Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Key Market Drivers

Growing Demand for Petrochemicals Driving Petroleum Liquid Feedstock Market

The increasing demand for petrochemicals is a key driver of the petroleum liquid feedstock market, as petrochemical derivatives are essential components in various industries, including plastics, chemicals, automotive, pharmaceuticals, and consumer goods. As global industrialization and urbanization continue to expand, the need for raw materials derived from petroleum liquid feedstock, such as naphtha and gas oil, is growing significantly. The rising demand for polymers and synthetic materials in packaging, automotive components, and construction further strengthens the consumption of petroleum liquid feedstock.Countries such as China, India, and the United States are witnessing robust petrochemical industry growth, primarily driven by infrastructure development, increasing disposable income, and evolving consumer lifestyles. Additionally, the automotive sector’s demand for lightweight materials, which rely on petrochemical products, is further fueling the market.

The expansion of refineries and petrochemical complexes in emerging economies is also a critical factor in increasing petroleum liquid feedstock consumption. With the shift towards high-performance and sustainable plastics, investments in advanced refining and cracking technologies are enhancing the efficiency of liquid feedstock utilization, ensuring optimized yield and reduced waste. Moreover, government policies supporting domestic petrochemical production, particularly in Asia-Pacific and the Middle East, are encouraging capacity expansion in the petroleum liquid feedstock market.

Key Market Challenges

Volatility in Crude Oil Prices and Supply Chain Disruptions

The Petroleum Liquid Feedstock Market faces significant challenges due to the inherent volatility in crude oil prices and frequent supply chain disruptions. Crude oil serves as the primary raw material for petroleum feedstocks such as naphtha and gas oil, making price fluctuations a critical factor impacting market stability. Price volatility is driven by geopolitical tensions, OPEC+ production decisions, changes in global demand-supply dynamics, and macroeconomic factors such as inflation and currency exchange rates.Sudden spikes or drops in crude oil prices create uncertainties for refiners and petrochemical producers, making long-term planning and investment strategies more complex. Higher crude oil prices lead to increased feedstock costs, reducing profit margins for downstream industries, including petrochemicals, plastics, and synthetic rubber manufacturing. Conversely, when crude oil prices decline sharply, companies may face reduced revenues and capital constraints, impacting their ability to invest in infrastructure and technological advancements.

Supply chain disruptions further exacerbate this challenge, as logistical constraints, refinery shutdowns, and global trade imbalances disrupt the steady flow of petroleum liquid feedstocks. Events such as the COVID-19 pandemic, geopolitical conflicts, and extreme weather conditions have demonstrated how fragile the global energy supply chain can be. For instance, the Russia-Ukraine conflict led to significant disruptions in crude oil and refined product flows, forcing companies to seek alternative feedstock sources and adapt to rapidly changing market conditions. Additionally, transportation bottlenecks, including port congestion, shipping delays, and regulatory barriers, further complicate feedstock procurement and delivery schedules.

Key Market Trends

Rising Demand for Petrochemical Feedstocks Driving Market Growth

The Petroleum Liquid Feedstock Market is experiencing significant growth due to the increasing demand for petrochemicals, which are essential for manufacturing plastics, synthetic rubber, fertilizers, and various industrial chemicals. As global industries continue to expand, the need for petroleum-derived feedstocks such as naphtha and gas oil is rising to meet the growing production requirements. The surge in demand for lightweight and durable materials in industries such as automotive, construction, and packaging is particularly fueling the consumption of petrochemical products, thereby boosting the need for petroleum liquid feedstocks. Additionally, the rapid urbanization in emerging economies like China, India, and Southeast Asia has led to increased consumer demand for plastic-based products, further escalating the demand for petroleum-based feedstocks.Key Market Players

- Exxon Mobil Corporation

- Reliance Industries Limited

- Chevron Phillips Chemical Company LLC

- TotalENergies SE

- Shell plc

- Idemitsu Kosan Co., Ltd.

- BP p.l.c.

- China Petrochemical Corporation

- Koch Industries, Inc.

- Die Rosneft Deutschland GmbH

Report Scope:

In this report, the Global Petroleum Liquid Feedstock Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Petroleum Liquid Feedstock Market, By Type:

- Light Naphtha

- Heavy Naphtha

- Gas Oil

Petroleum Liquid Feedstock Market, By Product Type:

- Ethylene

- Propylene

- Hexane

- Benzene

- Others

Petroleum Liquid Feedstock Market, By Application:

- Industrial Solvents

- Cleaning Fluids

- Adulterant to Petrol

- Gasoline

- Others

Petroleum Liquid Feedstock Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe

- France

- United Kingdom

- Italy

- Germany

- Spain

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Kuwait

- Turkey

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Petroleum Liquid Feedstock Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional Market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Exxon Mobil Corporation

- Reliance Industries Limited

- Chevron Phillips Chemical Company LLC

- TotalENergies SE

- Shell plc

- Idemitsu Kosan Co., Ltd.

- BP p.l.c.

- China Petrochemical Corporation

- Koch Industries, Inc.

- Die Rosneft Deutschland GmbH

Table Information

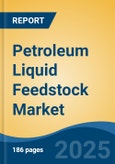

| Report Attribute | Details |

|---|---|

| No. of Pages | 186 |

| Published | March 2025 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 102.85 Billion |

| Forecasted Market Value ( USD | $ 168.09 Billion |

| Compound Annual Growth Rate | 8.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |