purchase agreements (PPAs) and innovative financing options make solar energy more accessible to commercial entities.

In conclusion, the commercial segment of the Global Photovoltaic Mounting System Market is characterized by a growing adoption of solar energy solutions across diverse applications. Factors such as economic viability, architectural integration, regulatory support, and technological innovation are driving the expansion of photovoltaic installations in the commercial sector. As businesses continue to prioritize sustainability and energy resilience, the commercial segment is expected to play a pivotal role in the broader adoption of solar energy globally.

Regional Insights

Asia-Pacific emerged as the dominating region in 2023, holding the largest market share. The Asia-Pacific region has witnessed rapid growth in solar energy installations, with several countries in the region making significant investments in renewable energy infrastructure. The push towards solar energy is driven by the need to meet rising energy demands, reduce reliance on fossil fuels, and address environmental concerns. Countries like China, India, Japan, and Australia have emerged as key players in the Asia-Pacific solar energy landscape, creating substantial opportunities for the Photovoltaic Mounting System Market.The Asia-Pacific region is experiencing robust economic growth and urbanization, leading to an increased demand for electricity. Governments are investing in expanding their energy infrastructure and improving access to electricity, with solar power playing a crucial role in meeting these demands. Photovoltaic mounting systems are integral to these solar projects, supporting the deployment of solar panels on rooftops, ground-mounted installations, and other applications.

The Asia-Pacific region has been at the forefront of technological advancements in the solar industry. Continuous innovation in photovoltaic modules, mounting system designs, and smart technologies is driving efficiency improvements and cost reductions. The adoption of bifacial solar panels, advanced tracking systems, and lightweight materials in the Asia-Pacific region creates opportunities for manufacturers and suppliers of photovoltaic mounting systems to offer cutting-edge solutions.

The Asia-Pacific region features a diverse market landscape, with various countries at different stages of solar energy adoption. While some countries have well-established solar markets, others are rapidly emerging. Local manufacturing of photovoltaic mounting systems is gaining importance, as it contributes to cost competitiveness and supports regional economic development. This trend provides opportunities for both local and international companies to establish a presence in the market.

In certain parts of the Asia-Pacific region, particularly in rural areas, there is a focus on off-grid solar installations and rural electrification initiatives. Photovoltaic mounting systems play a crucial role in these projects, providing reliable and sustainable energy solutions to communities that are not connected to the central electricity grid. Governments and non-governmental organizations are actively supporting these initiatives, creating opportunities for photovoltaic mounting system providers.

Environmental awareness and commitments to sustainable development goals are gaining prominence in the Asia-Pacific region. Countries are aligning their energy policies with climate action targets, and the Photovoltaic Mounting System Market contributes to the achievement of these goals. The emphasis on reducing carbon emissions and promoting clean energy aligns with the deployment of photovoltaic systems, creating opportunities for market growth.

Cross-border collaboration and investment are becoming more prevalent in the Asia-Pacific Photovoltaic Mounting System Market. Countries are partnering to share technologies, best practices, and investments, fostering a regional approach to advancing solar energy. Companies looking to expand their presence in the Asia-Pacific region can explore collaborative opportunities and partnerships with local stakeholders to navigate diverse markets effectively.

In conclusion, the Asia-Pacific region is a dynamic and influential player in the Global Photovoltaic Mounting System Market. The combination of increasing energy demand, supportive policies, technological advancements, and a commitment to sustainability positions the region as a key driver of the ongoing growth and development of the solar energy industry.

Report Scope

In this report, the Global Photovoltaic Mounting System Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Photovoltaic Mounting System Market, By Product Type:

- Rooftop-mounted

- Ground-mounted

Photovoltaic Mounting System Market, By Application:

- Fixed

- Tracking

Photovoltaic Mounting System Market, By End-User:

- Residential

- Commercial

- Industrial

Photovoltaic Mounting System Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe

- France

- United Kingdom

- Italy

- Germany

- Spain

- Netherlands

- Belgium

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- Thailand

- Malaysia

- South America

- Brazil

- Argentina

- Colombia

- Chile

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Turkey

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Photovoltaic Mounting System Market.Available Customizations:

The analyst offers customization according to specific needs, along with the already-given market data of the Global Photovoltaic Mounting System Market report.This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Schletter Group

- Unirac Inc.

- K2 Systems GmbH

- Clenergy

- Tata International Limited

- Mounting Systems Inc.

- Risen Energy Co., Ltd.

- Van der Valk Solar Systems BV

- Renusol GmbH

- Quick Mount PV

Table Information

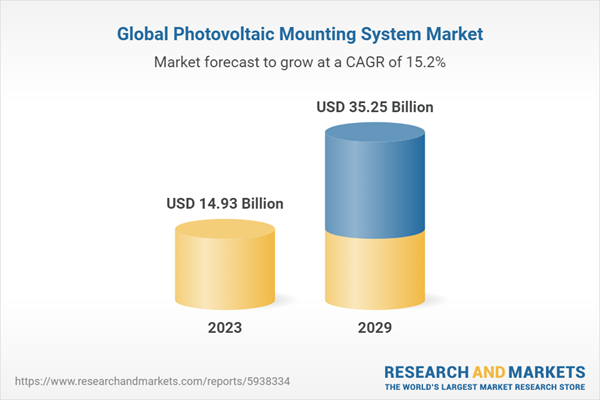

| Report Attribute | Details |

|---|---|

| No. of Pages | 186 |

| Published | January 2024 |

| Forecast Period | 2023 - 2029 |

| Estimated Market Value ( USD | $ 14.93 Billion |

| Forecasted Market Value ( USD | $ 35.25 Billion |

| Compound Annual Growth Rate | 15.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |