Cattle feed is the food given to cows and other bovine animals to meet their nutritional needs. It can consist of various types of molasses, mixers, grains, forages, oilseeds, protein cakes, and agro-industrial by-products, formulated to provide essential nutrients like carbohydrates, protein, fats, vitamins, minerals, phosphorous, magnesium, omega-3, and fibers. It aids in protecting pellets against infestations caused by insects or molds, maintaining optimum body conditions, and preventing muscular disorders, including laminitis and azoturia. It also improves reproductive efficiency, enhances milk production with better fat content, and maintains a balanced diet.

The increasing competition among livestock farmers to produce higher yields and better-quality products is driving the adoption of advanced cattle feed formulations around the world. Moreover, the rising awareness about diseases that can affect livestock is catalyzing the use of specialized cattle feeds with added medications or supplements as preventive measures. In addition, the growing number of online platforms for the direct purchase of farming supplies that have made cattle feed more accessible to remote or small-scale farmers is influencing the market positively.

Apart from this, the increasing influence of social media that helps shape consumer preferences and spread knowledge about ethical farming and animal welfare is contributing to the market growth. Furthermore, the rising popularity of agri-tourism, wherein visitors wish to see well-maintained, healthy livestock, is propelling the growth of the market.

Cattle Feed Market Trends/Drivers:

Increasing health awareness

There is an increase in the awareness about the health benefits of quality meat and dairy products among individuals. This awareness has led to rise in the number of people seeking out products from animals that are well-fed and raised in good conditions. In turn, this consumer demand is propelling cattle farmers to use high-quality, nutritious feed, thereby contributing to the market growth. The health-conscious consumers are becoming a key driver catalyzing the demand for premium cattle feed, designed to enhance both the health of the animal and the end-product.Rise in environmental factors

Changes in environmental conditions are also causing a rise in the demand for cattle feed. Factors like droughts or floods can severely impact the natural availability of grazing fields for cattle. When natural foraging options are limited, farmers are compelled to depend more on formulated cattle feed to sustain their livestock. These environmental challenges have increased the need for reliable and nutritionally balanced cattle feed to ensure that cattle are receiving all the essential nutrients, thus driving up its demand.Growing ethical farming practices

Ethical and sustainable farming practices are becoming more prevalent, driven by consumer demand for responsibly produced food. These practices often require specialized types of cattle feed that are organic or free from genetically modified organisms (GMOs). As consumers become more educated about the origins of their food, the demand for such specialized cattle feed options is on the rise. The need for environment friendly farming techniques directly correlates with increased demand for specific types of cattle feed.Cattle Feed Industry Segmentation:

This report provides an analysis of the key trends in each segment of the global cattle feed market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on ingredient, type, and distribution channel.Breakup by Ingredient:

- Corn

- Soybean Meal

- Wheat

- Oilseeds

- Additives

- Others

Corn dominates the market

The report has provided a detailed breakup and analysis of the market based on the ingredient. This includes corn, soybean meal, wheat, oilseeds, additives, and others. According to the report, corn represented the largest segment. Corn is a primary source of energy in cattle feed due to its high carbohydrate content. It provides the calories needed for daily activities, growth, and milk production. It is generally easy to digest and often included in the form of whole grain, cracked corn, or cornmeal.Soybean meal is a byproduct of soybean oil extraction that serves as a high-protein supplement in cattle feed. Rich in essential amino acids, it helps in the development of muscles, tissues, and enzymes in the cattle. It is particularly beneficial for younger animals that are still growing, and lactating cows that need additional protein to produce milk.

Breakup by Type:

- Dairy

- Beef

- Calf

- Others

Dairy holds the largest share in the market

A detailed breakup and analysis of the market based on the type has also been provided in the report. This includes dairy, beef, calf, and others. According to the report, dairy accounted for the largest market share. Dairy cattle require a specialized diet designed to support high milk production, reproductive health, and overall well-being. Their feed typically has higher protein content, often supplied through ingredients like alfalfa, soybean meal, and canola meal. Essential nutrients, such as calcium and phosphorus, are also added to support bone health and milk quality. Carbohydrates are usually derived from corn or barley to provide the energy required for lactation. The focus is on balanced nutrition to maximize milk yield and quality while maintaining the animal's health.Beef cattle feed is formulated to optimize growth and meat quality. It generally has a higher energy content, often supplied through corn, and less emphasis is placed on protein as compared to dairy cattle feed. The feed can also include additives like antibiotics or growth hormones, although this varies depending on local regulations and specific farming practices. Beef cattle diets are often adjusted during different stages of life like growing, finishing, or breeding to meet the changing nutritional needs.

Breakup by Distribution Channel:

- Offline

- Online

Offline dominates the market

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes offline and online. According to the report, offline represented the largest segment. Offline channels remain the mainstay for many, particularly in rural areas where digital penetration is less prevalent. These include local feed stores, co-operatives, and agricultural supply shops where farmers can physically inspect products, seek expert advice, and make immediate purchases. Some large-scale operations even opt for direct relationships with manufacturers to secure bulk supplies.The rise of e-commerce platforms has made it easier for farmers to access a wider variety of cattle feed options online. These platforms offer the convenience of home delivery, easy price comparisons, and often a broader range of products, including specialty feeds that is not available locally. Online channels also offer the advantage of customer reviews and detailed product descriptions, which aid in making more informed decisions.

Breakup by Region:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Asia Pacific exhibits a clear dominance, accounting for the largest cattle feed market share

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Asia Pacific accounted for the largest market share.The increasing adoption of more commercialized farming practices represents one of the primary factors bolstering the market growth in the Asia Pacific region. Moreover, the rising consumption of meat and dairy products is contributing to the market growth in the region. Besides this, the growing health-consciousness is influencing the market positively.

Competitive Landscape:

The leading companies are integrating artificial intelligence (AI), machine learning (ML), sensors, and the internet of things (IoT) that allows real time monitoring of feed intake and cattle health and helps in making timely adjustments to the feed formula. They are also enabling customized diet formulations that can be tailored to individual animal needs and maximize feed utilization, improve animal health, and minimize waste. Moreover, key players are using advanced genetic and breeding techniques to enhance the nutritional value of traditional feed crops like corn and soy, which can result in crops with higher levels of essential nutrients like omega-3 fatty acids that make the feed more beneficial for cattle health.The report has provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided.

Some of the key players in the market include:

- Alltech

- Archer Daniels Midland Company

- BASF SE

- Cargill Inc.

- Chr. Hansen A/S (Chr Hansen Holding A/S)

- De Heus Animal Nutrition

- DSM N.V

- DuPont de Nemours Inc.

- Evonik Industries AG (RAG-Stiftung)

- Godrej Agrovet Ltd.

- J.R. Simplot Company

- Kemin Industries Inc.

- Kent Corporation

Key Questions Answered in This Report:

- How big is the cattle feed market?

- What is the future outlook of cattle feed market?

- What are the key factors driving the cattle feed market?

- Which region accounts for the largest cattle feed market share?

- Which are the leading companies in the global cattle feed market?

Table of Contents

Companies Mentioned

- Alltech

- Archer Daniels Midland Company

- BASF SE

- Cargill Inc.

- Chr. Hansen A/S (Chr Hansen Holding A/S)

- De Heus Animal Nutrition

- DSM N.V

- DuPont de Nemours Inc.

- Evonik Industries AG (RAG-Stiftung)

- Godrej Agrovet Ltd.

- J.R. Simplot Company

- Kemin Industries Inc.

- Kent Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 145 |

| Published | April 2025 |

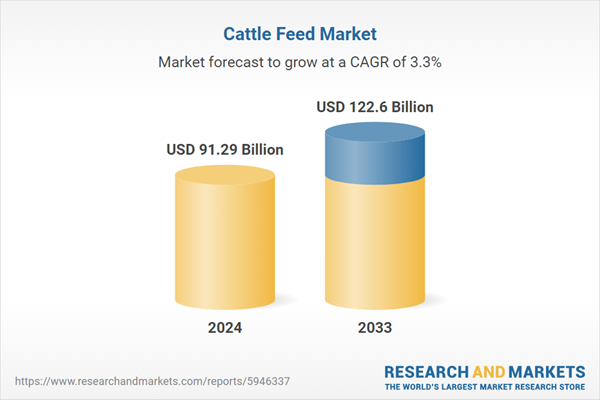

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 91.29 Billion |

| Forecasted Market Value ( USD | $ 122.6 Billion |

| Compound Annual Growth Rate | 3.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 13 |