Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Innovations in MRI ferromagnetic detection systems have significantly contributed to market growth. Modern systems are equipped with advanced sensors, artificial intelligence, and machine learning algorithms to enhance their detection capabilities, reducing the risk of accidents. Stringent regulatory requirements and safety standards have made it mandatory for MRI facilities to implement ferromagnetic detection systems. This has further propelled the market growth. MRI is an essential diagnostic tool in various medical fields, including radiology, neurology, cardiology, and orthopaedics. The growing demand for MRI scans has translated into higher adoption rates for ferromagnetic detection systems.

Key Market Drivers

Increasing MRI Utilization is Driving the Global MRI Ferromagnetic Detection Systems Market

Magnetic Resonance Imaging (MRI) is a crucial diagnostic tool in modern medicine, allowing healthcare professionals to obtain detailed images of the human body's internal structures. With advancements in healthcare technology and increasing awareness of the benefits of MRI, the global demand for MRI scans is on the rise. As a result, the need for MRI Ferromagnetic Detection Systems, an essential component of MRI safety, is also increasing.Several factors contribute to the increasing utilization of MRI technology. Continuous technological advancements have made MRI machines more efficient, offering higher resolution images and faster scan times. This has expanded the range of applications for MRI, making it an attractive choice for both routine screenings and complex diagnostic procedures. An aging global population is driving the demand for medical imaging services, as older individuals require more frequent and comprehensive medical assessments. MRI is often preferred for its ability to detect age-related conditions like osteoarthritis, neurological disorders, and cardiovascular diseases. Patients and healthcare providers are increasingly recognizing the benefits of early disease detection and accurate diagnosis through MRI. This has led to a greater demand for MRI scans as a vital tool in preventive healthcare. Ongoing research and development efforts in the field of MRI continue to enhance its capabilities, uncovering new applications and clinical possibilities. This, in turn, drives further adoption.

The increasing utilization of MRI technology has propelled the growth of the Global MRI Ferromagnetic Detection Systems Market. Healthcare facilities worldwide are investing in MRI Ferromagnetic Detection Systems to enhance safety measures and minimize the risk of accidents in MRI suites. Stringent safety regulations and guidelines mandate the use of MRI Ferromagnetic Detection Systems in MRI facilities, driving market growth. Continuous innovation in detection technology is improving the performance and accuracy of these systems, further boosting their adoption. Greater awareness of the risks associated with ferromagnetic objects in MRI environments is prompting healthcare providers to invest in advanced detection systems.

Growing Healthcare Infrastructure is Driving the Global MRI Ferromagnetic Detection Systems Market

The global MRI ferromagnetic detection systems market is witnessing significant growth, thanks to the ever-expanding healthcare infrastructure around the world. Magnetic Resonance Imaging (MRI) is a crucial diagnostic tool in modern medicine, enabling healthcare professionals to obtain detailed images of the human body for diagnosis and treatment planning. However, MRI machines are sensitive to ferromagnetic objects, which can pose serious risks to patient safety and equipment integrity. To address this concern, the demand for MRI ferromagnetic detection systems is on the rise, driven by the continuous expansion of healthcare facilities. One of the primary drivers behind the growth of the MRI ferromagnetic detection systems market is the expansion of healthcare infrastructure worldwide. Developing countries are investing heavily in building new hospitals and medical facilities, while established healthcare systems are constantly upgrading and modernizing their equipment. As MRI machines become more accessible, the need for robust safety measures like ferromagnetic detection systems increases.MRI has become a go-to diagnostic tool in various medical specialties, including neurology, orthopedics, cardiology, and oncology. With the increasing demand for MRI scans, there is a parallel need for enhancing safety measures. As more patients undergo MRI procedures, the likelihood of ferromagnetic objects being accidentally introduced into MRI rooms also increases, emphasizing the importance of ferromagnetic detection systems. Regulatory bodies in the healthcare sector are imposing stricter safety standards to prevent accidents and ensure patient welfare. These regulations necessitate the implementation of ferromagnetic detection systems in MRI facilities. Healthcare providers are compelled to adhere to these standards, further boosting the demand for ferromagnetic detection systems.

The MRI ferromagnetic detection systems market is expected to continue its growth trajectory, fueled by the ongoing expansion of healthcare infrastructure and the ever-increasing utilization of MRI scans. As technology continues to advance, these systems will become more affordable and user-friendly, making them accessible to a wider range of healthcare providers. In conclusion, the global MRI ferromagnetic detection systems market is driven by the imperative need to ensure patient safety and protect costly MRI equipment from damage. The growth of healthcare infrastructure and the increasing regulatory emphasis on safety in healthcare settings are key factors propelling the market forward. As technology evolves, these systems will become an integral component of MRI facilities, safeguarding patients, healthcare professionals, and the valuable MRI equipment they depend on.

Key Market Challenges

Limited Awareness and Education

One of the primary challenges in the MRI ferromagnetic detection systems market is the lack of awareness and education among healthcare professionals, patients, and the general public. Many people are unaware of the risks associated with ferromagnetic objects in MRI suites and the solutions offered by detection systems. Healthcare facilities often underinvest in education and training programs, which can hinder the adoption of these systems.High Initial Costs

MRI ferromagnetic detection systems are technologically advanced and sophisticated devices. They can be expensive to purchase, install, and maintain. The high initial costs can deter healthcare facilities from investing in such systems, especially when they are already facing budget constraints. Cost considerations often lead to a delay in the implementation of these critical safety measures.Integration with Existing MRI Infrastructure

Integrating ferromagnetic detection systems with existing MRI infrastructure can be a complex and time-consuming process. Compatibility issues with MRI machines and the need for retrofitting can pose a significant challenge. As a result, healthcare facilities may be hesitant to adopt these systems, as they fear disruptions to their existing MRI services.False Alarms and Reliability

One of the essential functions of ferromagnetic detection systems is to minimize false alarms while detecting potentially dangerous objects accurately. The reliability of these systems is critical, as frequent false alarms can lead to user frustration and a decrease in confidence in the technology. Manufacturers must continue to improve the accuracy and reliability of their systems to gain trust within the medical community.Regulatory and Certification Challenges

Manufacturers of MRI ferromagnetic detection systems must navigate complex regulatory pathways and standards to ensure their products are safe, effective, and compliant with industry requirements. Achieving necessary certifications and approvals can be time-consuming and costly, and the process may vary by region. These challenges can delay market entry and increase the overall cost of development and production.Competition in the Market

The MRI ferromagnetic detection systems market is becoming increasingly competitive, with multiple manufacturers and technologies vying for market share. While competition can lead to innovation and improved offerings, it can also make it challenging for healthcare facilities to choose the right system that meets their specific needs.Resistance to Change

Healthcare professionals and staff may be resistant to change, especially if they have been using existing safety protocols for years. Implementing ferromagnetic detection systems requires a shift in institutional culture and the adoption of new operating procedures. Convincing staff to embrace these changes and adapt to new routines can be a significant challenge.Key Market Trends

Technological Advancements

The field of medical imaging has seen remarkable advancements over the years, revolutionizing healthcare by enabling early and accurate diagnoses of various conditions. Magnetic Resonance Imaging (MRI) is one of the most vital imaging technologies, offering non-invasive, detailed views of the human body's internal structures. To ensure the safety and effectiveness of MRI, there is a growing demand for MRI Ferromagnetic Detection Systems. These systems, which help prevent accidents and ensure patient and staff safety, have witnessed a significant boost in their global market, driven by increasing technological advancements.Modern MRI Ferromagnetic Detection Systems are equipped with highly sensitive sensors and advanced algorithms that can detect even tiny ferromagnetic objects. This enhanced sensitivity ensures that even the smallest metallic objects, like earrings or dental implants, can be detected before they pose a threat. Many systems now provide real-time monitoring capabilities. They continuously scan the MRI room for any ferromagnetic objects and instantly alert the MRI technologist or radiologist in case of a potential threat. This real-time feedback is crucial for immediate intervention and maintaining a safe MRI environment. Some advanced MRI Ferromagnetic Detection Systems can be integrated with MRI scanners, allowing for seamless communication and coordination between the detection system and the MRI machine. This integration ensures that the MRI scan is only initiated when the room is free of ferromagnetic hazards. User-friendly interfaces and touchscreen controls make it easier for healthcare professionals to operate these systems. Training requirements are reduced, and personnel can quickly adapt to the technology, ensuring the efficient operation of MRI suites. Many modern systems are capable of storing data and generating reports on ferromagnetic incidents. This data can be valuable for quality control, performance improvement, and compliance with safety standards.

Segmental Insights

Type Insights

Based on the category of type, stationary MRI ferromagnetic detection system emerged as the dominant player in the global market for MRI Ferromagnetic Detection Systems in 2023. Stationary MRI ferromagnetic detection systems are highly sensitive, capable of detecting even small ferromagnetic objects. This ensures that no potential threats are overlooked, enhancing the overall safety of MRI procedures. Unlike portable detection systems that require manual checks, stationary systems offer continuous, 24/7 monitoring. This minimizes the chances of human error and guarantees ongoing safety within the MRI suite. Stationary systems can be integrated with the MRI machine itself, enabling automatic pausing of the scan if a ferromagnetic object is detected. This seamless integration enhances the overall efficiency and safety of MRI operations. Stationary systems are robust and require minimal maintenance. This is a cost-effective solution for healthcare facilities, as it reduces the need for frequent upkeep and recalibration. These systems can immediately alert healthcare staff and operators if a ferromagnetic object is detected, enabling quick response and minimizing the risk of accidents.End use Insights

The Hospitals & Clinics is projected to experience rapid growth during the forecast period. Hospitals and clinics have a primary responsibility to ensure the safety of their patients. MRI Ferromagnetic Detection Systems help minimize the risk of accidents within the MRI suite, giving patients peace of mind and ensuring their well-being during the imaging procedure. Medical facilities must adhere to strict regulations and guidelines, including those related to patient safety. By implementing MRI Ferromagnetic Detection Systems, hospitals and clinics not only enhance patient safety but also demonstrate their commitment to compliance with these regulations. MRI machines are expensive, with the cost of purchasing, installing, and maintaining them running into the millions of dollars. Ferromagnetic accidents can result in significant repair and replacement costs. Hospitals and clinics understand the importance of protecting these valuable assets.Regional Insights

• North America emerged as the dominant player in the global MRI Ferromagnetic Detection Systems market in 2023, holding the largest market share in terms of value. North America, home to numerous cutting-edge healthcare and technology companies, has been at the forefront of developing and implementing advanced MRI Ferromagnetic Detection Systems. These systems utilize state-of-the-art technologies such as artificial intelligence, machine learning, and high-resolution imaging to detect even the smallest ferromagnetic objects accurately. North American regulatory bodies, such as the Food and Drug Administration (FDA) in the United States and Health Canada, have played a pivotal role in setting stringent safety standards for MRI environments. Compliance with these regulations has necessitated the adoption of advanced ferromagnetic detection systems, contributing to North America's dominant position in the global market.Report Scope:

In this report, the Global MRI Ferromagnetic Detection Systems Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:MRI Ferromagnetic Detection Systems Market, By Type:

- Stationary

- Portable

MRI Ferromagnetic Detection Systems Market, By End use:

- Hospitals & Clinics

- Ambulatory Care Centers

- Others

MRI Ferromagnetic Detection Systems Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe

- France

- United Kingdom

- Italy

- Germany

- Spain

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the MRI Ferromagnetic Detection Systems Market.Available Customizations:

Global MRI Ferromagnetic Detection Systems market report with the given market data, the publisher offers customizations according to a company's specific needs.This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Kopp Development Inc.

- Bio-x, Magmedix Inc.

- Metrasens

- Tactical Solutions

- C.E.I.A. S.p.A.

- ITEL Telecomunicazioni S.r.l.

- Nanjing Cloud Magnet Electronics Technology Co., Ltd.

- ETS Lindgren

- Fujidenolo Co. Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | February 2024 |

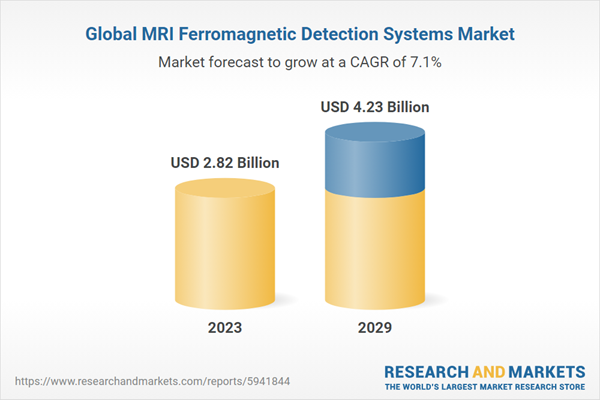

| Forecast Period | 2023 - 2029 |

| Estimated Market Value ( USD | $ 2.82 Billion |

| Forecasted Market Value ( USD | $ 4.23 Billion |

| Compound Annual Growth Rate | 7.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 9 |