Motion sensors, including accelerometers and gyroscopes, play a crucial role in navigation systems for aircraft and defense applications. Therefore, the aerospace and defense segment generated 13.3% revenue share in 2022. They provide essential data for determining the platforms' orientation, acceleration, and angular velocity, contributing to precise navigation and control. Therefore, the segment will witness increased growth in the coming years.

Motion sensors like accelerometers and gyroscopes enable gesture recognition in devices like smartphones and tablets. This functionality allows users to interact with their devices through gestures, such as tilting, shaking, or rotating. Motion sensors help in determining the orientation of a device in three-dimensional space.

Additionally, as per the data released by the International Trade Administration in 2023, China continues to hold its position as the worldwide leader in both annual vehicle sales and manufacturing output, and it is projected that domestic production will reach 35 million vehicles by 2025. Likewise, as per the data from the International Trade Administration, the automotive sector in Middle East and North Africa (MENA) region is currently experiencing a 36% growth rate, with Saudi Arabia emerging as the primary industry in the area. In 2020, Saudi Arabia constituted 35% of the vehicles sold in the MENA region and nearly 52% of the vehicles sold in the Gulf Cooperation Council (GCC).

However, this technology often involves purchasing hardware devices, including sensors, controllers, and associated components. Additionally, the cost of installation, wiring, and integration with existing systems can contribute to the overall initial investment. Higher-quality motion sensors, such as those with advanced features like increased accuracy, longer detection range, or multi-sensing capabilities, tend to be more expensive. Thus, these aspects can hamper the growth of the market.

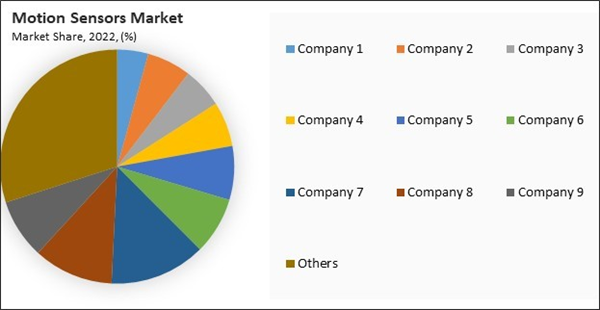

The leading players in the market are competing with diverse innovative offerings to remain competitive in the market. The above illustration shows the percentage of revenue shared by some of the leading companies in the market. The leading players of the market are adopting various strategies in order to cater demand coming from the different industries. The key developmental strategies in the market are Acquisitions, and Partnerships & Collaborations.

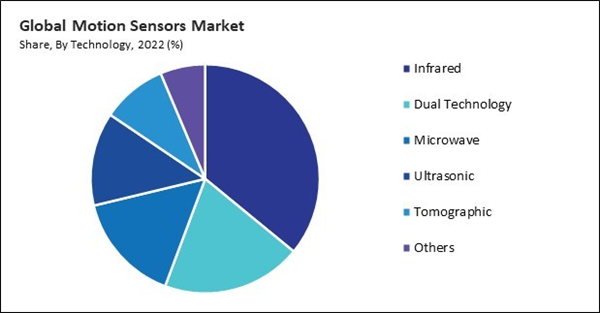

By Technology Analysis

Based on technology, the market is segmented into infrared, ultrasonic, microwave, dual technology, tomographic, and others. In 2022, the dual technology segment witnessed 19.7% revenue share in the market. Dual technology sensors typically combine two different sensing technologies, such as infrared (IR) and ultrasonic sensors. This combination can result in improved accuracy and reliability by mitigating the limitations of each technology when used alone.By Application Analysis

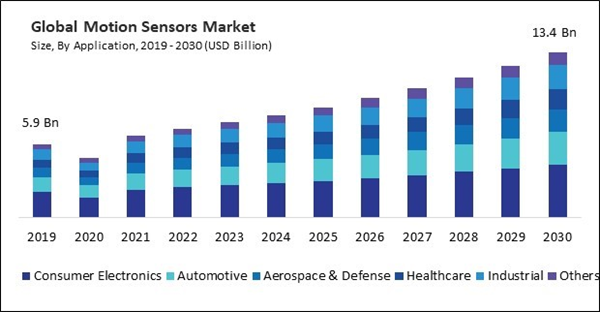

On the basis of application, the market is divided into consumer electronics, aerospace & defense, healthcare, automotive, industrial, and others. The consumer electronics segment captured 34.2% revenue share in the market in 2022. The proliferation of smartphones and tablets has been a major contributor to the growth of the market.By Regional Analysis

By region, the market is segmented into North America, Europe, Asia Pacific, and LAMEA. The North America segment procured 28.8% revenue share in the market in 2022. North America has been a significant consumer of it, driven by the widespread adoption of consumer electronics. Smartphones, gaming consoles, wearables, and other electronic devices leverage it for gesture control, screen rotation, and gaming interactions.Recent Strategies Deployed in the Market

- Jan-2024: Bosch Sensortec GmbH introduced the "Smart connected sensors platform". The smart connected sensors platform includes hardware, software, and a pre-built wearable reference design. This design is readily deployable and can be linked to a variety of applications, enabling full-body motion tracking in wearables, wearables, and AR/VR headsets.

- Oct-2023: TDK Corporation came into partnership with LEM International SA, an appliance, electrical, and electronics manufacturing company in Switzerland. Through this partnership, TDK Corporation would bolster its presence in the magnetic sensors market, the company aims to provide top-notch products that cater to both existing and emerging applications, aligning with prevalent market trends such as energy transformation (EX) and digital transformation (DX).

- Jul-2023: Murata Manufacturing Co., Ltd. came into partnership with MobileKnowledge, a semiconductor manufacturing company. Through this partnership, Murata Manufacturing Co., Ltd. would enhance its business portfolio.

- Feb-2023: MEMSIC Semiconductor Co., Ltd. Introduced "MMC5616WA" sensor. The MMC5616WA is compatible with the high-speed communication interface of I3C, offering communication rates of up to 12.5MHz while maintaining backward compatibility with the I2C interface. Additionally, it accommodates a low voltage of 1.2V for the I/O interface, aligning seamlessly with the contemporary trend of I/O voltage standards across diverse mainstream platforms.

- Jan-2023: Honeywell International, Inc. came into partnership with Nexceris, a renewable energy semiconductor manufacturing company. Through this partnership, Honeywell International, Inc. would provide state-of-the-art automotive sensing technology to mitigate conditions that could lead to thermal runaway in electric vehicle (EV) batteries. Thermal runaway is a phenomenon characterized by exceedingly high temperatures within the battery cell, potentially leading to a fire.

List of Key Companies Profiled

- TDK Corporation

- MEMSIC Semiconductor Co., Ltd. (IDG Capital Investment Consultant Beijing Co Ltd.)

- Bosch Sensortec

- Murata Manufacturing Co., Ltd.

- Honeywell International, Inc.

- Analog Devices, Inc.

- Microchip Technology Incorporated

- STMicroelectronics N.V.

- NXP Semiconductors N.V.

- TE Connectivity Ltd.

Market Report Segmentation

By Technology (Volume, Thousand Units, USD Billion, 2019-2030)- Infrared

- Dual Technology

- Microwave

- Ultrasonic

- Tomographic

- Others

- Consumer Electronics

- Automotive

- Aerospace & Defense

- Healthcare

- Industrial

- Others

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Table of Contents

Companies Mentioned

- TDK Corporation

- MEMSIC Semiconductor Co., Ltd. (IDG Capital Investment Consultant Beijing Co Ltd.)

- Bosch Sensortec

- Murata Manufacturing Co., Ltd.

- Honeywell International, Inc.

- Analog Devices, Inc.

- Microchip Technology Incorporated

- STMicroelectronics N.V.

- NXP Semiconductors N.V.

- TE Connectivity Ltd.