Market Introduction

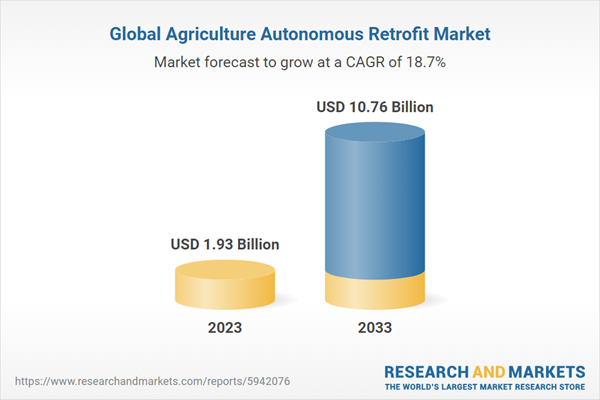

The global agriculture autonomous retrofit market was valued at $1,931.1 million in 2023 and is expected to reach $10,760.3 million by 2033. Companies involved in manufacturing driverless tractor kits, spot spraying systems, and other autonomous retrofit solutions can strategically position themselves for this growth by investing in research and development, fortifying production infrastructure, and forging strategic partnerships. This strategic positioning aligns with market trends as the agriculture industry increasingly embraces sustainable and efficient farming practices enabled by autonomous technologies. As the demand for agriculture autonomous retrofit solutions continues to soar, companies adopting proactive strategies are likely to shape the future of the global agriculture autonomous retrofit market and cater to the evolving needs of farmers worldwide.Industrial Impact

The agriculture autonomous retrofit market is witnessing significant activity from key players, each employing strategic initiatives to capitalize on the growing demand for advanced farming solutions. AGCO Corporation, a major player in the industry, made a noteworthy move by acquiring an 85% interest in Trimble's agriculture technology business in September 2022. This strategic partnership aims to integrate Trimble's precision agriculture technologies with AGCO Corporation's retrofit offerings, particularly focusing on enhancing precision planting seed planter products.Similarly, CNH Industrial N.V. has been actively advancing in precision agriculture. In 2021, CNH Industrial N.V. acquired Raven Industries for $2.1 billion, integrating Raven's guidance systems, crop-spraying machines, and autonomous driving systems into their product lineup. CNH Industrial N.V.'s focus on smart machines capable of adjusting to variances in field conditions underscores their commitment to delivering precise and efficient farming solutions. Moreover, the company’s Harvest Automation System and tillage automation technology demonstrate their dedication to optimizing farm operations and increasing productivity.

Market Segmentation:

Segmentation 1: by Application

- Tractor Autonomy

- Implement Autonomy

Tractor Autonomy to Dominate the Global Agriculture Autonomous Retrofit Market (by Application)

The tractor autonomy segment is expected to maintain its dominance in the agriculture autonomous retrofit market during 2023-2033. This is driven by increasing demand for efficient and cost-effective farming solutions, especially in regions facing labor shortages and relying on aging equipment. Retrofitting existing tractors with autonomous capabilities offers economic and operational advantages, making it the preferred choice for many farmers.Segmentation 2: by Product

- Driverless Tractor Kit

- In-Cab Display

- Spot Spraying Kit

- Planting Automation Kit

Driverless Tractor Kit to Dominate the Global Agriculture Autonomous Retrofit Market (by Product)

The global agriculture autonomous retrofit market is currently undergoing a significant transformation, with the driverless tractor kit segment expected to hold a dominating share throughout the forecast period. This shift is notably propelled by both developed and developing countries, particularly due to strong government support advocating for reduced taxes, incentives, and infrastructure development. Companies are also coming up with new products and taking strategic initiatives to grasp the market opportunity. In December 2022, CNH Industrial N.V. unveiled its newest automation and autonomy solutions during its Tech Day in the U.S. These include innovative Driverless Tillage and Driver Assist Harvest solutions from Raven, as well as Baler Automation from Case IH and New Holland. These advancements in automation and autonomous equipment aim to address key challenges in farming, such as improving productivity and achieving sustainability goals with fewer resources.Segmentation 3: by Region

- North America: U.S., Mexico, and Canada

- Europe: France, Germany, Italy, Spain, U.K., and Rest-of-Europe

- Asia-Pacific: China, Japan, Australia, and Rest-of-Asia-Pacific

- Rest-of-the-World: Brazil and Other

Recent Developments in the Global Agriculture Autonomous Retrofit Market

- In August 2023, New Holland Agriculture, a brand of CNH Industrial N.V., launched the world's first accessible farm tractor, the TL5 Acessível, in Brazil. Designed for individuals with lower limb disabilities, the tractor aims to provide autonomy for farmers with physical challenges, addressing a significant portion of the Brazilian population and is financially supported by the Brazilian government's 'Rota 2030' financing line for innovation projects in social inclusion.

- In October 2023, the Sabanto Steward-equipped Kubota M5 111 is the first aftermarket-installed level five autonomous tractor in Canada, featuring a retrofittable system allowing remote programming and operation. Priced at $65,000 with an annual subscription, it offers efficiency gains, labor savings, and potential return on investment within a year to a year-and-a-half, addressing challenges in agriculture, such as labor shortages and maximizing productivity.

- In September 2023, AGCO Corporation planned to establish a 300-acre smart farm in North Dakota's Grand Farm Innovation Campus, focusing on precision agriculture and retrofit technologies. The project, led by Agca subsidiary Appareo, aimed to develop sustainable farming practices through advancements in crop production, resource utilization, and overall farm management.

Demand - Drivers, Challenges, and Opportunities

Market Drivers: Alleviating Farming Labor Shortages with Autonomous Tractor Technology

- Labor shortage in agriculture is a major challenge faced by many countries across the world. It refers to a situation where the demand for agricultural workers exceeds the supply, resulting in lost productivity, income, and food security.

- The Canadian Agricultural Human Resource Council (CAHRC) has revealed a severe labour shortage in the agriculture sector, causing an estimated $3.5 billion in losses for on-farm businesses in 2022. With a 7.4% vacancy rate, two in five farmers struggle to find necessary workers. To overcome labour challenges, the agriculture industry is exploring autonomous tractor technology to reduce dependency on human labour and enhance productivity.

Market Challenges: Navigating Data Ownership and Privacy Challenges

- Agricultural hardware, including automatic crop sprayers, drones, and robotic harvesters, could be exploited by hackers, as highlighted in a University of Cambridge report. Ethical hackers have identified vulnerabilities in Deere & Company's and CNH Industrial N.V.'s systems, emphasizing the need to prevent disruptions to critical agricultural infrastructure during key periods such as seeding or harvesting. Experts stress that hacking into a fleet of tractors could impact yields across entire regions.

- The major stakeholders in agricultural data include farmers, agricultural technology providers, input companies, and governments. A survey by the American Farm Bureau Federation revealed that over 75% of farmers worry about data ownership and potential regulatory use, while 60% fear companies influencing market decisions using their agricultural data.

Market Opportunities: Growing Demand for Carbon Footprint Cutbacks

- Agriculture contributes to greenhouse gas emissions through various processes, including the use of fossil fuels, fertilizers, and land-use changes. As a result, there is a growing emphasis on adopting technologies and practices that can help minimize the carbon footprint of agricultural operations.

- Nations are putting concerted efforts into reducing their carbon footprint. For instance, the release of the U.S. Department of Agriculture's (USDA) comprehensive assessment in 2023 on the role of agriculture and forestry in carbon markets aligns with the growing demand for carbon footprint cutbacks, creating significant opportunities for agriculture autonomous retrofit equipment manufacturers. The report, a key deliverable under the Growing Climate Solutions Act (GCSA), underscores the Biden-Harris Administration's commitment to leveraging agriculture and forestry as solutions to climate change while fostering economic opportunities for rural communities.

How can this report add value to an organization?

Product/Innovation Strategy: The product segment helps the reader understand the different applications of agriculture autonomous retrofit products. The market is poised for significant expansion with ongoing technological advancements, increased investments, and growing awareness of the use of retrofit kits. Therefore, the autonomous retrofit business is a high-investment and high-revenue generating model.Growth/Marketing Strategy: The global agriculture autonomous retrofit market has been growing at a rapid pace. The market offers enormous opportunities for existing and emerging market players. Some of the strategies covered in this segment are mergers and acquisitions, product launches, partnerships and collaborations, business expansions, and investments. The strategies preferred by companies to maintain and strengthen their market position primarily include partnerships and collaborations.

Competitive Strategy: The key players in the global agriculture autonomous retrofit market analyzed and profiled in the study include manufacturers of agriculture autonomous retrofit kits. Additionally, a comprehensive competitive landscape such as partnerships, agreements, and collaborations are expected to aid the reader in understanding the untapped revenue pockets in the market.

Research Methodology

Factors for Data Prediction and Modeling

- The base currency considered for the market analysis is US$. Currencies other than the US$ have been converted to the US$ for all statistical calculations, considering the average conversion rate for that particular year.

- The currency conversion rate has been taken from the historical exchange rate of the Oanda website.

- Nearly all the recent developments from January 2020 to January 2024 have been considered in this research study.

- The information rendered in the report is a result of in-depth primary interviews, surveys, and secondary analysis.

- Where relevant information was not available, proxy indicators and extrapolation were employed.

- Any economic downturn in the future has not been taken into consideration for the market estimation and forecast.

- Technologies currently used are expected to persist through the forecast with no major technological breakthroughs.

Market Estimation and Forecast

This research study involves the usage of extensive secondary sources, such as certified publications, articles from recognized authors, white papers, annual reports of companies, directories, and major databases to collect useful and effective information for an extensive, technical, market-oriented, and commercial study of the global agriculture autonomous retrofit market.The process of market engineering involves the calculation of the market statistics, market size estimation, market forecast, market crackdown, and data triangulation (the methodology for such quantitative data processes is explained in further sections). The primary research study has been undertaken to gather information and validate the market numbers for segmentation types and industry trends of the key players in the market.

Primary Research

The primary sources involve industry experts from the global agriculture autonomous retrofit market and various stakeholders in the ecosystem. Respondents such as CEOs, vice presidents, marketing directors, and technology and innovation directors have been interviewed to obtain and verify both qualitative and quantitative aspects of this research study.The key data points taken from primary sources include:

- validation and triangulation of all the numbers and graphs

- validation of reports segmentation and key qualitative findings

- understanding the competitive landscape

- validation of the numbers of various markets for market type

- percentage split of individual markets for geographical analysis

Secondary Research

This research study involves the usage of extensive secondary research, directories, company websites, and annual reports. It also makes use of databases, such as Hoovers, Bloomberg, Businessweek, and Factiva, to collect useful and effective information for an extensive, technical, market-oriented, and commercial study of the global market. In addition to the aforementioned data sources, the study has been undertaken with the help of other data sources and websites, such as GFI and Delft University of Technology.Secondary research was done in order to obtain crucial information about the industry’s value chain, revenue models, the market’s monetary chain, the total pool of key players, and the current and potential use cases and applications.

The key data points taken from secondary research include:

- segmentations and percentage shares

- data for market value

- key industry trends of the top players of the market

- qualitative insights into various aspects of the market, key trends, and emerging areas of innovation

- quantitative data for mathematical and statistical calculations

Key Market Players and Competition Synopsis

The companies that are profiled have been selected based on inputs gathered from primary experts and analyzing company coverage, product portfolio, and market penetration.Some of the prominent names in this market are:

- ONE SMART SPRAY

- ARAG

- Braun Maschinenbau GmbH

- GPX Solutions

- GOtrack

- Sabanto Inc.

- Fieldin

- AGCO Corporation

- WEED-IT

- Hexagon AB

- TOPCON CORPORATION

- Ag Leader Technology

- CNH Industrial N.V.

- Deere & Company

This product will be delivered within 3-5 business days.

Table of Contents

Companies Mentioned

- AGCO Corporation

- Deere & Company

- CNH Industrial N.V.

- Ag Leader Technology

- TOPCON CORPORATION

- Hexagon AB

- WEED-IT

- Fieldin

- Sabanto Inc.

- GOtrack

- THORNFIELD

- GPX Solutions

- Braun Maschinenbau GmbH

- ONE SMART SPRAY

- ARAG (Subsidiary of Nordson Corporation)

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 128 |

| Published | March 2024 |

| Forecast Period | 2023 - 2033 |

| Estimated Market Value ( USD | $ 1.93 Billion |

| Forecasted Market Value ( USD | $ 10.76 Billion |

| Compound Annual Growth Rate | 18.7% |

| Regions Covered | Global |

| No. of Companies Mentioned | 15 |