POC is a kind of medical testing conducted at or near the site of patient care, rather than in a centralized laboratory. Such a modality offers immediate results that can speed up clinical decisions, improve patient outcomes, and enhance the overall efficiency of healthcare delivery. Tests vary from simple glucose monitoring to advanced molecular diagnostics, and range within many fields of medicine.

There is an increase in the demand for point-of-care diagnostics globally, especially resulting from the need to have rapid testing solutions during emergency conditions, in remote sites, and in conditions of public health, such as the COVID-19 pandemic. Medical practitioners and patients are appreciative of the convenience and speed these tests bring to them, reducing waiting time for results and thus enabling timely interventions. Besides, technological development has made POC devices increasingly accurate, easy to use, and affordable.

These, put together with the growing focus on patient-centered care and the need for personalized medicine, place point-of-care diagnostics as one of the major components in the future of health care, driving innovation to extend access to critical diagnostic information around the world.

Top 5 Companies in the Point of Care Diagnostics Market by 2033

Sysmex

Headquarters: JapanFounded: 1968

Sysmex Corp (Sysmex) is a medical device company that researches, develops, manufactures, and sells instruments, reagents, and software applications to facilitate health checkups, treatment, and disease management. The company provides diagnostic instruments and related reagents, as well as laboratory information systems, to clinical laboratories for testing purposes. The company's product portfolio includes haematology, haemostasis, and urinalysis analyzers, among others. Medical institutions are the users of the company's products. Sysmex conducts research and development at facilities in Japan, France, New Zealand, Germany, and the US. The company operates with its subsidiaries in the Americas, Europe, the Middle East, Africa, and Asia Pacific.

Abbott Laboratories

Headquarters: United States of AmericaFounded: 1888

Abbott Laboratories is a prominent company in the medical devices and healthcare sectors, specializing in the discovery, development, manufacturing, and sale of a diverse range of products. The company’s offerings primarily include gastroenterology and women’s health products, along with solutions for cardiovascular and metabolic health, pain management, and central nervous system disorders. Additionally, Abbott produces respiratory drugs and vaccines, biosimilars, core laboratory systems, and transfusion medicine technologies. Their product line also encompasses point-of-care systems, rapid diagnostic lateral flow tests, informatics and automation solutions, nutritional products, as well as devices related to rhythm management, electrophysiology, and heart failure. The company addresses a wide array of vascular and structural heart needs, as well as neuromodulation therapies. Abbott distributes its products through various channels, including wholesalers, distributors, government agencies, healthcare facilities, pharmacies, and independent retailers. This extensive distribution network spans multiple regions, including North America, Latin America, the Middle East, Europe, Asia-Pacific, and Africa.

Becton Dickinson and Company

Headquarters: United States of AmericaFounded: 1897

BD is a leading medical technology company that is engaged in the development, manufacture, and distribution of medical supplies, devices, laboratory equipment, and diagnostic products. Its product portfolio comprises vascular and urology devices, surgical products, molecular diagnostic systems, infusion pumps, pre-fillable drug delivery systems, hemodynamic monitoring tools, and cell analysis solutions, among others. The various product categories of BD target healthcare institutions, physicians, life science researchers, clinical laboratories, the pharmaceutical industry, and the general public. In addition, BD has manufacturing operations in several countries such as Bosnia and Herzegovina, Brazil, Canada, the US, the Dominican Republic, France, Germany, Hungary, India, Japan, and Mexico, among many others, thereby making it a global player in the field of medical technology.

Danaher Corporation

Headquarters: United States of AmericaFounded: 1984

Danaher Corporation is a major science and technology company that develops healthcare and life sciences solutions using biotechnology and diagnostic tools. The company designs and delivers a wide range of test instruments and medical diagnostic products. Its product portfolio includes life sciences research instruments, professional microscopes, mass spectrometry reagents, genomic consumables, filtration systems, flow cytometers, lab automation instruments, centrifugation instruments, and particle counting and characterization instruments. Danaher sells its products to pharmaceutical and biotechnology companies, healthcare facilities, and research institutions through independent distributors in the Americas, Europe, the Middle East, Africa, and the Asia-Pacific region. Manufacturing facilities are located in Europe, Australia, Asia, and the Americas.

Quidel Diagnostics

Headquarters: United States of AmericaFounded: 1979

Quidel Corp is one of the major subsidiaries of Quidelortho Corp that predominately engages in the development, manufacturing, and marketing of rapid diagnostic testing solutions innovatively. These solutions are quite crucial in ensuring timely detection and diagnosis of some diseases and other medical conditions. The company offers a wide variety of advanced immunoassays, leading-edge molecular assays, as well as several virology products, including traditional cell lines. Quidel Corporation also provides quality specimens that are collected by using various appliances, all meant to ensure accuracy and efficiency in medical diagnostics.

Product Launches in the Point of Care Diagnostics Market

F. Hoffmann-La Roche Ltd

Nov 2023, Roche announced today the launch of the LightCycler® PRO System, which is based on the tried and tested gold standard technology of its predecessor LightCycler® Systems, offering improved performance and usability for a bridge between translational research and in-vitro diagnostics. The LightCycler® PRO System further extends Roche's molecular PCR testing portfolio, ranging from researcher solutions to those for diagnosis in cancer, infectious diseases, and other public health concerns.Thermo Fisher Scientific Inc.

Dec 2023: Thermo Fisher Scientific today announced two new products aimed at laboratory nucleic acid purification. Thermo Scientific KingFisher Apex Dx is a fully automated instrument designed for such purposes, while the Applied Biosystems MagMAX Dx Viral/Pathogen NA Isolation Kit focuses on viral and bacterial pathogen isolation and purification from respiratory biological specimens. Both products meet IVD and IVD-R standards and extend reliable automated sample preparation into the lab. The company said that this will enable laboratories to take even greater confidence in their downstream results.SWOT Analysis of Company in the Point of Care Diagnostics Market

Bio-Rad Laboratories Inc.

Strength - Robust Diagnostic R&D and Trusted Brand with Scalable Manufacturing

Bio-Rad's chief strength in the PoC diagnostics marketplace is a deep diagnostic expertise combined with proven R&D, regulatory know-how, and scalable manufacturing capabilities. With a long history in clinical assays and instrumentation, the company brings a strong foundation to the development of reliable, high-sensitivity PoC tests that meet both clinical and regulatory standards. Bio-Rad's ability to translate complex laboratory assays into compact, user-friendly formats-supported by rigorous quality systems and validation expertise-reduces the technical risk for customers adopting decentralized testing. Its global commercial footprint, combined with established relationships with leading hospitals, reference labs, and distributors, accelerates market access and clinician trust. In addition, in-house manufacturing and supply-chain control support rapid scale-up during periods of surging demand and ensure consistent reagent quality. This combination of scientific credibility, regulatory experience, and operational scale positions Bio-Rad to compete effectively in PoC diagnostics through the delivery of clinically robust, manufacturable solutions that clinicians and healthcare systems can rely on.QIAGEN N.V.

Strength - Strong Molecular Diagnostics Expertise and Integrated Sample-to-Result Solutions

QIAGEN N.V. is a recognized leader in the PoC diagnostics market, driven by deep expertise in molecular biology and a broad portfolio of sample-to-result technologies. Proven competencies in nucleic acid extraction, assay development, and molecular detection enable the delivery of diagnostic solutions with unparalleled accuracy, reliability, and speed. QIAGEN's flagship platforms, including QIAstat-Dx and NeuMoDx, are compact, automated systems for decentralized clinical settings that integrate sample preparation, amplification, and detection. This further instills customer confidence through its global reach, strong regulatory track record, and strategic partnerships with healthcare institutions that facilitate its rapid uptake. Furthermore, QIAGEN's strategic focus on menu expansion within infectious diseases and syndromic testing fuels its competitiveness across critical-care diagnostics. By building on decades of innovation in molecular testing and its strong R&D infrastructure, QIAGEN is best positioned to lead the transformation from centralized lab testing toward accessible, high-performance point-of-care molecular diagnostics worldwide.Recent Development in Point of Care Diagnostics Market

bioMérieux S.A.

Sept 2025, Altesa BioSciences is a pharmaceutical company currently in its clinical stage that is focused on developing innovative solutions for the prevention and treatment of rhinovirus infections-illnesses that play an important role in causing exacerbations of COPD and asthma. In a recent development, Altesa has entered into a partnership with bioMérieux, an in vitro diagnostics leader. Together, they will use the BIOFIRE® SPOTFIRE® respiratory solution as the primary point-of-care diagnostics platform for Altesa's upcoming Phase 2B clinical trial at various sites across the United States.Siemens Healthineers AG

Oct. 2025, Siemens Healthineers and the National University Hospital (NUH) in Singapore have signed a strategic research collaboration on increasing diagnostic solutions for Metabolic Dysfunction-Associated Steatotic Liver Disease (MASLD). This condition affects almost 40% of adults in Singapore-remarkably higher compared to the global average prevalence of 30.05%. This partnership will work toward fostering understanding and diagnosing this swiftly emerging health problem.Sustainability Objective in the Point of Care Diagnostics Market

EKF Diagnostics Holdings plc.

EKF Diagnostics Holdings plc. aims to put sustainability at the center of all it does, from responsible manufacturing and reduction of its environmental footprint to developing products that improve access to healthcare. The sustainability objectives of the company encompass minimizing its carbon footprint by using energy-efficient production processes, reduction of waste, and sourcing raw materials in a responsible way. Complying with regulations regarding the environment and labor in respect to the supply chain is considered of paramount importance by EKF. Furthermore, the company invests in developing diagnostic technologies that support early detection of disease and contribute toward sustainable health outcomes through reduced hospital admissions and better patient management. EKF invests in employee well-being initiatives, diversity programs, and community health support as ways of responding to social responsibility. By aligning business growth with global environmental and social objectives, EKF aims to ensure long-term value creation while supporting a healthier planet and equitable access to diagnostic solutions globally.Nova Biomedical

Nova Biomedical's sustainability objective is to advance healthcare innovation while minimizing environmental impact and promoting social responsibility. Therefore, the company is committed to reducing waste, conserving energy, and improving manufacturing efficiency throughout its worldwide operations. Nova strives to reduce its carbon footprint and maintain resources in a sustainable manner through lean methods of production and responsible sourcing of materials. The longevity, reliability, and low waste produced during the lifespan of its diagnostic products-point-of-care testing systems, for example-align innovation with environmental stewardship. Beyond the environmental initiatives, Nova focuses on ethical business practices, care for employee welfare, and support for community health. Nova Biomedical embraces accountability via a culture of continuous improvement and adherence to global environmental standards. By integrating sustainability into product design, manufacturing, and corporate culture, Nova Biomedical strives to help create a healthier planet while delivering accessible, high-quality diagnostic solutions to healthcare professionals worldwide.Market Segmentation

Point of Care Diagnostics Market

- Historical Trends

- Forecast Analysis

Market Share Analysis - Point of Care Diagnostics Market

Sysmex

Overview

- Company History and Mission

- Business Model and Operations

- Workforce

Key Persons

- Executive Leadership

- Operational Management

- Division Leaders

- Board Composition

Recent Development & Strategies

- Mergers & Acquisitions

- Partnerships

- Investments

Sustainability Analysis

- Renewable Energy Adoption

- Energy-Efficient Infrastructure

- Use of Sustainable Packaging Materials

- Water Usage and Conservation Strategies

- Waste Management and Circular Economy Initiatives

Product Analysis

- Product Profile

- Quality Standards

- Product Pipeline

- Product Benchmarking

Strategic Assessment: SWOT Analysis

- Strengths

- Weaknesses

- Opportunities

- Threats

Revenue Analysis

The above information will be available for all the following companies:

- Sysmex

- Abbott Laboratories

- Becton Dickinson and Company

- Danaher Corporation

- Quidel Diagnostics

- F. Hoffmann-La Roche Ltd

- Thermo Fisher Scientific Inc.

- Bio-Rad Laboratories Inc.

- QIAGEN N.V.

- bioMérieux S.A.

- Siemens Healthineers AG

- EKF Diagnostics Holdings plc.

- Nova Biomedical

- Sekisui Diagnostics LLC

- Trinity Biotech plc.

- Chembio Diagnostics Systems, Inc.

- PTS Diagnostics

- Alere Inc.

- ACON Laboratories

- Nipro Diagnostics

Table of Contents

Companies Mentioned

- Sysmex

- Abbott Laboratories

- Becton Dickinson and Company

- Danaher Corporation

- Quidel Diagnostics

- F. Hoffmann-La Roche Ltd

- Thermo Fisher Scientific Inc.

- Bio-Rad Laboratories Inc.

- QIAGEN N.V.

- bioMérieux S.A.

- Siemens Healthineers AG

- EKF Diagnostics Holdings plc.

- Nova Biomedical

- Sekisui Diagnostics LLC

- Trinity Biotech plc.

- Chembio Diagnostics Systems, Inc.

- PTS Diagnostics

- Alere Inc.

- ACON Laboratories

- Nipro Diagnostics

Methodology

In this report, for analyzing the future trends for the studied market during the forecast period, the publisher has incorporated rigorous statistical and econometric methods, further scrutinized by secondary, primary sources and by in-house experts, supported through their extensive data intelligence repository. The market is studied holistically from both demand and supply-side perspectives. This is carried out to analyze both end-user and producer behavior patterns, in the review period, which affects price, demand and consumption trends. As the study demands to analyze the long-term nature of the market, the identification of factors influencing the market is based on the fundamentality of the study market.

Through secondary and primary researches, which largely include interviews with industry participants, reliable statistics, and regional intelligence, are identified and are transformed to quantitative data through data extraction, and further applied for inferential purposes. The publisher's in-house industry experts play an instrumental role in designing analytic tools and models, tailored to the requirements of a particular industry segment. These analytical tools and models sanitize the data & statistics and enhance the accuracy of their recommendations and advice.

Primary Research

The primary purpose of this phase is to extract qualitative information regarding the market from the key industry leaders. The primary research efforts include reaching out to participants through mail, tele-conversations, referrals, professional networks, and face-to-face interactions. The publisher also established professional corporate relations with various companies that allow us greater flexibility for reaching out to industry participants and commentators for interviews and discussions, fulfilling the following functions:

- Validates and improves the data quality and strengthens research proceeds

- Further develop the analyst team’s market understanding and expertise

- Supplies authentic information about market size, share, growth, and forecast

The researcher's primary research interview and discussion panels are typically composed of the most experienced industry members. These participants include, however, are not limited to:

- Chief executives and VPs of leading corporations specific to the industry

- Product and sales managers or country heads; channel partners and top level distributors; banking, investment, and valuation experts

- Key opinion leaders (KOLs)

Secondary Research

The publisher refers to a broad array of industry sources for their secondary research, which typically includes, however, is not limited to:

- Company SEC filings, annual reports, company websites, broker & financial reports, and investor presentations for competitive scenario and shape of the industry

- Patent and regulatory databases for understanding of technical & legal developments

- Scientific and technical writings for product information and related preemptions

- Regional government and statistical databases for macro analysis

- Authentic new articles, webcasts, and other related releases for market evaluation

- Internal and external proprietary databases, key market indicators, and relevant press releases for market estimates and forecasts

LOADING...

Table Information

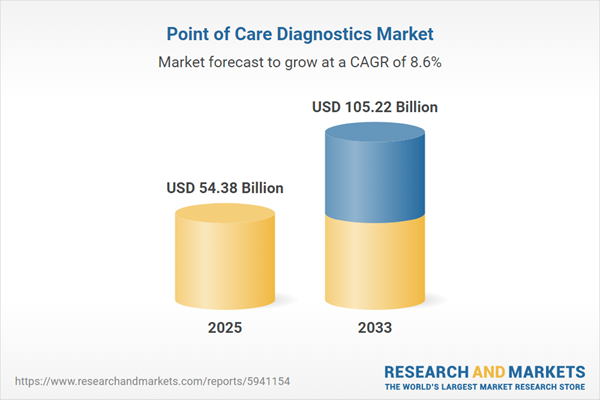

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | December 2025 |

| Forecast Period | 2025 - 2033 |

| Estimated Market Value ( USD | $ 54.38 Billion |

| Forecasted Market Value ( USD | $ 105.22 Billion |

| Compound Annual Growth Rate | 8.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 20 |