Baby Food Packaging Market Analysis:

Market Growth and Size: The market is witnessing steady growth, driven by the increasing birth rates and changing consumer preferences.Technological Advancements: Technological innovations have played a crucial role in the baby food packaging industry. Advanced materials and designs have enhanced the safety and convenience of packaging.

Industry Applications: Baby food packaging is primarily used for packaging infant formula, baby cereals, purees, and snacks. The industry also caters to toddler food packaging as children transition to solid foods.

Geographical Trends: North America and Europe dominate the market due to higher disposable incomes and health-conscious parenting trends.

Competitive Landscape: Key players in the baby food packaging market include well-established companies with a strong presence in the food packaging industry. Competition is fierce, with companies vying to provide innovative and sustainable packaging solutions.

Challenges and Opportunities: Challenges include stringent regulations related to food safety and labeling, which can impact packaging design and materials. Opportunities lie in eco-friendly packaging options, as sustainability becomes a key focus for both consumers and manufacturers.

Future Outlook: The global baby food packaging market is expected to continue its growth trajectory, fueled by an increasing global population and evolving dietary preferences. Sustainable packaging solutions, such as recyclable and biodegradable materials, are likely to gain prominence in the coming years, aligning with environmental concerns.

Baby Food Packaging Market Trends:

Growing birth rates

The increase in global birth rates is a significant driver of the baby food packaging market. As populations expand in various regions, the demand for baby food products rises. This demographic shift fuels the need for safe and convenient packaging solutions for infant formula, purees, and snacks. Market research indicates that regions such as, Asia-Pacific and Africa, with their high birth rates, contribute significantly to the growth of the market. Additionally, urbanization and changing lifestyles often lead to more working parents who opt for packaged baby food products, further boosting demand. Packaging companies respond by developing user-friendly, portion-controlled, and shelf-stable packaging to cater to the needs of busy parents.Health-Conscious Parenting Trends

With the growing awareness about the importance of nutrition during infancy, parents are increasingly seeking healthier and more transparent baby food options. This trend drives innovation in baby food packaging, as companies strive to create packaging that preserves the freshness and nutritional value of the products. Parents look for packaging that clearly conveys ingredient information, allergen warnings, and nutritional content, promoting trust and confidence in the products. Additionally, the demand for organic and natural baby food products is on the rise. Sustainable and eco-friendly packaging solutions align with these preferences, further propelling market growth.Technological Advancements in Packaging

Technological innovations play a pivotal role in the baby food packaging market. Advanced packaging materials, such as BPA-free plastics and recyclable options, ensure product safety and sustainability. Smart packaging with features such as, temperature indicators and portion control aids parents in maintaining optimal storage and serving conditions for baby food. Furthermore, packaging companies are investing in research and development to create designs that enhance the convenience of use, such as single-serve pouches and resealable packages. These innovations cater to parental preferences and also contribute to the expansion of the market.Increasing Disposable Incomes

The rise in disposable incomes in many parts of the world has led to an increase in consumer spending on premium baby food products. Parents are willing to invest in higher-quality and more expensive baby food options, driving the demand for premium packaging solutions. Premium packaging often includes aesthetically pleasing designs, premium materials, and unique shapes that distinguish products on the shelves. This trend allows packaging companies to offer a wider range of options to cater to varying consumer preferences.Regulatory Compliance and Safety Concerns

Stringent regulations and safety concerns regarding baby food packaging promote market growth. Governments and regulatory bodies impose strict standards to ensure the safety and hygiene of baby food products, including packaging materials. Packaging companies must adhere to these regulations, which can lead to ongoing improvements in packaging technology and materials. Compliance with safety standards protects infants and enhances consumer trust in baby food products and their packaging.Baby Food Packaging Industry Segmentation:

The publisher provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional, and country levels for 2025-2033. Our report has categorized the market based on product, material, and package type.Breakup by Product:

- Liquid Milk Formula

- Dried Baby Food

- Powder Milk Formula

- Prepared Baby Food

Prepared baby food accounts for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the product. This includes liquid milk formula, dried baby food, powder milk formula, and prepared baby food. According to the report, prepared baby food represented the largest segment.Breakup by Material:

- Plastic

- Paperboard

- Metal

- Glass

- Others

Plastic holds the largest share in the industry

A detailed breakup and analysis of the market based on the material have also been provided in the report. This includes plastic, paperboard, metal, glass, and others. According to the report, plastic accounted for the largest market share.Breakup by Package Type:

- Bottles

- Metal Cans

- Cartons

- Jars

- Pouches

- Others

Pouches represents the leading market segment

The report has provided a detailed breakup and analysis of the market based on the package type. This includes bottles, metal cans, cartons, jars, pouches, and others. According to the report, pouches represented the largest segment.Breakup by Region:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America leads the market, accounting for the largest baby food packaging market share

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America accounted for the largest market share.The market research report has provided a comprehensive analysis of the competitive landscape. Detailed profiles of all major companies have also been provided.

Some of the key players in the market include:

- Amcor PLC

- Ardagh Group S.A.

- Mondi Plc

- RPC Gorup Plc (Berry Global Group Inc.)

- Sonco Products Company

- Tetra Pak (Tetra Laval)

- Winpak Ltd. (Wihuri Oy)

Key Questions Answered in This Report:

- How has the global baby food packaging market performed so far, and how will it perform in the coming years?

- What are the drivers, restraints, and opportunities in the global baby food packaging market?

- What is the impact of each driver, restraint, and opportunity on the global baby food packaging market?

- What are the key regional markets?

- Which countries represent the most attractive baby food packaging market?

- What is the breakup of the market based on the product?

- Which is the most attractive product in the baby food packaging market?

- What is the breakup of the market based on the material?

- Which is the most attractive material in the baby food packaging market?

- What is the breakup of the market based on the package type?

- Which is the most attractive package type in the baby food packaging market?

- What is the competitive structure of the market?

- Who are the key players/companies in the global baby food packaging market?

Table of Contents

Companies Mentioned

- Amcor PLC

- Ardagh Group S.A.

- Mondi Plc

- RPC Gorup Plc (Berry Global Group Inc.)

- Sonco Products Company

- Tetra Pak (Tetra Laval)

- Winpak Ltd. (Wihuri Oy)

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 136 |

| Published | March 2025 |

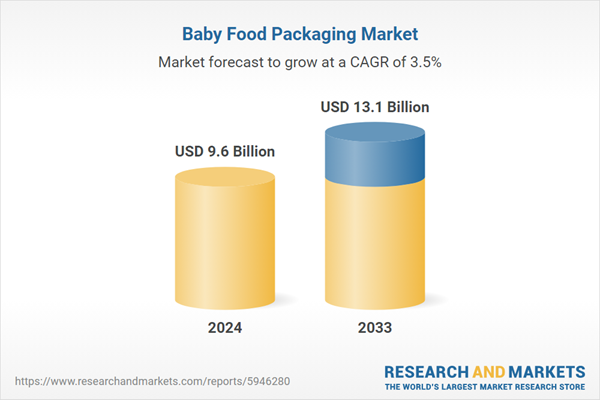

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 9.6 Billion |

| Forecasted Market Value ( USD | $ 13.1 Billion |

| Compound Annual Growth Rate | 3.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 7 |