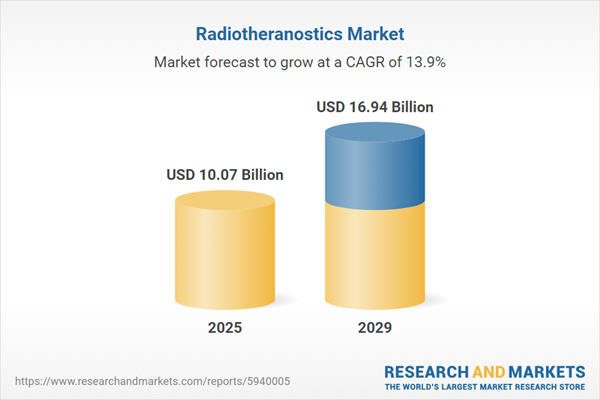

The radiotheranostics market size is expected to see rapid growth in the next few years. It will grow to $16.94 billion in 2029 at a compound annual growth rate (CAGR) of 13.9%. The growth in the forecast period can be attributed to advancements in targeted cancer therapies, expansion in oncology research, rise in chronic diseases, and growth in theranostic applications. Major trends in the forecast period include theranostic radiopharmaceutical development, expanding applications beyond oncology, personalized radiopharmaceuticals, nanotechnology in radiotheranostics, regulatory shifts and standardization.

The rising incidence of cancer is anticipated to drive the growth of the radiotheranostics market in the future. Cancer is characterized by the uncontrolled development of certain cells in the body that spread to other areas. Radiotheranostics medications are widely used in oncology to provide the concept of personalized medicine through paired diagnostic and therapeutic radionuclide probes. These probes enable selective and targeted detection and treatment of specific (typically cancerous) cells, tailored to the patient's specific condition to enhance treatment efficacy and improve clinical outcomes. For example, in January 2024, the American Cancer Society, a US-based nonprofit organization focused on cancer advocacy, reported an increase in cancer cases to 2,001,140, up from 1,958,310 in 2023, marking a growth of 2.19%. Thus, the increasing prevalence of cancer is propelling the radiotheranostics market.

The increasing adoption of personalized medicine is poised to contribute to the growth of the radiotheranostics market. Personalized medicine, an innovative healthcare approach tailoring medical treatments to individual patient characteristics, is facilitated by radiotheranostics. This approach, utilizing specific radiopharmaceuticals, enables the identification of individualized molecular targets, allowing for precise diagnosis and tailored therapeutic interventions based on the patient's unique characteristics. In 2022, the Food and Drug Administration’s Center for Drug Evaluation and Research (CDER) approved 37 new molecular entities (NMEs), with approximately 34% classified as personalized medicines, according to the Personalized Medicine Coalition. The increasing adoption of personalized medicine is a key driver for the growth of the radiotheranostics market.

An emerging trend in the radiotheranostics market is the focus on product innovations. Major companies are directing their efforts towards creating innovative products to solidify their market positions. For instance, Advanced Cyclotron Systems Inc., a Canada-based company specializing in cyclotrons for medical isotope production, introduced TR-ALPHA in May 2023. This innovation is designed for the production of alpha-emitting radioisotopes used in cancer treatment. TR-ALPHA addresses market demands for a low-cost cyclotron capable of producing substantial amounts of Astatine-211, a promising alpha-emitting radioisotope. This product is smaller, more cost-effective, and easier to operate compared to previous cyclotron models, making it an ideal solution for efficiently producing therapeutic alpha-emitting radioisotopes.

Major companies in the radiotheranostics market are forming strategic partnerships to develop new products and strengthen their market positions. Collaborations and partnerships in this market facilitate the pooling of resources, expertise, and research efforts, accelerating the development, commercialization, and widespread adoption of advanced diagnostic and therapeutic solutions. In April 2022, Ion Beam Applications partnered with SCK CEN to advance the production of the radioisotope Actinium-225, a crucial element in cancer treatment. This collaboration aims to establish a state-of-the-art production facility in Mol, Belgium, combining expertise in particle accelerators and the provision of rare raw materials. Such collaborations are crucial for making radiotheranostic solutions commercially viable for treating various cancers with enhanced precision.

In June 2023, Ariceum Therapeutics GmbH, a Germany-based radiopharmaceutical company, acquired Theragnostics Ltd. for $41.5 million. This strategic acquisition is intended to broaden Ariceum's portfolio of therapeutic and diagnostic assets in late preclinical and early clinical development and expand its operations in the US. Theragnostics Ltd., a US-based radiopharmaceutical company, specializes in offering radio-theranostic solutions.

Major companies operating in the radiotheranostics market include Lantheus Holdings Inc., Cardinal Health Inc., GE Healthcare Inc., Bayer AG, Novartis AG, Siemens Healthineers, Orano Med, Curium SAS, IBA Molecular, The Eckert & Ziegler Group, Advanced Accelerator Applications (AAA), Telix Pharmaceuticals Limited., Abdera Therapeutics, Blue Earth Diagnostics, Sirtex Medical Limited, Y-mAbs Therapeutics Inc., ITM Radiopharma, NorthStar Medical Radioisotopes LLC, Trasis S.A., Molecular Targeting Technologies Inc., RadioMedix Inc, Clarity Pharmaceuticals, Actinium Pharmaceuticals Inc., Navidea Biopharmaceuticals Inc.

North America was the largest region in the radiotheranostics market in 2024. The regions covered in the radiotheranostics market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the radiotheranostics market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

Radiotheranostics refers to a medical approach that combines diagnoses and treatments using imaging methods with radioactive substances to precisely identify specific targets within the body. This method is employed for delivering targeted radiation therapy to defined locations, enabling precise and tailored cancer treatment while minimizing damage to healthy tissues. This approach enhances treatment outcomes and improves patient care.

The primary radiotheranostics radioisotopes include technetium-99, gallium-68, iodine-131, iodine-123, fludeoxyglucose-18F, yttrium-90, lutetium (Lu) 177, copper (Cu) 67, copper (Cu) 64, and others. Technetium (Tc) is a silver-gray radioactive metal that occurs naturally at extremely low levels in the earth's crust but is predominantly man-made. It is used for skeletal and heart muscle scans and imaging of various organs such as the brain, thyroid, lungs, liver, spleen, kidneys, gall bladder, bone marrow, salivary and lacrimal glands, as well as in some specialized medical research. The different approaches include targeted therapeutic and targeted diagnostic applications in both oncology and non-oncology. The end users of this technology include hospitals and clinics, pharmaceutical and biotechnology companies, and others.

The radio theranostics market research report is one of a series of new reports that provides radio theranostics market statistics, including radio theranostics industry global market size, regional shares, competitors with a radio theranostics market share, detailed radio theranostics market segments, market trends, and opportunities, and any further data you may need to thrive in the radio theranostics industry. This radio theranostics market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

The radiotheranostics market consists of sales of iodine-125, radium-223 (223Ra), astatin-211 (211At), actinium-225 (225Ac), lead-212 (212Pb), bismuth-212 (212Bi), thorium-227, strontium-89 (89Sr), rhenium-188 (188Re), and samarium-153 (153Sm). Values in this market are ‘factory gate’ values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors, and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Radiotheranostics Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on radiotheranostics market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for radiotheranostics? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The radiotheranostics market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Radioisotope: Technetium-99; Gallium-68; Iodine-131; Iodine-123; Fludeoxyglucose-18F; Yttrium-90; Lutetium (Lu) 177; Copper (Cu) 67; Copper (Cu) 64; Other Radioisotopes2) By Approach: Targeted Therapeutic; Targeted Diagnostic

3) By Application: Oncology; Non-Oncology

4) By End-Users: Hospitals and Clinics; Pharmaceutical and Biotechnology Companies; Other End-Users

Subsegments:

1) By Technetium-99: Technetium-99m; Technetium-99 Pertechnetate2) By Gallium-68: Gallium-68 DOTATATE; Gallium-68 PSMA

3) By Iodine-131: Iodine-131 For Thyroid Cancer Treatment; Iodine-131 For Hyperthyroidism Treatment

4) By Iodine-123: Iodine-123 For Thyroid Scans; Iodine-123 For Cardiac Imaging

5) By Fludeoxyglucose-18F (FDG): FDG For Oncology Imaging; FDG For Brain Imaging

6) By Yttrium-90: Yttrium-90 Microspheres For Liver Cancer; Yttrium-90 For Radioimmunotherapy

7) By Lutetium (Lu) 177: Lutetium-177 PSMA For Prostate Cancer; Lutetium-177 DOTATATE For Neuroendocrine Tumors

8) By Copper (Cu) 67: Copper-67 For Targeted Radiotherapy; Copper-67 in Clinical Trials

9) By Copper (Cu) 64: Copper-64 For PET Imaging; Copper-64 For Radiotherapy

10) By Other Radioisotopes: Radium-223; Samarium-153; Other Emerging Radioisotopes in Theranostics

Key Companies Mentioned: Lantheus Holdings Inc.; Cardinal Health Inc.; GE Healthcare Inc.; Bayer AG; Novartis AG

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

- Lantheus Holdings Inc.

- Cardinal Health Inc.

- GE Healthcare Inc.

- Bayer AG

- Novartis AG

- Siemens Healthineers

- Orano Med

- Curium SAS

- IBA Molecular

- The Eckert & Ziegler Group

- Advanced Accelerator Applications (AAA)

- Telix Pharmaceuticals Limited.

- Abdera Therapeutics

- Blue Earth Diagnostics

- Sirtex Medical Limited

- Y-mAbs Therapeutics Inc.

- ITM Radiopharma

- NorthStar Medical Radioisotopes LLC

- Trasis S.A.

- Molecular Targeting Technologies Inc.

- RadioMedix Inc

- Clarity Pharmaceuticals

- Actinium Pharmaceuticals Inc.

- Navidea Biopharmaceuticals Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | February 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 10.07 Billion |

| Forecasted Market Value ( USD | $ 16.94 Billion |

| Compound Annual Growth Rate | 13.9% |

| Regions Covered | Global |

| No. of Companies Mentioned | 24 |